Forex Trading Strategy for Beginners

2025-03-27 10:06:41

If you're just starting your journey in forex trading, one of the most important skills you need to develop is understanding how to analyze market trends. Trend analysis forms the backbone of any solid forex trading strategy—helping you trade in the direction of momentum, avoid costly mistakes, and make confident decisions.

In this beginner-friendly guide, we’ll explore simple and effective ways to identify market trends using both price action techniques and technical indicators. Whether you're trading major currency pairs like EUR/USD or GBP/JPY or even metals like Gold and Stock Indices like Nasdaq, this strategy-focused breakdown will give you a clear edge in navigating the markets.

What You’ll Learn in This Guide

This beginner-friendly forex trading guide walks you through a structured, actionable approach to trend analysis. By the end of it, you’ll understand:

- ✅ Why trend analysis matters and how it can give you a clear trading edge

- ✅ The difference between subjective (price action) and objective (indicator-based) analysis

- ✅ How to identify trends using trendlines, swing highs/lows, moving averages, and RSI

- ✅ A step-by-step strategy to combine multiple tools for high-probability entries

- ✅ The power of confirmation and how it filters noise, validates setups, and secures stop placements

- ✅ How to align timeframes for trade direction, execution, and exits

- ✅ A practical method to set targets and know when to exit a trend

Whether you're trading Gold, EUR/USD, or Nasdaq, this guide provides a repeatable process to read trends, enter with confidence, and manage trades like a pro.

Why Trend Analysis is Essential

"The trend is your friend until it bends."

Analyzing trends gives traders the edge to stay in-line with the current direction and lessen risks of trading against the overall direction. Here's why trend trading remains a top strategy in 2025:

- Forecast Future Price Direction

By reading current price structure and momentum, you can anticipate where the market is likely headed.

2. Follow the Trend

Aligning your trades with the prevailing trend improves accuracy and consistency. Trend-following strategies remain among the most effective approaches in both bullish and bearish markets.

3. Forewarning of Incoming Reversals

Even the strongest trends eventually end. Learning how to recognize trend reversal signals gives you the chance to exit early or even capitalize on the move in the opposite direction.

Two Core Approaches to Trend Analysis

There are two main ways to analyze trends

- Subjective Trend Analysis (Price Action)

Relies on visual interpretation and trader intuition.

- The approach varies depending on individual perception of price action and may differ from past analyses.

- Bias shifts from one trade to another.

- Driven by intuition and experience.

Common tools include:

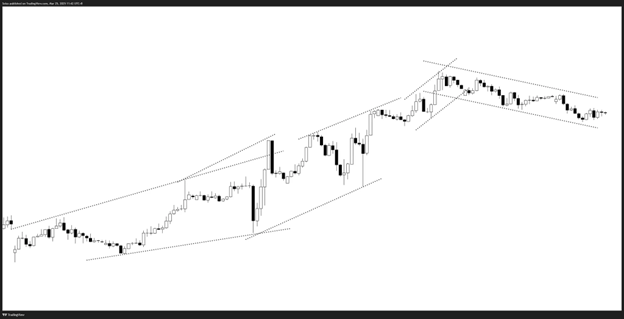

- Trendlines and price channels: Drawing trendlines helps visualize the trend’s direction and strength. Channels indicate potential price boundaries.

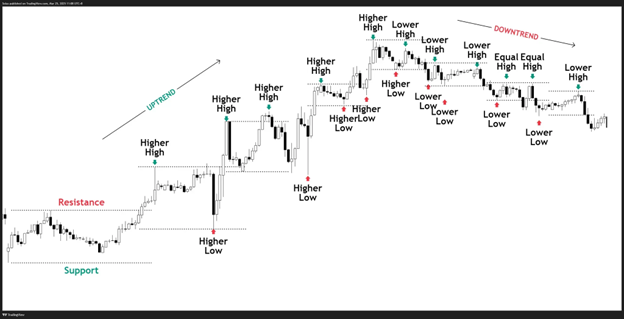

- Swing highs and lows (HH/HL or LH/LL): Higher highs and higher lows confirm an uptrend, while lower highs and lower lows indicate a downtrend.

It’s flexible, intuitive, and ideal for traders with strong chart-reading experience.

2. Objective Trend Analysis (Indicator-Based)

Uses math-based indicators to define and measure trends.

- The approach remains consistent with other traders and previous analyses.

- Bias is clearly defined and easily identifiable.

- Governed by mathematical calculations.

Common tools include:

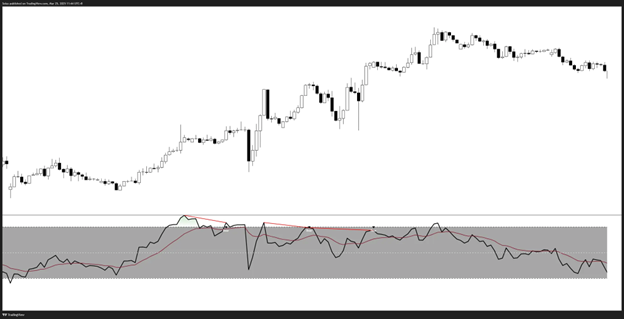

- Moving Averages (MAs): Common indicators like the 20-day and 50-day moving averages help smooth out price fluctuations and confirm trend direction.

- Oscillators: Indicators like the RSI (Relative Strength Index) help identify the momentum strength of price, signaling a continuation move or potential trend reversals.

It’s consistent, quantifiable, and great for systematic or beginner traders.

Combining Trend Tools for Maximum Accuracy

For the best of both worlds, you can use a confluence-based approach like this:

Step 1: Determine the Daily Timeframe Direction

In this example, we will use Gold.

What I usually do is always start my analysis on the Daily Timeframe.

Looking at the Daily Chart, we can see that Gold is still inside a big range, price bouncing off at the resistance and support level.

What’s the status of the swing highs and lows?

Are we in a trending or non-trending condition?

Do we have an obvious trend to mark out our highs and lows?

Checking the status of Gold, its currently above the 50% of the whole range, which could tell us that despite being on an overall range-bound market, there are signs that it is at a bullish territory inside the range.

We were able to determine the higher timeframe direction by just looking at the highs and lows and if its still intact or not.

Step 2: Drop Down to a Lower Timeframe and Analyze the Swing Highs and Lows

Dropping to H1 Timeframe, we can see that we are also in a range. And we have ranges inside the bigger range that tells us a story building up.

Note that I use H1 Timeframe as my higher timeframe on a day trading scale for trend direction during the day.

Previously, price was ranging at the 50% of the range, and now price is ranging near the resistance level, indicating that:

- Price is at a Bullish Level

- Potential breakout is Imminent

The approach that we could take here is:

- Wait for price to breakout of the current range.

After sometime, Gold has broken out of the range.

Now, we look for opportunities.

Step 3: Plot the Moving Averages & Wait for a Pullback

We only activated the Moving Averages after price already showed us that its now willing to go to a certain direction which in this case is to the upside.

We could use the Moving Averages for:

- Trend Confirmation

- Support & Resistance Formation

- Trade Level Execution

Hence, we are now looking for a trade once price goes back to our Moving Averages for a potential upside move.

Once price has now dropped to our Moving Averages, we could look for long opportunities on a lower time-frame.

Step 4: Drop to Your Execution Timeframe to Frame Trades

As we can see, there is still no confirmation that Gold is now finished with its pullback.

To lessen risk, we want:

- Range Breakout on this Level

- Price Breaking out of the MAs

The narrative for this is that, we need CONFIRMATION before we execute a trade.

We also want our Execution timeframe to be in-synced with our Direction timeframe, which is the Daily.

Once price breaks out, we look for longs with stops behind the structure.

This is the importance of waiting for CONFIRMATION:

1. Filters Out False Signals

Not every breakout, bounce, or reversal is genuine. Confirmation—whether it’s a candle close, indicator alignment, or structural break—helps you avoid getting trapped by market noise.

2. Increases Trade Validity

Combining a clear trend bias (e.g., HH/HL structure, bullish channel) with a confirmation trigger (e.g., RSI > 50, break of a micro range, FVG reaction) stacks the odds in your favor.

3. Supports Emotion-Controlled Entries

When you wait for confirmation, you’re letting the market prove itself before you commit capital. This reduces impulsive decision-making and improves discipline.

4. Allows for Secured Stop Placement

Confirmation often provides a logical structure point (e.g., swing low, FVG edge, or EMA) to place your stop-loss. This results in better risk management, tighter stops, and improved risk-to-reward ratios.

Rather than guessing, you're anchoring your stop-loss to price behavior and market context.

Jumping into a trade without confirmation is like entering a building without checking if the floor beneath you is stable. Confirmation is your safety net. It gives you the added edge of probability in an environment where uncertainty is the norm.

Step 5: After Execution, Scale Up to Higher Timeframe to Reduce Noise

The primary reason why we entered on the Lower Timeframe is the Higher Timeframe confirmed that we are already set for an upside direction.

We only dropped down to the Lower Timeframe, which in this is M15, for us to:

- Frame Trades

- Look for Confirmation.

We scale up to the H1 Timeframe to:

- Follow the Trend

- Reduce Noise

Step 6: Mark Levels for Potential Reaction Points

Always mark levels where price could encounter potential roadblocks.

Step 7: Set Targets

2 Approaches That We Could Take:

- Static Target

You could set specific reward targets as you follow your trade.

You could also set reward targets at previous resistance levels if you are going long in the market.

2. Dynamic Target

Follow the trend until the Moving Average breaks.

But there’s a way to determine if the Trend is about to End.

Trend Exit Strategy

Step 1: Dropdown to Your Lower Timeframe

Once price reaches a key level, higher timeframe resistance levels, drop to your execution timeframe. In this case, we drop to M15.

Step 2: Wait for Signs of Weakness

Signs of Weakness:

- Range Breakdown

- Moving Average Breakdown

If this all happened at a key level, you can exit the trade.

What if price shoots up?

The answer to this is, “What if it doesn’t?”

If we did not exit after the range and the moving averages broke down, we’d be returning gains.

The solution to “What if price shoots up?”

H1 Timeframe

M15 Timeframe

H1 Timeframe

You can always reenter in the market.

Final Thoughts: Build with Clarity, Trade with Confidence

Master your process, and the profits will follow.

Trend analysis is more than just identifying market direction—it's about building a complete narrative across timeframes, supported by confirmation, structure, and technical logic. What we have used as an example of analyzing and riding the trend is just one of the strategies available out there that is simple. Whether you're using trendlines and price action or incorporating moving averages and RSI, combining both subjective and objective tools gives you a high-probability edge.

As a beginner in forex trading, your priority is to develop a consistent process. Don’t rush entries. Let price show you the story. Wait for confirmation, place secure stops, and frame trades based on what the market is actually doing—not what you hope it will do.

Try These Next