USD/CAD: How to Trade the Oil-Backed Dollar Pair

2025-08-08 08:58:59

At first glance, USD/CAD may not seem like the most exciting pair on your watchlist.

It doesn’t always whip like GBP/USD or grind like USD/JPY. But don’t mistake quiet for weak.

USD/CAD is a macro trader’s playground.

It reflects two of the world’s most interconnected economies, one driven by oil exports and the other by global reserve flows.

When crude oil surges, Canada’s economy flexes, and the Canadian dollar gains ground. When U.S. data shocks the market, the dollar asserts dominance. This dynamic makes USD/CAD one of the most predictable and profitable pairs,if you know what to track.

It doesn’t need drama to move. It just needs divergence.

And when that divergence appears,between oil and the dollar, or between the Fed and the BoC,this pair delivers clean, structured opportunities.

What Is USD/CAD?

USD/CAD tells you how many Canadian dollars are needed to buy one U.S. dollar.

Going long means you're buying USD and selling CAD.

Shorting the pair means you're selling USD and buying CAD.

- Base currency: USD

- Quote currency: CAD

- Nickname: The Loonie

- Core driver: Oil prices, interest rate spreads, U.S. and Canadian economic divergence

Why It’s Called “The Loonie”

The nickname “Loonie” comes from Canada’s one-dollar coin, which features an image of the common loon,a bird known across the country.

Over time, traders began referring to the Canadian dollar as “the loonie.”

When you’re trading USD/CAD, you’re essentially trading the U.S. dollar against the loonie.

But the real power behind this pair isn’t just interest rates or CPI numbers.

It’s oil.

Trading a Pipeline of Flow

USD/CAD is like a pressure-sensitive pipeline.

When oil flows fast and prices surge, the pipeline pushes CAD forward and USD/CAD leaks lower.

When oil dries up and global demand slows, USD pressure builds and the pair flows upward.

It doesn’t explode without reason. But when it does, it reflects an entire macro environment in motion.

The Oil Connection: Why USD/CAD Moves with Crude

Canada is one of the world’s top oil exporters.

Its economy depends heavily on energy exports,especially crude oil sent directly to the United States.

When oil prices rise, Canada earns more revenue, the Canadian dollar strengthens, and USD/CAD tends to fall.

When oil prices drop, CAD weakens, and USD/CAD climbs as investors rotate back into the dollar.

This relationship is not just a correlation. It’s a reflection of trade flow and national revenue.

Think of oil as Canada’s economic lifeline.

And when that lifeline pulses, USD/CAD moves.

USD/CAD Macro + Structure = Bias

USD/CAD is one of the cleanest “macro-to-price” pairs in forex. You don’t need 10 indicators to figure out what’s next. You just need to know where oil is going, what the central banks are saying, and how risk sentiment is shifting.

When you align structure with these fundamental signals, USD/CAD can feel almost mechanical.

When Is the Best Time to Trade USD/CAD?

- New York Session (8:00 AM to 12:00 PM EST): U.S. and Canadian markets are open, oil is active, and volatility kicks in

- During U.S. and Canadian data releases: Especially NFP, CPI, GDP, and BoC statements

- After OPEC news or oil shocks: Large crude oil movements often lead USD/CAD trends, even if news isn't directly Canadian

Avoid Asian hours unless oil makes a sharp overnight move or unless you’re in a swing position from earlier setups.

USD/CAD Multi-Timeframe Strategy with Smart Money Concepts: Trade the Oil-Driven Dollar with Structure and Precision

If you’re looking for a structured, repeatable way to trade USD/CAD,this is it.

By combining higher-timeframe bias with lower-timeframe execution, this multi-timeframe strategy lets you align technical levels with macro catalysts like oil prices, rate differentials, and liquidity sweeps.

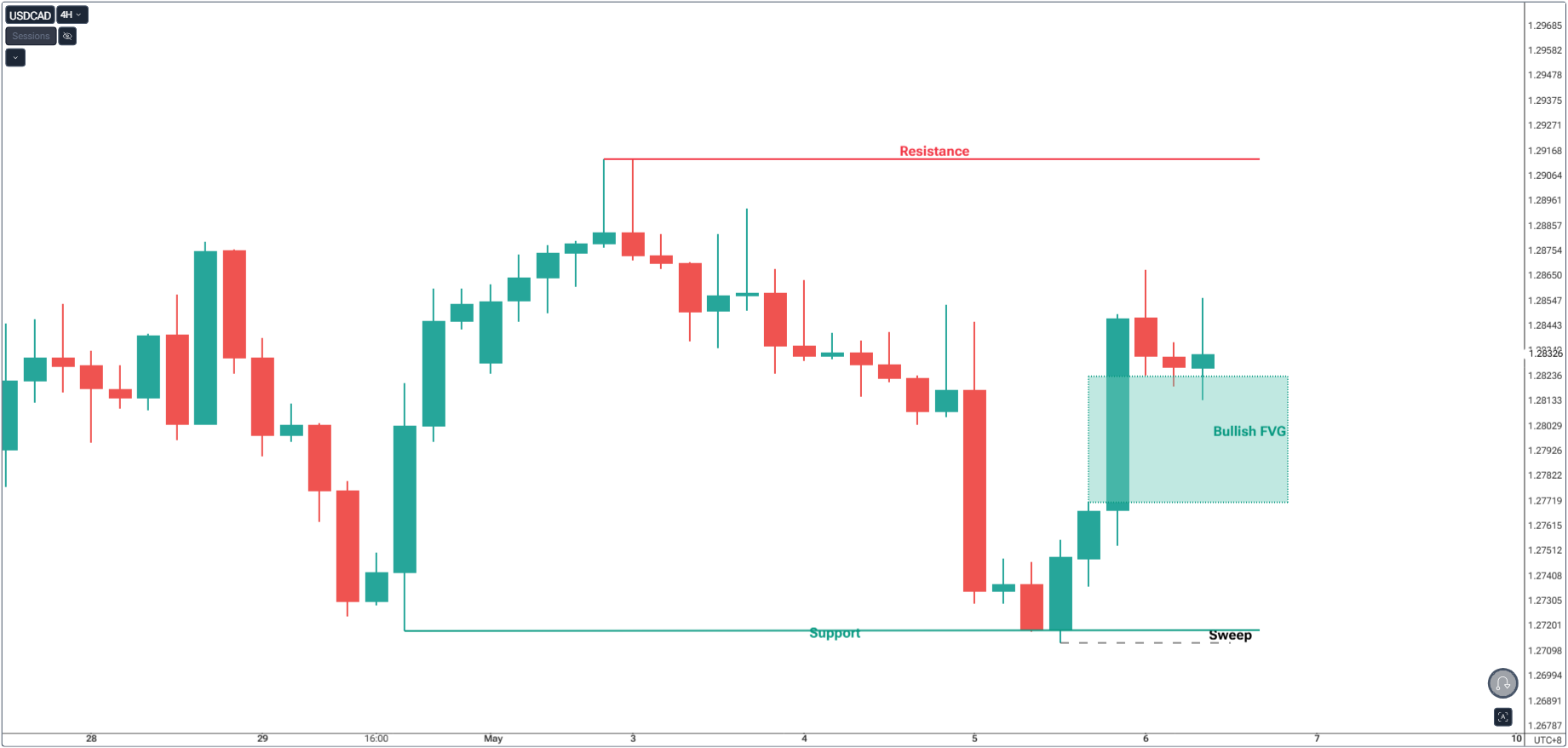

Step 1: Start With the Daily (D1) or 4-Hour (H4) to Frame the Bias

- Draw key zones: Supply/Demand, Fair Value Gaps (FVGs), Market Structure Breaks, Support and Resistances.

- Identify trend direction , bullish or bearish order flow.

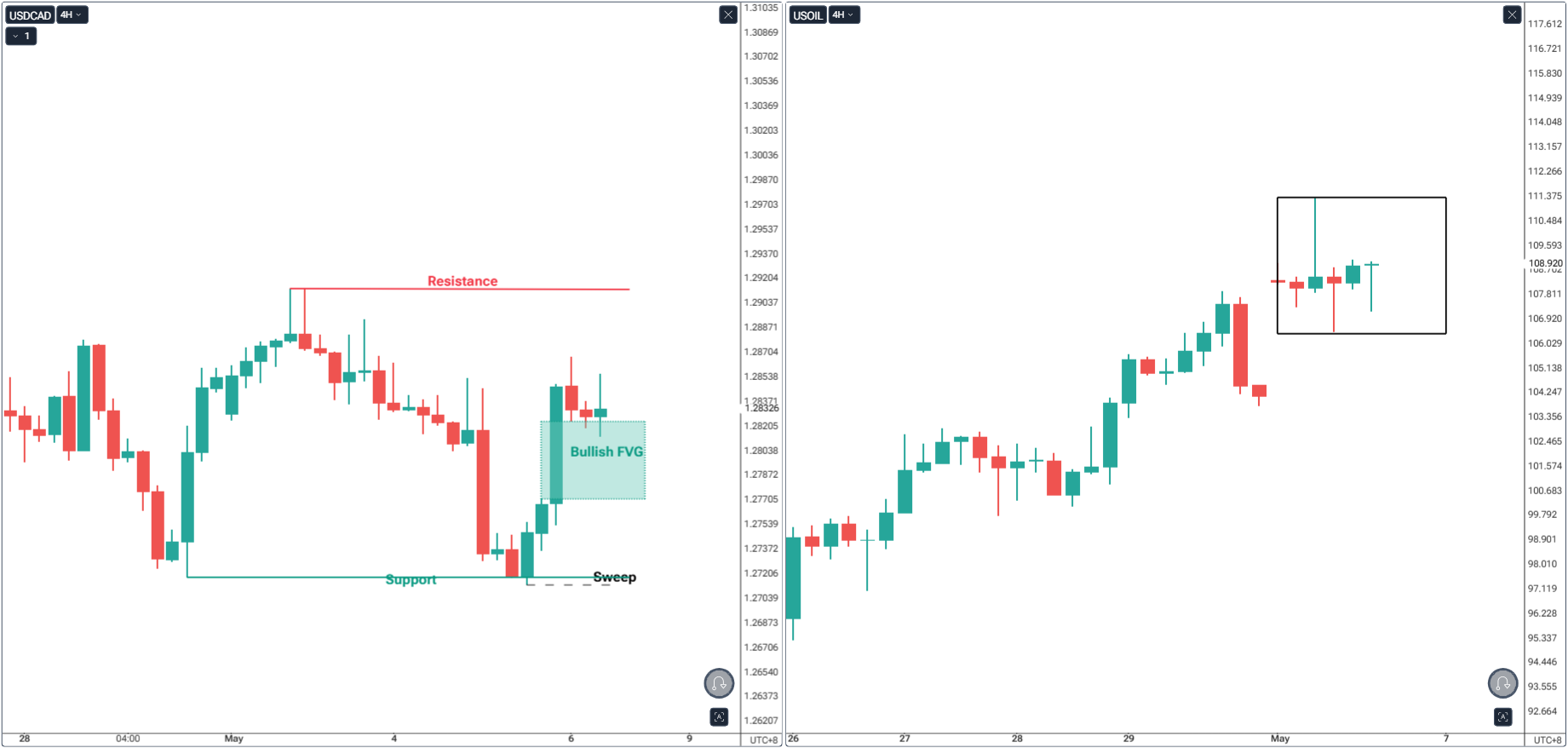

- Overlay WTI Crude Oil:

- If oil is rallying and structure is bearish, USD/CAD bias = short.

- If oil is dropping and structure is bullish, USD/CAD bias = long.

- Look at DXY to confirm overall USD strength/weakness.

Your goal: Define the macro and structural bias.

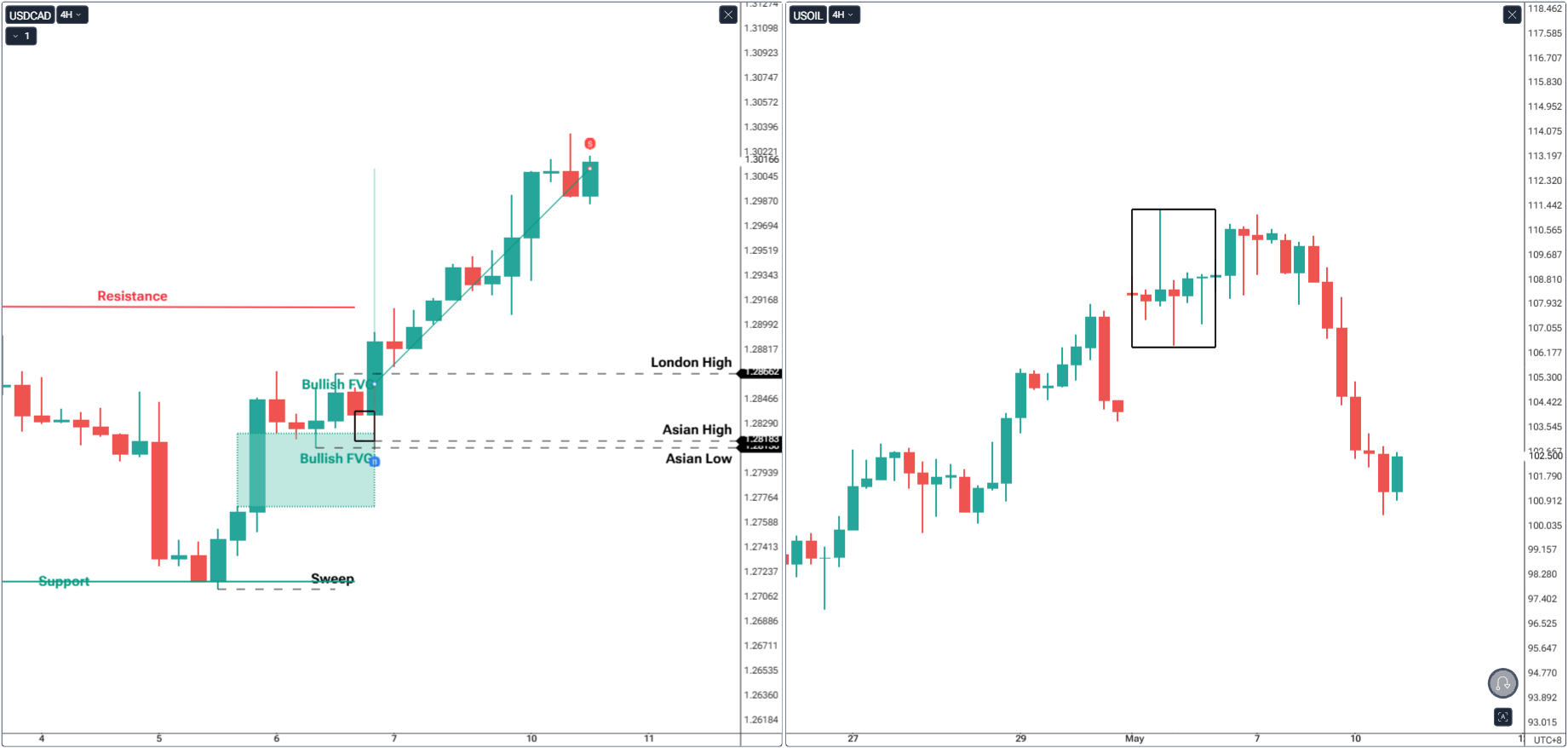

Step 2: Drop to H1 or M15 to Refine Setup

- Look for:

- Internal FVGs aligned with the higher-timeframe trend.

- Liquidity pools from recent highs/lows.

- Equal highs/lows that could be swept.

- Mark key levels for sweep.

- Watch price behavior at NY session open:

- Often a sweep of London session levels creates a trap for reversal.

- Use 7AM–9AM NY time as the key window for setup.

Your goal: Prepare the zone where you expect the reversal or continuation.

Step 3: Confirm with Key Level Sweep + Breakout Execution Model + FVG Pullback

Use a trigger like:

- Wait for price to sweep key high/low (liquidity).

- Look for a market structure shift (MSS) in your favor.

- Confirm entry on a close outside the range after sweeping a key high/low.

Add confluence with:

- Oil breaking a key structure level (e.g., WTI forming higher highs as USD/CAD forms lower highs).

- NY data releases (NFP, CPI, crude inventories).

Your goal: Enter with tight risk and clean validation.

Step 4: Manage Your Trade with Precision

- Stop Loss: Below/above the swept liquidity or the FVG invalidation level.

- Partial Take Profits:

- TP1: First imbalance or internal range level

- TP2: Previous day/session high or low

- TP3: HTF supply/demand zone

If oil is surging and USD is weak, consider holding for deeper extension.

Bonus Tips

- Avoid pre-NY entries unless oil or DXY has already broken key levels.

- Overlay oil and USD/CAD side-by-side. If WTI trends before USD/CAD reacts, it’s a signal.

- Watch for Canadian data surprises , these often move faster than U.S. data for this pair.

Essential Topics to Master for USD/CAD

- Oil inventory data (EIA/DOE reports): Weekly numbers often lead to spikes in USD/CAD

- OPEC announcements: These often trigger major CAD moves,even without domestic Canadian data

- U.S. and Canadian CPI divergences: Key driver for medium-term trends

- Central bank divergence trades: When Fed or BoC moves out of sync, trends become highly directional

- Risk sentiment flows: USD/CAD may rise even if oil is strong during risk-off moments as USD becomes a safety play

Correlated Assets to Watch

| Asset | Why It Matters |

|---|---|

| Crude Oil (WTI) | CAD moves with oil. WTI trends often lead USD/CAD by minutes or hours |

| Dollar Index (DXY) | Helps confirm whether USD is strengthening across the board |

| BoC rate expectations | Market pricing for BoC hikes or cuts influences CAD quickly |

| U.S. 10Y Yield | Supports USD leg, especially during Fed statements |

| S&P 500 / Risk sentiment | Extreme volatility can drive USD/CAD regardless of oil movement |

How USD/CAD Compares to Other Majors

- More oil-driven than EUR/USD, GBP/USD, or even AUD/USD

- Less volatile than GBP/USD, but often more consistent in trending behavior

- Highly macro-reactive, especially to U.S. and Canadian divergence

- Preferred by swing traders who align fundamentals and higher-timeframe structure

Challenge for the Week

Choose two U.S. or Canadian data days this week.

Overlay WTI Crude Oil on your USD/CAD chart.

Mark the previous day’s high and low, wait for a liquidity sweep, then look for confirmation via MSS or fair value gap.

Track whether oil gave you the early macro signal,and how structure aligned with it.

At the end of the week, note which moved first: oil or price action?

That’s where your edge lives.

Footer

Start Practicing with Confidence - Risk-Free!

Open a free demo account today and experience institutional-grade spreads, lightning-fast execution, and all the tools you need to grow as a trader.

- Trade forex, indices, gold, and more

- Access ACY, MT4, MT5, & Copy Trading Platforms

- Practice with zero risk

It’s time to go from theory to execution - risk-free.

Create an Account. Start Your Free Demo!

Check Out My Contents:

Strategies That You Can Use

How To Trade & Scalp Indices at the Open Using Smart Money Concepts (SMC)

How to Trade Breakouts Effectively in Day Trading with Smart Money Concepts

Complete Step-by-Step Guide to Day Trading Gold (XAU/USD) with Smart Money Concepts (SMC)

The Power of Multi-Timeframe Analysis in Smart Money Concepts (SMC)

Forex Trading Strategy for Beginners

Mastering Candlestick Pattern Analysis with the SMC Strategy for Day Trading

Mastering Risk Management: Stop Loss, Take Profit, and Position Sizing

How to Use Fibonacci to Set Targets & Stops (Complete Guide)

RSI Divergence Trading Strategy for Gold: How to Identify and Trade Trend Reversals

Stochastics Trading Secrets: How to Time Entries in Trending Markets using Stochastics

Gold Trading Stochastics Strategy: How to Trade Gold with 2R–3R Targets

RSI Hidden Divergence Explained: How to Spot Trend Continuations Like a Pro

Indicators / Tools for Trading

The Ultimate Guide to Risk Management in Trading – A Complete Compilation for 2026

Moving Averages Trading Strategy Playbook

How to Think Like a Price Action Trader

Mastering Fibonacci Trading Psychology – Trusting the Levels, Managing the Mind

How To Trade News

Why Smart Money Concepts Work in News-Driven Markets - CPI, NFP, and More

How to Trade NFP Using Smart Money Concepts (SMC)-A Proven Strategy for Forex Traders

How to Trade CPI Like Smart Money - A Step-by-Step Guide Using SMC

Learn How to Trade US Indices

How to Start Trading Indices and Get into the Stock Market with Low Capital (2026 Guide)

Best Indices to Trade for Day Traders | NASDAQ, S&P 500, DAX + Best Times to Trade Them

How To Trade & Scalp Indices at the Open Using Smart Money Concepts (SMC)

NAS100 - How to Trade the Nasdaq Like a Pro (Smart Money Edition)

How to Trade CPI Like Smart Money - A Step-by-Step Guide Using SMC

Why Smart Money Concepts Work in News-Driven Markets - CPI, NFP, and More

How to Start Trading Gold

How to Swing Trade Gold (XAU/USD) Using Smart Money Concepts: A Simple Guide for Traders

Complete Step-by-Step Guide to Day Trading Gold (XAU/USD) with Smart Money Concepts (SMC)

The Ultimate Guide to Backtesting and Trading Gold (XAU/USD) Using Smart Money Concepts (SMC)

Why Gold Remains the Ultimate Security in a Shifting World

How to Trade Japanese Candlesticks

How to Trade Candlestick Patterns with High Probability: A Complete Guide for Beginners

The Top Japanese Candlestick Guide: What is an Engulfing Pattern and How to Trade It?

Piercing Pattern Candlestick Explained: How to Trade It - Step-By-Step Guide

Morning & Evening Star Candlestick Patterns – How to Trade Market Reversals with Confidence

How to Start Day Trading

5 Steps to Start Day Trading: A Strategic Guide for Beginners

8 Steps How to Start Forex Day Trading in 2026: A Beginner’s Step-by-Step Guide

3 Steps to Build a Trading Routine for Consistency and Discipline - Day Trading Edition

The Ultimate Guide to Understanding Market Trends and Price Action

Trading with Momentum: The Best Trading Session to Trade Forex, Gold and Indices

Learn how to navigate yourself in times of turmoil

How to Identify Risk-On and Risk-Off Market Sentiment: A Complete Trader’s Guide

How to Trade Risk-On and Risk-Off Sentiment - With Technical Confirmation

The Ultimate Guide to Understanding Market Trends and Price Action

Want to learn how to trade like the Smart Money?

Why Smart Money Concepts Work: The Truth Behind Liquidity and Price Action

Mastering the Market with Smart Money Concepts: 5 Strategic Approaches

Mastering Candlestick Pattern Analysis with the SMC Strategy for Day Trading

Understanding Liquidity Sweep: How Smart Money Trades Liquidity Zones in Forex, Gold, US Indices

The SMC Playbook Series Part 4: How to Confirm Trend Reversal & Direction using SMC

The SMC Playbook Series Part 5: The Power of Multi-Timeframe Analysis in Smart Money Concepts (SMC)

Fair Value Gaps Explained: How Smart Money Leaves Footprints in the Market

The Best Time to Use Smart Money Concepts (SMC): Why Timing Is Everything in Trading SMC

How to Trade the London Session Using Smart Money Concepts (SMC)

Trading Psychology and Continuous Improvement Contents

The Mental Game of Execution - Debunking the Common Trading Psychology

5 Steps to Backtest a Trading Strategy with AI: A Step-by-Step Guide

Managing Trading Losses: Why You Can Be Wrong and Still Win Big in Trading

The Hidden Threat in Trading: How Performance Anxiety Sabotages Your Edge

Why You Fail in Trading: You Don’t Have Enough Capital to Survive

Why 90% of Retail Traders Fail Even with Profitable Trading Strategies

The Top 10 Best Trading Books That Changed My Mindset, Strategy & Performance

Discovering Your Trader Profile: What Kind of Trader Are You?

Follow me for more daily market insights!

Jasper Osita - LinkedIn - FXStreet - YouTube

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.

Try These Next