How Beginner Traders Use Expert Advisor to Conquer Fear and Greed in Forex Trading?

2025-08-26 17:51:41

This article is reviewed annually to reflect the latest market regulations and trends

- Psychological Transference: Free Forex Expert Advisors (EAs) don't eliminate fear and greed; they transfer these powerful emotions from individual trades to high-stakes system management.

- The "Free" Illusion: The concept of a "free" EA is a misnomer. Hidden costs, especially mandatory Virtual Private Server (VPS) hosting and the high probability of capital loss, create significant financial burdens.

- Deceptive Simplicity: Effective EA trading demands a steep learning curve in backtesting, statistical analysis, and risk management skills that far exceed a simple software installation.

- Inherent Strategy Risks: Many free EAs employ high-risk strategies like Martingale or Grid systems, which are mathematically designed to eventually cause catastrophic account failure.

- Education First, Tools Second: The most strategic path for a beginner is to build a strong foundation in manual trading and psychology, using EAs strictly as educational instruments on a demo account.

"The most important quality for an investor is temperament, not intellect. You need a temperament that neither derives great pleasure from being with the crowd or against the crowd." - Warren Buffett

Can Free EAs Conquer a Beginner's Fear and Greed?

You've been told a lie. The lie is that a piece of code, a "robot," can be the silver bullet for your trading success. It whispers that it can slay the twin dragons of fear and greed that sabotage every novice trader. But what if this free "solution" is actually a Trojan horse, designed to exploit your psychological weaknesses rather than solve them? This is the dangerous reality of relying on free Expert Advisors (EAs) before you've learned to trade yourself.

Why Do 90% of Retail Traders Fail? Hint: It's Not Just Their Strategy

Before we dive into the world of automated trading, we must confront a sobering statistic. The vast majority of retail traders, some estimate as high as 90%, fail to achieve consistent profitability.Why is this?

Many believe the "holy grail" is a flawless strategy. But as ACY Securities points out, the real issue is execution. A profitable strategy is useless if a trader's psychology causes them to abandon it after a few losses, chase the market out of FOMO (Fear Of Missing Out), or over-leverage an account hoping for a quick win.

The core reasons for failure are deeply human:

- Inconsistency: Not sticking to the plan.

- Unrealistic Expectations: Overleveraging in pursuit of fast, life-changing profits.

- Poor Psychology: Letting fear, greed, and hope dictate decisions.

- Lack of a Clear Plan: Trading without a tested, defined edge.

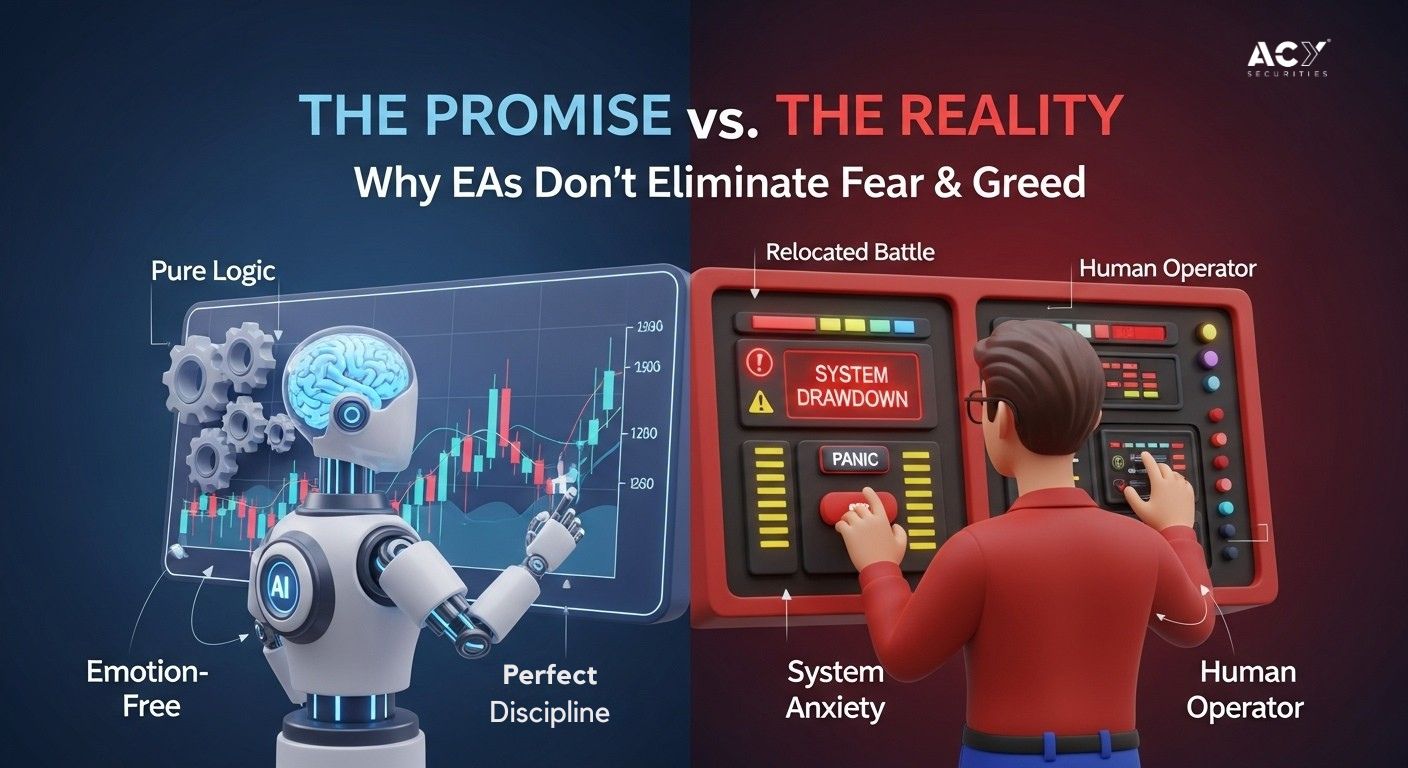

It is this psychological battlefield that makes the promise of an emotionless, automated trading robot so incredibly appealing. But can code truly conquer the trader's mind?

Can Code Conquer Trading Psychology? The Automated Promise

Expert Advisor is rooted in its promise to be the ultimate circuit breaker for our destructive emotional cycles. An EA is a program, written in a language like MQL4 or MQL5, that executes trades on a set of predefined, objective rules.

It feels no fear. It feels no greed.

- When market conditions in its algorithm are met, it executes.

- When a stop-loss is hit, it closes the trade without hesitation.

- It enforces discipline and consistency, 24/5, without emotional compromise.

In theory, this removes the trader's greatest liability: themselves. The strategy can finally operate on its own statistical merit. This is the powerful value proposition of algorithmic trading a world where logic reigns supreme.

However, this is a dangerous oversimplification. The software is emotionless, but the human operator is not. An EA doesn't eliminate fear and greed; it merely relocates the battle. Instead of fearing a single losing trade, you now experience the amplified anxiety of a system-wide drawdown. Instead of feeling greedy for one win, you're tempted to over-leverage the entire "hot" system.

The psychological battle has shifted from the tactical (the trade) to the strategic (the system), a fight for which a beginner is completely unprepared.

The Anatomy of a "Free" Expert Advisor

To understand the risk, you must understand the tool. An EA is a script that integrates into trading platforms like MetaTrader 4 and MT5. Its logic is often based on technical indicators: "IF the 50-period moving average crosses above the 200-period, THEN execute a buy order."

The "free" EA domain is dominated by a few common strategies, each with inherent, catastrophic risks:

- Scalping: High-frequency EAs aiming for tiny profits. They are extremely sensitive to real-world conditions like network latency and spread, which backtests often fail to model accurately. A 1-pip change can turn a profitable strategy into a losing one.

- Grid Trading: This strategy places a series of orders without stop-losses, assuming the market will range. In a strong trend, it accumulates a massive floating loss that can easily wipe out an entire account.

- Martingale: The most dangerous of all. After a losing trade, the EA doubles the position size. This creates a deceptively smooth equity curve until a statistically inevitable losing streak causes position sizes to grow exponentially, leading to a margin call and the complete destruction of the account.

Free vs. Paid EAs: Is There a Difference?

The difference between a free and a paid EA isn't just the price; it's a chasm in development, support, and transparency.

Comparative Analysis: Free vs. Paid EAs

| Attribute | Free EAs | Paid EAs |

| Cost | $0 upfront, but with significant hidden costs. | One-time fee ($50 - $1,000+) or subscription. |

| Development | Often a hobbyist's project or a promotional tool. | Backed by a professional budget for a commercial product. |

| Strategy | Simplistic or employs high-risk models (Martingale, Grid). | Can be more sophisticated, but complexity isn't a guarantee of profit. |

| Risk Management | Often rudimentary or completely absent. | A key selling point with advanced risk controls. |

| Support | None. You are entirely on your own. | Typically offered via forums, email, or direct developer contact. |

| Updates | Infrequent to non-existent; cannot adapt to market changes. | Regular updates are common to maintain performance. |

| Transparency | Low to none. The logic is often a "black box." | Reputable vendors provide detailed manuals and strategy explanations. |

| Security Risk | High. A common vector for malware or spyware. | Lower, but due diligence is still required. |

The "Free" Paradox: Uncovering the True Costs

The most dangerous illusion is that "free" means no cost. The reality is that a free EA is one of the most expensive ways a beginner can approach the market.

Free EA Feasibility Matrix for Beginners (2026 Outlook)

| Factor | Rating | Brief Justification |

| True Learning Curve | High | Requires proficiency in risk management, statistical analysis, and system evaluation. |

| Hidden & Operational Costs | High | Mandatory monthly VPS fees and the high probability of trading losses are significant. |

| Projected Risk Profile | Very High | Risks include scams, malware, flawed strategies (Martingale), and opaque AI models. |

| Projected Reward Potential | Very Low | Verifiable, consistent profitability from free EAs is exceedingly rare. |

| Impact of AI (2026) | Negative | The rise of "black box" AI EAs will make strategy vetting impossible for beginners. |

A critical and non-negotiable cost is the Virtual Private Server (VPS). An EA must run 24/5 without interruption. A home computer crash, power outage, or internet failure can prevent a crucial exit, leading to devastating losses. A reliable Forex VPS is a mandatory recurring expense, turning your "free" software into a monthly liability that creates psychological pressure to trade live before you're ready.

Day Trading Beginner vs. EA Trading Beginner

Let's compare the journey of two beginners to highlight the different challenges and skillsets required.

| Aspect | Manual Day Trading Beginner | Free EA Trading Beginner |

| Primary Activity | Learning price action, chart patterns, and market structure. | Searching for EAs, learning to install files, and configuring software settings. |

| Core Skill Development | Develops an intuitive feel for the market, risk management, and discipline. | Develops skills in software operation and backtest interpretation (often poorly). |

| Feedback Loop | Direct and immediate. A bad trade provides a clear lesson in strategy or psychology. | Indirect and delayed. It's hard to know if a loss was due to the EA, the market, or settings. |

| Psychological Focus | Managing fear and greed on a trade-by-trade basis. | Managing fear and greed at a system level (drawdowns, winning streaks). |

| Cost Structure | Primarily the cost of learning resources and initial trading capital. | Mandatory VPS costs, plus the high risk of the EA losing the entire trading capital. |

| Path to Competence | Slower, more deliberate, but builds a foundational, transferable trading skill. | Faster initial setup, but often leads to a dead end with no real trading skills learned. |

What Would Warren Buffett Think About Free Forex EAs?

Warren Buffett, the epitome of long-term, value-based investing, has built a fortune on principles that stand in stark opposition to the world of high-frequency, automated Forex trading. While he doesn't comment on Forex EAs directly, his philosophy provides a clear verdict.

"Beware of Geeks Bearing Formulas." Buffett has consistently warned investors to be skeptical of complex, history-based models. He argues that these models, often wrapped in esoteric jargon, create an illusion of authority while obscuring flawed assumptions. A free EA, especially a "black box" one, is the perfect embodiment of this warning.

Understand What You Own. Buffett's core tenet is to never invest in a business you cannot understand. Applying this to trading, how can a beginner trust their capital to an algorithm whose logic is a complete mystery? This violates the most fundamental principle of prudent capital allocation.

Speculation vs. Investing. Buffett distinguishes between investing (analyzing an asset's intrinsic value) and speculating (betting on price movements). Most Forex EAs are speculative tools. They focus entirely on short-term price behavior, a practice Buffett believes distracts from the "main ball" of valuing businesses or in this case, understanding fundamental market drivers.

In essence, Buffett would view relying on a free EA as a form of gambling disguised in technology a dangerous shortcut that bypasses the essential work of learning how to actually invest or trade.

10 Lessons from "The Mental Game of Trading" by Jared Tendler

Jared Tendler, a leading mental game coach, offers a revolutionary perspective that directly challenges the idea that an EA can solve your psychological problems. His core thesis is that emotions like fear and greed are not the problem; they are signals that point to deeper flaws in your logic or process.

Here are 10 lessons from his work that every beginner should absorb before touching an EA:

- Emotions are Messengers: Fear isn't your enemy; it's a signal. Fear of losing might mean your risk management is flawed or you don't truly trust your strategy.

- Map Your Patterns: Instead of suppressing emotions, map them. When do you feel greedy? What triggers FOMO? An EA simply automates the underlying flawed patterns you haven't fixed.

- Identify the Root Cause: Greed might not be greed at all. It could be a symptom of impatience or unrealistic expectations about how quickly you should be profitable.

- The "Inchworm" Concept: Focus on making small, incremental improvements. Trying to eliminate fear overnight is impossible. Aim to be slightly less fearful on the next trade.

- Build a Strategic Logic: Your confidence should come from a sound, tested process, not from recent results. An EA provides a false sense of confidence that shatters during the first drawdown.

- Recognize Your "A- to C-Game": Understand what your best trading mindset ("A-Game") feels like and what your worst ("C-Game") looks like. An EA can't distinguish between them; it just executes.

- Correct Flaws, Don't Just Cope: An EA is a coping mechanism. It doesn't fix the underlying reason you hesitate to pull the trigger or hold losers too long.

- Discipline is a Skill, Not a Trait: True discipline is built through a consistent process of planning, executing, and reviewing. Handing this process over to a robot prevents you from developing this crucial skill.

- Tilt is a Sign of Unresolved Issues: "Tilt" (anger-driven mistakes) happens when emotions overwhelm logic. An EA user will still experience tilt, but it will manifest as turning the system off at the worst time or cranking up the risk after a winning streak.

- The Goal is Not to Be Emotionless: The goal is to perform well with your emotions. Professional traders feel fear and the temptation of greed, but their well-honed mental process allows them to execute their plan regardless.

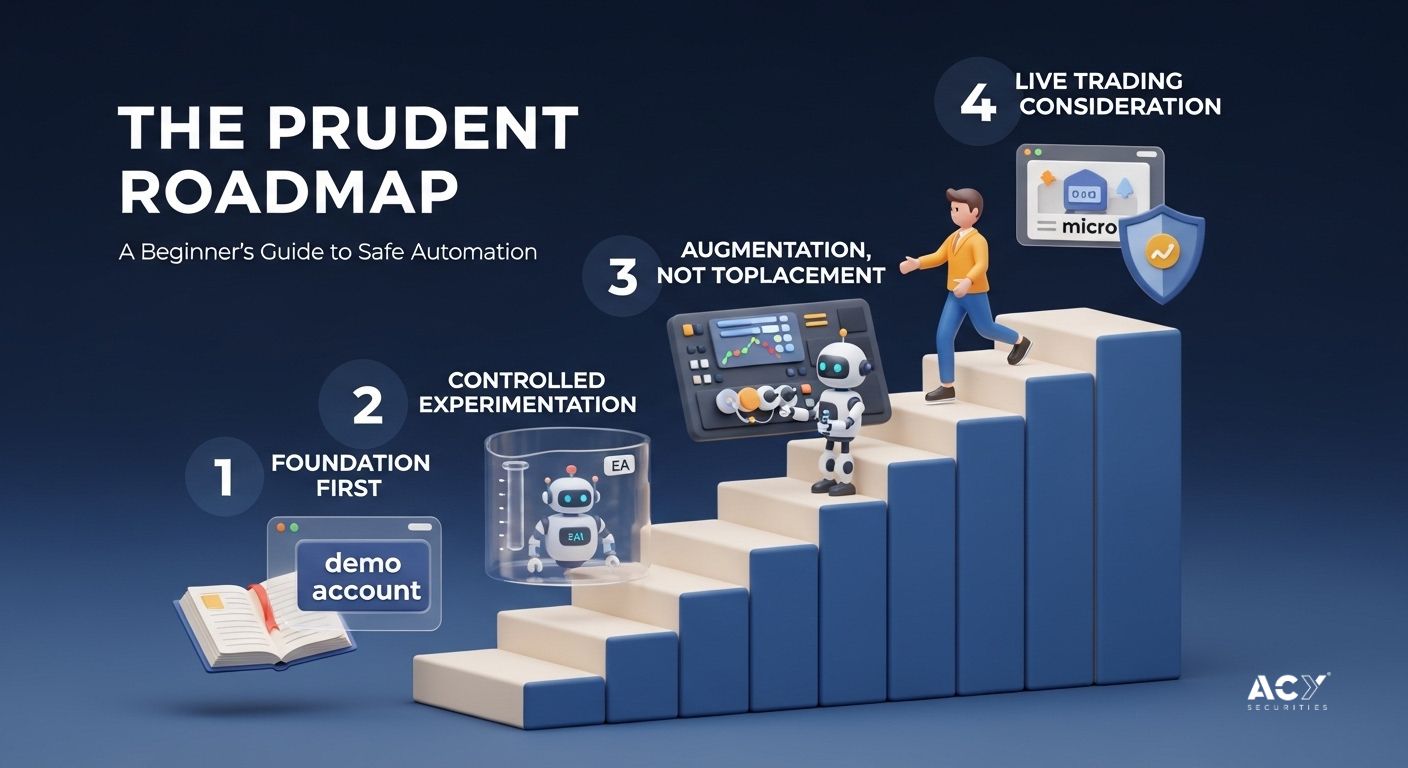

The Final Verdict and a Strategic Roadmap for 2026

The verdict is unequivocal: for a beginner trader in 2026, using free Expert Advisors to conquer fear and greed is not a viable or prudent strategy. It is a path far more likely to lead to financial loss and skill stagnation than to disciplined, profitable trading.

So, what is the right path?

A Recommended Roadmap for the Prudent Beginner

Phase 1: Foundation First (3-6 Months)

- Action: Forget automation. Focus 100% on education. Learn technical analysis, fundamental drivers, and, most importantly, risk management.

- Tool: Use a demo account to practice manual trading. Gain an intuitive feel for the market without risking real capital.

Phase 2: Controlled Experimentation (3-6 Months)

- Action: Now, you can explore a simple, transparent free EA as a learning tool. Your goal is not profit but to understand the mechanics of automated systems.

- Tool: Run the EA exclusively on a demo account. Learn to backtest, change parameters, and observe its behavior.

Phase 3: Augmentation, Not Replacement

- Action: View EAs as potential assistants. Consider tools like a Trade Assistant, which can help manage trades with features like one-click execution, trade management, and risk calculation, but leaves the final decision to you. This keeps you in control while streamlining your process.

- Tool: Explore no-code EA builders to translate your manual strategy into code. This is a powerful exercise that forces you to define your rules with absolute precision.

Phase 4: Live Trading Consideration

- Action: Only go live after achieving consistent profitability on a demo account for 3+ months with a strategy you thoroughly understand.

- Tool: Start with a micro account and minimal capital. Budget for a reliable VPS as a non-negotiable business expense.

How to Get Started with Trading Tools (The Right Way)

If you've followed the roadmap and are ready to experiment with an assistant tool on a demo account, the process is straightforward. For example, installing a tool from a provider like TradingByte involves a few simple steps:

- Download: Choose the correct version for your platform (MT4 or MT5).

- Install: Open your trading platform, go to 'File' > 'Open Data Folder', and place the downloaded file in the appropriate 'Experts' or 'Indicators' folder.

- Refresh & Load: Refresh your Navigator window in the platform and drag the tool onto your chart.

- Authorize: You will likely need to register on the provider's website and enter an email and license key to authorize the tool for the first time.

This process highlights that even using a simple tool requires a basic level of technical competence another part of the learning curve beginners must master.

Conclusion:

The journey to becoming a successful Forex trader is a marathon of skill acquisition, not a sprint powered by a free piece of code. The discipline required to manage fear and greed cannot be downloaded; it must be forged through education, deliberate practice, and the development of a robust trading plan.

The allure of a "set and forget" robot is a siren's call that leads countless beginners onto the rocks of financial ruin. The smarter path is to invest in yourself first. Build your knowledge, master your psychology, and then, and only then, look to technology as a tool to augment your skills, not replace them.

By making smarter decisions from the start, you lay the groundwork for a long and successful trading career, positioning yourself to take advantage of quality partnerships, like those offered by acy.partners, when you are truly ready.

Frequently Asked Questions (FAQ)

Q: What are the main psychological biases that sabotage traders?

A: The most common and destructive cognitive biases are Loss Aversion, where the pain of a loss is felt more intensely than the pleasure of an equivalent gain, leading traders to hold losing positions too long. Confirmation Bias causes traders to seek information that confirms their existing beliefs and ignore contradictory data. Finally, Overconfidence Bias, often after a string of wins, leads to excessive risk-taking and can quickly blow an account.

Q: How do fear and greed specifically manifest in trading decisions?

A: Fear manifests as the Fear of Loss (closing winning trades too early), Fear of Missing Out (FOMO) (chasing price movements impulsively), and the Fear of Being Wrong (leading to "analysis paralysis" and missed opportunities). Greed appears as Over-leveraging positions after a win and Holding Losing Trades Too Long in the desperate hope of a reversal.

Q: What is "revenge trading" and how can I avoid it?

A: Revenge trading is the vicious cycle of taking a loss, feeling angry, and immediately jumping back into the market with a poorly planned, often oversized trade to "win the money back." To avoid it, implement a "cooling-off" protocol: immediately close your platform after a significant loss, physically step away for at least 30 minutes, and review your trading plan and journal before considering another trade.

Q: Can an automated trading system really eliminate these emotions?

A: No, it cannot. An Expert Advisor is a tool that executes a pre-programmed strategy without emotion. However, the human operator still experiences fear and greed. These emotions are simply transferred from managing a single trade to managing the entire system's performance, which can be even more stressful for a beginner who doesn't understand the system's inevitable drawdowns.

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.

Try These Next