Outsmarting Stop Hunts: The Psychology Behind the Trap

2025-08-22 11:06:39

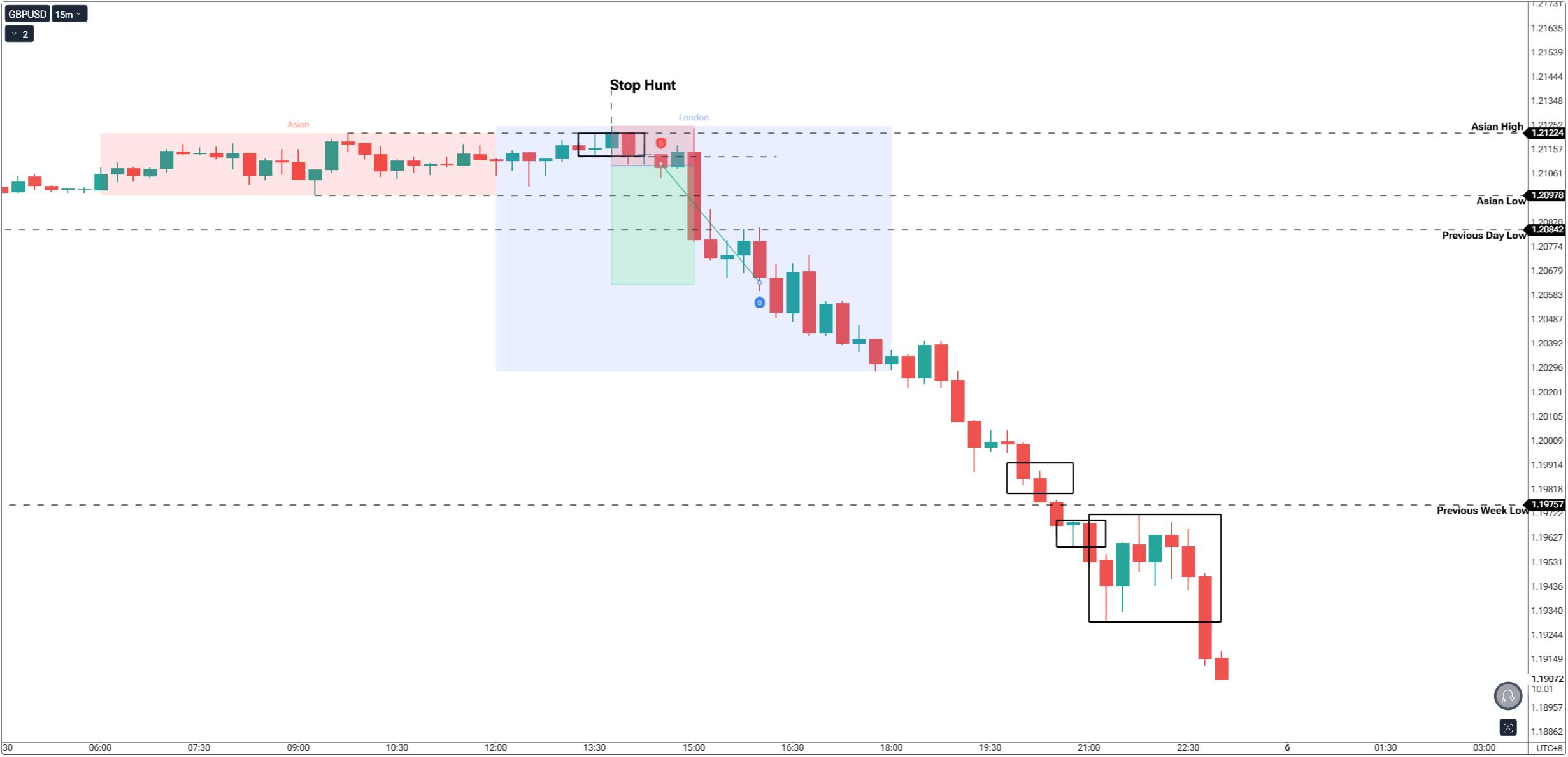

Few things feel worse in trading than being stopped out at the high or low of the day - only to watch price move exactly where you expected. That moment of frustration isn’t just bad luck. It’s a carefully engineered stop hunt, designed to exploit the predictable psychology of retail traders.

Stop hunts are more than technical tricks. They’re designed to exploit the predictable psychology of retail traders - fear, impatience, and the need to be right. To win against them, you don’t just need charts and tools; you need to rewire your mindset.

The Herd Mentality: Why We All Place Stops in the Same Spots

Traders are creatures of habit. We like clear rules and obvious levels. That’s why stops often pile up in the same places:

- Just above yesterday’s high

- Just below last week’s low

- Around round numbers (1.1000, 2000, etc.)

This creates a herd effect - liquidity clusters in predictable zones. Institutions see this, and like hunters tracking footprints in fresh snow, they know exactly where the herd has passed. The stop hunt is simply the ambush.

The Illusion of Breakouts: How FOMO Fuels the Trap

Markets know traders crave breakouts. The moment price pushes through a swing high or low, breakout traders jump in with conviction. For a few seconds, it feels like they’re ahead of the crowd. But often, that breakout is nothing more than bait - a sweep of stops before reversing.

This plays directly on FOMO (fear of missing out). Traders don’t want to be left behind, so they grab the move without confirmation. The result? They become liquidity for the real players.

The Pain Cycle: Why Stop Hunts Break Traders, Not Accounts

A single stop-out doesn’t destroy an account - but the emotional reaction to it can. Many traders fall into this spiral:

- Stop hunt triggers → frustration.

- Jump back in immediately → revenge trade.

- Get caught again → tilt, over-leverage, and bigger losses.

- Miss the real move because of fear → hesitation and regret.

This pain cycle is what destroys accounts, not the stop hunt itself. The trap isn’t just on the chart - it’s in your psychology.

The Trap of Overconfidence

Stop hunts also exploit overconfidence. Traders often think:

- “This breakout looks too clean, it has to run.”

- “Everyone can see this level - it must hold.”

But the obvious is often the target. The market knows where the crowd is looking. The stop hunt thrives on traders who place blind faith in obvious swing highs and lows without waiting for confirmation.

Patience vs. Impulse: Confirmation as Psychological Armor

The key to surviving stop hunts isn’t just technical - it’s mental. Confirmation gives you psychological grounding. Instead of reacting emotionally, you’re waiting for the market to prove itself.

Ask yourself before entering:

- Has liquidity just been taken (a swing swept)?

- Did the market shift structure afterward?

- Is there a fair value gap or imbalance to frame risk?

- Is the higher timeframe draw on liquidity aligned?

By filtering your trades through confirmation, you shift from chasing traps to waiting for the market to reveal intent.

The Asymmetry: Why One Stop Hunt Doesn’t Matter

Here’s the truth: you’ll still get caught in stop hunts sometimes. But if your risk is small and your winners are bigger, one or two hunts mean nothing.

Smart traders embrace asymmetry:

- Risk 1R

- Win 2R, 3R, or more

Even if stop hunts hit you 40% of the time, the math still works in your favor. The key is not trying to dodge every trap, but managing your losses so that one win pays for many cuts.

Training Your Mind Against Stop Hunts

- Expect Them – Stop hunts aren’t exceptions; they’re part of the market’s design.

- Detach From the Crowd – If the level looks obvious, assume stops are there.

- Embrace the Sweep – See a stop hunt not as failure, but as the beginning of opportunity.

- Journal the Pattern – Track how often stops are cleared before the true move. The more examples you record, the less personal it feels when it happens to you.

The Higher Timeframe Filter: Context Saves You

Most traders lose because they trade every swing sweep as a reversal. But not all sweeps are equal.

- If the daily or weekly trend is bullish, sweeping a swing low may just be fuel for continuation upward.

- If the higher timeframe is bearish, a sweep of a swing high might simply be momentum for another leg down.

The higher timeframe is your filter against noise. Without it, every stop hunt looks like opportunity - when in reality, most are just continuation fuel.

The Acceptance: Stop Hunts Are Part of the Game

The last piece of the puzzle is acceptance. Stop hunts aren’t unfair. They aren’t the market attacking you. They’re part of the design.

When you accept them as natural, the sting fades. Instead of feeling like a victim, you start to see them as signals of opportunity: the market showing its hand before the real move.

Real-World Analogy: The Deer Hunter’s Patience

A hunter doesn’t fire the second they see movement in the bushes. They wait for confirmation - the deer stepping into the open. If they shoot too soon, they scare it off and miss the real chance.

Stop hunts are the market’s way of shaking the bushes. If you react impulsively, you waste ammo. If you wait patiently, you take the high-probability shot.

Your Challenge This Week

Every time you’re tempted to jump into a breakout or reversal at a swing high/low, pause and demand confirmation. Journal what happened:

- Did price reverse, or did it continue?

- Did confirmation appear, or did it stay noisy?

After just a week, you’ll notice a shift. You’ll no longer see stop hunts as personal attacks, but as predictable traps you’re now too disciplined to fall for.

Start Practicing with Confidence - Risk-Free!

Open a free demo account today and experience institutional-grade spreads, lightning-fast execution, and all the tools you need to grow as a trader.

- Trade forex, indices, gold, and more

- Access ACY, MT4, MT5, & Copy Trading Platforms

- Practice with zero risk

It’s time to go from theory to execution - risk-free.

Create an Account. Start Your Free Demo!

Check Out My Contents:

Strategies That You Can Use

How To Trade & Scalp Indices at the Open Using Smart Money Concepts (SMC)

How to Trade Breakouts Effectively in Day Trading with Smart Money Concepts

Complete Step-by-Step Guide to Day Trading Gold (XAU/USD) with Smart Money Concepts (SMC)

The Power of Multi-Timeframe Analysis in Smart Money Concepts (SMC)

Forex Trading Strategy for Beginners

Mastering Candlestick Pattern Analysis with the SMC Strategy for Day Trading

Mastering Risk Management: Stop Loss, Take Profit, and Position Sizing

How to Use Fibonacci to Set Targets & Stops (Complete Guide)

RSI Divergence Trading Strategy for Gold: How to Identify and Trade Trend Reversals

Stochastics Trading Secrets: How to Time Entries in Trending Markets using Stochastics

Gold Trading Stochastics Strategy: How to Trade Gold with 2R–3R Targets

RSI Hidden Divergence Explained: How to Spot Trend Continuations Like a Pro

Indicators / Tools for Trading

The Ultimate Guide to Risk Management in Trading - A Complete Compilation for 2026

Moving Averages Trading Strategy Playbook

How to Think Like a Price Action Trader

Mastering Fibonacci Trading Psychology - Trusting the Levels, Managing the Mind

How To Trade News

Why Smart Money Concepts Work in News-Driven Markets - CPI, NFP, and More

How to Trade NFP Using Smart Money Concepts (SMC)-A Proven Strategy for Forex Traders

How to Trade CPI Like Smart Money - A Step-by-Step Guide Using SMC

Learn How to Trade US Indices

How to Start Trading Indices and Get into the Stock Market with Low Capital (2026 Guide)

Best Indices to Trade for Day Traders | NASDAQ, S&P 500, DAX + Best Times to Trade Them

How To Trade & Scalp Indices at the Open Using Smart Money Concepts (SMC)

NAS100 - How to Trade the Nasdaq Like a Pro (Smart Money Edition)

How to Trade CPI Like Smart Money - A Step-by-Step Guide Using SMC

Why Smart Money Concepts Work in News-Driven Markets - CPI, NFP, and More

How to Start Trading Gold

How to Swing Trade Gold (XAU/USD) Using Smart Money Concepts: A Simple Guide for Traders

Complete Step-by-Step Guide to Day Trading Gold (XAU/USD) with Smart Money Concepts (SMC)

The Ultimate Guide to Backtesting and Trading Gold (XAU/USD) Using Smart Money Concepts (SMC)

Why Gold Remains the Ultimate Security in a Shifting World

How to Trade Japanese Candlesticks

How to Trade Candlestick Patterns with High Probability: A Complete Guide for Beginners

The Top Japanese Candlestick Guide: What is an Engulfing Pattern and How to Trade It?

Piercing Pattern Candlestick Explained: How to Trade It - Step-By-Step Guide

Morning & Evening Star Candlestick Patterns - How to Trade Market Reversals with Confidence

How to Start Day Trading

5 Steps to Start Day Trading: A Strategic Guide for Beginners

8 Steps How to Start Forex Day Trading in 2026: A Beginner’s Step-by-Step Guide

3 Steps to Build a Trading Routine for Consistency and Discipline - Day Trading Edition

The Ultimate Guide to Understanding Market Trends and Price Action

Trading with Momentum: The Best Trading Session to Trade Forex, Gold and Indices

Learn how to navigate yourself in times of turmoil

How to Identify Risk-On and Risk-Off Market Sentiment: A Complete Trader’s Guide

How to Trade Risk-On and Risk-Off Sentiment - With Technical Confirmation

The Ultimate Guide to Understanding Market Trends and Price Action

Want to learn how to trade like the Smart Money?

Why Smart Money Concepts Work: The Truth Behind Liquidity and Price Action

Mastering the Market with Smart Money Concepts: 5 Strategic Approaches

Mastering Candlestick Pattern Analysis with the SMC Strategy for Day Trading

Understanding Liquidity Sweep: How Smart Money Trades Liquidity Zones in Forex, Gold, US Indices

The SMC Playbook Series Part 4: How to Confirm Trend Reversal & Direction using SMC

The SMC Playbook Series Part 5: The Power of Multi-Timeframe Analysis in Smart Money Concepts (SMC)

Fair Value Gaps Explained: How Smart Money Leaves Footprints in the Market

The Best Time to Use Smart Money Concepts (SMC): Why Timing Is Everything in Trading SMC

How to Trade the London Session Using Smart Money Concepts (SMC)

Trading Psychology and Continuous Improvement Contents

The Mental Game of Execution - Debunking the Common Trading Psychology

5 Steps to Backtest a Trading Strategy with AI: A Step-by-Step Guide

Managing Trading Losses: Why You Can Be Wrong and Still Win Big in Trading

The Hidden Threat in Trading: How Performance Anxiety Sabotages Your Edge

Why You Fail in Trading: You Don’t Have Enough Capital to Survive

Why 90% of Retail Traders Fail Even with Profitable Trading Strategies

The Top 10 Best Trading Books That Changed My Mindset, Strategy & Performance

Discovering Your Trader Profile: What Kind of Trader Are You?

Follow me for more daily market insights!

Jasper Osita - LinkedIn - FXStreet - YouTube

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.

Try These Next