Introduction to Trading: What Beginners Must Understand

2025-11-24 09:56:46

If you’re starting your trading journey with zero knowledge, this module is your honest orientation before you put real money at risk. Before indicators, strategies, and fancy setups, you first need a clear introduction to trading that strips away hype and shortcuts. If you skip this and jump straight into signals or “secret strategies,” you quietly join the 90% who blow accounts and have no idea why.

This isn’t about discouragement. It’s about clarity.

Because clarity is where confidence begins, and confidence is what leads to consistency.

Once you have a grounded view of the markets, then it makes sense to explore structured guides like the 5 Steps to Start Day Trading: A Strategic Guide for Beginners, not the other way around.

What Financial Markets Really Are

Financial markets are simply places where buyers and sellers exchange assets. As a trader, you’re choosing which battlefield you want to specialize in. Here are the main categories you will encounter:

1. Forex (Foreign Exchange)

Currencies like EURUSD, GBPUSD, and USDJPY dominate global trading volume. If you’re brand new, a roadmap like the Forex Trading Strategy for Beginners provides a clean starting point.

2. Indices

You’re trading the performance of whole markets-not individual companies. NAS100, SPX500, and US30 are popular choices, explained well in the 2026 Guide to Starting Indices Trading with Low Capital.

3. Gold (XAUUSD)

A safe-haven, high-volume hybrid asset. Many beginners gravitate to gold because of its clean reactions at levels. The Complete Step-by-Step Guide to Day Trading Gold with SMC is the best reference if you want to specialize here.

4. Other Metals (Silver, Platinum, Palladium)

These move based on both risk sentiment and industrial demand. You can explore big-picture context in Metals Trading: Why Gold and Metals Are Rising Again.

5. Energy & Commodities (Oil, Natural Gas, Corn, etc.)

Oil is tied to geopolitics, currencies, and global supply chains. Learn how commodities and Forex connect in Commodities & Global Trade: Oil, Gold, and Forex Explained.

6. Individual Stocks

Company-specific assets like Tesla or Apple. These require deeper company analysis compared with indices. Many traders start with indices first before leveling up into stocks.

7. Cryptocurrencies (Bitcoin, Ethereum, etc.)

Highly volatile digital assets trading 24/7. They behave differently from traditional markets-better explored after mastering structure, trend, and risk.

You do NOT need to master everything at once. Most successful traders specialize in one to two markets early on-usually Forex + either gold or an index.

Why Prices Move

Prices move when buyers and sellers negotiate value. But behind that simple idea lies a deeper structure:

- Market liquidity

- News, fundamentals, and expectations

- Institutional order flow

- Market structure cycles

If you want a clear understanding of what fuels price direction, read SMC Playbook Series Part 1: What Moves the Markets?.

It breaks down the cause-and-effect behind every candle you see.

Once you understand why price moves, you stop guessing and start reading the market like a language.

What Volatility Means

Volatility is how fast and how far price moves. It dictates the size of opportunity-and the size of danger.

- High volatility → Big potential + emotional pressure

- Low volatility → Small movement + patience required

Instead of chasing random spikes, understand when volatility naturally appears. The Trading Session Momentum Guide shows how market sessions influence volatility for Forex, gold, and indices.

Volatility becomes manageable once you have structure, timing, and emotional awareness.

Trading vs Long-Term Investing

These two are often confused, but they require completely different skill sets.

Trading

- Short-term decisions

- Daily analysis

- Needs tight structure, risk management, and psychology

Investing

- Long-term wealth building

- Based on fundamentals and compounding

- Slow, intentional decision-making

Many beginners convert losing trades into “investments”-a common denial pattern. Instead, follow a structured approach like the 8 Steps to Start Forex Day Trading in 2026 if your goal is active trading.

Why Most Beginners Lose

Most beginners lose not because the market is impossible, but because they enter it with the wrong expectations.

Common traps include:

- Hoping to make fast money

- Jumping between strategies

- Trading without risk management

- Overtrading due to boredom, fear, or FOMO

- Letting emotions override logic

If you want an honest breakdown of these mistakes, study Why 90% of Retail Traders Fail Even With Profitable Trading Strategies.

Success in trading is not about luck or prediction-it’s about consistency, risk control, and emotional stability.

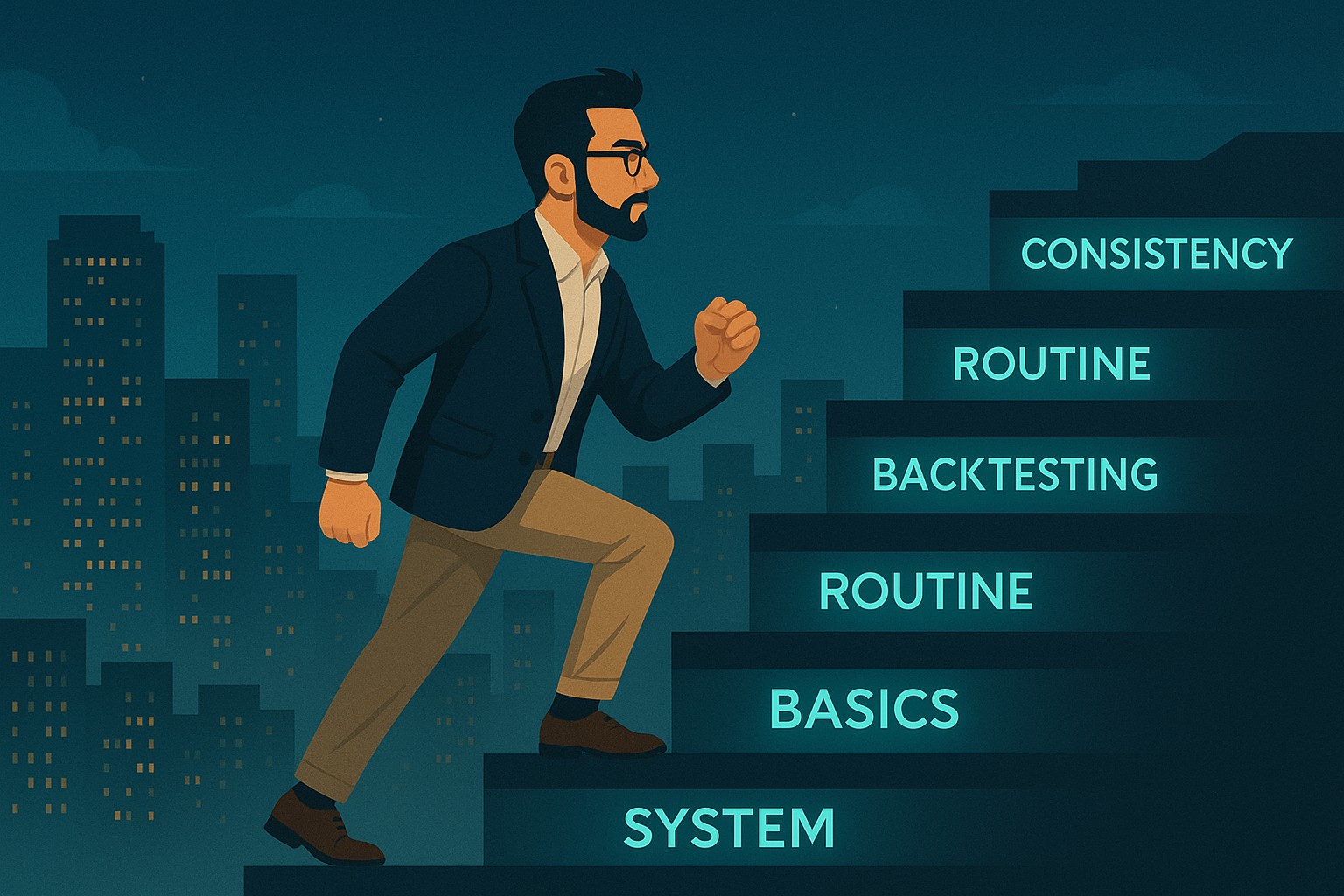

What a Realistic Trading Journey Looks Like

The real path to becoming a trader is a progression:

- Learn the foundational concepts.

- Choose one market to specialize in.

- Build a simple trading system.

- Use proper risk management.

- Backtest and forward test consistently.

- Create a daily routine.

- Develop patience and emotional resilience.

For a clear roadmap, see the Three Stages to Becoming a Consistent Trader, which outlines how every trader evolves-from confusion to structure to confidence.

There is no shortcut, but there is a path.

Learning to Drive Before the Highway

You don’t learn to drive by flooring the gas at 120 km/h on your first day. You start in a quiet area, learning steering, timing, and reaction.

Trading works the same way.

You don’t begin by scalping NASDAQ during New York open. You start by understanding structure, key levels, and market behavior. Once you grasp that, a resource like Mastering Price Action at Key Levels becomes your next natural step.

Final Thoughts

You’re not “trying trading.” You’re entering a field where discipline, structure, and emotional control determine everything. Beginners lose because they enter blindly; you’re doing the opposite-you’re building your foundation first.

This module is your starting point. From here, you will understand markets, manage risk, and grow like a professional.

FAQs

What is the easiest market for beginners?

Forex majors like EURUSD or USDJPY. more stability and structure. Later you can explore Top Forex Pairs.

How much money do I need to start?

You can start with $50–$100 or demo trading. Focus on skills first.

Is trading risky?

Trading is risky if you lack structure. Frameworks like Mastering Risk Management make the risk controlled.

Can anyone become profitable?

Yes. But only those who build habits and discipline. Guides like Identity-Based Trading help tremendously.

Start Trading Live!

- Trade forex, indices, gold, and more

- Access ACY, MT4, MT5, & Copy Trading Platforms

It’s time to go from theory to execution!

Create an Account. Start Your Live Trading Now!

Check Out My Contents:

Strategies That You Can Use

Looking for step-by-step approaches you can plug straight into the charts? Start here:

- How To Trade & Scalp Indices at the Open Using Smart Money Concepts (SMC)

- How to Trade Breakouts Effectively in Day Trading with Smart Money Concepts

- Complete Step-by-Step Guide to Day Trading Gold (XAU/USD) with Smart Money Concepts (SMC)

- The Power of Multi-Timeframe Analysis in Smart Money Concepts (SMC)

- Forex Trading Strategy for Beginners

- Mastering Candlestick Pattern Analysis with the SMC Strategy for Day Trading

- How to Use Fibonacci to Set Targets & Stops (Complete Guide)

- RSI Divergence Trading Strategy for Gold: How to Identify and Trade Trend Reversals

- Stochastics Trading Secrets: How to Time Entries in Trending Markets using Stochastics

- Gold Trading Stochastics Strategy: How to Trade Gold with 2R - 3R Targets

- RSI Hidden Divergence Explained: How to Spot Trend Continuations Like a Pro

- Moving Averages Trading Strategy Playbook

- Mastering Fibonacci Trading Psychology - Trusting the Levels, Managing the Mind

- Mastering Price Action at Key Levels - How to Spot, Trade, and Win at the Most Crucial Zones

- Mastering Retests: How to Enter with Confirmation After a Breakout

Indicators / Tools for Trading

Sharpen your edge with proven tools and frameworks:

- The Ultimate Guide to Risk Management in Trading - A Complete Compilation for 2026

- Moving Averages Trading Strategy Playbook

- How to Think Like a Price Action Trader

- Mastering Fibonacci Trading Psychology - Trusting the Levels, Managing the Mind

How To Trade News

News moves markets fast. Learn how to keep pace with SMC-based playbooks:

- Why Smart Money Concepts Work in News-Driven Markets - CPI, NFP, and More

- How to Trade NFP Using Smart Money Concepts (SMC) - A Proven Strategy for Forex Traders

- How to Trade CPI Like Smart Money - A Step-by-Step Guide Using SMC

- Learn to Trade News by Backtesting it with Forex Tester

Learn How to Trade US Indices

From NASDAQ opens to DAX trends, here’s how to approach indices like a pro:

- How to Start Trading Indices and Get into the Stock Market with Low Capital (2026 Guide)

- Best Indices to Trade for Day Traders | NASDAQ, S&P 500, DAX + Best Times to Trade Them

- How To Trade & Scalp Indices at the Open Using Smart Money Concepts (SMC)

- NAS100 - How to Trade the Nasdaq Like a Pro (Smart Money Edition)

How to Start Trading Gold

Gold remains one of the most traded assets - here’s how to approach it with confidence:

- How to Swing Trade Gold (XAU/USD) Using Smart Money Concepts: A Simple Guide for Traders

- Complete Step-by-Step Guide to Day Trading Gold (XAU/USD) with Smart Money Concepts (SMC)

- The Ultimate Guide to Backtesting and Trading Gold (XAU/USD) Using Smart Money Concepts (SMC)

- Why Gold Remains the Ultimate Security in a Shifting World

- How to Exit & Take Profits in Trading Gold Like a Pro: Using RSI, Range Breakdowns, and MAs as Your Confluence

- Backtest Gold using Forex Tester Online

How to Trade Japanese Candlesticks

Candlesticks are the building blocks of price action. Master the most powerful ones:

- Mastering the Top Japanese Candlesticks: The Top 5 Candlesticks To Trade + Top SMC Candlestick Pattern

- How to Trade Candlestick Patterns with High Probability: A Complete Guide for Beginners

- The Top Japanese Candlestick Guide: What is an Engulfing Pattern and How to Trade It?

- Piercing Pattern Candlestick Explained: How to Trade It - Step-By-Step Guide

- Morning & Evening Star Candlestick Patterns - How to Trade Market Reversals with Confidence

How to Start Day Trading

Ready to go intraday? Here’s how to build consistency step by step:

- 5 Steps to Start Day Trading: A Strategic Guide for Beginners

- 8 Steps How to Start Forex Day Trading in 2026: A Beginner’s Step-by-Step Guide

- 3 Steps to Build a Trading Routine for Consistency and Discipline - Day Trading Edition

- The Ultimate Guide to Understanding Market Trends and Price Action

- Trading with Momentum: The Best Trading Session to Trade Forex, Gold and Indices

Swing Trading 101

- Introduction to Swing Trading

- The Market Basics for Swing Trading

- Core Principles of Swing Trading

- The Technical Foundations Every Swing Trader Must Master

- Swing Trader’s Toolkit: Multi-Timeframe & Institutional Confluence

- The Psychology of Risk Management in Swing Trading

- Swing Trading Concepts To Know In Trading with Smart Money Concepts

- Becoming a Consistent Swing Trader: Trading Structure & Scaling Strategy

Learn how to navigate yourself in times of turmoil

Markets swing between calm and chaos. Learn to read risk-on vs risk-off like a pro:

- How to Identify Risk-On and Risk-Off Market Sentiment: A Complete Trader’s Guide

- How to Trade Risk-On and Risk-Off Sentiment - With Technical Confirmation

- The Ultimate Guide to Understanding Market Trends and Price Action

- Metals in Risk-On and Risk-Off Environments: How Sentiment Moves Gold and Commodities

Want to learn how to trade like the Smart Money?

Step inside the playbook of institutional traders with SMC concepts explained:

- Why Smart Money Concepts Work: The Truth Behind Liquidity and Price Action

- Mastering the Market with Smart Money Concepts: 5 Strategic Approaches

- Understanding Liquidity Sweep: How Smart Money Trades Liquidity Zones in Forex, Gold, US Indices

- The SMC Playbook Series Part 1: What Moves the Markets? Key Drivers Behind Forex, Gold & Stock Indices

- The SMC Playbook Series Part 2: How to Spot Liquidity Pools in Trading - Internal vs External Liquidity Explained

- Fair Value Gaps Explained: How Smart Money Leaves Footprints in the Market

- Accumulation, Manipulation, Distribution: The Hidden Cycle That Runs Every Market

- Institutional Order Flow - Reading the Market Through the Eyes of the Big Players

- London Session Trading Secrets: How Smart Money Sets the High & Low of the Day

- Mastering the New York Session - Smart Money Concepts Guide

- Anatomy of a Perfect Execution: How SMC Traders Trade with Precision

- Step-by-Step Trading Confirmation Guide for Precise Execution

- Execution Psychology: Turning Hesitation into Confidence

- What Is an Order Block? The Institutional Footprint Explained

- Anatomy of a Valid Order Block in Smart Money Concepts

- How to Draw Order Blocks Accurately - Day Trading Style

- Order Blocks and AMD Market Structure (Smart Money Concepts)

- The Confirmation Model: OB + FVG + Liquidity Sweep (Smart Money Concepts)

Master the World’s Most Popular Forex Pairs

Forex pairs aren’t created equal - some are stable, some are volatile, others tied to commodities or sessions.

- The Top 5 All-Time Best Forex Pairs to Trade

- Top Forex Pairs Beyond the Big Five

- EUR/USD: The King of Forex

- USD/JPY: The Fast Mover

- GBP/USD: The Volatile Cable

- AUD/USD: The Commodity Currency

- USD/CAD: The Oil-Backed Pair

- GBP/JPY: How to Trade The Beast

- Asian & London Session Secrets

- Mastering the New York Session

Metals Trading

- Metals Trading: Why Gold and Metals Are Rising Again

- Silver Trading: The Underdog with Dual Identity

- Gold vs Silver: Institutional Demand Breakdown Explained

- How to Day Trade Silver Like a Pro: Smart Money Tactics for XAG/USD

- Platinum & Palladium: The Quiet Power Duo of Industrial Metals

- How to Trade Metals with SMC and Fundamentals - Gold Trading Strategy

- Metals in Risk-On and Risk-Off Environments: How Sentiment Moves Gold and Commodities

- Future of Metals Market: Gold Forecast 2026 & Long-Term Commodities Outlook

Stop Hunting 101

If you’ve ever been stopped out right before the market reverses - this is why:

- Stop Hunting 101: How Swing Highs and Lows Become Liquidity Traps

- Outsmarting Stop Hunts: The Psychology Behind the Trap

- How to Lessen Risk From Stop Hunts in Trading

- How Stop Hunts Trigger Revenge Trading - Breaking the Pain Cycle

- How to Accept Stop Hunts Without Losing Discipline - Shifting From Frustration to Focus

Trading Psychology

Mindset is the deciding factor between growth and blowups. Explore these essentials:

- The Mental Game of Execution - Debunking the Common Trading Psychology

- Managing Trading Losses: Why You Can Be Wrong and Still Win Big in Trading

- The Hidden Threat in Trading: How Performance Anxiety Sabotages Your Edge

- Why 90% of Retail Traders Fail Even with Profitable Trading Strategies

- Top 10 Habits Profitable Traders Follow Daily to Stay Consistent

- Top 10 Trading Rules of the Most Successful Traders

- Top 10 Ways to Prevent Emotional Trading and Stay Disciplined in the Markets

- Why Most Traders Fail - Trading Psychology & The Hidden Mental Game

- Emotional Awareness in Trading - Naming Your Triggers

- Discipline vs. Impulse in Trading - Step-by Step Guide How to Build Control

- Trading Journal & Reflection - The Trader’s Mirror

- Overcoming FOMO & Revenge Trading in Forex - Why Patience Pays

- Risk of Ruin in Trading - Respect the Math of Survival

- Identity-Based Trading: Become Your Trading System for Consistency

- Trading Psychology: Aligning Emotions with Your System

- Mastering Fear in Trading: Turn Doubt into a Protective Signal

- Mastering Greed in Trading: Turn Ambition into Controlled Growth

- Mastering Boredom in Trading: From Restless Clicking to Patient Precision

- Mastering Doubt in Trading: Building Confidence Through Backtesting and Pattern Recognition

- Mastering Impatience in Trading: Turn Patience Into Profit

- Mastering Frustration in Trading: Turning Losses Into Lessons

- Mastering Hope in Trading: Replacing Denial With Discipline

- When to Quit on Trading - Read This!

- The Math of Compounding in Trading

- Why Daily Wins Matter More Than Big Wins

- Scaling in Trading: When & How to Increase Lot Sizes

- Why Patience in Trading Fuels the Compounding Growth

- Step-by-Step Guide on How to Manage Losses for Compounding Growth

- The Daily Habits of Profitable Traders: Building Your Compounding Routine

- Trading Edge: Definition, Misconceptions & Casino Analogy

- Finding Your Edge: From Chaos to Clarity

- Proving Your Edge: Backtesting Without Bias

- Forward Testing in Trading: How to Prove Your Edge Live

- Measuring Your Edge: Metrics That Matter

- Refining Your Edge: Iteration Without Overfitting

- The EDGE Framework: Knowing When and How to Evolve as a Trader

- Scaling Your Edge: From Small Account to Consistency

- Trading in the Zone: Execution Through Habit and Structure

- Trading in the Zone: Thinking in Probabilities

- The Inner War: Fear, Greed, and the Illusion of Control

- Detachment Discipline in Trading: How to Let Go of the Need to Be Right

- Trading Hack: Why You Keep Breaking Your Own Rules (And How to Stop)

- Trading Mindset Mastery: Building Confidence Through Data

- Flow State Trading: Entering the Zone Through Structure

- Cognitive Traps in Trading: Overconfidence, Recency Bias & Revenge Trades

- The Psychology of Risk in Trading: Fear of Loss vs Fear of Missing Out

- Self-Trust in Trading – Building Confidence from Repetition, Not Just Results

- The Zen of Trading: Becoming the Observer, Not the Reactor

- The Market Is Always Right: Why You Must Adapt, Not Demand

- The Three Stages to Becoming a Consistent Trader

- The Enemy Within: Limiting Beliefs and Emotional Conflict in Trading

- Self-Discipline in Trading: A Skill, Not a Personality Trait

- Mental Energy Management in Trading: Controlling Impulse, Stress, and Overwhelm

- Creating the Disciplined Trader Identity

- The Disciplined Trader: The Complete Blueprint for Consistency

Market Drivers

- Central Banks and Interest Rates: How They Move Your Trades

- Inflation & Economic Data: CPI Trading Strategy and PPI Indicator Guide

- Geopolitical Risks & Safe Havens in Trading (Gold, USD, JPY, CHF)

- Jobs, Growth & Recession Fears: NFP, GDP & Unemployment in Trading

- Commodities & Global Trade: Oil, Gold, and Forex Explained

- Market Correlations & Intermarket Analysis for Traders

Risk Management

The real edge in trading isn’t strategy - it’s how you protect your capital:

- Mastering Risk Management: Stop Loss, Take Profit, and Position Sizing

- Why Risk Management Is the Only Edge That Lasts

- How Much Should You Risk per Trade? (1%, 2%, or Less?)

- The Ultimate Risk Management Plan for Prop Firm Traders - Updated 2026

- Mastering Position Sizing: Automate or Calculate Your Risk Like a Pro

- Martingale Strategy in Trading: Compounding Power or Double-Edged Sword?

- How to Add to Winners Using Cost Averaging and Martingale Principle with Price Confirmation

- Managing Imperfect Entries in Trading - How Professionals Stay Composed

Suggested Learning Path

If you’re not sure where to start, follow this roadmap:

- Start with Trading Psychology → Build the mindset first.

- Move into Risk Management → Learn how to protect capital.

- Explore Strategies & Tools → Candlesticks, Fibonacci, MAs, Indicators.

- Apply to Assets → Gold, Indices, Forex sessions.

- Advance to Smart Money Concepts (SMC) → Learn how institutions trade.

- Specialize → Stop Hunts, News Trading, Turmoil Navigation.

This way, you’ll grow from foundation → application → mastery, instead of jumping around randomly.

Follow me for more daily market insights!

Jasper Osita - LinkedIn - FXStreet - YouTube

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.

Try These Next