AUD and NZD Defy Market Fears Despite U.S.-China Trade War Escalation But Risks Still Looms

2025-04-29 11:09:43

AUD and NZD Defy Market Fears Despite U.S.-China Trade War Escalation But Risks Still Looms

Global sentiment has shifted back into defensive mode after a string of escalating trade headlines and geopolitical risks.

- Global sentiment turned defensive as U.S.-China trade tensions escalated.

- Treasury Secretary Bessent reaffirmed tariffs will stay unless China de-escalates first, intensifying trade war risks and weighing on global supply chains.

- AUD and NZD remain resilient for now thanks to risk-on sentiment and China stimulus hopes, but downside risks are rising beneath the surface.

Renewed tensions between the U.S. and China reignited market fears, with Treasury Secretary Scott Bessent reaffirming that tariffs will remain firmly in place unless Beijing takes real steps to de-escalate.

U.S.-China Trade Tensions: Straining at New Breaking Points

The U.S.-China trade relationship, already fragile, took a major blow this week.

Markets had hoped for a cooling-off period after earlier escalations, but fresh moves on both sides made it clear: the trade war is not only alive — it's deepening.

- Agriculture Hit Hard: U.S. farmers are reeling after China canceled major orders for pork and soybeans, leading to a 44% drop in vessel traffic between the two countries.

- Small Business Alarm: Roughly 80% of U.S. small businesses that rely on Chinese imports are now at risk of bankruptcy under the Trump administration’s 145% tariff regime.

- China’s Tactical Adjustments: China moved to exempt select U.S. goods, including semiconductors, from its own 125% retaliatory tariffs — a signal that Beijing may be trying to contain broader economic fallout.

- Global Supply Chain Warning: Logistics providers report sharp slowdowns in key shipping corridors, raising concerns that broader inflationary pressures could reignite globally.

Rather than stabilizing, the U.S.-China economic confrontation appears set to intensify, adding another heavy layer of risk onto the global economy.

Treasury Secretary Bessent to China: De-escalate or Pay the Price

Following the renewed tariff crossfire, U.S. Treasury Secretary Scott Bessent made it clear over the weekend that Washington sees no benefit in blinking first. “China must be the one to de-escalate”, Trump also comments. His comments laid out the U.S. position firmly — and added new pressure on China to act.

- Tariffs Here to Stay: Bessent warned the high tariffs would remain until China offers meaningful concessions, beyond minor tariff exemptions.

- No Formal Talks Yet: Despite minor backchannel contacts, there are no scheduled bilateral meetings between U.S. and Chinese trade negotiators.

- Diversification Push: Washington is pushing hard to deepen trade ties with India, Japan, and South Korea to avoid overexposure to Chinese supply chains.

- Economic Consequences: Bessent emphasized that failure to resolve the impasse could cost China far more than the U.S. over the long term.

Unless Beijing makes the first move, the stalemate could stretch on — with real consequences for supply chains, businesses, and inflation outlooks.

AUD and NZD Resilient — But Cracks Are Forming Beneath the Surface

Despite heightened U.S.-China tensions and a wave of global risk concerns since late last week, the Australian dollar (AUD) and New Zealand dollar (NZD) have shown surprising resilience.

Both currencies have managed to hold firm, even as headlines point toward worsening trade relations and fresh economic risks.

Without clear and lasting improvement in China's economy or a calming of trade tensions, the balance of risks still points toward potential downside for both currencies.

Why AUD and NZD Are Still Holding Up (For Now)

- China’s Stimulus Expectations: Beijing’s promises of domestic stimulus — including potential rate cuts and infrastructure spending — have given markets hope that demand for Australian and New Zealand exports won't collapse immediately.

- Commodity Prices Still Stable: Key exports like iron ore, coal, and dairy have not seen major price crashes yet, helping to buffer the currencies against broader risk aversion.

- Global Risk Sentiment Remains Cautious, Not Panicked: Although there’s tension, major global stock markets haven't entered full-blown risk-off mode, supporting risk-sensitive currencies like AUD and NZD.

- Bearish Positioning Already Heavy: Speculators were already short AUD and NZD heading into this week, limiting fresh immediate selling pressure without a new catalyst.

Technical Outlook

USD Slump: Helps AUD and NZD to Stand Firm

As previously mentioned on our previous blog: https://acy.com/en/market-news/market-analysis/dxy-breaks-below-100-dollar-rebound-nfp-impact-j-o-204282025-135756/, dollar weakness still looms ahead key economic data for the US releases this week.

Non-Farm Payrolls will be the main event this week.

AUD

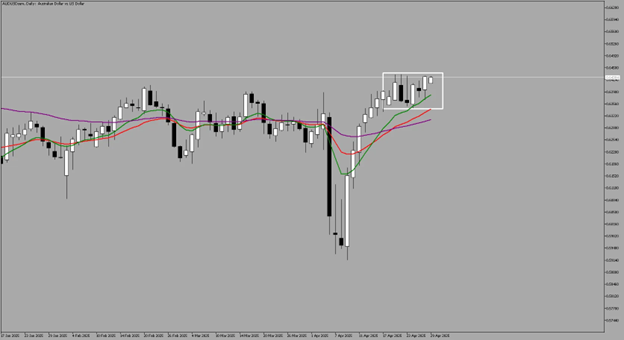

Daily

Despite ongoing pressure from the U.S.-China trade tensions and renewed escalations, the Australian dollar remains resilient, holding above key moving averages and consolidating within a tight range.

With risk-on sentiment still broadly intact, there is potential for further upside as long as support levels continue to hold.

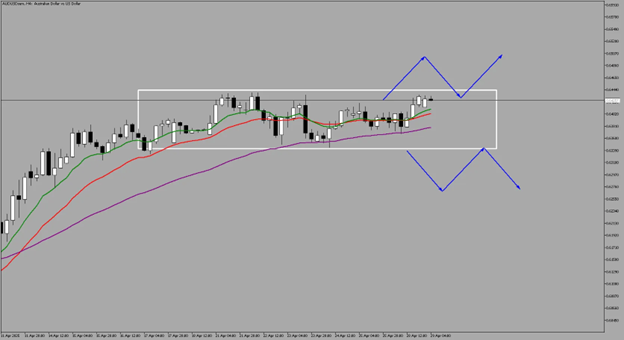

4-Hour

Potential Scenarios

- Bullish: Break of 0.644 could trigger renewed strength with potential new highs

- Bearish: Break of 0.634 could send Aussie for a shard pullback

These breaks would come into fruition with confluence on key economic developments especially with regards to the US-China trade war.

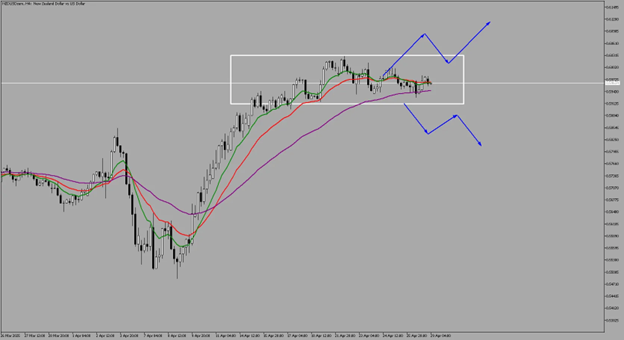

NZD

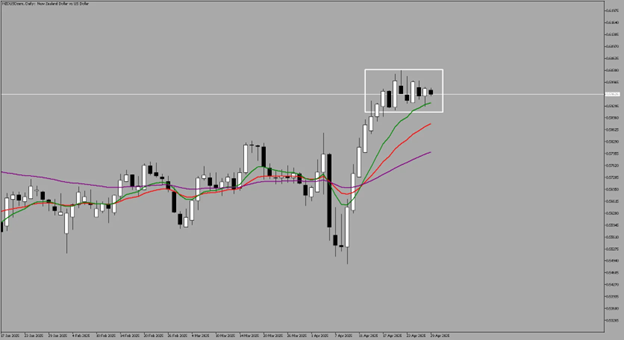

Daily

Compared to its correlated currency, the Aussie, Kiwi is in a much stronger trend as its trading far more higher relative to the previous highs price broke off.

4-Hour

With Aussie benefitting from the risk-on sentiment, New Zealand dollar is also gearing up for a new direction, either we go bearish or a renewed bullish momentum.

Potential Scenarios

- Bullish: A break of 0.603 could push Kiwi to a new upside potential.

- Bearish: A breakdown at 0.592 would pull the New Zealand dollar to a downside move, staging a potential pullback.

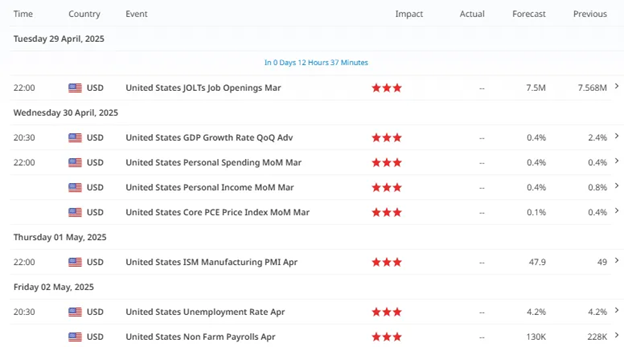

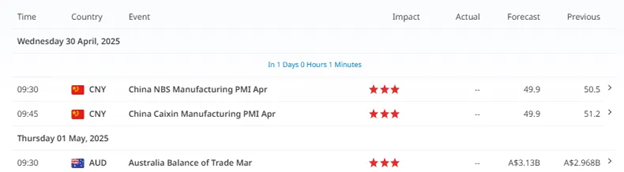

Upcoming Red Folders this Week

The Australian and New Zealand dollars have been remarkably steady in the face of rising risks — but that steadiness could be tested quickly if global sentiment sours or Chinese economic data underwhelms.

For now, the market is giving them the benefit of the doubt. But beneath the surface, the foundation is getting shakier — and the next few weeks could determine whether AUD and NZD can weather the storm or slip lower in line with growing fundamental pressures.

Check Out Our Market Education

Learn how to navigate yourself in times of turmoil. Check out my market education links:

Want to learn how to trade like the Smart Money? Check out my new contents:

https://acy.com/en/market-news/education/smc-playbook-series-beginners-guide-j-o-04032025-155530/

Follow me on LinkedIn: https://www.linkedin.com/in/jasperosita/

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.

Try These Next