Can't Afford a Premium EA? 3 Powerful Alternatives for Hands-Free Trading

2025-08-28 17:24:27

This article is reviewed annually to reflect the latest market regulations and trends

- Premium Isn't Always a Panacea: High-cost Expert Advisors are no guarantee of success. Many free and affordable tools can provide the automation you need without the hefty price tag.

- Focus on Strategy, Not Just Software: The most powerful alternatives, like Multi-Timeframe Indicators and Strategy Builders, augment your trading plan rather than replacing it, keeping you in control.

- Risk Management is Non-Negotiable: Timeless wisdom from legends like Jesse Livermore and the "Market Wizards" proves that managing downside risk is the true key to longevity in forex trading, regardless of the tools you use.

- Your Broker Matters: A reliable, low-cost broker is crucial for automated trading. ACY Securities offers ultra-fast execution and spreads from 0.0 pips, maximizing the effectiveness of any hands-free strategy.

- From Trader to Partner: Mastering these tools and building a profitable system opens the door to new opportunities, like forex affiliate marketing with trusted programs such as ACY Partners.

"The game of speculation is the most uniformly fascinating game in the world. But it is not a game for the stupid, the mentally lazy, the person of inferior emotional balance, or the get-rich-quick adventurer. They will die poor." - Jesse Livermore

The Million-Dollar Question: Can a Robot Truly Outsmart the Market?

You’ve seen the ads. The perfectly smooth equity curves, the promises of 50% monthly returns, and the allure of a "set-and-forget" robot that prints money while you sleep. A premium Expert Advisor (EA) seems like the ultimate shortcut, the key to conquering the psychological demons of fear and greed that plague 90% of traders.

But then you see the price tag: $500, $1,000, even $2,000 for a single license.

What if the secret isn't in buying the most expensive "black box" algorithm? What if the key to successful hands-free trading lies in using smarter, more transparent tools that empower your strategy, rather than replacing it?

This is the guide for the trader who is tired of the hype. The trader who wants to automate their process, save time, and maintain discipline without spending a fortune. We will not only reveal three powerful alternatives to expensive EAs that you can use right now but also show you how to build a professional-grade trading operation from the ground up.

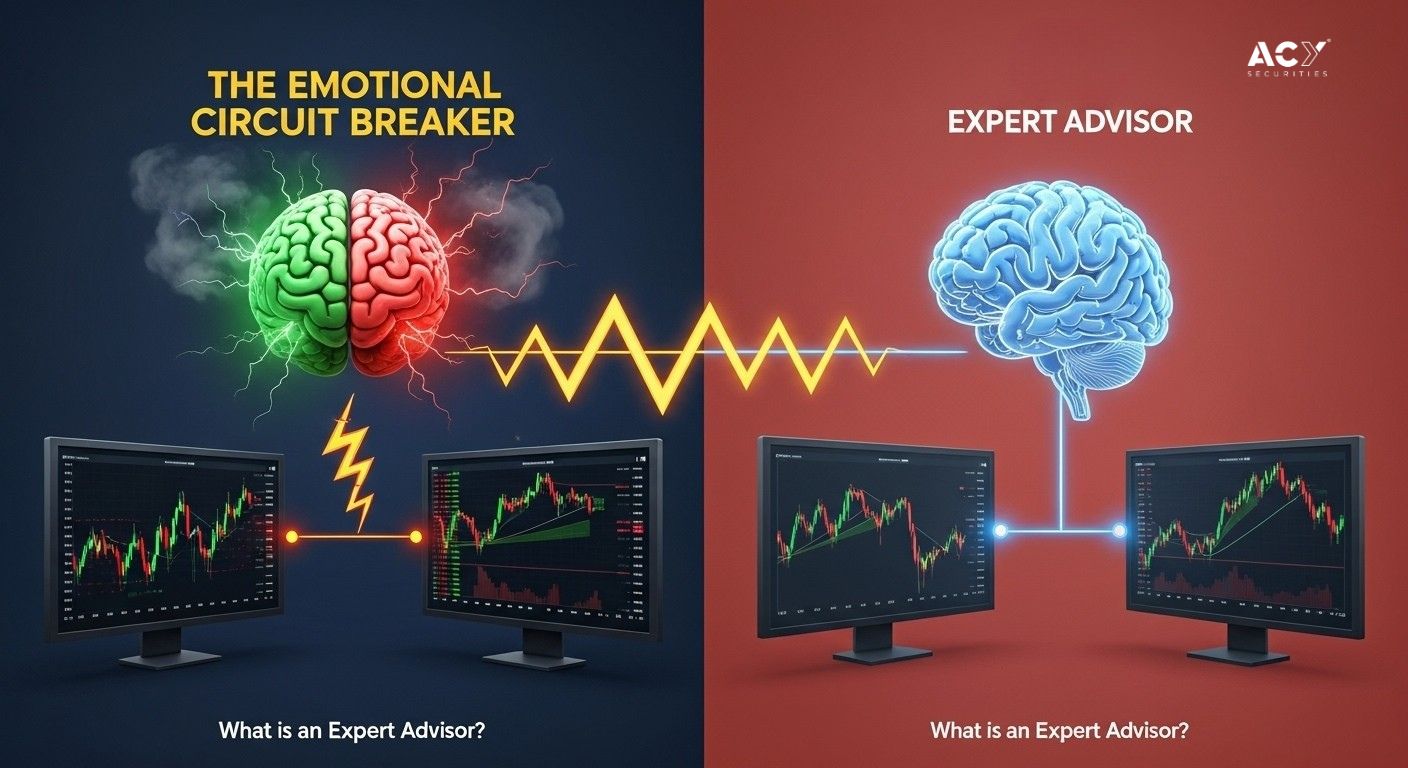

First, What Exactly is a Forex Expert Advisor (EA)?

An Expert Advisor is a piece of software, or a trading robot, that automates your trading decisions on platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5). It operates based on a set of pre-programmed rules, analyzing the market and executing trades on your behalf.

The core promise of an EA is to act as a circuit breaker for human emotion. It doesn't feel fear after a loss or greed after a win. It simply follows the code, executing a strategy with perfect discipline, 24 hours a day. This systematic approach is designed to remove the trader's greatest liability their own psychological fallibility, from the execution process.

Why Do So Many Traders Turn to Automation? The Benefits vs. Manual Day Trading

The appeal of automation is undeniable, especially when compared to the intense demands of manual day trading. For a beginner, the differences are stark and reveal why so many seek a hands-free solution.

| Feature | Manual Day Trading | EA / Automated Trading |

| Time Commitment | High (Requires hours of screen time for analysis and execution) | Low (Monitors and trades 24/5, freeing up your time) |

| Emotional Factor | Very High (Constant battle with fear, greed, and impatience) | Very Low (Executes trades based on pure logic, no emotional bias) |

| Speed & Efficiency | Limited by human reaction time | Near-instantaneous execution, reacting to signals faster than any human |

| Discipline | Difficult to maintain; prone to deviating from the trading plan | Absolute; follows the pre-programmed rules without exception |

| Backtesting | Manual and time-consuming | Fast and rigorous; can test a strategy on years of historical data in minutes |

| Complexity | Difficult to manage complex strategies with multiple indicators | Effortlessly handles complex calculations and monitors numerous variables at once |

The Hidden Costs: What Does It Really Take to Set Up an EA?

While the benefits are clear, the world of premium EAs comes with significant costs that go beyond the initial purchase price. Understanding this financial landscape is the first step toward making a smarter decision.

- The EA Itself ($300 - $2,000+): High-quality, reputable EAs often come with a premium price tag. For example, popular EAs like Waka Waka can cost over $2,000 for a license, while others like FXStabilizer might be in the 300−700 range.

- Virtual Private Server (VPS) ($5 - $50/month): An EA needs to run 24/5 without interruption. A power outage or internet disconnection at home could be catastrophic. A VPS is a remote server that guarantees uptime and low latency, making it a non-negotiable recurring cost for serious automated trading.

- Broker Spreads & Commissions: These trading costs directly eat into the profitability of an EA, especially high-frequency scalping models. A low-cost broker is not just a preference; it's a necessity.

When you add it all up, the annual cost of running a single premium EA can easily exceed 1,000 - 3,000, even before a single trade is placed. This reality check leads us to a crucial question: are there better alternatives?

Can't Afford a Premium EA? 3 Powerful Alternatives for Hands-Free Trading

Yes. The answer is to move away from expensive, opaque "black box" EAs and toward powerful, transparent tools that assist and automate your strategy. These alternatives provide the hands-free benefits you want without the exorbitant costs, and they keep you in the driver's seat.

Here are three powerful types of tools you can download and integrate into your MT4 or MT5 platform right now.

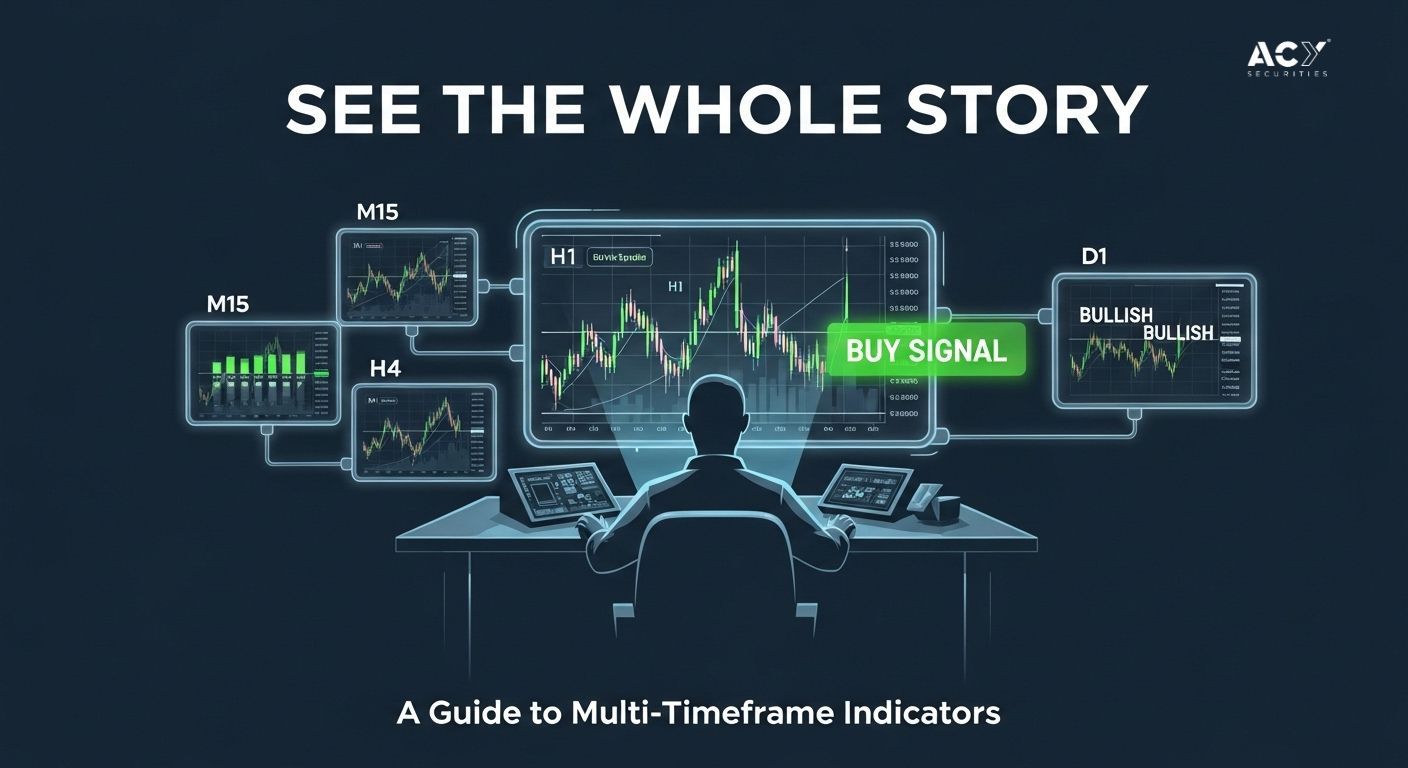

1. The Multi-Timeframe Analysis RSI Indicator

What It Is: A common mistake traders make is analyzing a chart on a single timeframe. A multi-timeframe indicator displays the readings of an indicator (like the Relative Strength Index - RSI) from multiple timeframes (e.g., M15, H1, H4, D1) directly on your current chart.

Key Benefits:

- At-a-Glance Market View: Instantly see if a short-term buy signal is aligned with the longer-term trend, or if it's a risky counter-trend move.

- Reduces Screen Time: Eliminates the need to constantly switch between different charts and timeframes, streamlining your analysis.

- Higher-Probability Setups: By confirming that multiple timeframes are in agreement (e.g., all are overbought or oversold), you can filter out weak signals and focus on high-conviction trades.

- Prevents Over-Trading: Acts as a powerful filter. If the higher timeframes don't support your idea, you have a clear, objective reason to stay out of the market.

Simple Steps to Use It:

- Download & Install: Download the indicator file for MT4 or MT5 from a provider like TradingByte.

- Apply to Chart: Open your platform, find the indicator in your "Navigator" window, and drag it onto your desired chart.

- Configure Settings: In the input settings, you can customize which timeframes you want to monitor and adjust the RSI parameters (e.g., period, levels).

- Trade the Confluence: Wait for moments when the indicator shows alignment across your chosen timeframes. For example, a strong buy signal occurs when the RSI on the M15, H1, and H4 are all rising from oversold conditions.

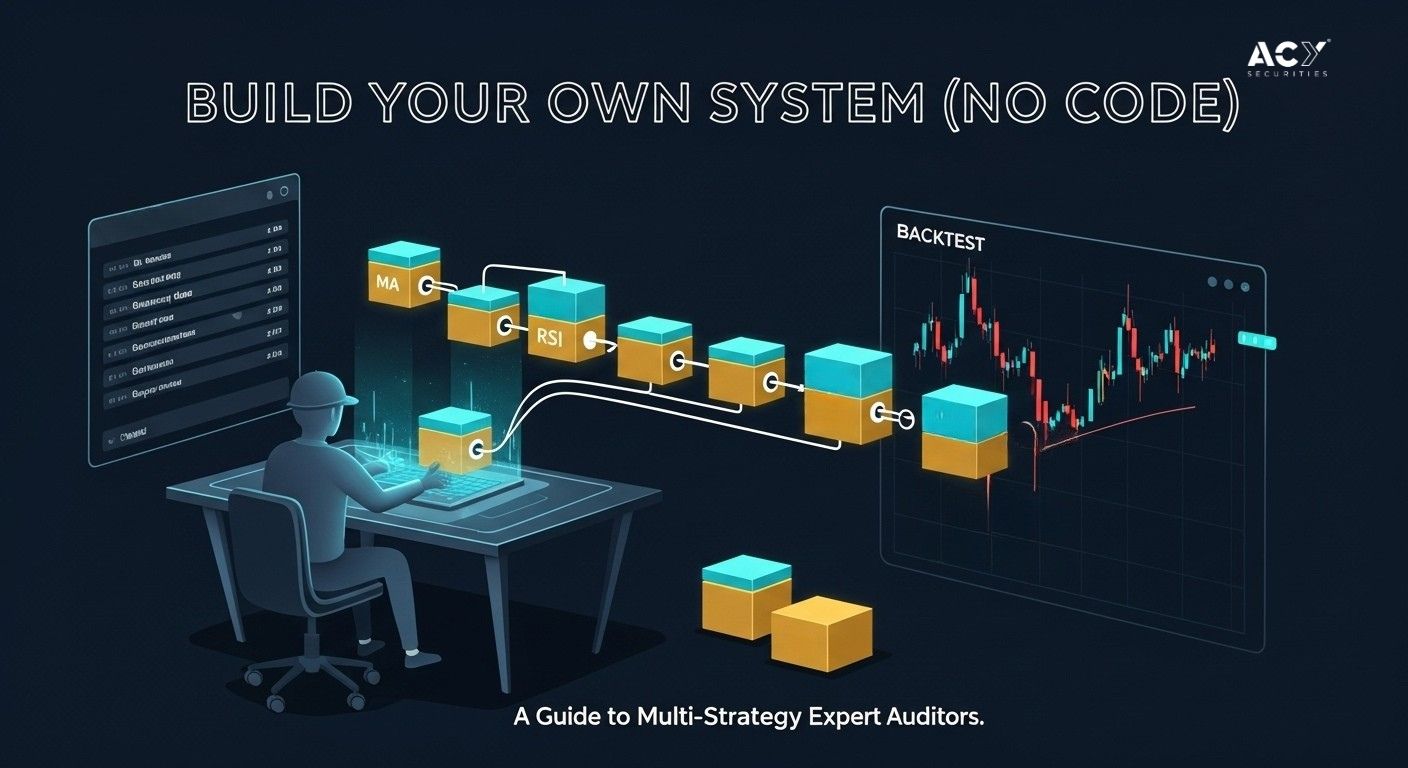

2. The Multi-Strategy Trading EA

What It Is: This is the next evolution in automation. Instead of relying on a single, rigid strategy, a multi-strategy EA allows you to combine different trading signals and conditions to create a more robust and customized automated system.

Key Benefits:

- Build Your Own System (No Code): You can define entry and exit rules based on a combination of indicators (e.g., "Enter a trade only if the Moving Average crosses over AND the RSI is below 30").

- Enhanced Confirmation: By requiring multiple conditions to be met, you drastically reduce false signals and improve the quality of your automated trades. This is a core principle of professional trading.

- Adaptability: The market changes. A simple trend-following strategy may fail in a ranging market. A multi-strategy EA lets you build logic that can account for different market conditions.

- Full Automation of a Nuanced Strategy: This tool bridges the gap between simple indicators and fully autonomous EAs, allowing you to automate a sophisticated, multi-layered trading plan.

Simple Steps to Use It:

- Download & Install: Get the EA file from a provider like TradingByte for your MT4 or MT5 platform.

- Apply to Chart: Load the EA onto your chart from the "Navigator" window.

- Define Your Logic: In the comprehensive input panel, you will select the indicators you want to use for your strategy (e.g., Bollinger Bands, Stochastic, ADX).

- Set the Rules: For each indicator, you define the conditions for a trade (e.g., for Bollinger Bands, you might set a rule to "Sell if the price touches the upper band"). You can combine multiple such rules.

- Backtest & Optimize: Use the MT4/MT5 Strategy Tester to rigorously backtest your custom-built strategy before deploying it on a live or even a demo account.

3. The Simple Trend-Following Indicator

What It Is: Sometimes, the most powerful tool is the one that does one job perfectly. A dedicated trend-following indicator is designed to identify the dominant market direction and provide clear, unambiguous visual signals for entries and exits.

Key Benefits:

- Clarity and Simplicity: It cuts through the "noise" on the charts, often displaying a simple colored line or arrows to indicate whether the market is in an uptrend, downtrend, or is ranging.

- Objective Decision-Making: Removes guesswork and subjective analysis. The signal is either there, or it isn't. This is crucial for building discipline.

- Keeps You on the Right Side of the Market: The old adage is "the trend is your friend." This tool is designed specifically to ensure you are always trading with the primary momentum, which is where the largest profits are often found.

- Perfect for Beginners: It provides a solid, rule-based foundation for building a trading plan.

Simple Steps to Use It:

- Download & Install: Obtain the indicator file from a source like TradingByte.

- Apply to Chart: Drag the indicator from your "Navigator" onto your chart.

- Configure Sensitivity: In the inputs, you can typically adjust the indicator's sensitivity or period to match your trading style (e.g., more sensitive for scalping, less sensitive for swing trading).

- Follow the Signals: Enter trades based on the indicator's signals. For example, "Buy when the line turns blue and price is above it; Sell when the line turns red and price is below it." Always use this in conjunction with proper risk management.

What Would Jesse Livermore Say About Automated Trading?

Jesse Livermore, the legendary "Boy Plunger," traded over a century ago using nothing but the ticker tape, his mind, and an iron will. He would have been deeply skeptical of any "black box" promising easy profits. His timeless philosophy, however, offers profound guidance for using modern tools wisely.

- "Markets are never wrong – opinions often are." Livermore believed in following the market's trend, not arguing with it. A trend-following indicator is a modern tool that enforces this exact principle, keeping a trader aligned with the market's primary direction.

- "Never average losses." This was one of his cardinal rules. It's a direct indictment of the high-risk Martingale and Grid EAs that dominate the "free" EA space. Livermore would view these as systems designed for catastrophic failure.

- "It is not good to be too curious about all the reasons behind price movements." He focused on price action itself, not the "why." This suggests he would appreciate tools like multi-timeframe indicators that provide a clear, objective view of price momentum across the board, without getting bogged down in conflicting news or opinions.

- Patience and Pivot Points: Livermore waited patiently for the market to confirm his thesis at key "pivot points" before entering. A multi-strategy EA that requires several conditions to align before executing a trade is the modern embodiment of this patient, confirmation-based approach.

Livermore's verdict? He would reject any tool that promised to replace the trader's brain. But he would likely embrace tools that enhance discipline, confirm market trends, and enforce strict risk management, precisely what our three powerful alternatives are designed to do.

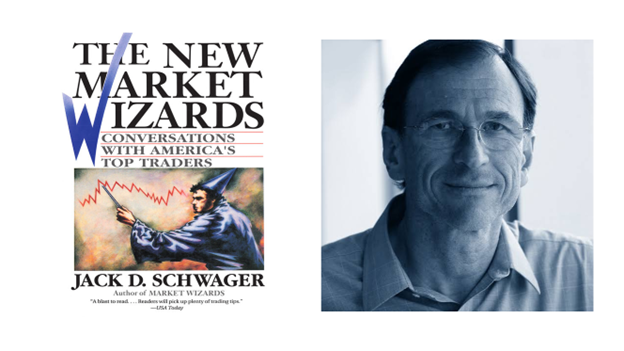

10 Lessons from "The New Market Wizards" for the Modern Automated Trader

Jack Schwager's "The New Market Wizards" is a masterclass in trading psychology and strategy, drawn from interviews with dozens of elite traders. Their collective wisdom is just as relevant for a trader using a multi-strategy EA as it is for a manual pit trader.

- There Is No Holy Grail: The traders in the book used vastly different systems. The lesson is that you must find or build a system that fits your personality and risk tolerance. A multi-strategy EA is a perfect tool for this, allowing you to construct a system that is uniquely yours.

- You MUST Have an Edge: If you don't know what your edge is, you don't have one. Simply turning on an EA is not an edge. Your edge is the logic you've developed and tested,the specific combination of rules you deploy in your multi-strategy EA.

- Risk Management is Everything: Every single Market Wizard prioritized capital preservation. Before you even think about profit, you must define your risk. This means setting stop-losses and position sizes within your EA's parameters.

- Hard Work is in the Preparation: Good trading should feel effortless. The hard work is the countless hours of backtesting, research, and optimization you do before you ever risk a single dollar.

- Discipline is More Valuable Than Intelligence: The most successful traders weren't necessarily geniuses; they were masters of execution. Using an automated tool enforces this discipline, ensuring your well-prepared plan is executed flawlessly.

- Learn to Lose: Losing is a natural part of trading. A good system is not one that never loses, but one that manages losses effectively and wins more than it loses over the long term. Don't panic and turn off your system during an inevitable drawdown.

- Don't Trade Scared Money: Only trade with capital you can afford to lose. This removes the emotional pressure that leads to bad decisions, like overriding your system at the worst possible moment.

- Patience Pays: Wait for your high-probability setups. If you've programmed your EA to only trade when three specific conditions align, let it wait. Don't force trades out of boredom.

- Listen to the Market, Not the Crowd: Your system should be based on your own research and testing, not on what's popular in a forum. Trust your data.

- Adapt or Die: Markets evolve. The strategy that worked last year may not work this year. Periodically review your system's performance and be prepared to re-optimize or change your rules.

Here’s Why ACY Securities is the Best Broker for Your Automated Strategy

The most sophisticated trading tool in the world will fail if it's run on a subpar brokerage platform. For automated trading, where speed and cost are paramount, your choice of broker is a critical component of your success. This is where ACY Securities stands out as the superior choice for traders in 2026.

As highlighted on the official MetaTrader 5 website, ACY Securities is built for performance:

- Ultra-Fast Execution (Under 30ms): For automated strategies, especially those that react to quick market movements, execution speed is everything. ACY's rock-solid infrastructure ensures your orders are filled at the prices you expect, minimizing costly slippage.

- Spreads from 0.0 Pips: Trading costs are a direct drag on your profitability. With institutional-grade liquidity, ACY offers razor-thin spreads, which is a massive advantage for any trading strategy and a necessity for more active systems.

- Low Minimum Deposit ($50): You don't need a massive account to get started with professional-grade trading conditions. This allows you to test your automated strategies in a live environment with minimal capital risk.

- Technologically Superior: ACY provides a robust and reliable trading environment, crucial for running EAs and indicators 24/5 without technical glitches. They offer free access to tools, scripts, and daily analysis to further support your trading.

- Multi-Jurisdictional Regulation: Headquartered in Sydney and regulated by authorities like ASIC and the SVGFSA, ACY provides a safe and transparent environment for your funds.

Running a powerful automated strategy on a slow, expensive, or unreliable broker is like putting cheap tires on a Formula 1 car. You'll never win the race. Choosing a high-performance broker like ACY Securities ensures your well-crafted strategy has the best possible environment to succeed.

The Final Verdict: Tools, Not Crutches

The idea that a novice trader can download a free EA and conquer the psychological challenges of trading is a dangerously flawed premise. As our comprehensive research shows, this path is littered with hidden costs, steep learning curves, and a high probability of financial loss.

Comparative Analysis: Free vs. Paid EAs

| Attribute | Free EAs | Paid EAs |

| Cost | $0 upfront, but high hidden costs (VPS, losses). | One-time fee ($50 - $1,000+) or subscription. |

| Strategy | Often simplistic or uses high-risk models (Martingale, Grid). | Can be more sophisticated, but complexity doesn't guarantee profit. |

| Risk Management | Often rudimentary or completely absent. | A key selling point with advanced risk controls. |

| Support | None. You are entirely on your own. | Typically offered via forums, email, or direct developer contact. |

| Transparency | Low to none. The logic is often a "black box." | Reputable vendors provide detailed manuals and strategy explanations. |

The strategic recommendation is an unambiguous "tools, not crutches" approach. A beginner should first prioritize education in market principles, risk management, and manual trading.

The powerful alternatives we've discussed, Multi-Timeframe Indicators, Strategy Builders, and Trend Indicators, are not magic bullets. They are professional-grade tools designed to augment the skills of a knowledgeable trader. They help enforce discipline, streamline analysis, and automate a well-defined plan. They are the tools you graduate to after you've done the foundational work.

Your Next Move: From Skilled Trader to Successful Partner

The journey we've outlined is about making smarter decisions. It's about rejecting the "get-rich-quick" hype and embracing a professional, systematic approach to trading. By focusing on education, leveraging powerful assistant tools, and partnering with a top-tier broker like ACY Securities, you build a durable, long-term trading career.

And once you achieve that? Once you have a proven, profitable system and the confidence that comes with it? You're no longer just a trader, you're an expert.

The next logical step is to leverage that expertise. The ACY Partners program offers a premier opportunity for successful traders to become forex affiliates, turning their hard-won knowledge into a scalable business. By guiding new traders and helping them start their journey with a trusted broker, you create a new stream of income built on a foundation of genuine skill.

Start by investing in yourself. Master the tools. Build your edge. And then, when you're ready, transform your success into a lasting enterprise.

Frequently Asked Questions (FAQ)

Q: Are these alternative tools really free?

A: Many high-quality indicators and trade assistants are offered for free by brokers or third-party developers, while some more advanced tools may have a one-time cost or subscription that is typically far lower than a premium "black box" EA. The key is that their value comes from augmenting your strategy, not from a secret, proprietary algorithm.

Q: Can I use these tools if I'm a complete beginner?

A: It is highly recommended that you first learn the basics of manual trading on a demo account. These tools are most powerful when you understand the underlying principles. A beginner should start with a simple Trend-Following Indicator to learn about market direction before moving to a Multi-Strategy EA.

Q: How do I know which indicators to combine in a Multi-Strategy EA?

A: This comes from education and testing. A common approach is to combine a trend indicator (like a Moving Average) with a momentum indicator (like the RSI or Stochastic) and a volatility indicator (like Bollinger Bands). The goal is to find a combination of non-correlated indicators that confirm each other. Always backtest your combination thoroughly.

Q: Does using these tools guarantee profit?

A: Absolutely not. No tool, indicator, or EA can guarantee profits in the financial markets. These are tools to help you execute a well-defined and thoroughly tested trading plan with more discipline and efficiency. Your success still depends on the quality of your strategy and your risk management.

Q: How does ACY Partners help me as an affiliate?

A: ACY Partners provides a robust platform for forex affiliate marketing. They offer competitive commission structures, advanced marketing tools, and dedicated support. For a trader who has developed a successful system, it's a way to monetize that expertise by referring others to the high-quality brokerage services of ACY Securities, creating a win-win partnership.

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.

Try These Next