How to Trade CPI Like Smart Money - A Step-by-Step Guide Using SMC

2025-06-09 17:47:38

Goal of This Lesson

To help you understand the Consumer Price Index (CPI), why it matters, how it impacts interest rates and market volatility, and how to trade it using Smart Money Concepts (SMC) with structure, precision, and risk control.

By the End of This Lesson, You Will Be Able To:

- Understand what CPI is and why it’s critical for financial markets

- Know how CPI affects the Fed’s interest rate decisions

- Spot high-probability SMC setups before and after CPI releases

- Apply structure, liquidity sweeps, and confirmation models (e.g., AMD, MSS, FVG)

- Manage risk and avoid emotional or impulsive trades on news days

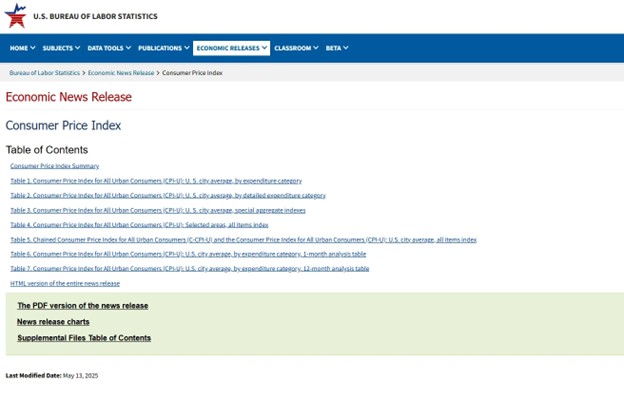

What Is CPI?

CPI = Consumer Price Index, a measure of inflation that tracks the change in prices consumers pay for goods and services.

- Released monthly by the U.S. Bureau of Labor Statistics (BLS)

- Typically published on the second week of the month at 8:30 AM EST

- Report includes headline CPI (total inflation) and core CPI (excludes food and energy)

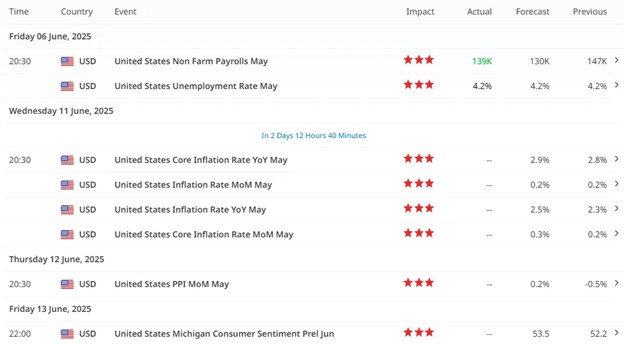

How to Know When CPI Is Coming

Day: Usually Wednesday or Thursday (check economic calendar)

Time: 8:30 AM Eastern Time (New York)

For easier tracking, you can check the Finlogix website and watch for the Core Inflation Rate:

Why CPI Matters for Traders

CPI is one of the most market-moving data releases each month. Why?

Because it directly influences Federal Reserve policy:

- Higher CPI = More inflation → Fed may hike rates (bullish USD (DXY), bearish Gold/stocks)

- Lower CPI = Less inflation → Fed may pause or cut rates (bearish USD, bullish Gold/stocks)

Markets don’t just react to the actual number, but also:

- The surprise factor (actual vs forecast)

- Core vs Headline trends

- How it changes rate hike expectations

Real-Life Analogy: CPI as the Thermostat

Imagine inflation as the heat in your house.

The CPI reading is like a thermostat-if it shows the room’s too hot (inflation high), the Fed turns on the AC (rate hikes). If it’s too cold (low inflation), the Fed turns on the heater (rate cuts). Markets move depending on how the Fed adjusts the temperature.

How to Trade CPI Using Smart Money Concepts

Step 1: Mark Key Liquidity Levels

15-30 minutes before the release, mark those liquidity levels that haven’t been traded yet:

- Mark Key Previous Highs/Lows as these levels contain a lot of liquidity, orders.

For more information, check out my blog: How to Plot Key Support & Resistance Levels the SMC Way for Day Trading

Step 2: Expect Manipulation First

Smart money often sweeps liquidity before or after the release. Watch for:

- Fake moves in the first 5 minutes post-CPI

- Stop hunts above/below highs and/or lows

- Aggressive candles without follow-through = trap

Narrative:

On May 11, 2022, the U.S. CPI report for April came in at:

- YoY: +8.3% (vs. 8.1% expected)

- MoM: +0.3% (vs. 0.2% expected)

- Core CPI YoY: +6.2% (vs. 6.0% expected)

Inflation cooled slightly from March’s +8.5%, but remained hotter than forecast, reinforcing the Fed’s hawkish stance.

EUR/USD dropped sharply post-release.

- The hotter-than-expected inflation triggered a USD surge, as markets priced in more aggressive rate hikes by the Fed.

- EUR/USD broke below 1.05250 and extended losses toward the 1.0500 handle within the session.

Step 3: Use Breakout Confirmation to Trade the Real Move on Key Levels

Scenario 1: Bullish Scenario (USD Bearish / EURUSD, Gold, Indices Bullish)

CPI Comes in Lower Than Expected

- Inflation is cooling faster than forecast

- Market expects Fed to pause or cut rates sooner

- Dollar weakens → risk assets rise (Gold, EUR/USD, Nasdaq)

Approach

- Wait for key lows to be taken out.

- Look for confirmations for reversal on those lows.

- Trade longs on foreign currencies against Dollar.

Scenario 2: Bearish Scenario (USD Bullish / EURUSD, Gold, Indices Bearish)

CPI Comes in Higher Than Expected

- Inflation is hotter than forecast

- Market expects more Fed rate hikes

- Dollar strengthens → risk assets fall

Approach

- Wait for key highs to be taken out.

- Look for confirmations for reversal on those lows.

- Trade longs on foreign currencies against Dollar.

Scenario 3: Divergence Between CPI Data and Market Reaction

CPI Comes in Hotter Than Expected, but Dollar Drops and Vice-Versa

- Reaction might be delayed.

- An already priced context weighs heavier:

- Overall, Fed is still hawkish despite of, and vice-versa.

- Central banks paired with USD are already more appealing or not vs the Dollar.

The key in approaching divergences between data and direction, look for technical confirmation on key levels whether price is willing to go up or down.

Pro Tip: Whatever the direction, you can always trade the other way and get in, in the market if you are wrong.

What to Learn from This Scenario:

- Data ≠ Direction — it’s about expectations vs surprise, context, and reaction

- Don’t react to the number. React to how price reacts to the number

- Use structure + liquidity sweeps + MSS to confirm the real direction

Check this out for more strategies in approaching momentum plays like this:

How to Trade Breakouts Effectively in Day Trading with Smart Money Concepts

How to Trade NFP Using Smart Money Concepts (SMC) – A Proven Strategy for Forex Traders

Understanding Liquidity Sweep: How Smart Money Trades Liquidity Zones in Forex, Gold, US Indices

Risk Management Rules for CPI

- Use fixed risk per trade: 0.5%-1% recommended

- Trade with small size if volatility is high

- Set alerts, not limit orders. You need to read structure after the release

- Avoid revenge trades. If you miss the move, wait for the next FVG or BOS

Best Time to Trade CPI

| Phase | Time (EST) | What to Watch |

|---|---|---|

| Pre-news range | 7:30 - 8:25 AM | Price buildup, liquidity pools |

| News release | 8:30 AM | Initial spike (don’t trade this!) |

| Post-news reaction | 8:35 - 9:00 AM | Confirmed trend direction via structure |

| Continuation setup | 9:00 - 10:30 AM | FVG + MSS reentry zones |

Quick Checklist - CPI Trading Rules with SMC

✅ Mark key highs/lows

✅ Expect initial manipulation, not direction

✅ Trade after confirmation, not before

✅ Look for clean breakout setups on lower timeframe

✅ Control risk and avoid overtrading

✅ Don't predict the number-react to structure

Summary

“CPI alone doesn’t move the market - how the market interprets it does. That’s why price action is king because everything’s already priced in.”

CPI moves markets because it tells the Fed how hot or cold inflation is. But smart money doesn’t chase - it manipulates. Using SMC, you don’t need to gamble the release. You wait, let liquidity be swept, and then ride the confirmed trend with structure, confidence, and precision.

Check Out Our Market Education

How to Start Day Trading:

5 Steps to Start Day Trading: A Strategic Guide for Beginners

8 Steps How to Start Forex Day Trading in 2026: A Beginner’s Step-by-Step Guide

3 Steps to Build a Trading Routine for Consistency and Discipline - Day Trading Edition

Learn how to navigate yourself in times of turmoil:

How to Identify Risk-On and Risk-Off Market Sentiment: A Complete Trader’s Guide

How to Trade Risk-On and Risk-Off Sentiment — With Technical Confirmation

The Ultimate Guide to Understanding Market Trends and Price Action

Want to learn how to trade like the Smart Money?

Mastering the Market with Smart Money Concepts: 5 Strategic Approaches

Mastering Candlestick Pattern Analysis with the SMC Strategy for Day Trading

Understanding Liquidity Sweep: How Smart Money Trades Liquidity Zones in Forex, Gold, US Indices

The SMC Playbook Series Part 4: How to Confirm Trend Reversal & Direction using SMC

The SMC Playbook Series Part 5: The Power of Multi-Timeframe Analysis in Smart Money Concepts (SMC)

Fair Value Gaps Explained: How Smart Money Leaves Footprints in the Market

Trading Psychology and Continuous Improvement Contents:

The Mental Game of Execution - Debunking the Common Trading Psychology

5 Steps to Backtest a Trading Strategy with AI: A Step-by-Step Guide

Managing Trading Losses: Why You Can Be Wrong and Still Win Big in Trading

Follow me on LinkedIn: Jasper Osita

Join me in Discord: The Analyst Guild

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.

Try These Next