Trade Like an Expert: Using MetaTrader Scripts for Systematic Trading

2025-09-03 14:30:49

This article is reviewed annually to reflect the latest market regulations and trends

TL;DR (Too Long; Didn’t Read)

- Systematic Over "Gut Feel": A rules-based, systematic approach using MetaTrader scripts is more reliable for long-term success than emotional, "gut feel" trading, which is prone to psychological pitfalls like fear and greed.

- Scripts Enforce Discipline: MetaTrader scripts are one-click tools that automate predefined actions, removing hesitation and ensuring your trading plan,from entry to exit, is followed with mechanical precision.

- Automate for Precision: Scripts for position sizing, complex order entry (with pre-set stop-loss and take-profit), and closing all trades are essential for precise, error-free trade management.

- Learn from the Masters: Trading legends like Jesse Livermore and modern psychologists like Mark Douglas both emphasize that success comes from discipline, emotional control, and a systematic approach to the markets.

- ACY.com is the Beginner's Gateway: ACY.com solves the biggest hurdles for new traders by providing a free, curated library of trusted, professional-grade MetaTrader scripts, eliminating security risks and lowering the technical barrier to entry.

"The game of speculation is the most uniformly fascinating game in the world. But it is not a game for the stupid, the mentally lazy, the person of inferior emotional balance, or the get-rich-quick adventurer. They will die poor." - Jesse Livermore

Stop gambling on "gut feelings" and start trading like a machine. If you're tired of the emotional rollercoaster of fear and greed dictating your P&L, it's time to discover the secret weapon of disciplined traders: MetaTrader scripts. This is your guide to transforming your trading from a game of chance into a systematic business.

Trade Like an Expert: A Systematic Approach with MetaTrader Scripts

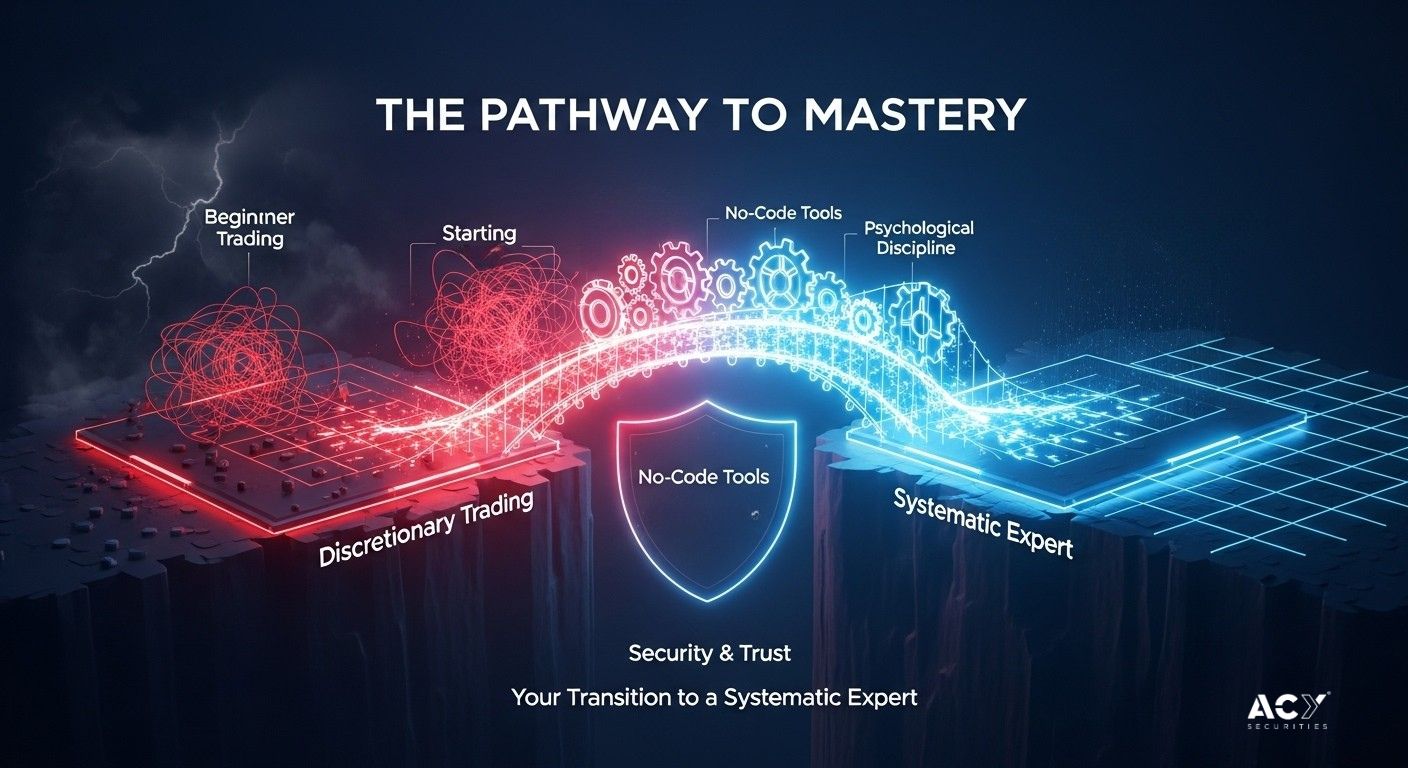

The path to consistent profitability in the financial markets is less about discovering a secret strategy and more about mastering the discipline to execute a sound one. At the heart of this mastery lies a fundamental choice between two opposing philosophies: discretionary trading, which relies on human judgment and intuition, and systematic trading, which is governed by predefined, objective rules.

While both aim for profit, their methodologies diverge sharply, particularly in how they handle the greatest variable in any trading equation: human emotion. For the vast majority of traders, a systematic approach offers a more reliable and sustainable framework for navigating the psychological complexities of the market.

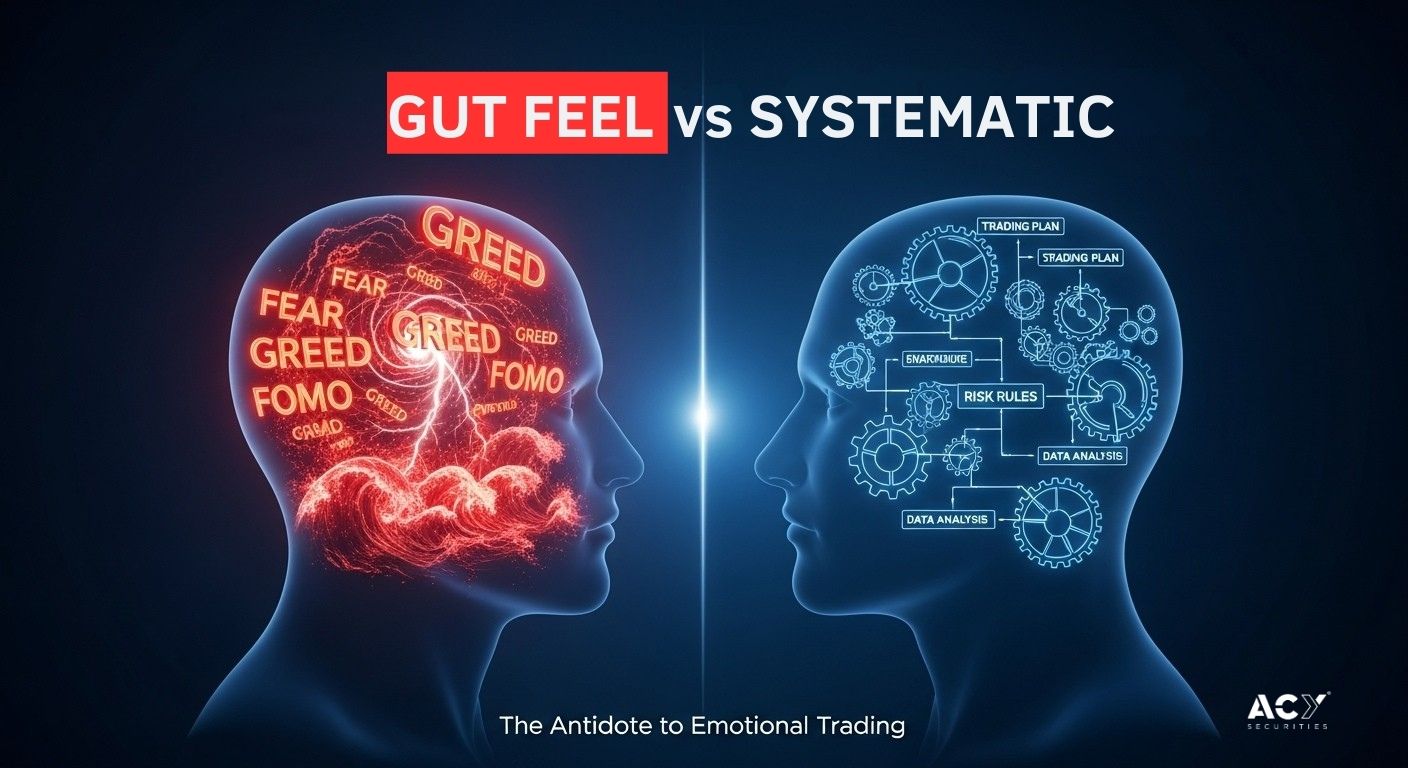

Why Is a Systematic Approach More Reliable Than "Gut Feel" Trading?

Discretionary trading, at its core, is decision-based, empowering the trader to use their experience and judgment to interpret market conditions in real-time. While this adaptability can be a significant advantage, it also exposes the trader to a minefield of psychological pitfalls.

The human brain is hardwired with a "fight-or-flight" response to uncertainty, a mechanism that perceives financial risk as an existential threat. This primal wiring unleashes powerful emotions fear, greed, euphoria, and panic, that consistently lead to suboptimal and irrational trading decisions.

Fear manifests in numerous ways: the fear of losing money can cause a trader to exit a winning position prematurely at the first sign of a minor correction, or worse, paralyze them from entering promising setups after a series of losses.

Greed, often fueled by overconfidence after a few successful trades, can lead to taking excessively large positions, ignoring established risk management rules, and ultimately catastrophic losses. This emotional rollercoaster is compounded by a host of cognitive biases that distort rational decision-making.

- Fear of Missing Out (FOMO): The anxiety of missing a perceived opportunity can drive traders to enter positions that do not align with their strategy, often at the worst possible price.

- Revenge Trading: After a loss, the emotional desire to "win back" the money can lead to impulsive, ill-conceived trades that almost invariably compound the initial loss.

- Confirmation Bias: The tendency to favor information that confirms pre-existing beliefs can cause a trader to stubbornly hold onto a losing trade, ignoring clear evidence that their analysis is wrong.

These emotional and cognitive pressures create a state of inconsistency where the trader's execution deviates from their plan, making long-term profitability nearly impossible. The discretionary trader's greatest challenge is not analyzing the market, but mastering their own mind, a task that proves insurmountable for many.

Systematic trading offers a direct antidote to the emotional chaos of discretionary decision-making. It is defined as a planned, ordered, and methodical procedure for buying and selling, where trades are executed based on a predefined set of rules and algorithms rather than subjective judgment. The primary strength of this approach is its ability to neutralize the destructive influence of fear and greed, forcing the trader to operate with a level of precision and discipline that is difficult to maintain manually.

By codifying a trading strategy into a set of non-negotiable rules, a systematic approach enforces consistency. Every entry, exit, and risk parameter is dictated by the system, not by the trader's fleeting emotional state. This mechanical execution ensures that the trading plan is followed religiously, allowing the statistical edge of the strategy, its "positive expectancy", to manifest over a large sample size of trades.

This concept, rooted in the Law of Large Numbers, is fundamental to long-term success. A discretionary trader might abandon a perfectly good strategy after three consecutive losses due to fear, but a systematic trader allows the probabilities to play out, knowing that losses are an inherent part of the process.

The mantra "Plan your trade and trade your plan" is not just a catchy phrase; it is the operational bedrock of systematic trading. This methodical approach transforms trading from a series of high-stakes guesses into a disciplined business operation, where adherence to the process is valued more than the outcome of any single trade.

What Are MetaTrader Scripts and How Do They Enforce Discipline?

Once a trader commits to a systematic approach, the next step is to find the right tools to implement and enforce their rules. Within the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, scripts serve as the ideal instrument for this purpose.

They are simple, powerful, and perfectly designed to translate a trading plan's rules into precise, repeatable actions, effectively hardwiring discipline into the execution process.

A MetaTrader script is a small program, written in the platform's native MetaQuotes Language (MQL4 or MQL5), that is designed to perform a single, specific task upon execution. Think of it as a one-click command. When a trader activates a script, it runs its programmed function from start to finish and then immediately stops and unloads itself from the chart.

It is essential to distinguish scripts from their more complex cousins, Expert Advisors (EAs).

- Expert Advisors (EAs) are programs that run continuously on a chart, analyzing the market with every incoming price tick. They are designed to manage an entire trading strategy autonomously, from identifying signals to opening, managing, and closing trades without any human intervention.

- Scripts, in contrast, are inert until deliberately activated by the trader. They do not monitor the market or make decisions. Their purpose is to execute a predefined, one-off action on command.

This distinction is the key to their value. Scripts are not a "black box" trading robot that removes the trader from the process. Instead, they are tools that the trader uses with intent. This unique position makes them the perfect "discipline bridge" for those transitioning from a purely discretionary style to a more systematic one.

The trader still makes the high-level decision (e.g., "Now is the time to exit all my positions"), but the script automates the low-level action ("Close all open orders and delete all pending orders").

This process requires a conscious decision, thus keeping the trader in control, but removes the potential for hesitation, second-guessing, or emotional error at the critical moment of execution. It allows the trader to build the "muscle of control" by automating the action but not the decision itself.

How Can Scripts Automate Your Trade Entry and Management with Precision?

In fast-moving markets, even a few seconds of delay can be the difference between a good entry and a missed opportunity. Scripts can be programmed to execute complex orders in a single click, completely bypassing the standard order window and its multiple input fields.

A well-designed entry script can, for instance, simultaneously open a market order, place a protective stop-loss a specific number of pips away, and set a take-profit target based on a predefined risk-to-reward ratio. This ensures that critical risk management parameters are never forgotten or entered incorrectly in the heat of the moment.

Order management scripts are equally powerful for enforcing discipline at the end of a trade's lifecycle. Instead of manually closing multiple positions, a process that can be fraught with emotional second-guessing, a trader can use scripts for precise, rule-based exits. Common examples include:

- Close All: A script that closes all open market positions and deletes all pending orders across all symbols. This is an indispensable tool for quickly flattening an account before major news or at the end of a trading day.

- Close Profit/Loss: Scripts that selectively close only the trades that are currently in profit or only those that are in loss. This can be part of a systematic strategy to secure gains or cut losses across the board.

- Close by Symbol: A script that closes all trades for only the symbol of the chart it is run on, leaving positions in other instruments untouched.

These tools allow a trader to manage their portfolio according to their plan, executing exits cleanly and efficiently without the emotional friction of closing each trade individually. Proper position sizing is arguably the most critical component of long-term survival and success in trading.

A position sizing script makes this process instantaneous and foolproof. The trader inputs their desired risk percentage and stop-loss level, and the script performs all the necessary calculations to determine the exact lot size that aligns with that risk parameter.

This automation elevates risk management from a mere guideline in a trading plan to an immutable law of execution.

How Would Jesse Livermore Approach Trading with MetaTrader Scripts?

Jesse Livermore, the legendary trader of the early 20th century, operated in an era of ticker tape and chalkboards, yet his philosophy is remarkably aligned with the principles of modern systematic trading. If he were trading today, he would undoubtedly see MetaTrader scripts not as a crutch, but as an essential tool for executing his rigorously defined strategies with unwavering discipline.

Livermore's core tenets were built on objective market observation and patience. He famously said, "Markets are never wrong – opinions often are." This philosophy demanded that a trader wait for the market to confirm their thesis before entering a trade. He would have used scripts to act on these confirmations instantly and without hesitation.

For example, his strategy of buying at "pivotal points", significant price levels that signal the start of a new trend, could be perfectly automated. A script could be designed to execute a buy order the moment a pivotal point is breached, with volume confirmation, eliminating any potential for second-guessing.

Furthermore, Livermore's strict risk management rules would have been hardwired into his scripts. His belief in cutting losses quickly and never averaging down on a losing position would translate directly into automated stop-loss placements on every trade. He would have despised the emotional temptation to move a stop-loss further away as a trade goes against him, and a script would have made that impossible.

Similarly, his principle of letting profits run could be managed systematically with a trailing stop script, perhaps one based on a moving average, allowing him to capture the majority of a trend without a premature, fear-based exit.

In essence, Livermore's mind was the original systematic engine. He spent years mastering his emotions to trade like a machine. MetaTrader scripts simply provide the modern trader with the tools to achieve that same level of mechanical precision from day one.

10 Lessons from "The Disciplined Trader" by Mark Douglas

Mark Douglas's seminal book, "The Disciplined Trader: Developing Winning Attitudes," is a masterclass in trading psychology. It argues that success is 80% psychological and only 20% methodological. The principles he lays out provide the mental framework, and MetaTrader scripts provide the practical tools to implement that framework.

- The Market is Always Right: Douglas stresses that the market is an objective force that "just is." A trader's beliefs or desires have no impact on it. Scripts enforce this reality by executing trades based on the market's signals, not the trader's hopes.

- Accept the Risk: Before entering a trade, you must fully accept the risk of loss without emotional discomfort. Using a position sizing script forces you to define and accept this risk in concrete, mathematical terms on every single trade.

- Create a Rules-Based System: Douglas advocates for creating a system with a clear, statistical edge. Scripts are the ultimate expression of a rules-based system, ensuring your edge can play out over time without emotional interference.

- Think in Probabilities: A disciplined trader doesn't see any single trade as a "sure thing." They see it as one instance in a long series of trades with a probable positive outcome. Scripts help maintain this mindset by automating the process, reducing the emotional attachment to any single trade's result.

- Eliminate Fear and Greed: Douglas identifies fear and greed as the primary saboteurs of trading success. Scripts that automate entries, exits, and risk management act as a circuit breaker, preventing these emotions from influencing your actions at critical moments.

- Act Without Hesitation: Once your system gives a signal, you must act. A simple one-click entry script removes the potential for the "paralysis of analysis" and ensures you execute your plan without delay.

- Take Responsibility for Your Results: A script executes your rules flawlessly. If the system isn't profitable, you can't blame a "moment of weakness." You are forced to take responsibility for the quality of your rules, leading to a more objective and productive feedback loop.

- Build Self-Trust: By consistently following your plan, you build trust in your ability to be disciplined. Using scripts to enforce your rules is like having a personal trainer for your discipline muscle, accelerating the development of self-trust.

- Stay in the "Now" Moment: Emotional trading is often driven by the pain of past losses or the fear of future ones. Scripts operate only on the "now" of a market signal, keeping your execution firmly planted in the present moment.

- Your Mindset is Your Greatest Asset: Ultimately, Douglas teaches that the internal environment (your mind) is more important than the external one (the market). By using scripts to handle the mechanical aspects of trading, you free up mental capital to focus on what truly matters: maintaining a calm, objective, and disciplined mindset.

What Are Some Essential MT4/MT5 Scripts Every Disciplined Trader Should Have?

For a trader committed to a disciplined, rules-based methodology, certain scripts are not just convenient, they are essential. They form a core toolkit that automates critical functions, enforces risk management, and enhances analytical efficiency. Forward-thinking brokers like ACY.com understand this and provide a comprehensive suite of these tools to their clients.

Core Utility & Efficiency Scripts

- Delete All Objects (Clean Chart): Analysis can quickly lead to cluttered charts filled with lines, indicators, and notes. This script instantly removes all graphical objects, providing a fresh canvas for analysis. It's a simple tool that promotes mental clarity and focus.

- History Simulator: This is an advanced educational tool that allows a trader to replay historical market data tick-by-tick. A dedicated History Simulator is invaluable for practicing strategy execution and building confidence in a trading system without risking any real capital.

Risk Management & Trade Execution Scripts

- Position Size Calculator: As mentioned, this is a non-negotiable tool. It automates the complex but vital calculation of the correct lot size for a trade based on account size, risk percentage, and stop-loss distance.

- Trailing Stop Loss: While continuous trailing stops are best managed by EAs, a script can be used to apply a specific type of trailing stop at a chosen moment. For example, ACY.com's "Long Short MA" indicatorEAs best manage continuous trailing stops can be used to trail a stop loss based on a moving average, helping to lock in profits as a trend develops.

Analytical Scripts & Indicators

- Trading Statistics: A script or indicator that creates a dashboard on the chart displaying critical real-time data such as open P&L and spread. Using a Trading Statistics indicator enhances situational awareness and allows for quick assessment of the current trading environment.

- Advanced Pivot Points: This script automatically calculates and plots the seven critical pivot levels. Using the Advanced Pivot Points tool automates a classic and widely-used method for identifying potential support and resistance zones.

- Multi-Timeframe Indicators: These are powerful tools that allow a trader to view an indicator from a higher timeframe on their current, lower-timeframe chart. For example, ACY.com offers a "Cross Timeframe MA" to plot a daily moving average on an hourly chart, and a "Multi-Timeframe RSI" that integrates signals across different periods. This helps traders ensure their intraday entries are aligned with the dominant, longer-term trend.

Why ACY.com is the Clear Winner for Aspiring Expert Traders

The journey from an aspiring novice to a disciplined, systematic expert is fraught with challenges. A trader must overcome deep-seated psychological biases, navigate a steep technical learning curve, and avoid a treacherous landscape of unreliable and dangerous tools. Success requires not only a sound strategy but also a robust ecosystem of support and technology.

An analysis of the offerings from the broker ACY.com reveals a comprehensive and strategically designed environment that directly addresses these challenges, presenting a premier choice for the trader committed to this path.

Building a Foundation: How ACY.com's Curated Script Library Solves the Trust Deficit

The open market for MetaTrader scripts suffers from a severe "trust deficit". Beginners are faced with a dilemma: risk using free tools from unknown sources that may contain malware or be fraudulent scams, or embark on the long journey of learning to code their own.

ACY.com provides a direct and powerful solution to this problem. By offering its clients a curated library of free, pre-vetted MetaTrader scripts and indicators, ACY effectively eliminates the risks associated with sourcing tools from the open internet.

This act of curation is of immense value. It removes the significant burden of due diligence from the trader, allowing them to focus on learning and strategy development rather than on cybersecurity and fraud detection.

For a beginner, this creates a safe, sandboxed environment where they can confidently experiment with high-quality systematic tools, knowing they have been provided by a trusted and regulated entity.

From Learning to Execution: An Analysis of ACY's Educational Ecosystem

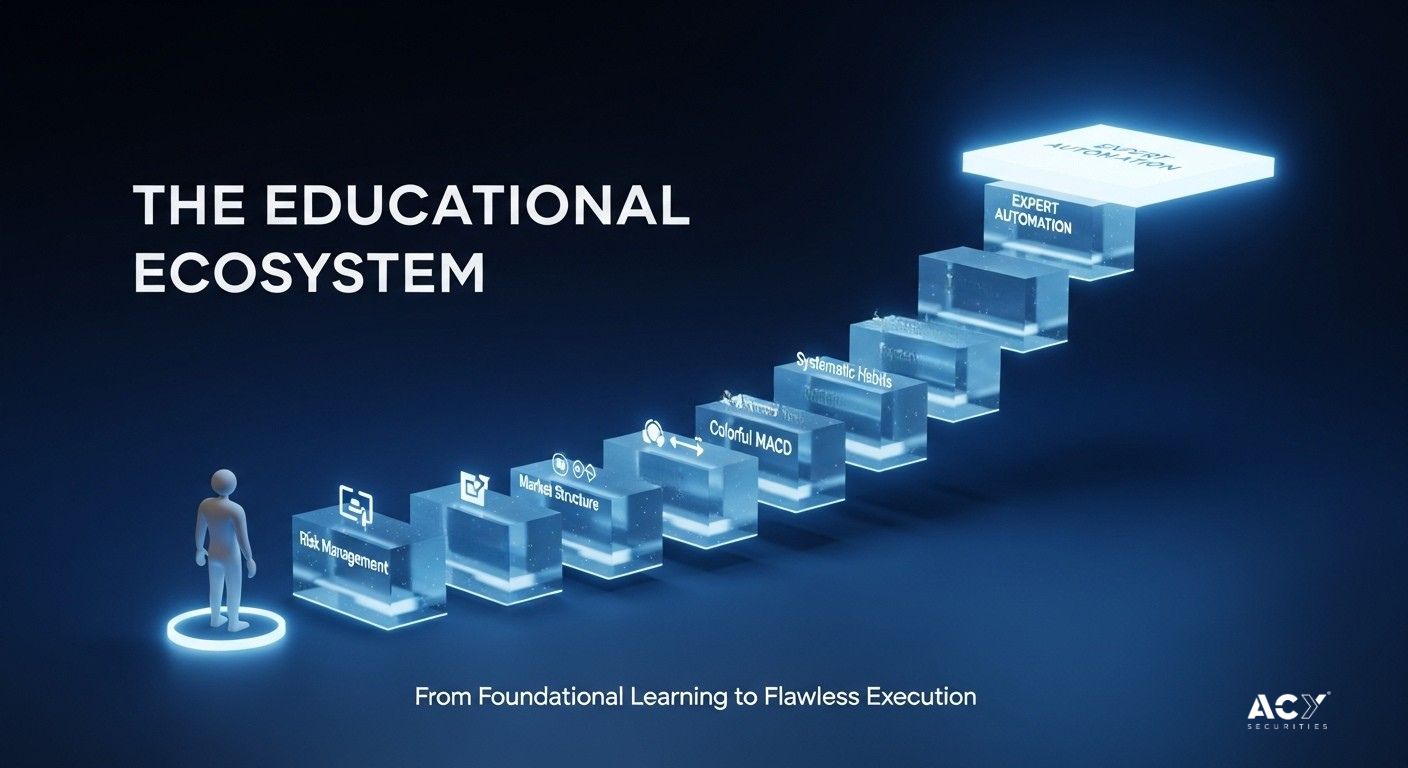

The script and indicator suite provided by ACY.com is not merely a random assortment of popular tools; it is a thoughtfully constructed toolkit that functions as a complete educational ecosystem.

Beyond the essentials, the toolkit extends to advanced visualization tools like the Colorful MACD Indicator for momentum analysis and a Periodic Separator Line Tool to better understand market cycles. These visual aids make complex indicators easier for new traders to interpret, helping them more quickly identify trends and potential trading opportunities.

By framing these tools as an "excellent stepping stone to creating expert advisors," ACY.com shows a clear understanding of the trader's journey. They provide the foundational building blocks that allow a novice to adopt systematic habits, build confidence, and gradually progress towards more advanced forms of automation.

Recommendation:

The transition from discretionary to systematic trading is a paradigm shift that requires a change in mindset, habits, and tools. ACY.com is uniquely positioned to facilitate this transition for the aspiring expert. We systematically address the primary obstacles a beginner faces:

- ACY Mitigate Psychological Errors: By providing scripts that automate execution and risk management, we help traders bypass the emotional pitfalls of fear and greed.

- ACY Lower the Technical Barrier: We offer a ready-made toolkit of professional-grade utilities, eliminating the need for beginners to learn MQL programming from scratch.

- ACY Eliminate Security Risks: We curated library provides a safe haven from the malware and scams prevalent in public forums.

In essence, ACY.com does not just provide a platform; it provides a complete pathway. By offering these essential, high-value tools for free to their live account holders, they demonstrate a vested interest in the long-term success of their clients.

For the trader seeking to leave behind the inconsistency of "gut feel" and embrace the discipline of a systematic expert, the integrated and secure ecosystem offered by ACY.com represents the clearest, safest, and most effective path to achieving their goals.

Frequently Asked Questions (FAQ)

Q1: What is the main advantage of systematic trading over discretionary trading?

A1: The primary advantage of systematic trading is its ability to neutralize the destructive influence of human emotions like fear and greed. By adhering to a predefined set of rules, it enforces consistency and discipline, allowing a strategy's statistical edge to manifest over time, which is very difficult for discretionary traders to maintain.

Q2: Are MetaTrader scripts the same as Expert Advisors (EAs)?

A2: No, they are different. Expert Advisors (EAs) are designed to run continuously and automate an entire trading strategy without human intervention. Scripts, on the other hand, are executed on command to perform a single, specific task, like closing all open trades or calculating a position size. They automate actions, not decisions.

Q3: How do scripts help with risk management?

A3: Scripts are crucial for risk management. A Position Size Calculator script, for example, can instantly determine the correct lot size based on your account balance, risk percentage, and stop-loss, ensuring you never risk more than your plan allows. This removes the emotional temptation to over-leverage on a trade that "feels" like a sure thing.

Q4: Can I get MetaTrader scripts for free?

A4: Yes, but you must be extremely cautious. The internet is flooded with free scripts, but many are poorly coded, fraudulent (e.g., "repainting" indicators), or even contain malware. The safest approach is to source free scripts from a trusted, curated provider, such as your broker.

Q5: Why is ACY.com recommended for traders who want to use scripts?

A5: ACY.com is recommended because they solve the biggest problems for beginners. They offer a curated library of professional-grade scripts and indicators for free to their clients. This eliminates the security risks of downloading from untrusted sources, lowers the technical barrier for entry, and provides the essential tools needed to build the habits of a disciplined, systematic trader in a safe and supportive environment.

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.

Try These Next