Morning & Evening Star Candlestick Patterns – How to Trade Market Reversals with Confidence

2025-07-03 10:56:15

Goal of This Lesson

To help traders identify and understand the Morning and Evening Star candlestick patterns, why they are powerful signals for potential trend reversals, how to trade them in confluence with key levels, price imbalances, and timeframes, and how to maximize the probability of success using Smart Money Concepts.

What Are Morning and Evening Stars?

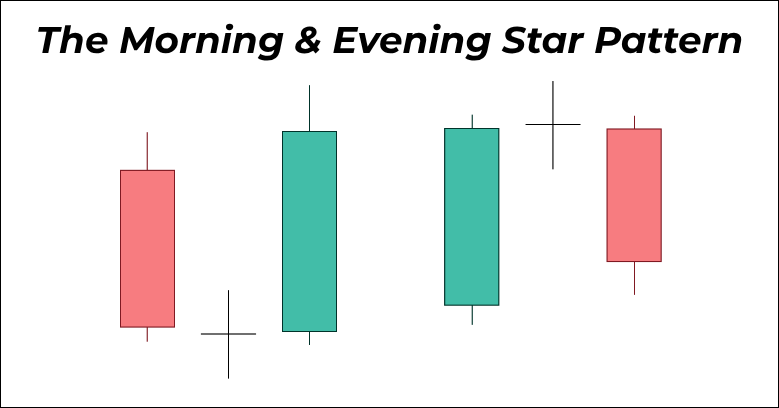

Morning and Evening Stars are three-candle reversal patterns that appear at the end of a trend, signaling a potential shift in control between buyers and sellers.

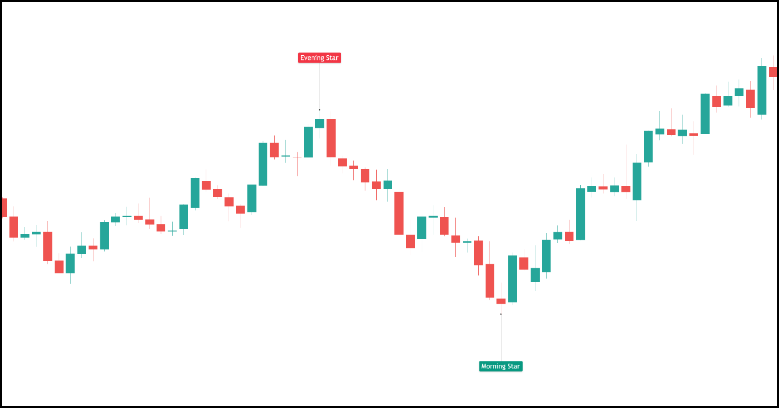

- Morning Star: Appears at the bottom of a downtrend → potential bullish reversal

- Evening Star: Appears at the top of an uptrend → potential bearish reversal

The Logic Behind These Patterns

These patterns are rooted in market psychology and order flow:

- The first candle shows strong trend continuation.

- The second candle reflects indecision or temporary exhaustion.

- The third candle signals a decisive takeover by the opposing force.

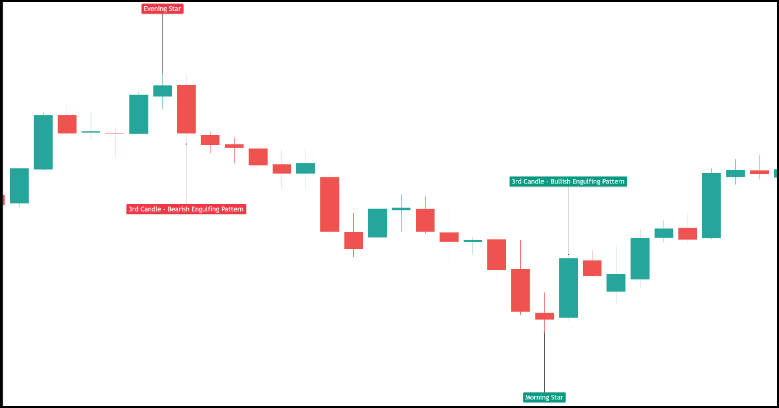

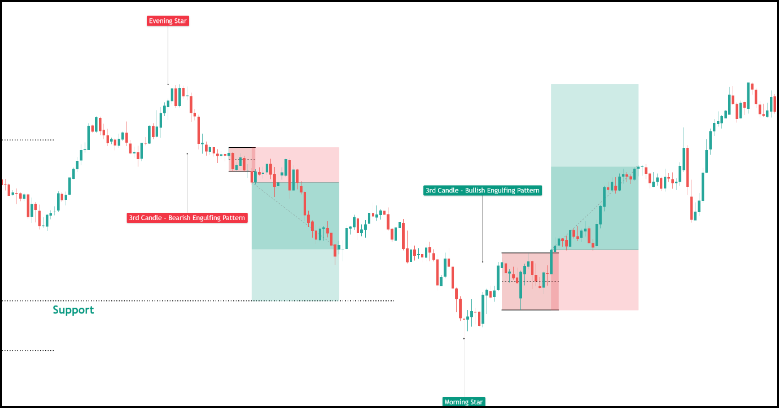

The secret lies in the 3rd candle:

- It’s usually a bullish engulfing (Morning Star) or bearish engulfing (Evening Star)

- Sometimes, it may be a piercing line (bullish) or dark cloud cover (bearish) if it closes 50–61.8% into the first candle

- This 3rd candle is the "shift candle" - the clearest signal that momentum has flipped

Why They’re Popular Among Traders

- Easy to spot visually, even for beginners

- Helps anticipate early reversals at exhaustion points

- Can be combined with institutional price concepts (e.g., liquidity sweeps, FVGs)

- Works well across Forex, Crypto, Stocks, and Indices

Structure of the Reversal Patterns

Morning Star (Bullish Reversal)

- Bearish Candle: Strong downward move

- Small/Doji Candle: Indecision (can gap down)

- Bullish Candle: Closes deep into or above the first candle’s body (engulfing/piercing)

Evening Star (Bearish Reversal)

- Bullish Candle: Strong upward momentum

- Small/Doji Candle: Indecision (can gap up)

- Bearish Candle: Closes deep into or below the first candle’s body (engulfing/dark cloud)

How to Spot a Real Momentum Shift

- 3rd candle is critical—without a strong close, it's just noise

- Look for volume divergence: high on the 1st and 3rd candles, low on the middle

- Confirm with market structure shift (MSS) or breakout/breakdown at the lower timeframe

- Consider FVG creation after the 3rd candle as a powerful confirmation

Confluence: What Makes Them High-Probability

- Key Levels

- Previous day/session highs/lows

- Support/resistance

- Institutional zones

- Time-Based

- London/NY Open or Power of 3 sessions

- Asia liquidity sweep → London reversal

- Liquidity Events

- Appears after a stop run of a support or resistance level

- Traps breakout traders → reverses with momentum

How to Trade the Pattern Effectively

Step 1: Mark Key Levels at the Higher Timeframe

Step 2: Once Price Reaches the Key Level & Creates the Pattern, Drop to Lower Timeframe

3. Wait for a Sideways Price Action and Mark It

4. Execute at Breakout. Target Next Key Level

Do’s and Don’ts of Trading Morning/Evening Stars

Do:

- Wait for the 3rd candle to fully close

- Look for a clear body that engulfs or pierces the first

- Seek HTF bias confluence (D1/H4 trend)

- Add FVG or MSS confirmations

Don’t:

- Enter mid-pattern

- Ignore context (news, time of day)

- Chase without imbalance to re-enter

- Forget stop placement—keep it logical

Real-Life Analogy

It’s like a courtroom trial:

- The first lawyer dominates (first candle).

- The judge pauses the case to hear both sides (doji).

- The other lawyer drops evidence so strong that the jury flips (3rd candle = market shifts).

Add in the institutional signature (FVG)—and you’ve got a verdict backed by power.

Final Thought

In a world flooded with candlestick patterns, the Morning and Evening Star stand out not because they’re perfect, but because they reveal something deeper—a shift in conviction. But conviction alone isn’t enough. When paired with institutional clues like a Fair Value Gap and supported by market structure, these patterns become a complete story—not just a signal.

Don’t trade them because they look good. Trade them because they make sense in the right context, with real intent behind the move.

Check Out My Contents:

Strategies That You Can Use

How To Trade & Scalp Indices at the Open Using Smart Money Concepts (SMC)

How to Trade Breakouts Effectively in Day Trading with Smart Money Concepts

Complete Step-by-Step Guide to Day Trading Gold (XAU/USD) with Smart Money Concepts (SMC)

The Power of Multi-Timeframe Analysis in Smart Money Concepts (SMC)

Forex Trading Strategy for Beginners

Mastering Candlestick Pattern Analysis with the SMC Strategy for Day Trading

Mastering Risk Management: Stop Loss, Take Profit, and Position Sizing

RSI Divergence Trading Strategy for Gold: How to Identify and Trade Trend Reversals

Stochastics Trading Secrets: How to Time Entries in Trending Markets using Stochastics

Gold Trading Stochastics Strategy: How to Trade Gold with 2R–3R Targets

RSI Hidden Divergence Explained: How to Spot Trend Continuations Like a Pro

How To Trade News

Why Smart Money Concepts Work in News-Driven Markets - CPI, NFP, and More

How to Trade NFP Using Smart Money Concepts (SMC)-A Proven Strategy for Forex Traders

How to Trade CPI Like Smart Money - A Step-by-Step Guide Using SMC

Learn How to Trade US Indices

How to Start Trading Indices and Get into the Stock Market with Low Capital (2026 Guide)

Best Indices to Trade for Day Traders | NASDAQ, S&P 500, DAX + Best Times to Trade Them

How To Trade & Scalp Indices at the Open Using Smart Money Concepts (SMC)

NAS100 - How to Trade the Nasdaq Like a Pro (Smart Money Edition)

How to Trade CPI Like Smart Money - A Step-by-Step Guide Using SMC

Why Smart Money Concepts Work in News-Driven Markets - CPI, NFP, and More

How to Start Trading Gold

How to Swing Trade Gold (XAU/USD) Using Smart Money Concepts: A Simple Guide for Traders

Complete Step-by-Step Guide to Day Trading Gold (XAU/USD) with Smart Money Concepts (SMC)

The Ultimate Guide to Backtesting and Trading Gold (XAU/USD) Using Smart Money Concepts (SMC)

Why Gold Remains the Ultimate Security in a Shifting World

How to Trade Japanese Candlesticks

How to Trade Candlestick Patterns with High Probability: A Complete Guide for Beginners

The Top Japanese Candlestick Guide: What is an Engulfing Pattern and How to Trade It?

Piercing Pattern Candlestick Explained: How to Trade It - Step-By-Step Guide

How to Start Day Trading

5 Steps to Start Day Trading: A Strategic Guide for Beginners

8 Steps How to Start Forex Day Trading in 2026: A Beginner’s Step-by-Step Guide

3 Steps to Build a Trading Routine for Consistency and Discipline - Day Trading Edition

The Ultimate Guide to Understanding Market Trends and Price Action

Learn how to navigate yourself in times of turmoil

How to Identify Risk-On and Risk-Off Market Sentiment: A Complete Trader’s Guide

How to Trade Risk-On and Risk-Off Sentiment - With Technical Confirmation

The Ultimate Guide to Understanding Market Trends and Price Action

Want to learn how to trade like the Smart Money?

Why Smart Money Concepts Work: The Truth Behind Liquidity and Price Action

Mastering the Market with Smart Money Concepts: 5 Strategic Approaches

Mastering Candlestick Pattern Analysis with the SMC Strategy for Day Trading

Understanding Liquidity Sweep: How Smart Money Trades Liquidity Zones in Forex, Gold, US Indices

The SMC Playbook Series Part 4: How to Confirm Trend Reversal & Direction using SMC

The SMC Playbook Series Part 5: The Power of Multi-Timeframe Analysis in Smart Money Concepts (SMC)

Fair Value Gaps Explained: How Smart Money Leaves Footprints in the Market

The Best Time to Use Smart Money Concepts (SMC): Why Timing Is Everything in Trading SMC

How to Trade the London Session Using Smart Money Concepts (SMC)

Trading Psychology and Continuous Improvement Contents

The Mental Game of Execution - Debunking the Common Trading Psychology

5 Steps to Backtest a Trading Strategy with AI: A Step-by-Step Guide

Managing Trading Losses: Why You Can Be Wrong and Still Win Big in Trading

The Hidden Threat in Trading: How Performance Anxiety Sabotages Your Edge

Why You Fail in Trading: You Don’t Have Enough Capital to Survive

Why 90% of Retail Traders Fail Even with Profitable Trading Strategies

The Top 10 Best Trading Books That Changed My Mindset, Strategy & Performance

Discovering Your Trader Profile: What Kind of Trader Are You?

Follow me for more daily market insights!

Jasper Osita - LinkedIn - FXStreet - YouTube

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.

Try These Next