Mastering the New York Session - Smart Money Concepts Guide

2025-08-14 11:18:36

The New York session is not just “another trading window” - It’s the deciding session of the trading day - the point where liquidity peaks, institutional flows either complete the London narrative or flip the script entirely, and some of the day’s largest moves are delivered.

This is where liquidity peaks, market makers complete their daily accumulation-distribution cycle, and the biggest traps - or the cleanest moves - happen.

Understanding whether NY will pull back, continue, or reverse the London move can mean the difference between banking a day’s profits or watching them evaporate.

- Pullback session – a retracement into key institutional zones before resuming the main trend.

- Continuation session – a direct extension of London’s momentum.

- Reversal session – a complete change in market direction after liquidity objectives are met.

Why the New York Session Matters

From an institutional perspective, the New York session is a liquidity completion phase.

- It overlaps with London for a short window (one of the most volatile periods of the day).

- It aligns with the U.S. equity market open (which injects large volatility spikes).

- It absorbs both European and American order flows, making it a prime time for major market decisions.

For traders using SMC, the session is not about guessing - it’s about identifying what phase of the day’s delivery we are in and aligning execution accordingly.

Understanding the Three NY Session Roles

A. Pullback Session

Occurs when London has established a strong directional move aligned with higher timeframe bias.

- NY retraces into a Higher Timeframe Fair Value Gap (FVG), Order Block (OB), or previous session’s liquidity pool before resuming the same direction.

- Seen often when the market needs to rebalance imbalances left behind during London’s run.

SMC Tip:

Mark the premium/discount zones from the London move and wait for NY to trade into those areas before looking for continuation entries.

B. Continuation Session

Occurs when London’s trend is strong, unopposed by higher timeframe zones, and liquidity is still resting further along the trend path.

- NY builds upon London’s momentum without a deep retrace.

- Typically features sustained displacement and clean order flow.

SMC Tip:

On trend days, the overlap between London close and NY open often provides micro pullbacks into M5 or M15 FVGs - ideal for continuation entries.

C. Reversal Session

Occurs when London has already reached or exceeded its liquidity objectives and runs into major Higher Timeframe supply or demand zones.

- NY sweeps final highs/lows and delivers a Market Structure Shift (MSS), flipping the daily narrative.

- This is where the largest intraday reversals occur.

SMC Tip:

Reversals are higher probability when London’s move is against the higher timeframe bias - NY acts as the “realignment” session.

D. Sideways/Slowdown Session

Occurs when the previous session (often London) has already completed its distribution phase, meaning most liquidity objectives for the day are done.

- NY opens with no clear directional conviction, causing the market to consolidate within a range.

- Volume can drop significantly, and price often oscillates between intraday equilibrium and minor liquidity pockets.

- This is common on days with low-impact news or ahead of major economic events (e.g., FOMC, CPI).

SMC Tip:

If the market is in sideways mode, avoid forcing trades. Either wait for a confirmed breakout with displacement or focus on smaller scalps around well-defined liquidity edges.

The NY Killzone Framework

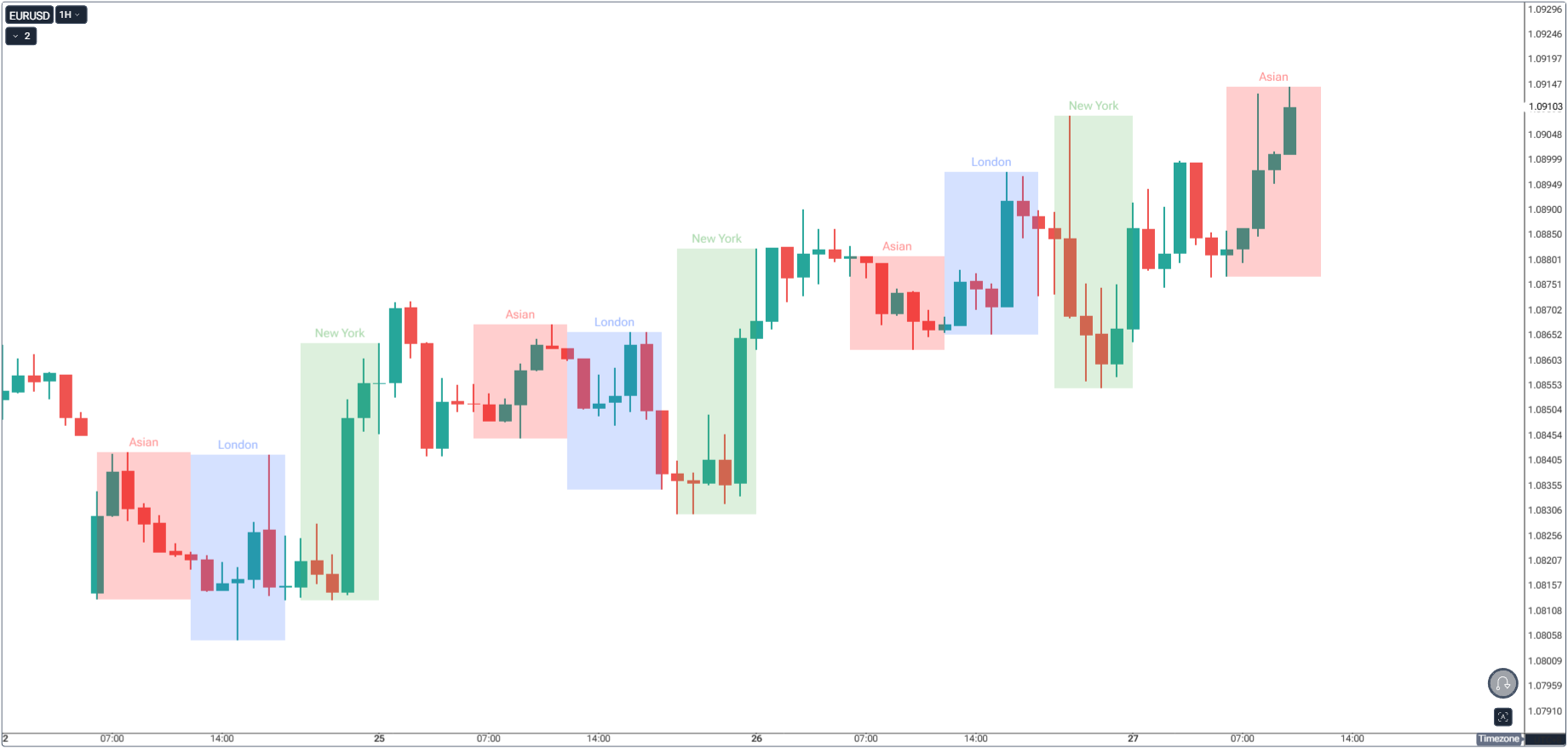

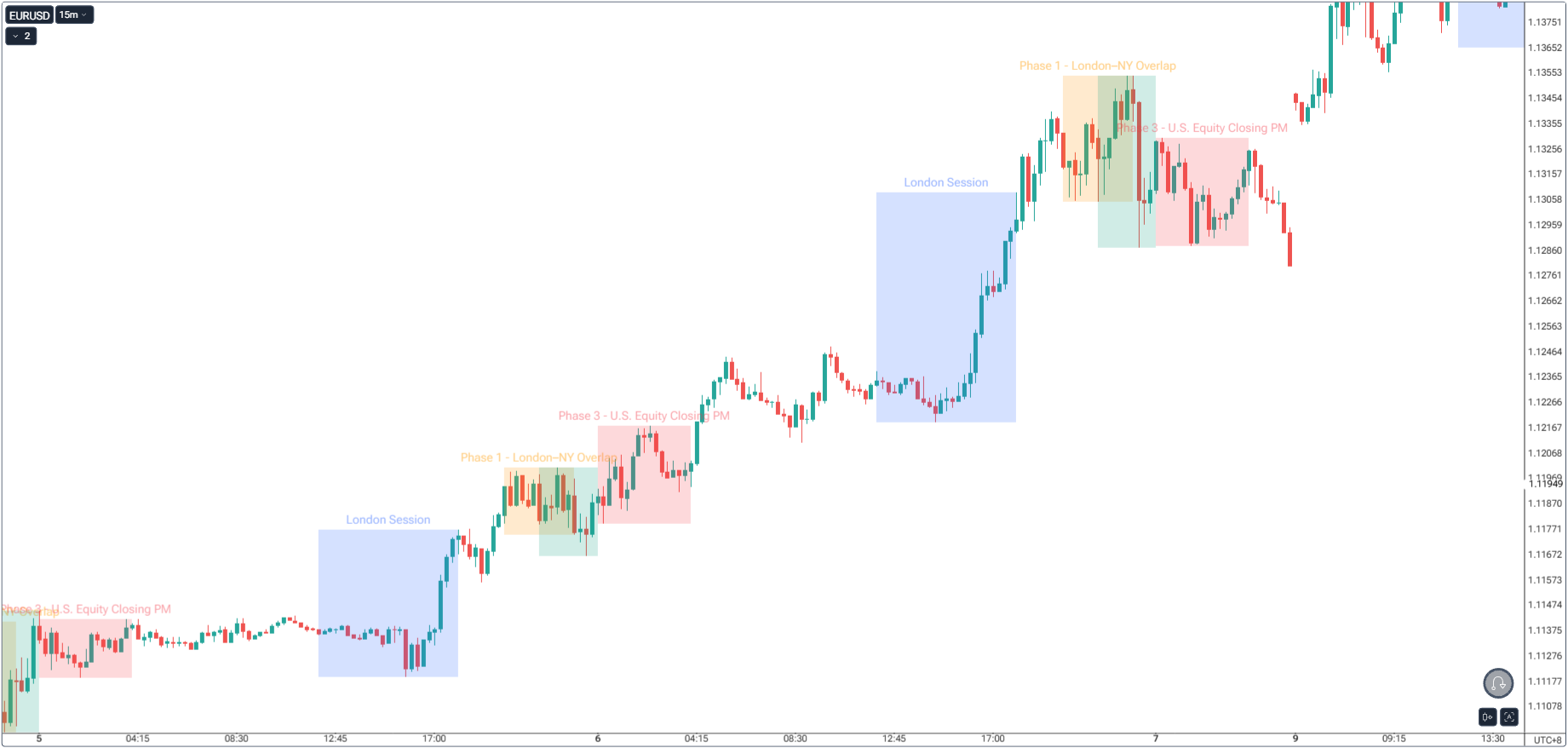

Phase 1 – London–NY Overlap (8:00–11:00 AM NY Time)

- Identify if London’s move is impulsive (likely continuation) or corrective (watch for reversal).

- Mark the London high and low - these serve as intraday liquidity boundaries.

- Look for sweeps during overlap hours before the true NY move.

Phase 2 – U.S. Equity Open (9:30 AM NY Time)

- One of the most volatile 15–30 minutes of the day.

- Often triggers false breakouts or liquidity grabs before trending.

- Best approach: Let the first 15–30 minutes develop to avoid being the liquidity.

Phase 3 – Delivery to NY Close (12:00–3:00 PM NY Time)

- Continuation days: Grind toward next liquidity pool.

- Reversal days: Acceleration in the opposite direction.

- Avoid overtrading late unless a high-quality HTF setup emerges.

SMC Execution Process for NY Session

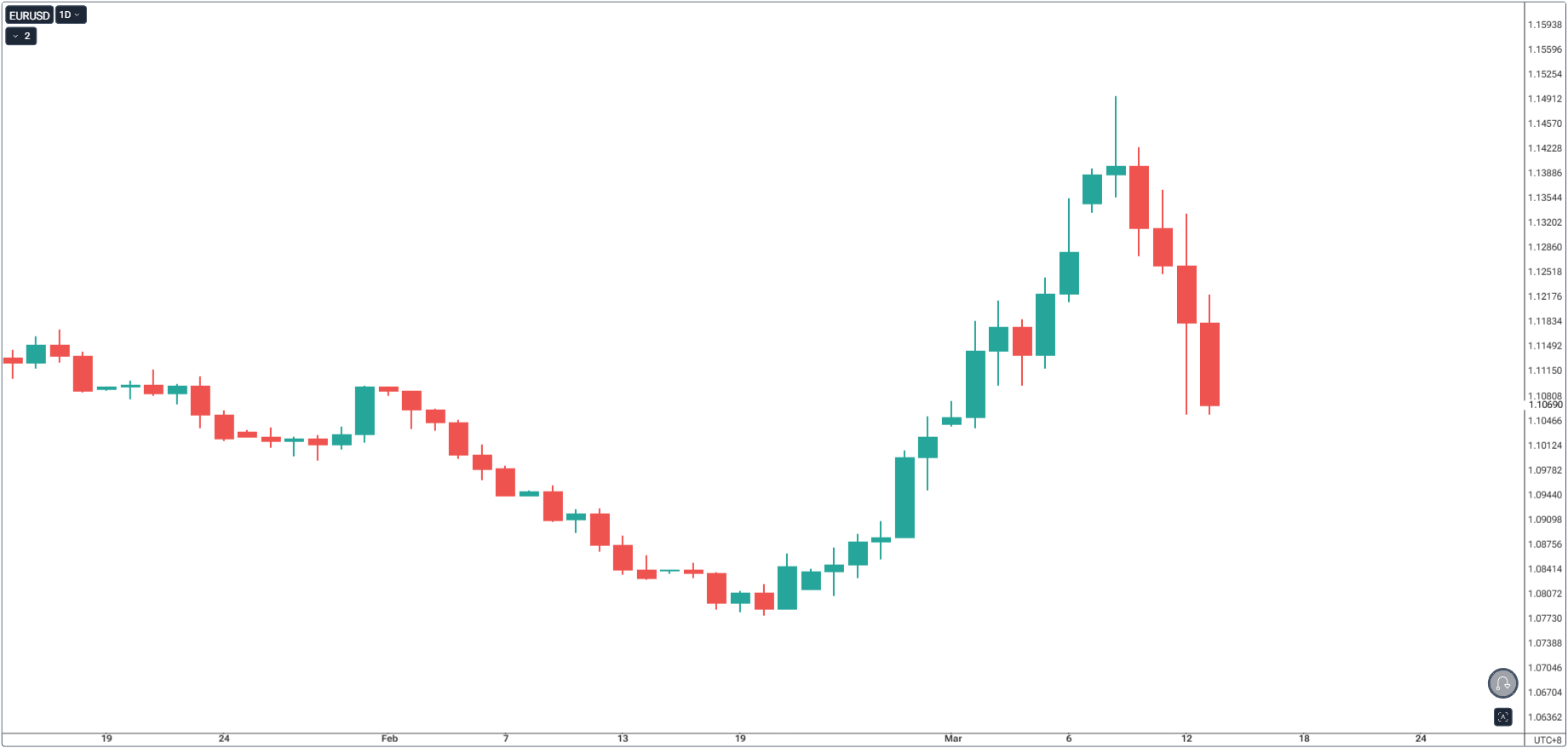

Step 1 – Frame the Daily Bias

- Use Daily/H4 to define institutional order flow.

- Identify the main liquidity targets (previous day high/low, session extremes, HTF imbalances).

In the example above, we are seeing that the institutional order flow is bearish since EUR/USD has been in a downside momentum, basing from the size and consistency of the bearish candles.

This will give us a clue that the next day’s candle would continue to take out lows for bearish continuation.

Step 2 – Study London’s Imprint

- Did London leave unfilled FVGs?

- Did it take out key liquidity but fail to follow through?

- Was the move aligned or against HTF bias?

Pro-Tip: Determine if the London session is in an Accumulation, Manipulation, Distribution phase. This will help you what’s the next phase in New York.

Step 3 – Plan for One of Four Scenarios

- Pullback into continuation.

- Direct continuation.

- Reversal after sweep.

- Sideways - Wait!

Step 4 – Drop to Execution Timeframe

- Wait for liquidity sweep.

- Confirm with market structure shift + displacement.

- Enter on FVG retest, placing stop beyond the sweep.

Additional Filters for NY Session SMC Trades

DXY – The USD Barometer

- DXY sweeping highs & rejecting = USD bearish → bullish bias on EUR/USD, GBP/USD, Gold.

- DXY sweeping lows & rejecting = USD bullish → bearish bias on EUR/USD, GBP/USD, Gold.

News as a Liquidity Event

- CPI, NFP, FOMC often act as engineered liquidity grabs.

- The first spike is often the trap; confirmation comes after structure shift.

Best NY Session Pairs & Instruments

- Forex: EUR/USD, GBP/USD, USD/JPY

- Commodities: XAU/USD, XAG/USD

- Indices: NASDAQ 100, Dow Jones, S&P 500

Quick NY Session Bias Map

| London Move | HTF Bias | NY Likely Role |

|---|---|---|

| Bullish trend day | Bullish | Continuation / Shallow Pullback |

| Bearish trend day | Bearish | Continuation / Shallow Pullback |

| Bullish into HTF supply | Bearish | Reversal |

| Bearish into HTF demand | Bullish | Reversal |

| Choppy London | Neutral | NY decides the trend |

Final Thoughts

The New York session is not random - it’s where the liquidity story ends for the day.

By breaking it down into pullback, continuation, or reversal phases, and aligning with higher timeframe bias, you can filter out low-probability trades and focus only on those with institutional alignment.

Instead of reacting to every spike at the NY open, let the market show its hand.

When London’s footprint, higher timeframe bias, and NY killzone setup all align - that’s when SMC traders find the cleanest, most decisive intraday moves.

Start Practicing with Confidence - Risk-Free!

Open a free demo account today and experience institutional-grade spreads, lightning-fast execution, and all the tools you need to grow as a trader.

- Trade forex, indices, gold, and more

- Access ACY, MT4, MT5, & Copy Trading Platforms

- Practice with zero risk

It’s time to go from theory to execution - risk-free.

Create an Account. Start Your Free Demo!

Check Out My Contents:

Strategies That You Can Use

How To Trade & Scalp Indices at the Open Using Smart Money Concepts (SMC)

How to Trade Breakouts Effectively in Day Trading with Smart Money Concepts

Complete Step-by-Step Guide to Day Trading Gold (XAU/USD) with Smart Money Concepts (SMC)

The Power of Multi-Timeframe Analysis in Smart Money Concepts (SMC)

Forex Trading Strategy for Beginners

Mastering Candlestick Pattern Analysis with the SMC Strategy for Day Trading

Mastering Risk Management: Stop Loss, Take Profit, and Position Sizing

How to Use Fibonacci to Set Targets & Stops (Complete Guide)

RSI Divergence Trading Strategy for Gold: How to Identify and Trade Trend Reversals

Stochastics Trading Secrets: How to Time Entries in Trending Markets using Stochastics

Gold Trading Stochastics Strategy: How to Trade Gold with 2R–3R Targets

RSI Hidden Divergence Explained: How to Spot Trend Continuations Like a Pro

Indicators / Tools for Trading

The Ultimate Guide to Risk Management in Trading - A Complete Compilation for 2026

Moving Averages Trading Strategy Playbook

How to Think Like a Price Action Trader

Mastering Fibonacci Trading Psychology - Trusting the Levels, Managing the Mind

How To Trade News

Why Smart Money Concepts Work in News-Driven Markets - CPI, NFP, and More

How to Trade NFP Using Smart Money Concepts (SMC)-A Proven Strategy for Forex Traders

How to Trade CPI Like Smart Money - A Step-by-Step Guide Using SMC

Learn How to Trade US Indices

How to Start Trading Indices and Get into the Stock Market with Low Capital (2026 Guide)

Best Indices to Trade for Day Traders | NASDAQ, S&P 500, DAX + Best Times to Trade Them

How To Trade & Scalp Indices at the Open Using Smart Money Concepts (SMC)

NAS100 - How to Trade the Nasdaq Like a Pro (Smart Money Edition)

How to Trade CPI Like Smart Money - A Step-by-Step Guide Using SMC

Why Smart Money Concepts Work in News-Driven Markets - CPI, NFP, and More

How to Start Trading Gold

How to Swing Trade Gold (XAU/USD) Using Smart Money Concepts: A Simple Guide for Traders

Complete Step-by-Step Guide to Day Trading Gold (XAU/USD) with Smart Money Concepts (SMC)

The Ultimate Guide to Backtesting and Trading Gold (XAU/USD) Using Smart Money Concepts (SMC)

Why Gold Remains the Ultimate Security in a Shifting World

How to Trade Japanese Candlesticks

How to Trade Candlestick Patterns with High Probability: A Complete Guide for Beginners

The Top Japanese Candlestick Guide: What is an Engulfing Pattern and How to Trade It?

Piercing Pattern Candlestick Explained: How to Trade It - Step-By-Step Guide

Morning & Evening Star Candlestick Patterns - How to Trade Market Reversals with Confidence

How to Start Day Trading

5 Steps to Start Day Trading: A Strategic Guide for Beginners

8 Steps How to Start Forex Day Trading in 2026: A Beginner’s Step-by-Step Guide

3 Steps to Build a Trading Routine for Consistency and Discipline - Day Trading Edition

The Ultimate Guide to Understanding Market Trends and Price Action

Trading with Momentum: The Best Trading Session to Trade Forex, Gold and Indices

Learn how to navigate yourself in times of turmoil

How to Identify Risk-On and Risk-Off Market Sentiment: A Complete Trader’s Guide

How to Trade Risk-On and Risk-Off Sentiment - With Technical Confirmation

The Ultimate Guide to Understanding Market Trends and Price Action

Want to learn how to trade like the Smart Money?

Why Smart Money Concepts Work: The Truth Behind Liquidity and Price Action

Mastering the Market with Smart Money Concepts: 5 Strategic Approaches

Mastering Candlestick Pattern Analysis with the SMC Strategy for Day Trading

Understanding Liquidity Sweep: How Smart Money Trades Liquidity Zones in Forex, Gold, US Indices

The SMC Playbook Series Part 4: How to Confirm Trend Reversal & Direction using SMC

The SMC Playbook Series Part 5: The Power of Multi-Timeframe Analysis in Smart Money Concepts (SMC)

Fair Value Gaps Explained: How Smart Money Leaves Footprints in the Market

The Best Time to Use Smart Money Concepts (SMC): Why Timing Is Everything in Trading SMC

How to Trade the London Session Using Smart Money Concepts (SMC)

Trading Psychology and Continuous Improvement Contents

The Mental Game of Execution - Debunking the Common Trading Psychology

5 Steps to Backtest a Trading Strategy with AI: A Step-by-Step Guide

Managing Trading Losses: Why You Can Be Wrong and Still Win Big in Trading

The Hidden Threat in Trading: How Performance Anxiety Sabotages Your Edge

Why You Fail in Trading: You Don’t Have Enough Capital to Survive

Why 90% of Retail Traders Fail Even with Profitable Trading Strategies

The Top 10 Best Trading Books That Changed My Mindset, Strategy & Performance

Discovering Your Trader Profile: What Kind of Trader Are You?

Follow me for more daily market insights!

Jasper Osita - LinkedIn - FXStreet - YouTube

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.

Try These Next