Why Gold Remains the Ultimate Security in a Shifting World

2025-04-22 11:56:14

Why Gold Bulls Are Still in Control Despite Robust U.S. Data and Global Market Noise

Gold has remained impressively resilient over the past week, even as economic data out of the U.S. surprised to the upside. Since April 17, Gold has hovered between $3,320 and $3,430, with traders continuing to favor the yellow metal over the greenback.

Looking at Gold in a monthly chart, Gold has never experienced a major downtrend. Gold keeps climbing ever since! This shows us how Gold remains intact, strong, and in-demand despite market turmoil.

Let’s break down what’s driving the market — and what it means for you moving forward for 2025

1. Economic Data: Strong Numbers, but Gold Holds Firm

U.S. data pointed to a robust economy last week — typically a green light for the dollar. But gold didn’t blink.

- Retail sales surged 1.4% in March, as consumers front-loaded spending before tariffs.

- Jobless claims fell to 219,000 lower than the 225k previous and forecast, reflecting ongoing labor market strength.

- Yet, CPI slowed to 2.4%, easing inflation concerns and softening Fed hike expectations.

Despite positive headlines, gold stayed firm above $3,300. The market is clearly looking beyond short-term economic resilience and bracing for deeper structural risks. Overall, everything’s still risky!

2. Fed Rhetoric: Dovish Tilt Boosts Gold Appeal

The Fed is shifting its tone — and traders are paying attention.

- Jerome Powell’s April 16 speech acknowledged economic slowdown and hinted at tariff-induced stagflation risks.

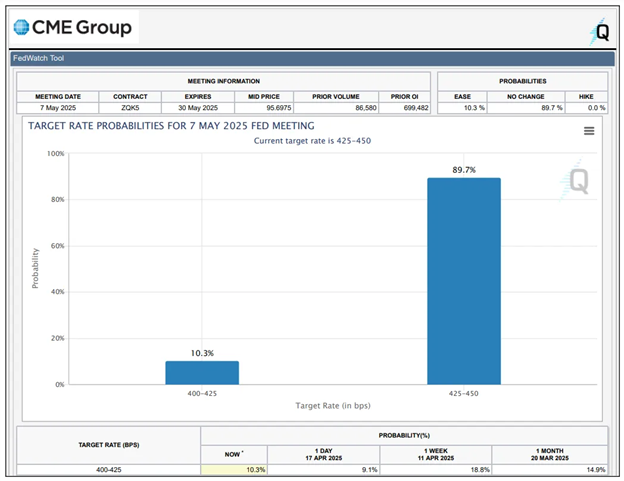

- Rate futures now price in Fed cuts as early as June, with markets expecting a pause at 4.25–4.50%. Trump does not like this.

- Political pressure from Trump on the Fed has further eroded confidence in U.S. monetary independence.

As rate expectations fall and real yields dip, gold’s attractiveness rises. A weaker dollar driven by Fed dovishness is doing gold bulls a big favor.

3. Geopolitical Risks: Safety Demand on the Rise

This week’s events pushed investors deeper into gold’s safety net.

- Iran–Israel tensions escalated, triggering flight to safety across markets.

- U.S. debt ceiling concerns resurfaced, raising questions about long-term fiscal stability.

- Renewed tension with Ukraine and Russia, breaking ceasefire protocols.

4. Global Trade Tensions: Tariffs Add Fuel to the Fire

Gold has become a hedge not just against inflation — but also against fractured trade dynamics.

- China retaliated with 125% tariffs on U.S. imports, escalating the ongoing trade war.

- Global recession fears are mounting as major economies brace for slower exports and costlier imports.

The deeper the trade rift, the stronger the case for gold. Traders are reacting not just to tariffs, but to what they imply about future growth and dollar stability.

Top 3 Reasons Why Gold Remains the World’s Premier Safe-Haven Asset

1. Gold Preserves Value When Currencies Falter

Gold is the foundation of modern money.

Most modern fiat currencies trace their origins back to gold. For much of history, global economies operated under a gold standard, where paper money could be exchanged for a fixed amount of gold. This system ensured currency stability, as governments were limited in how much money they could issue — their supply was anchored by physical gold reserves.

- In the 19th and early 20th centuries, major powers like the UK and U.S. tied their currencies to gold.

- After World War II, the Bretton Woods Agreement maintained a modified gold standard, where the U.S. dollar was convertible to gold, and other currencies were pegged to the dollar.

- In 1971, the U.S. fully abandoned the gold standard (the “Nixon Shock”), officially transitioning the world to fiat currencies — money backed solely by government trust, not tangible assets.

Today, currencies can be printed at will. Gold cannot. That’s why investors still flock to gold during inflationary cycles or currency devaluation — it represents real, limited, non-manipulable value.

2. Gold Protects Capital During Geopolitical and Market Crises

From wars and recessions to stock market crashes and sovereign defaults, gold has consistently acted as a safe harbor. When global uncertainty rises, capital flows into gold increase, pushing prices higher as investors seek safety outside traditional financial systems.

3. Gold Is Free from Counterparty Risk

Physical gold is one of the few financial assets that carries no counterparty risk. It doesn’t rely on a bank’s solvency, a government’s credit rating, or a corporate issuer’s performance. That independence makes gold a unique hedge in an environment of systemic risk or financial contagion.

From shifting Fed signals to renewed trade tensions and political uncertainty, gold’s status as the market’s go-to safe haven looks more entrenched than ever.

Actionable Trading Approach: Ride the Trend, But Choose Your Entry

With gold’s strength showing no signs of fading, a "buy-the-dip" approach makes tactical sense:

- Entry Zone: Look for pullbacks into the $3,300–$3,350 area.

- Dip Levels: 3396.03 - 3404.79 / 3328.62 - 3365.98

- Risk Management: Once price touches those dip levels, look for confirmations and structures at the lower timeframe and set stops behind the structures.

- Strategies you can use:

- Upside Target: Consider scaling out near $3,480–$3,500 with $3,700 as the ultimate target, with trailing stops to lock in profits.

Stay Patient!

“The big money is not in the buying or the selling, but in the waiting.”

— Jesse Livermore

Patience isn’t passive — it’s strategic. In this gold market, those waiting for the right dip may be rewarded.

Check Out Our Market Education

Learn how to navigate yourself in times of turmoil. Check out my market education links:

Want to learn how to trade like the Smart Money? Check out my new contents:

https://acy.com/en/market-news/education/smc-playbook-series-beginners-guide-j-o-04032025-155530/

Follow me on LinkedIn: https://www.linkedin.com/in/jasperosita/

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.

Try These Next