Less Screen Time, More Freedom: How MT5 Alerts & Scripts Automate Your Trading Day?

2025-09-04 15:31:38

This article is reviewed annually to reflect the latest market regulations and trends

TL;DR (Too Long; Didn’t Read)

- Automate Discipline: Use MT5 scripts to execute your trading plan with mechanical precision, removing fear, greed, and hesitation from your process.

- "Set It and Forget It": Adopt a philosophy of pre-planned trades. Use multi-condition alerts to notify you of opportunities so you don't have to watch charts all day.

- Work Smarter, Not Harder: Simple scripts like "Close All," "Move SL to Breakeven," and automated position sizing save you time and enforce professional risk management.

- Embrace the 4-Hour Workweek Mindset: Apply Tim Ferriss's principles of elimination and automation to free yourself from the screen and build a trading business, not a high-stress job.

- Your Broker Is Your Partner: The success of automation depends on a high-performance broker. ACY.com provides the essential free scripts, low-latency execution, and trusted environment needed to succeed.

"Wealth is the ability to fully experience life." - Henry David Thoreau

You pictured a life of financial control and flexibility. Instead, you're chained to your desk, eyes burning from hours of chart-watching, your stomach in knots with every market swing.

What if you could reclaim that dream? What if you could execute your strategy flawlessly, capture opportunities while you sleep, and win back the one asset you can never replace, your time? This isn't a fantasy.

It's a strategic shift from being a stressed-out market participant to a calm, liberated systems architect. It's time to trade with less screen time and more freedom.

How Can You Trade Effectively Without Staring at Charts for 8 Hours?

The modern trading world sells a lie: that success requires constant vigilance. This relentless pressure leads to trader burnout, a state of mental and physical exhaustion where poor, emotionally-charged decisions become inevitable.

A balanced life isn't a luxury for a trader; it's a prerequisite for success, fostering the calm objectivity needed to navigate markets professionally.

This is where the "set it and forget it" trading philosophy offers a lifeline.

This approach is a disciplined process where you conduct thorough analysis to pre-define the exact entry, stop-loss, and take-profit levels for a trade before it's ever placed. Once the trade is active, you commit to letting it play out without manual intervention or emotional tinkering.

The psychological benefit is immense. By pre-committing to a plan, you sidestep the primary drivers of trading failure: fear and greed. You stop making common mistakes like widening a stop-loss on a losing trade (fear) or closing a winning trade too early (greed). This transforms trading from an emotional battle into an exercise in probability.

The practical benefit is freedom. You can maintain a day job, enjoy hobbies, and be present with your family, all while your trading plan works for you. This is where MetaTrader 5 (MT5) automation becomes your greatest ally, acting as the technological enforcer of your discipline.

How Do You Set Up Powerful, Multi-Condition Alerts in MetaTrader 5?

Alerts are the sensory system of a "set it and forget it" trader. They are the digital tripwires that eliminate the need for constant chart-watching, notifying you only when your high-probability setup has occurred and your attention is required.

Part 1: A Practical Tutorial on MT5's Native Alerts

MT5’s built-in alert system is your starting point for reclaiming your time. Setting up mobile push notifications is the key to true freedom from your desk.

- Find Your MetaQuotes ID: In your MT5 mobile app, go to Settings > Messages. Your unique ID is at the bottom.

- Enable Notifications on Desktop: In your desktop MT5 platform, go to Tools > Options > Notifications tab.

- Pair Your Devices: Check "Enable Push Notifications" and enter the MetaQuotes ID from your phone.

- Test the Connection: Click "Test." A notification should appear on your phone instantly.

- Set the Alert: Now, on your desktop chart, right-click at a specific price level and select Trading > Alert. Any alert configured with the "Notification" action will now be pushed directly to your phone.

Part 2: The Expert's Path to Multi-Condition Alerts

The native MT5 system is great for price levels, but what about more complex conditions, like "alert me when the 50 EMA crosses above the 200 EMA, but only if the RSI is above 50"? The MT5 interface can't do this alone. This is a critical fork in the road for the aspiring systems trader, leading to two powerful paths.

- The MQL5 Path (For Coders): By writing a custom indicator or Expert Advisor (EA) in the MQL5 language, you can program any logic imaginable. The script can check for your specific multi-indicator conditions on every new price tick and send a custom notification directly to your phone. This offers unparalleled power and integration but requires programming knowledge.

- The TradingView Webhook Path (For Non-Coders): A more accessible route is to use TradingView's advanced alert engine. You can easily create a multi-indicator alert in TradingView and select "Webhook URL" as the notification option. This webhook points to a third-party connector service that translates the alert from TradingView into an action in your MT5 platform, giving you powerful, code-free automation.

What Simple Scripts Can Manage Your Trades While You're Away?

Once an alert notifies you of an opportunity, scripts are how you manage the trade with hands-free, emotionless precision. It's crucial to understand that scripts are not EAs. An EA is a fully autonomous robot; a script is a single-task tool you deploy on command. You remain the strategist, while the script becomes your disciplined soldier.

Sourcing scripts online can be risky. This is why a trusted source is paramount. A broker like ACY.com provides a professionally developed and curated suite of free MT4 and MT5 scripts, removing a major barrier and security risk for traders.

Here are some of the most high-impact scripts and indicators that can benefit every trader, many of which are available from providers like ACY.com and TradingByte:

| Tool Name | Core Function & Benefit | Strategic Application |

| Script Close All | Closes all open positions and deletes all pending orders with a single click. Benefit: Prevents catastrophic errors and emotional decisions in volatile moments. | End-of-day clearing, pre-news risk mitigation, or hitting a portfolio-wide profit target. |

| Delete all Objects Script | Instantly removes all drawing objects (trendlines, notes, etc.) from the active chart. Benefit: Provides a clean slate for fresh analysis, improving focus and clarity. | At the start of a new analysis session to remove old, irrelevant chart markups. |

| Trailing Stop | Automatically moves the stop-loss to lock in profits as a trade moves in your favor. Benefit: Protects profits systematically and allows you to capture the majority of a trend without manual intervention. | Applied to a winning trade to automate profit protection according to pre-set rules. |

| Move SL to Breakeven | A script that automatically moves your stop-loss to the entry price once a trade is a certain number of pips in profit. Benefit: Makes a trade "risk-free" on your original capital, removing stress and the temptation to mismanage the trade. | Used after a trade has moved a profitable distance to secure your initial capital. |

| Partial Close | Automates the closing of a specified percentage of your position once a profit target is hit. Benefit: Systematically locks in profits while leaving the rest of the position to run, blending security with opportunity. | Part of an advanced strategy to scale out of winning positions at key levels. |

| Quick Order | A panel that allows for one-click order execution with pre-configured lot sizes, stop-loss, and take-profit levels. Benefit: Drastically speeds up trade entry and reduces the chance of manual errors during execution. | For scalpers or news traders who need to enter the market with maximum speed and precision. |

| Risk Calculator | Before placing a trade, this tool automatically calculates the correct lot size based on your account equity, desired risk percentage, and stop-loss distance. Benefit: Enforces disciplined and consistent position sizing, the cornerstone of long-term survival. | Before every single trade entry to ensure risk management is never an afterthought. |

| Advanced Pivot Points | Automatically calculates and displays key daily or weekly pivot levels on your chart. Benefit: Saves time in analysis and provides objective, mathematically-derived levels for planning trades. | During pre-market analysis to identify key potential support and resistance zones. |

| Auto Trendline | An indicator that automatically detects and draws significant trendlines on the chart. Benefit: Removes subjectivity from trendline analysis and helps newer traders identify important market structures. | To quickly get an objective view of the dominant trends on any chart. |

| Long Short MA | A visual indicator that changes color based on whether a fast-moving average is above or below a slow one. Benefit: Provides a clear, at-a-glance signal of trend direction, filtering out market noise. | As a primary trend filter to ensure you are always trading in the direction of momentum. |

| Stochastic MTF with Alert | A multi-timeframe (MTF) stochastic indicator that can provide alerts when overbought/oversold conditions are met on higher timeframes. Benefit: Helps align your entry with broader market cycles, preventing you from buying at major tops or selling at bottoms. | To confirm entries by ensuring you are not fighting a larger, unseen momentum shift. |

| News Indicator | Displays upcoming high-impact news events directly on your trading chart. Benefit: Prevents you from being caught off-guard by market-moving data releases. | To be aware of scheduled volatility and decide whether to tighten stops or avoid entering new trades. |

| Spread Indicator | Displays the current spread directly on your chart, often highlighting when it widens. Benefit: Provides crucial awareness of trading costs in real-time, preventing entries during prohibitively expensive conditions. | To monitor costs, especially around market open/close and major news events. |

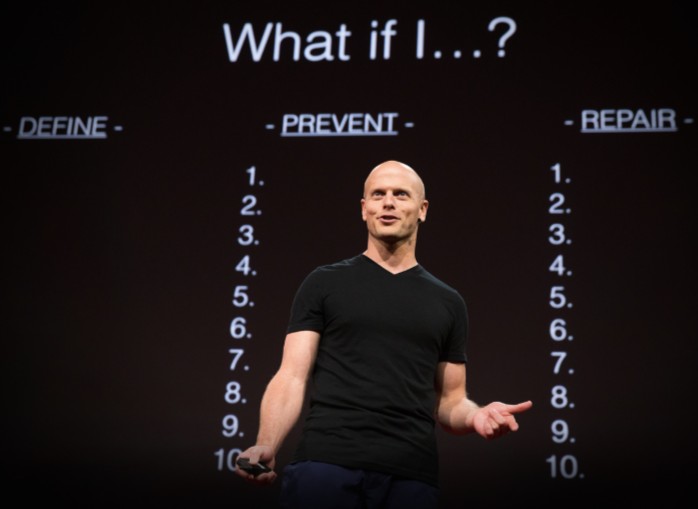

How Tim Ferriss Thinks About Trading Automation

Tim Ferriss, in his groundbreaking book The 4-Hour Workweek, provides a powerful framework for lifestyle design that aligns perfectly with the ethos of the automated trader.

He asks a revolutionary question: "How can you separate your income from your time?" For a trader, MT5 alerts and scripts are a direct answer.

Applying Ferriss's principles to trading reveals a clear path to freedom:

- Elimination: Ferriss argues for ruthlessly eliminating low-impact, time-consuming tasks. Manual trade execution is a prime candidate. It's a repetitive, high-stress task that consumes immense mental energy. Automating it via scripts eliminates this drain entirely.

- Automation: This is the core of the philosophy. Just as Ferriss automates business processes, an automated trading system using alerts and scripts automates your strategy. It works for you 24/7, freeing you from the "work" of being a chart-watcher and allowing you to become the CEO of your trading business.

- Liberation: The ultimate goal is to reclaim your time and location. By automating your execution, you are no longer tied to your screen during specific market sessions. You can manage your system from anywhere in the world in a fraction of the time, achieving the location-independent lifestyle that drew you to trading in the first place.

10 Lessons from "The 4-Hour Workweek" for the Modern Trader

- Define Your Dreamline: Why are you trading? It’s not just for money; it’s for what money provides. Define the lifestyle you want, and build a trading system that serves it, not the other way around.

- Focus on the 20% (Pareto's Law): 80% of your trading profits will likely come from 20% of your efforts. That 20% is building and refining a solid, rule-based system. The 80% of "busy work" is staring at charts. Automate it.

- Cultivate Selective Ignorance: Stop consuming endless financial news and opinions. It creates noise and emotional distraction. Trust your system's signals, not the talking heads on TV.

- Outsource and Automate: You don't need to be a programming genius. Use pre-built, trusted scripts to automate your rules. This is the trader's equivalent of hiring a virtual assistant.

- Batch Your Tasks: Dedicate specific, scheduled blocks of time for your market analysis (e.g., 1 hour every morning). For the rest of the day, let your alerts do the monitoring.

- Work Is Not the Goal; Effectiveness Is: Spending 8 hours watching charts is not a badge of honor. A trader who spends one hour setting up alerts and scripts that capture a move while they're at the beach is infinitely more effective.

- Create Systems, Not To-Do Lists: A to-do list is "watch the EUR/USD." A system is "set an alert at the 1.1050 resistance level that will notify my phone if the price tests it and the 4-hour RSI is overbought."

- Embrace a Low-Information Diet: The constant stream of market data is overwhelming and often useless. A multi-condition alert filters the entire market's noise down to the one signal that actually matters to your strategy.

- Find Your Muse: In trading, your "muse" is your automated system. It's a scalable, low-maintenance business that generates income without requiring your constant presence.

- Fear-Setting is More Important than Goal-Setting: What's the worst-case scenario of adopting a "set it and forget it" approach? You might miss a few discretionary moves. Now, what's the worst-case of not adopting it? Burnout, emotional mistakes, and blowing up your account. The choice is clear.

Can These Small Automations Genuinely Improve Your Work-Life Balance?

Absolutely. The impact of these small automations is cumulative and profound.

Think about the time spent on a single trade: calculating the lot size, entering the order, setting the SL/TP, and then monitoring it. This might take 5-10 minutes of focused, high-stress effort. If you take 5 trades a day, that's nearly an hour of just mechanical work.

Now, imagine a script does all of that in one click. You save minutes on every trade, which adds up to hours of freedom every week. More importantly, you save mental energy.

Instead of being drained by the low-value tasks of execution, your mind is free for the high-value tasks of strategy, analysis, and living your life. This is how you escape the market grind.

Here's Why Beginners Use It to Trade Like Experts

Experts are not defined by a magic strategy but by their unwavering discipline and consistency. Beginners often struggle because their emotions override their plans. Scripts bridge this gap. By using a simple script to, for example, calculate position size or close all trades at the end of the day, a beginner can instantly execute with the discipline of a seasoned professional. It allows them to build the habits of an expert from day one, which is why beginners can trade like an expert using MetaTrader scripts.

Here's Why It Reduces Stress

The primary source of trading stress is the constant decision-making under uncertainty. An automated system using alerts and scripts dramatically reduces this burden. You make one high-quality decision during your analysis session: "I will enter if X, Y, and Z happen."

The alert and script handle the rest. You've outsourced the cognitive load of execution, which is the key to escaping the market grind and reducing trading stress.

Here's Why You Need It to Avoid Emotional Trading

Fear and greed are the twin wrecking balls of a trading account. A script is a circuit breaker for these emotions. When the market is crashing and fear tells you to hold on "just a little longer," a "Close All" script executes your end-of-day plan without emotion.

When a trade is soaring and greed tells you to double your position, a position sizing script forces you to stick to your 1% risk rule. This is how you start using automation to conquer fear and greed in Forex.

Frequently Asked Questions (FAQ)

Q1: Is this "set it and forget it" approach suitable for all trading strategies?

A1: It is best suited for rule-based strategies on higher timeframes (like the 4-hour or Daily charts). These timeframes naturally filter out market "noise" and create more reliable signals that don't require constant oversight. High-frequency scalping or purely discretionary strategies are less compatible with this hands-off approach.

Q2: What is the biggest risk of relying on automation like alerts and scripts?

A2: The biggest risk is technological failure. A loss of internet, a computer crash, or a Virtual Private Server (VPS) issue can prevent an alert from being received or a script from executing. This is why a reliable infrastructure, including a high-quality broker and potentially a VPS, is critical for any serious automated trader.

Q3: Do I need to learn to code to use these MT5 scripts?

A3: Absolutely not. While coding offers the most customization, the most practical solution for most traders is to use pre-built, professionally coded scripts. This is why choosing a broker like ACY.com, which provides a comprehensive library of trusted scripts for free, is such a significant advantage. It gives you all the power of automation without the steep learning curve of programming.

Q4: How much time should I spend on analysis in a "set it and forget it" system?

A4: The goal is to shift your time from monitoring to analyzing. Most successful systems traders dedicate a specific, scheduled block of time each day or week (e.g., 1-2 hours) for in-depth analysis and setting up their alerts. Once the "work" is done, they are free from the screen until an alert is triggered.

Q5: Can I start using scripts with a small trading account?

A5: Yes, and you absolutely should. Scripts are even more critical for small accounts because they enforce strict risk management. Using a position size calculator script ensures you never risk too much on one trade, which is the number one mistake that destroys small accounts. Starting with a low minimum deposit broker allows you to test these tools in a live environment with minimal capital risk.

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.

Try These Next