Institutional Order Flow – Reading the Market Through the Eyes of the Big Players

2025-08-11 14:12:24

From SMC Foundations to Institutional Order Flow

Once you start learning Smart Money Concepts, the market begins to look completely different. You stop seeing random candles and start seeing a story - liquidity being built, swept, and price delivered with purpose.

Within SMC, there are several pillars traders lean on - liquidity concepts, displacement, market structure shifts, and fair value gaps. But one of the key concepts that ties them all together is institutional order flow.

If SMC is the language of the market, then institutional order flow is the tone - the subtle signal that reveals whether the big players are speaking with conviction or just whispering.

A Layer Beyond Trend Direction

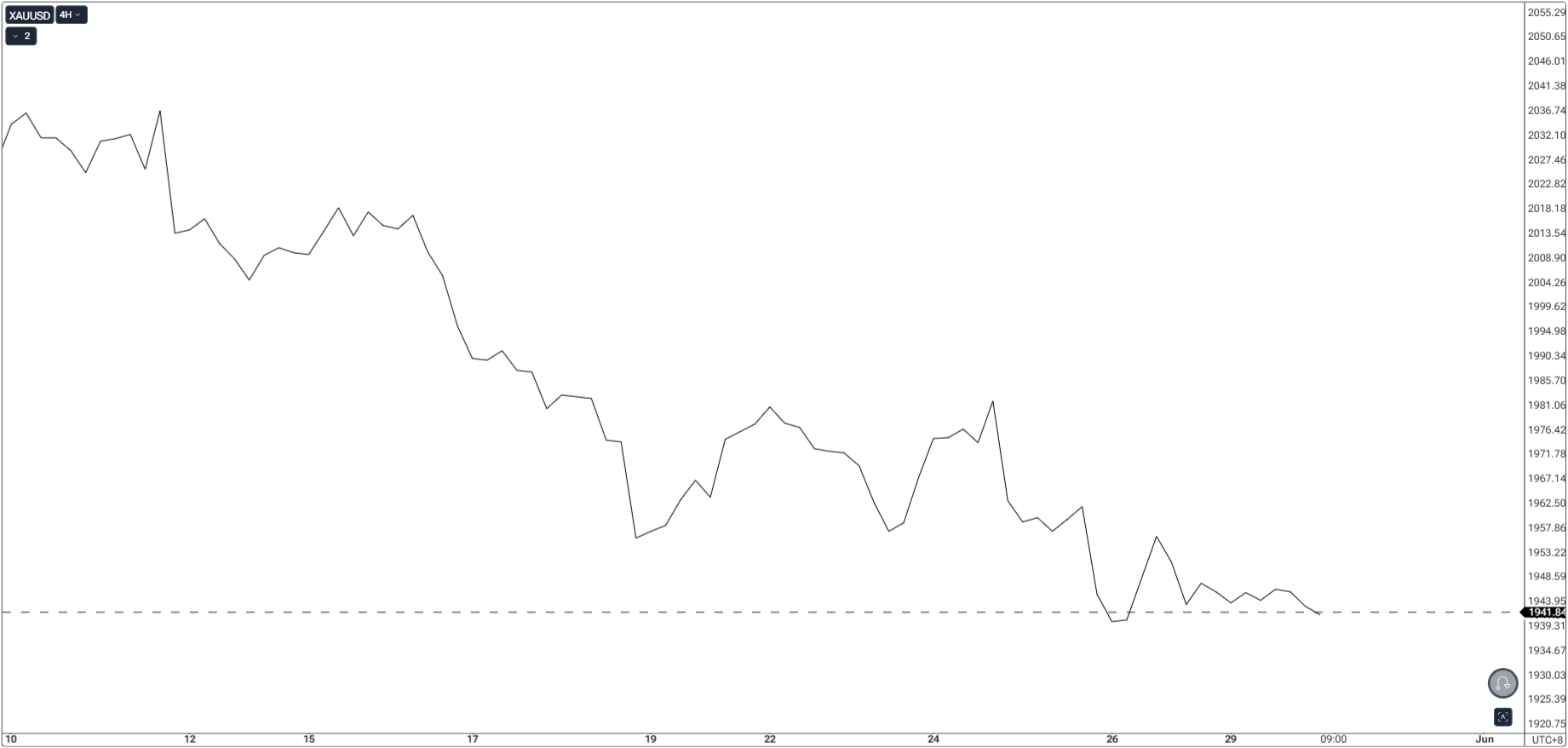

If you’ve been trading for a while, you already know the value of identifying trend direction - higher highs and higher lows for bullish, lower highs and lower lows for bearish. It’s a proven method that works and has stood the test of time.

Institutional order flow doesn’t replace that - it adds a layer of depth. Think of it as trend direction with a magnifying glass. You still respect the same structure, but now you measure the quality of the trend and the psychology behind the moves.

Where trend direction tells you what the market is doing, institutional order flow tells you how strong the move is, why it’s happening, and whether it’s likely to continue.

The Core Difference – Trend Direction vs Institutional Order Flow

| Trend Direction | Institutional Order Flow |

|---|---|

| Describes the general path of price movement. | Describes the general path and the quality, intent, and source of that movement. |

| Relies on price structure (highs/lows). | Relies on structure + displacement, imbalances, and liquidity engineering. |

| Works without knowing market participants. | Focuses on the role of large players in shaping price thru imbalances, liquidity sweeps & draw on liquidity. |

| Often measures outcome. | Measures cause and intent behind the outcome. |

Both are valuable - order flow simply sharpens the lens.

Why It Matters in SMC

- Quality Control: Not all trends are backed by institutional commitment. Order flow helps you filter strong moves from weak drifts.

- Psychology Insight: Shows the intent behind market structure shifts - accumulation, distribution, liquidity grabs.

- Precision Timing: Helps pinpoint where the next institutional push is likely to begin.

- Avoiding Traps: Reveals when a move is just engineered liquidity to catch retail traders.

The Footprints of the Big Players

Institutions can’t hide their activity forever. Their size forces them to leave clues:

1. Displacement

Sharp, decisive price movement with wide candles and minimal overlap.

- Why it’s important: Signals aggressive positioning by big players.

- Where to spot it: Often follows a liquidity sweep or break of structure.

2. Imbalances (Fair Value Gaps)

Gaps between candle wicks where price moved too fast to fill all orders.

- Why it’s important: Acts as a magnet for price before continuation.

- Where to spot it: Immediately after strong displacement.

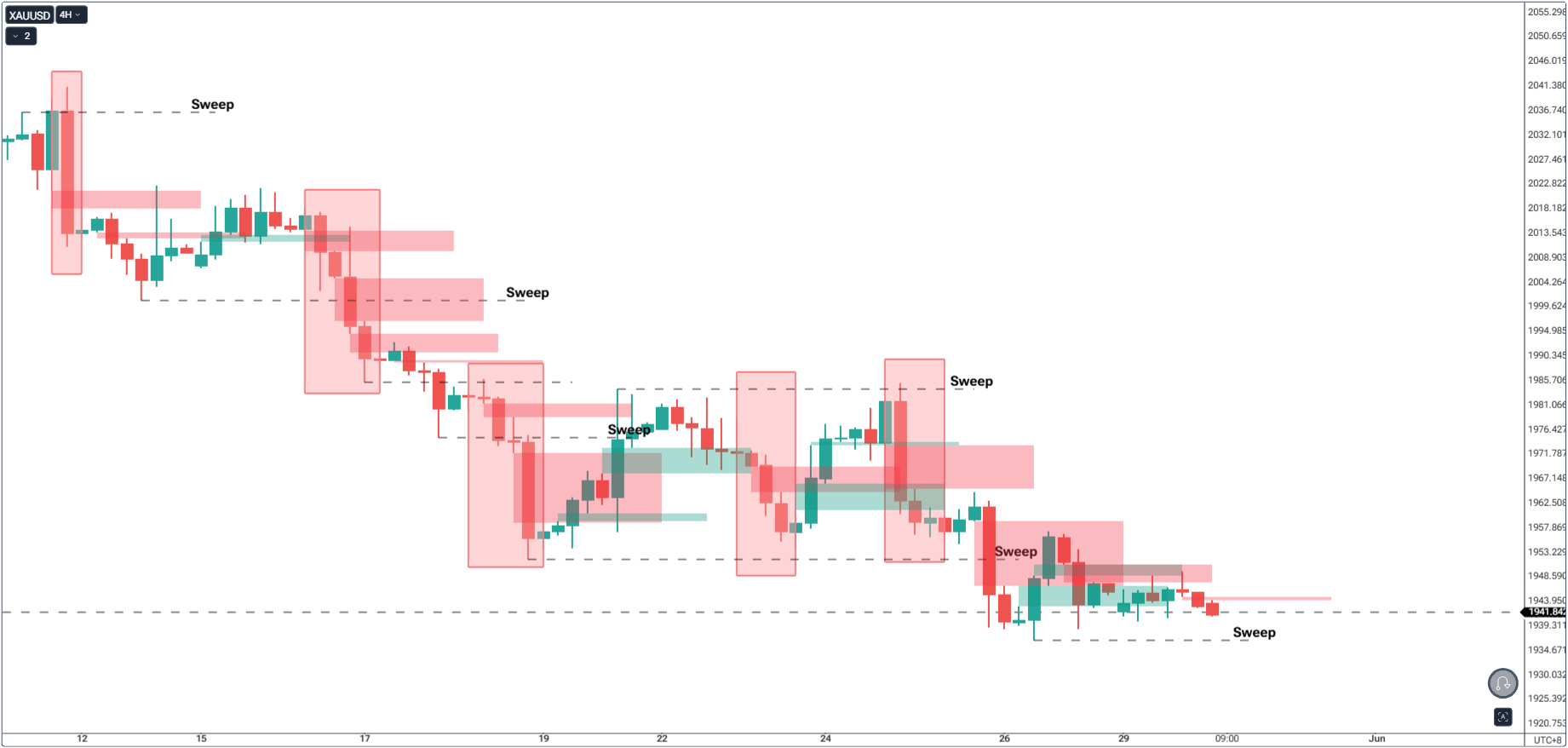

3. Liquidity Engineering

Price targeting obvious highs/lows to trigger stop orders.

- Why it’s important: Prepares the market for the next major move.

4. Controlled Market Structure

Clean sequences of highs/lows without erratic swings.

- Why it’s important: Shows deliberate market participation rather than random drift.

5. Session Timing

Institutional moves often align with London/NY opens or high-impact news.

- Why it’s important: Time filters out noise and improves accuracy.

The Ocean Current and the Wave

Trend direction is like spotting the wave - you can see its height and movement.

Institutional order flow is like reading the current beneath it - you know what’s powering the wave, how strong it will be, and whether it will keep pushing you forward or fade away. The best surfers use both to decide when to paddle in.

Applying It in Trading

Identify the Main Structure: Use H1/H4 to define the directional bias.

Check for Quality: Look for displacement, imbalances, and liquidity engineering in that direction.

Zoom In for Precision: Use M15/M5 to catch optimal entries aligned with both structure and order flow.

Trade in High-Activity Windows: Focus on London/NY opens and major news events for higher probability setups.

Mistakes to Avoid

- Treating order flow as a replacement for structure - they work together.

- Ignoring time-of-day context.

- Overloading charts with too many order flow signals - stick to the strongest 2–3 clues.

Final Thoughts

Institutional order flow is not a replacement for the tools you already trust - it’s an enhancement that sharpens your read of the market. Trend direction will always have its place, but when you add the layer of quality and psychology, you start trading with a clearer picture of market intent.

Over time, you’ll find that the trades that align both structure and institutional flow often feel smoother, more decisive, and less stressful to manage. That’s because you’re not just following the path of price - you’re following the conviction behind it.

Like learning to read a person’s tone as well as their words, understanding order flow lets you hear the market’s real message. And once you can hear it, you can respond with precision instead of guesswork.

Weekly Assignment

This week, keep trading the way you normally do - but each time you mark trend direction, also identify one clear sign of institutional order flow that supports it. Over time, you’ll start noticing which trends had true institutional backing - and which ones didn’t have the strength to last.

Start Practicing with Confidence - Risk-Free!

Open a free demo account today and experience institutional-grade spreads, lightning-fast execution, and all the tools you need to grow as a trader.

- Trade forex, indices, gold, and more

- Access ACY, MT4, MT5, & Copy Trading Platforms

- Practice with zero risk

It’s time to go from theory to execution - risk-free.

Create an Account. Start Your Free Demo!

Check Out My Contents:

Strategies That You Can Use

How To Trade & Scalp Indices at the Open Using Smart Money Concepts (SMC)

How to Trade Breakouts Effectively in Day Trading with Smart Money Concepts

Complete Step-by-Step Guide to Day Trading Gold (XAU/USD) with Smart Money Concepts (SMC)

The Power of Multi-Timeframe Analysis in Smart Money Concepts (SMC)

Forex Trading Strategy for Beginners

Mastering Candlestick Pattern Analysis with the SMC Strategy for Day Trading

Mastering Risk Management: Stop Loss, Take Profit, and Position Sizing

How to Use Fibonacci to Set Targets & Stops (Complete Guide)

RSI Divergence Trading Strategy for Gold: How to Identify and Trade Trend Reversals

Stochastics Trading Secrets: How to Time Entries in Trending Markets using Stochastics

Gold Trading Stochastics Strategy: How to Trade Gold with 2R–3R Targets

RSI Hidden Divergence Explained: How to Spot Trend Continuations Like a Pro

Indicators / Tools for Trading

The Ultimate Guide to Risk Management in Trading – A Complete Compilation for 2026

Moving Averages Trading Strategy Playbook

How to Think Like a Price Action Trader

Mastering Fibonacci Trading Psychology – Trusting the Levels, Managing the Mind

How To Trade News

Why Smart Money Concepts Work in News-Driven Markets - CPI, NFP, and More

How to Trade NFP Using Smart Money Concepts (SMC)-A Proven Strategy for Forex Traders

How to Trade CPI Like Smart Money - A Step-by-Step Guide Using SMC

Learn How to Trade US Indices

How to Start Trading Indices and Get into the Stock Market with Low Capital (2026 Guide)

Best Indices to Trade for Day Traders | NASDAQ, S&P 500, DAX + Best Times to Trade Them

How To Trade & Scalp Indices at the Open Using Smart Money Concepts (SMC)

NAS100 - How to Trade the Nasdaq Like a Pro (Smart Money Edition)

How to Trade CPI Like Smart Money - A Step-by-Step Guide Using SMC

Why Smart Money Concepts Work in News-Driven Markets - CPI, NFP, and More

How to Start Trading Gold

How to Swing Trade Gold (XAU/USD) Using Smart Money Concepts: A Simple Guide for Traders

Complete Step-by-Step Guide to Day Trading Gold (XAU/USD) with Smart Money Concepts (SMC)

The Ultimate Guide to Backtesting and Trading Gold (XAU/USD) Using Smart Money Concepts (SMC)

Why Gold Remains the Ultimate Security in a Shifting World

How to Trade Japanese Candlesticks

How to Trade Candlestick Patterns with High Probability: A Complete Guide for Beginners

The Top Japanese Candlestick Guide: What is an Engulfing Pattern and How to Trade It?

Piercing Pattern Candlestick Explained: How to Trade It - Step-By-Step Guide

Morning & Evening Star Candlestick Patterns – How to Trade Market Reversals with Confidence

How to Start Day Trading

5 Steps to Start Day Trading: A Strategic Guide for Beginners

8 Steps How to Start Forex Day Trading in 2026: A Beginner’s Step-by-Step Guide

3 Steps to Build a Trading Routine for Consistency and Discipline - Day Trading Edition

The Ultimate Guide to Understanding Market Trends and Price Action

Trading with Momentum: The Best Trading Session to Trade Forex, Gold and Indices

Learn how to navigate yourself in times of turmoil

How to Identify Risk-On and Risk-Off Market Sentiment: A Complete Trader’s Guide

How to Trade Risk-On and Risk-Off Sentiment - With Technical Confirmation

The Ultimate Guide to Understanding Market Trends and Price Action

Want to learn how to trade like the Smart Money?

Why Smart Money Concepts Work: The Truth Behind Liquidity and Price Action

Mastering the Market with Smart Money Concepts: 5 Strategic Approaches

Mastering Candlestick Pattern Analysis with the SMC Strategy for Day Trading

Understanding Liquidity Sweep: How Smart Money Trades Liquidity Zones in Forex, Gold, US Indices

The SMC Playbook Series Part 4: How to Confirm Trend Reversal & Direction using SMC

The SMC Playbook Series Part 5: The Power of Multi-Timeframe Analysis in Smart Money Concepts (SMC)

Fair Value Gaps Explained: How Smart Money Leaves Footprints in the Market

The Best Time to Use Smart Money Concepts (SMC): Why Timing Is Everything in Trading SMC

How to Trade the London Session Using Smart Money Concepts (SMC)

Trading Psychology and Continuous Improvement Contents

The Mental Game of Execution - Debunking the Common Trading Psychology

5 Steps to Backtest a Trading Strategy with AI: A Step-by-Step Guide

Managing Trading Losses: Why You Can Be Wrong and Still Win Big in Trading

The Hidden Threat in Trading: How Performance Anxiety Sabotages Your Edge

Why You Fail in Trading: You Don’t Have Enough Capital to Survive

Why 90% of Retail Traders Fail Even with Profitable Trading Strategies

The Top 10 Best Trading Books That Changed My Mindset, Strategy & Performance

Discovering Your Trader Profile: What Kind of Trader Are You?

Follow me for more daily market insights!

Jasper Osita - LinkedIn - FXStreet - YouTube

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.

Try These Next