Stochastics Trading Secrets: How to Time Entries in Trending Markets using Stochastics

2025-06-23 14:56:36

“Momentum doesn’t just fade, it resets. And when it resets near the right price levels, that’s your signal to strike.”

Goal of This Lesson:

To help you understand what Stochastics actually shows, how to use it correctly in trending markets, and how to combine it with price action across multiple timeframes to identify trade-worthy setups.

What is the Stochastic Oscillator

The Stochastic Oscillator is a momentum indicator but not one that predicts or forecasts direction.

“How strong is the current move compared to the recent highs and lows?”

It looks at where price is closing relative to its recent high-low range over a set number of periods (usually 14).

- If price is closing near the top of the range, Stoch goes up → strong buying pressure

- If price is closing near the bottom of the range, Stoch drops → strong selling pressure

It gives you two lines:

- %K (RED) - the fast line (momentum raw speed)

This is the main line-it measures the current closing price in relation to the recent high-low range.

- Think of this as the raw speed of momentum.

- It reacts quickly to price changes.

- It’s more volatile, meaning it can jump up and down faster.

Analogy: %K is like the actual speed your car is going right now, updated second by second.

- %D (BLUE) - the smoothed signal line

This is a moving average of the %K line, usually a 3-period simple moving average of %K.

- It smooths out the noise from %K.

- It helps you see the trend of momentum, not just the latest spike.

- Many traders wait for %K to cross %D to trigger a signal (like buy or sell alerts).

Analogy: %D is like the average speed over the last few seconds. It doesn’t change as fast, but helps you spot direction and turning points more clearly.

In Practice:

- When %K crosses above %D in an oversold area → potential buy signal

- When %K crosses below %D in an overbought area → potential sell signal

But remember, in trending markets, you don’t use these blindly. You wait for confirmation from price action.

Real-Life Analogy: A Sprinter Mid-Race…

He explodes off the starting line - legs pumping, speed building, the crowd on their feet.

That’s %K-the fast line in the Stochastic Oscillator - raw, real-time momentum.

But off to the side, his coach is watching carefully with a stopwatch.

He isn’t just watching the burst… he’s measuring pacing over time, noting when fatigue creeps in, or when it’s time for a final push.

That’s %D - the smoothed signal line.

This is how the Stochastic Oscillator works in your trading.

%K shows the immediate pace. %D tracks the overall shift.

And when they cross or diverge-momentum is likely shifting. That’s when smart traders lean in.

Stochastics Was Built for Range Markets - But You Can Adapt It with Trending Markets

George Lane created Stochastics to help spot reversals inside ranges:

- When Stoch > 80 → market is overbought → maybe time to sell

- When Stoch < 20 → market is oversold → maybe time to buy

But that logic breaks down in strong trends.

Stochastics vs RSI - Know the Difference

| Indicator | Stochastics | RSI |

| Measures | Close vs high-low range | Avg gains vs avg losses |

| Sensitivity | Faster, better for short-term momentum | Smoother, better for divergence |

| Use in Trends | Pullback timing tool | Reversal exhaustion + divergence |

| Best Combo | With price zones + lower-timeframe entry + pullback levels | With divergence and trend strength confirmation + trend riding tool |

Simple Summary:

- RSI = Who’s winning overall? (bulls vs bears)

- Stochastics = How hard are they pushing right now?

When to Use Each:

- Use RSI when you want to:

- Spot divergences

- Measure trend exhaustion

- Confirm the strength or weakness of a move

- Use Stochastics when you want to:

- Time pullbacks within a trend

- Catch momentum resets

- Get early entry signals using multi-timeframe setups

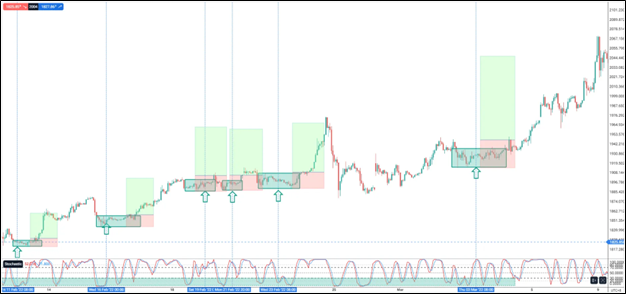

How to Use Stochastics in a Trending Market

Use Stochastics not as a reversal tool, but as a pullback timer.

In an Uptrend:

- Wait for Stochastics to pull back into the 20-30 range. Goal here is to look for pullback trades while the trend is going.

- As added confluence, for stronger confirmation, price must be approaching a support level(s)

- Moving averages

- Previous resistance turned support

- Fibonacci retracement

- Then drop to your lower timeframe:

- Wait for a sideways range

- Wait for a breakout

- Execute once price breaks above with a body close

In a Downtrend:

- Wait for Stochastics to reset into the 70-80 range

- Price should align also with previous resistances

- Confirm:

- Wait for a sideways range

- Wait for a breakdown

- Execute once price breaks below with a body close

Trade Management:

Stop Loss: Beyond the Range

Take Profit: 2x - 3x

Aiming for 2R-3R (risk-to-reward ratio) is generally smart when using Stochastics-based setups as we are also applying the rubber-band effect in trading Stochasatics.

Check also these contents:

How to Trade Breakouts Effectively in Day Trading with Smart Money Concepts

Mastering Risk Management: Stop Loss, Take Profit, and Position Sizing

Multi-Timeframe Setup (Stoch + Price Action)

Here’s your full blueprint:

- HTF (H1 or H4):

- Identify the main trend

- Wait for Stochastics to enter pullback areas

- Uptrend (20-30 Range)

- Downtrend (70-89 Range)

- Price Location:

- Price should be near a key support/resistance or FVG

- LTF (H1 or M15):

- Wait for sideways

- Wait for a break

- Execute with tight risk and clear target

- Stop beyond the range

- Target 2x - 3x

For other combinations, check this out: The Power of Multi-Timeframe Analysis in Smart Money Concepts (SMC)

Final Thought: Confirmation is Everything

Stochastics gives you the “when.”

Price action gives you the “where” and “how.”

Using Stochastics without price confirmation is like seeing your car slow down and hitting the gas without checking the road ahead.

The Winning Formula:

Stochastics + Price Action Confirmation = Trade Opportunity

So before you enter based on momentum alone, make sure price tells the same story. Wait for the key Stochastics zones for pullbacks and rebounds. Look for precision at the Lower Timeframes. Wait for a break. Let price confirm you the trade not just the indicator.

Check Out My Contents:

Strategies That You Can Use:

How To Trade & Scalp Indices at the Open Using Smart Money Concepts (SMC)

How to Trade Breakouts Effectively in Day Trading with Smart Money Concepts

Complete Step-by-Step Guide to Day Trading Gold (XAU/USD) with Smart Money Concepts (SMC)

The Power of Multi-Timeframe Analysis in Smart Money Concepts (SMC)

Forex Trading Strategy for Beginners

The Ultimate Guide to Understanding Market Trends and Price Action

Mastering Candlestick Pattern Analysis with the SMC Strategy for Day Trading

Mastering Risk Management: Stop Loss, Take Profit, and Position Sizing

How To Trade News:

Why Smart Money Concepts Work in News-Driven Markets - CPI, NFP, and More

How to Trade NFP Using Smart Money Concepts (SMC)-A Proven Strategy for Forex Traders

How to Trade CPI Like Smart Money - A Step-by-Step Guide Using SMC

Learn How to Trade US Indices:

How to Start Trading Indices and Get into the Stock Market with Low Capital (2026 Guide)

Best Indices to Trade for Day Traders | NASDAQ, S&P 500, DAX + Best Times to Trade Them

How To Trade & Scalp Indices at the Open Using Smart Money Concepts (SMC)

NAS100 - How to Trade the Nasdaq Like a Pro (Smart Money Edition)

How to Trade CPI Like Smart Money - A Step-by-Step Guide Using SMC

Why Smart Money Concepts Work in News-Driven Markets - CPI, NFP, and More

How to Start Trading Gold:

How to Swing Trade Gold (XAU/USD) Using Smart Money Concepts: A Simple Guide for Traders

Complete Step-by-Step Guide to Day Trading Gold (XAU/USD) with Smart Money Concepts (SMC)

The Ultimate Guide to Backtesting and Trading Gold (XAU/USD) Using Smart Money Concepts (SMC)

Why Gold Remains the Ultimate Security in a Shifting World

How to Start Day Trading:

5 Steps to Start Day Trading: A Strategic Guide for Beginners

8 Steps How to Start Forex Day Trading in 2026: A Beginner’s Step-by-Step Guide

3 Steps to Build a Trading Routine for Consistency and Discipline - Day Trading Edition

Learn how to navigate yourself in times of turmoil:

How to Identify Risk-On and Risk-Off Market Sentiment: A Complete Trader’s Guide

How to Trade Risk-On and Risk-Off Sentiment - With Technical Confirmation

The Ultimate Guide to Understanding Market Trends and Price Action

Want to learn how to trade like the Smart Money?

Mastering the Market with Smart Money Concepts: 5 Strategic Approaches

Mastering Candlestick Pattern Analysis with the SMC Strategy for Day Trading

Understanding Liquidity Sweep: How Smart Money Trades Liquidity Zones in Forex, Gold, US Indices

The SMC Playbook Series Part 4: How to Confirm Trend Reversal & Direction using SMC

The SMC Playbook Series Part 5: The Power of Multi-Timeframe Analysis in Smart Money Concepts (SMC)

Fair Value Gaps Explained: How Smart Money Leaves Footprints in the Market

Trading Psychology and Continuous Improvement Contents:

The Mental Game of Execution - Debunking the Common Trading Psychology

5 Steps to Backtest a Trading Strategy with AI: A Step-by-Step Guide

Managing Trading Losses: Why You Can Be Wrong and Still Win Big in Trading

The Hidden Threat in Trading: How Performance Anxiety Sabotages Your Edge

Why You Fail in Trading: You Don’t Have Enough Capital to Survive

Why 90% of Retail Traders Fail Even with Profitable Trading Strategies

Follow me for more daily market insights!

Jasper Osita - LinkedIn - FXStreet - YouTube

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.

Try These Next