Mastering Retests: How to Enter with Confirmation After a Breakout

2025-07-15 11:06:13

Goal of This Lesson:

To help you time high-probability entries after a breakout using retests—removing FOMO, improving entry price, and increasing your edge as a price action trader.

Real-Life Analogy

Imagine a boxer lands a clean punch (the breakout).

The opponent staggers—but then regains footing and circles back.

That’s the retest.

If the boxer strikes again and the opponent goes down—you had confirmation.

Don’t bet on the first punch. Wait for the second blow that proves the fight is yours.

Why Retests Matter in Price Action

Not all breakouts fly. Even valid breakouts often return to the breakout zone before continuing. This return move is called the retest.

In price action terms, a retest serves two critical purposes:

- Confirms the breakout was valid (support becomes resistance, or vice versa)

- Provides a cleaner and a good risk-reward ratio entry point

What Is a Retest?

A retest happens when price breaks a key level (resistance or support), then returns to that same level and either:

- Bounces off it (confirming the level flip), or

- Consolidates briefly before continuing in the breakout direction.

This forms the classic break-and-retest pattern.

Retest vs. Pullback – What’s the Difference?

While both involve price moving “backward,” they serve different structural purposes:

| Feature | Retest | Pullback |

|---|---|---|

| Purpose | Confirms breakout or S/R flip | Temporary correction in ongoing trend |

| Location | At the breakout level (S/R flip zone) | Usually deeper, into internal structure or moving average |

| Timing | Immediately after a breakout | Occurs after trend continuation or extended move |

| Behavior | Often sharp, single candle, low volatility | Can be multi-legged, corrective, or even choppy |

| Entry | Aggressive confirmation or limit order | Trend continuation or FVG-style entry |

| Risk | Defined by breakout level | Depends on deeper structural zones or FVG invalidation |

A retest is tied to the breakout zone—it’s your confirmation that structure has shifted.

A pullback is part of the normal ebb and flow of a trend.

3 Types of Retests Every Trader Should Know

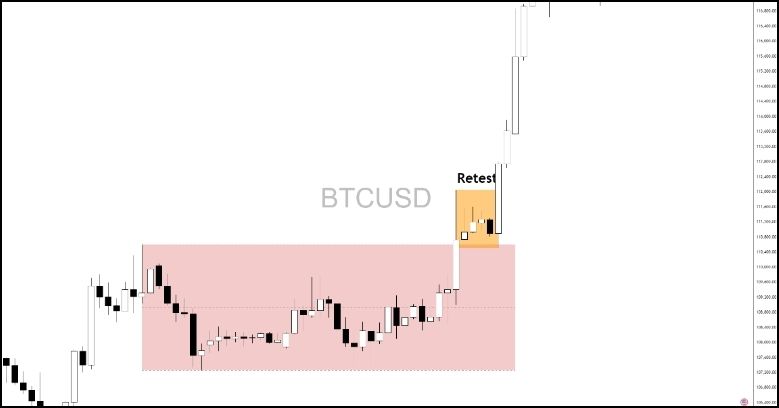

1. Clean Retest

- Price returns exactly to the breakout level

- Usually forms a wick or small-bodied candle

- Great for limit orders or confirmation entries

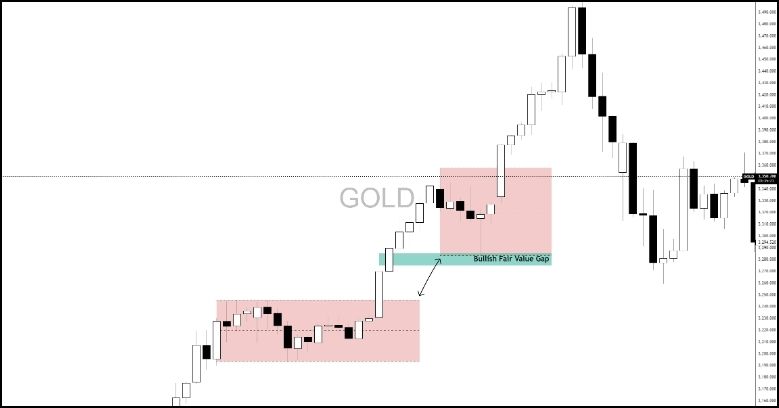

2. Shallow Retest

- Price barely pulls back, usually, creates a gap between the previous structure and current

- Often requires lower timeframes for trade opportunities

- Usually happens when there’s strong momentum

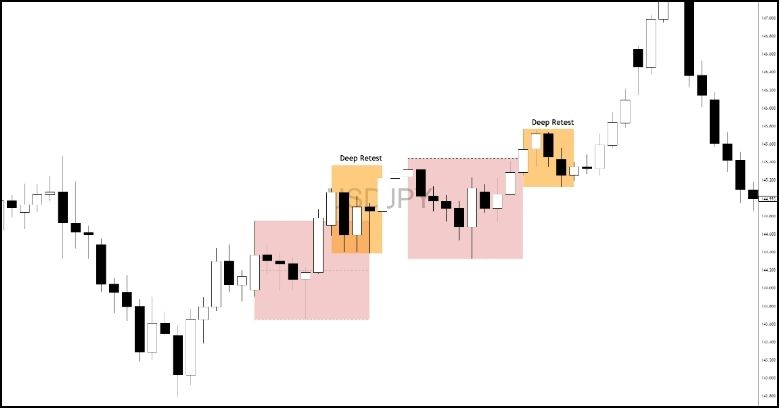

3. Deep Retest

- Price returns beyond the breakout level, often testing internal structure, even reaching below the 50% of the previous range

- Still valid if followed by a strong reaction or shift in market structure

Deep retests often trap traders expecting a failed breakout, then resume in the original direction.

Ideal Retest Conditions (Price Action Checklist)

| # | Question to Ask |

|---|---|

| 1 | Was there a strong, clean breakout candle with follow-through? |

| 2 | Is price returning to a well-defined level or zone? |

| 3 | Are you seeing wick rejections, rejection candles, or confirmation candle (e.g., pin bars)? |

| 4 | Is volume or momentum slowing down on the return? |

| 5 | Are you within a high-probability session (London/NY Open)? |

| 6 | Can you confirm the reaction with a shift in market structure in the lower timeframe? |

| 7 | Do you have a clear invalidation point (e.g., below the retest zone)? |

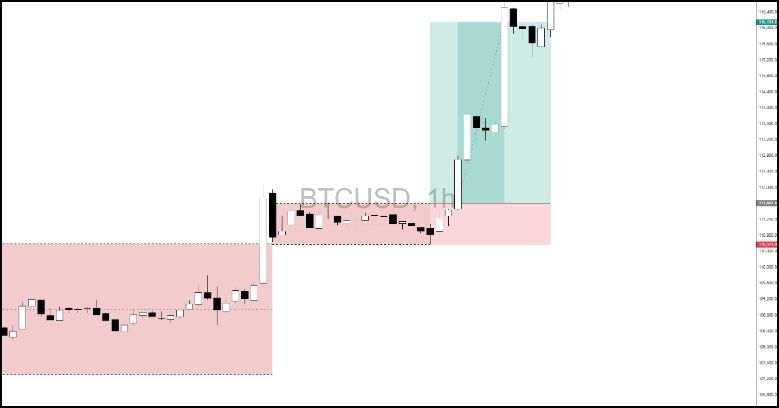

Entry Model: The Retest + Confirmation Combo

You don’t need to guess. Combine two things:

- HTF Breakout

- LTF Confirmation (after retest)

Example:

- Price breaks H4 resistance

- Returns to the zone with a small wick

- Drop to LTF H1 or M15

- Wait for a breakout at LTF

This method avoids chasing and keeps your entry tight and smart.

For targets, check this:

Mastering Risk Management: Stop Loss, Take Profit, and Position Sizing

How to Use Fibonacci to Set Targets & Stops (Complete Guide)

Retest Entry Blueprint

| Step | Action |

|---|---|

| 1 | Identify key breakout level (previous S/R or range) |

| 2 | Watch price return to the zone—mark wick zones or FVGs |

| 3 | Wait for confirmation (wick rejection, engulfing, or BoS) |

| 4 | Enter on confirmation or place limit with structure stop |

| 5 | Target the next clean level or follow a 2R–3R model |

Key Takeaways

- Retests are confirmation checkpoints, not random pullbacks

- Avoid chasing the breakout—let price come to you

- Use structure, timing, and reaction to validate the setup

- Retests reduce risk and improve reward-to-risk ratios

Start Practicing with Confidence — Risk-Free!

Open a free demo account today and experience institutional-grade spreads, lightning-fast execution, and all the tools you need to grow as a trader.

- Trade forex, indices, gold, and more

- Access ACY, MT4, MT5, & Copy Trading Platforms

- Practice with zero risk

It’s time to go from theory to execution — risk-free.

Create an Account. Start Your Free Demo!

Check Out My Contents:

Strategies That You Can Use

How To Trade & Scalp Indices at the Open Using Smart Money Concepts (SMC)

How to Trade Breakouts Effectively in Day Trading with Smart Money Concepts

Complete Step-by-Step Guide to Day Trading Gold (XAU/USD) with Smart Money Concepts (SMC)

The Power of Multi-Timeframe Analysis in Smart Money Concepts (SMC)

Forex Trading Strategy for Beginners

Mastering Candlestick Pattern Analysis with the SMC Strategy for Day Trading

Mastering Risk Management: Stop Loss, Take Profit, and Position Sizing

How to Use Fibonacci to Set Targets & Stops (Complete Guide)

RSI Divergence Trading Strategy for Gold: How to Identify and Trade Trend Reversals

Stochastics Trading Secrets: How to Time Entries in Trending Markets using Stochastics

Gold Trading Stochastics Strategy: How to Trade Gold with 2R–3R Targets

RSI Hidden Divergence Explained: How to Spot Trend Continuations Like a Pro

How To Trade News

Why Smart Money Concepts Work in News-Driven Markets - CPI, NFP, and More

How to Trade NFP Using Smart Money Concepts (SMC)-A Proven Strategy for Forex Traders

How to Trade CPI Like Smart Money - A Step-by-Step Guide Using SMC

Learn How to Trade US Indices

How to Start Trading Indices and Get into the Stock Market with Low Capital (2026 Guide)

Best Indices to Trade for Day Traders | NASDAQ, S&P 500, DAX + Best Times to Trade Them

How To Trade & Scalp Indices at the Open Using Smart Money Concepts (SMC)

NAS100 - How to Trade the Nasdaq Like a Pro (Smart Money Edition)

How to Trade CPI Like Smart Money - A Step-by-Step Guide Using SMC

Why Smart Money Concepts Work in News-Driven Markets - CPI, NFP, and More

How to Start Trading Gold

How to Swing Trade Gold (XAU/USD) Using Smart Money Concepts: A Simple Guide for Traders

Complete Step-by-Step Guide to Day Trading Gold (XAU/USD) with Smart Money Concepts (SMC)

The Ultimate Guide to Backtesting and Trading Gold (XAU/USD) Using Smart Money Concepts (SMC)

Why Gold Remains the Ultimate Security in a Shifting World

How to Trade Japanese Candlesticks

How to Trade Candlestick Patterns with High Probability: A Complete Guide for Beginners

The Top Japanese Candlestick Guide: What is an Engulfing Pattern and How to Trade It?

Piercing Pattern Candlestick Explained: How to Trade It - Step-By-Step Guide

Morning & Evening Star Candlestick Patterns – How to Trade Market Reversals with Confidence

How to Start Day Trading

5 Steps to Start Day Trading: A Strategic Guide for Beginners

8 Steps How to Start Forex Day Trading in 2026: A Beginner’s Step-by-Step Guide

3 Steps to Build a Trading Routine for Consistency and Discipline - Day Trading Edition

The Ultimate Guide to Understanding Market Trends and Price Action

Trading with Momentum: The Best Trading Session to Trade Forex, Gold and Indices

Learn how to navigate yourself in times of turmoil

How to Identify Risk-On and Risk-Off Market Sentiment: A Complete Trader’s Guide

How to Trade Risk-On and Risk-Off Sentiment - With Technical Confirmation

The Ultimate Guide to Understanding Market Trends and Price Action

Want to learn how to trade like the Smart Money?

Why Smart Money Concepts Work: The Truth Behind Liquidity and Price Action

Mastering the Market with Smart Money Concepts: 5 Strategic Approaches

Mastering Candlestick Pattern Analysis with the SMC Strategy for Day Trading

Understanding Liquidity Sweep: How Smart Money Trades Liquidity Zones in Forex, Gold, US Indices

The SMC Playbook Series Part 4: How to Confirm Trend Reversal & Direction using SMC

The SMC Playbook Series Part 5: The Power of Multi-Timeframe Analysis in Smart Money Concepts (SMC)

Fair Value Gaps Explained: How Smart Money Leaves Footprints in the Market

The Best Time to Use Smart Money Concepts (SMC): Why Timing Is Everything in Trading SMC

How to Trade the London Session Using Smart Money Concepts (SMC)

Trading Psychology and Continuous Improvement Contents

The Mental Game of Execution - Debunking the Common Trading Psychology

5 Steps to Backtest a Trading Strategy with AI: A Step-by-Step Guide

Managing Trading Losses: Why You Can Be Wrong and Still Win Big in Trading

The Hidden Threat in Trading: How Performance Anxiety Sabotages Your Edge

Why You Fail in Trading: You Don’t Have Enough Capital to Survive

Why 90% of Retail Traders Fail Even with Profitable Trading Strategies

The Top 10 Best Trading Books That Changed My Mindset, Strategy & Performance

Discovering Your Trader Profile: What Kind of Trader Are You?

Follow me for more daily market insights!

Jasper Osita - LinkedIn - FXStreet - YouTube

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.

Try These Next