Why the Yen and Aussie Dollar Are Falling Out of Favour with Global Reserve Managers

2025-07-11 11:14:00

Over the past quarter, a quiet yet telling shift has taken place beneath the surface of global financial markets.

Reserve managers the world’s most conservative and strategic investors have been rebalancing their portfolios in ways that challenge long-standing assumptions about currency safety and strength.

Their actions suggest rising skepticism toward some traditional havens and growing interest in alternatives, revealing deeper concerns about geopolitical risks, inflation volatility, and trade friction.

At the heart of this shift lies a stark divergence: global demand for the Japanese yen and Australian dollar has sharply declined, while allocations to Swiss francs and British pounds have risen meaningfully.

On the surface, these moves appear tactical but they point to broader structural anxiety.

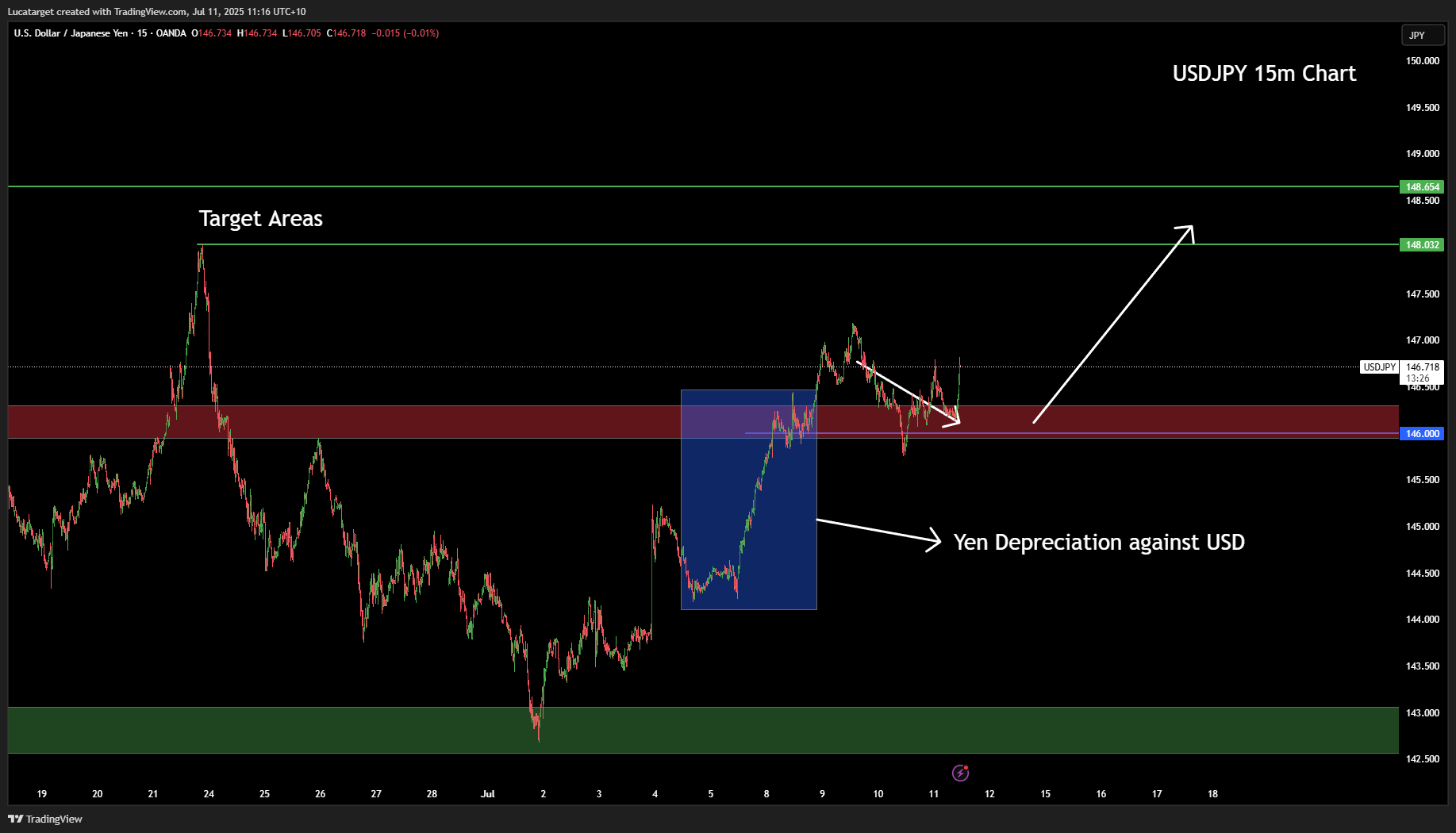

Yen No Longer the Ultimate Refuge?

The yen has long held safe-haven status, especially during episodes of global turmoil.

But its steep decline in reserve allocation last quarter its largest single-quarter drop in over a decade raises serious questions about whether that reputation is fading.

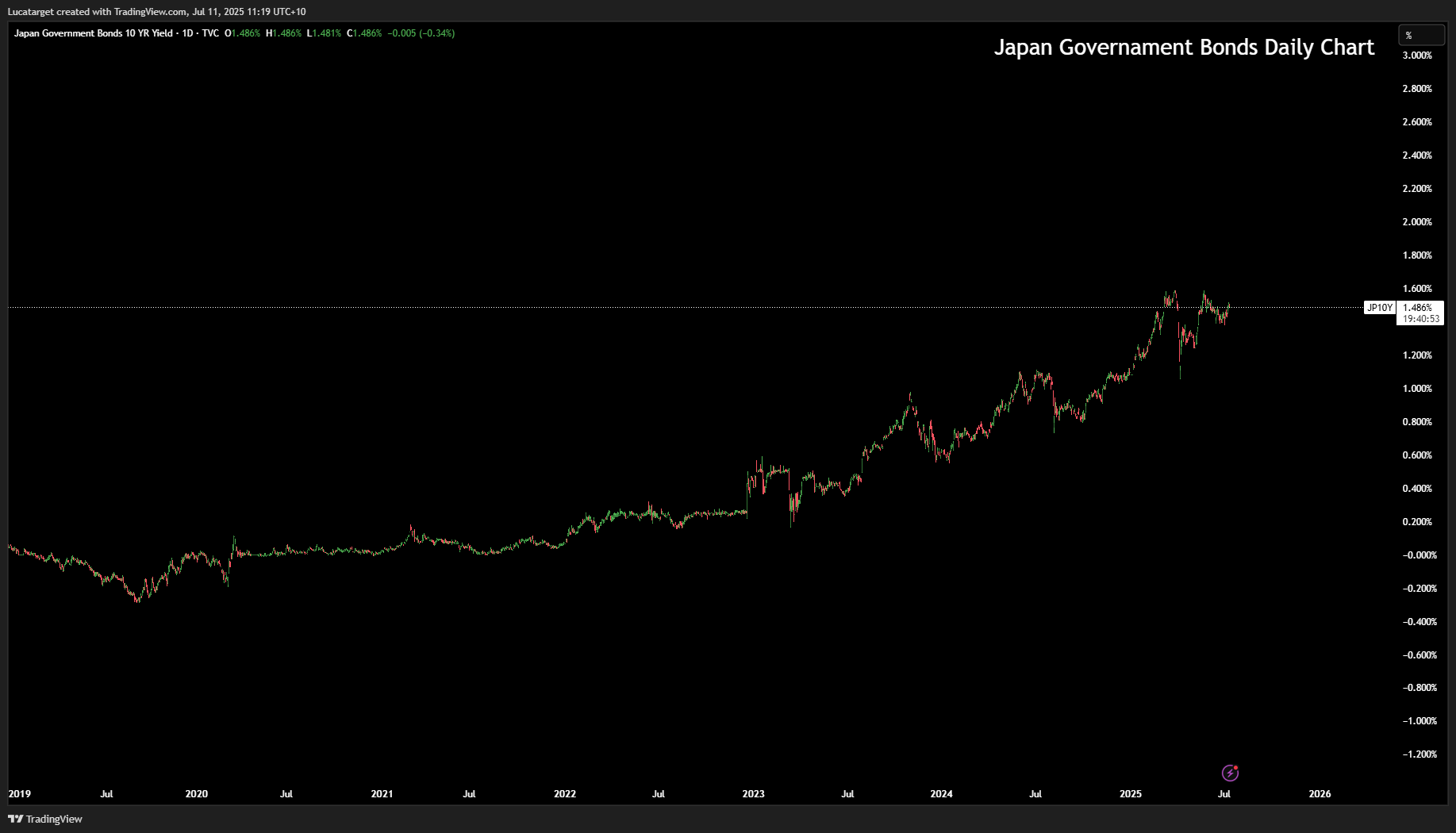

Part of the retreat may be attributed to Japan’s internal policy shifts. The Bank of Japan’s rate hike earlier this year, though historically modest, introduced unexpected volatility into the Japanese bond market.

For reserve managers accustomed to stability, the spike in uncertainty around Japanese Government Bonds (JGBs) likely reduced the yen’s appeal, despite its nominal appreciation against the dollar.

But beyond rates and yields, sentiment may also be reflecting doubts about the yen’s performance in future crises.

The re-election of Donald Trump and the potential for renewed trade skirmishes may be prompting central banks to reconsider which currencies truly offer protection in an unpredictable macro environment.

AUD Dumping: A Collateral Victim of China Trade Risks?

If the yen's fall from grace is surprising, the plunge in Australian dollar allocations is even more striking.

Reserve holdings of AUD dropped to their lowest level since 2012 an extraordinary one-quarter drawdown that suggests a powerful shift in perception.

The move may have less to do with Australia itself and more with its deep economic ties to China. In a world where protectionism is once again on the rise, the Aussie dollar may be seen as collateral damage in the broader risk repricing associated with China.

The irony, however, is that holdings of the Chinese yuan remained relatively stable possibly a sign that central banks still see value in the yuan’s managed exchange rate regime and long-term strategic role in the global financial system.

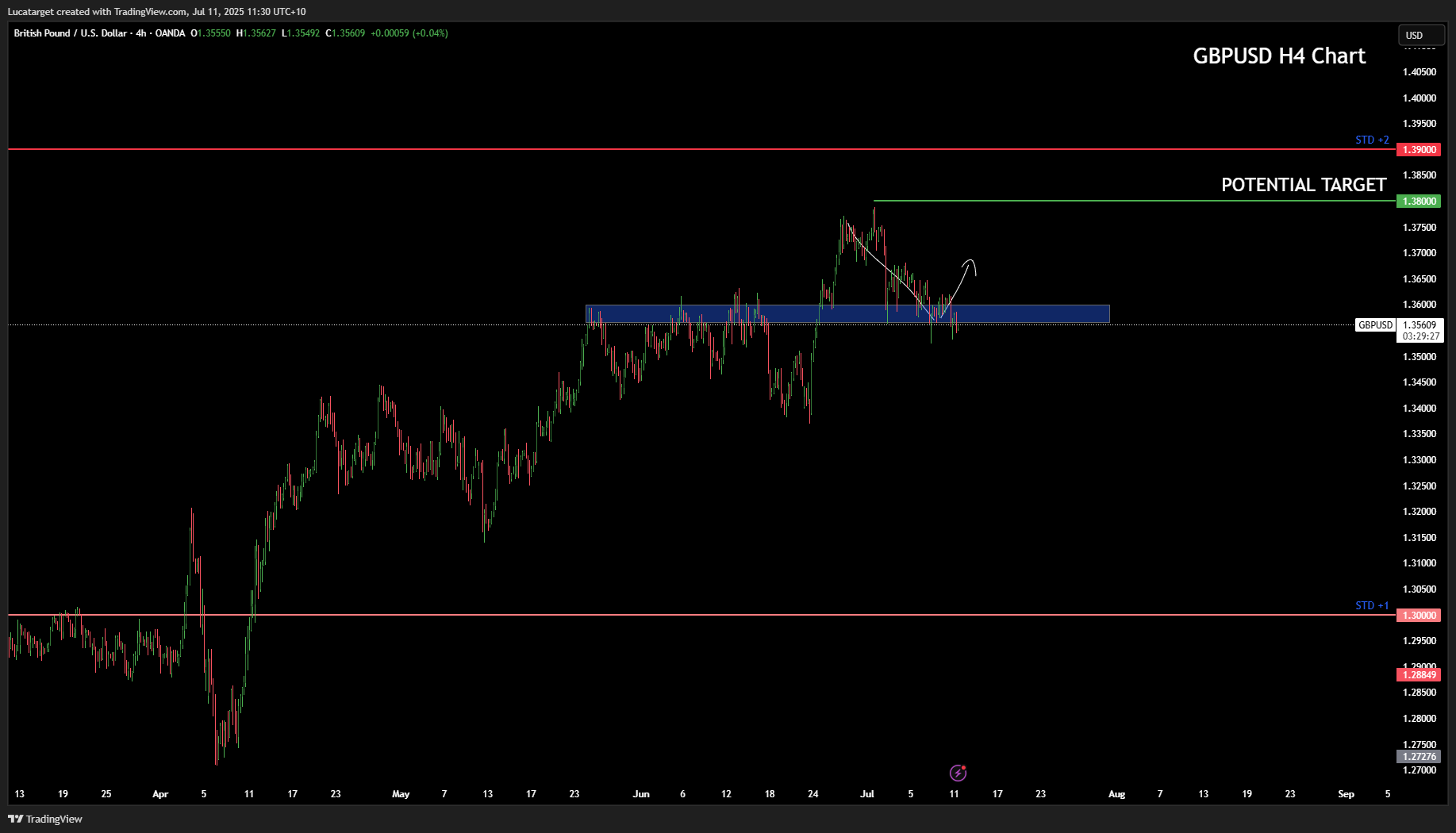

The Swiss Franc and the Pound Make a Comeback

The standout beneficiary of this reshuffle was the Swiss franc, which saw a dramatic increase in reserve holdings far outpacing what could be explained by market valuation alone.

This sudden surge suggests renewed faith in the franc as a reliable hedge against global shocks, despite Switzerland's ultra-low interest rates.

Meanwhile, the British pound also saw a notable rise in demand, a somewhat surprising development given ongoing fiscal concerns in the UK.

But strong Q1 growth figures and a perceived easing in political uncertainty appear to have reassured reserve managers, prompting substantial GBP purchases despite its appreciation against the US dollar.

Euro Appetite Growing—Cautiously

Although the euro saw a modest uptick in composition, most of the increase was driven by valuation effects rather than active buying.

This suggests that while sentiment is improving, reserve managers remain cautious. However, forward-looking data offers a more optimistic picture.

A recent global survey of public financial institutions indicated that the euro is now the most sought-after currency for increased allocation over the next one to two years hinting that deeper confidence may emerge if the eurozone strengthens its fiscal coordination.

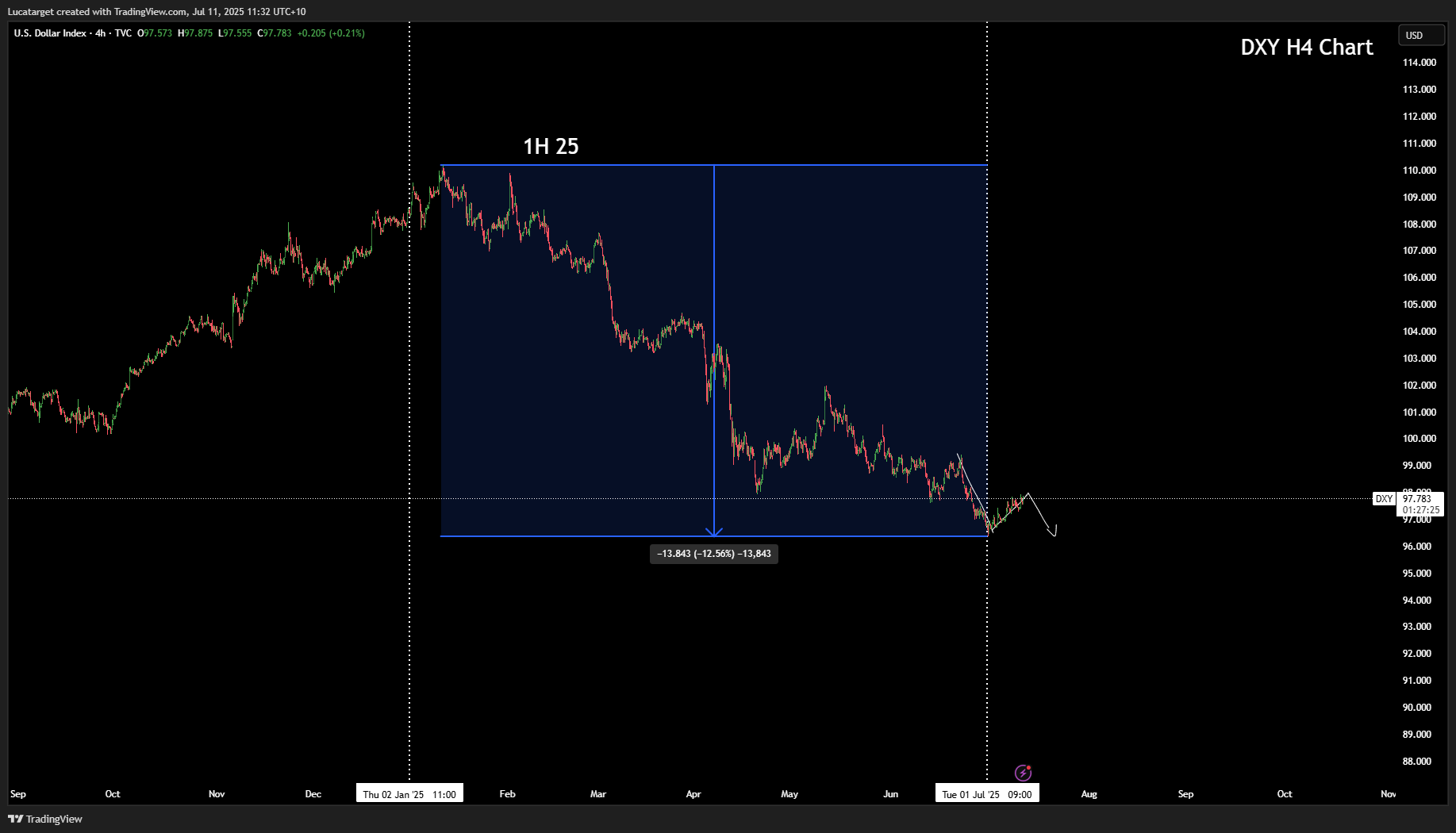

What About the Dollar?

Despite the broader diversification trend, US dollar holdings remained relatively stable last quarter. But the survey data suggests the tide could soon shift.

A growing number of reserve managers cite US political instability, trade policy uncertainty, and long-term fiscal imbalances as reasons to reduce USD exposure in the coming years. If these concerns intensify, we may see a more meaningful rotation out of the greenback in future IMF reserve data.

What Traders Should Watch

For FX traders, this reserve rebalancing carries several implications:

JPY and AUD remain vulnerable to further liquidation by institutional investors, particularly if risk sentiment deteriorates and alternative safe havens like CHF continue to gain ground.

CHF and GBP may attract more strategic flows, especially if the global economic outlook remains muddled by uncertainty.

EUR positioning could turn more constructive as Q2 and Q3 data rolls in particularly if European policymakers capitalize on recent momentum to solidify the euro’s role as a reserve asset.

The USD remains at a crossroads, and upcoming data on trade policy, fiscal direction, and inflation will be critical in determining whether confidence erodes further.

Q1: Why are global central banks reducing their holdings of the Japanese yen?

A: The sharp decline in yen reserves may reflect doubts about its traditional role as a safe haven. Japan’s surprise rate hike created volatility in government bonds, while geopolitical uncertainty under Trump 2.0 may have made the yen less attractive compared to other defensive currencies like the Swiss franc.

Q2: What triggered the sudden sell-off in Australian dollar reserves?

A: AUD allocations fell to record lows, likely due to its strong trade ties to China. With global trade tensions on the rise, particularly involving the U.S. and China, reserve managers may be reducing exposure to currencies most vulnerable to tariff shocks even while holding yuan allocations steady.

Q3: Why is the Swiss franc suddenly back in fashion?

A: Despite low Swiss interest rates, reserve managers significantly boosted CHF holdings. This suggests a renewed belief in the franc’s stability as a geopolitical hedge. Also, the cost to hedge into CHF has become more favourable compared to the yen, further driving allocations.

Q4: Is the euro starting to gain more traction in reserve portfolios?

A: For now, EUR reserve increases were largely due to valuation gains rather than active buying. However, survey data shows a strong medium-term outlook, with the euro ranked as the most desired currency for increased allocation over the next 12–24 months.

Q5: Are central banks losing faith in the US dollar?

A: Not immediately USD allocations remained stable in Q1. But survey results show growing concern over U.S. political instability, fiscal management, and trade unpredictability. These factors could drive more reserve diversification away from the dollar in future quarters.

Q6: What do these changes mean for FX traders and investors?

A: Currencies like JPY and AUD could remain under pressure from continued reserve selling. Meanwhile, CHF and GBP may benefit from safe-haven inflows. The euro is a medium-term bullish story, while the USD is at risk of losing ground if policy uncertainty escalates.

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.

Try These Next

4 Powerful Tactics to Overcome the Most Costly Forex Mistakes

How to Master MT4 & MT5 - Tips and Tricks for Traders

The Importance of Fundamental Analysis in Forex Trading

Forex Leverage Explained: Mastering Forex Leverage in Trading & Controlling Margin

The Importance of Liquidity in Forex: A Beginner's Guide

Close All Metatrader Script: Maximise Your Trading Efficiency and Reduce Stress

Best Currency Pairs To Trade in 2025

Forex Trading Hours: Finding the Best Times to Trade FX

MetaTrader Expert Advisor - The Benefits of Algorithmic Trading and Forex EAs

Top 5 Candlestick Trading Formations Every Trader Must Know