Bollinger Bands: A Comprehensive Guide for Forex Traders

2023-07-06 11:48:34

In this era of inflation, investors are increasingly seeking ways to protect their investments from the impact of rising prices. Alongside traditional safe-haven assets like Gold and the US dollar, Forex, and Crypto trading have emerged as appealing options to hedge against inflation. However, trading forex and crypto involves inherent risks due to the market's high volatility. Fortunately, there is a tool that can provide valuable insights into market volatility and assist in determining entry and exit levels: Bollinger Bands.

Traders in the forex market utilise various technical indicators to forecast future price movements, and one of the most popular indicators is Bollinger Bands. This indicator effectively measures market volatility, identifies potential entry, and exit levels, analyses market trends, and indicates overbought and oversold conditions for a given currency pair.

Let us delve deeper into the functionality of Bollinger Bands: how they are calculated, how to interpret them, and their application in different trading strategies within the forex market to identify trading opportunities.

ACY Securities is here to guide you through the intricacies of Bollinger Bands and enhance your trading knowledge.

What are Bollinger Bands?

The Bollinger Bands, also known as BBs in financial markets, were developed by John Bollinger, an American asset manager and technical analyst, in 1980. This technical indicator, named after its creator, is widely used to assess the historical and current volatility of various financial assets, including stocks, commodities, and forex, in addition to cryptocurrencies.

The Bollinger Bands consist of three distinct bands that serve as volatility measures, providing information about the relative highs and lows of a forex currency pair's price in relation to previous trades. Volatility is quantified using standard deviations, which fluctuate alongside market volatility. As the price increases, the gap between the bands widens, and conversely, the gap between the bands contracts when the price declines.

The Bollinger Bands encompass three lines: the upper band, the middle band, and the lower band. The middle band represents a simple moving average, while the upper and lower bands indicate two standard deviations from the middle band. The Bollinger Bands offer insights into the volatility of a forex market compared to its historical norms over a specific period.

ACY Securities can guide you further on how to effectively interpret and utilise Bollinger Bands in your forex trading strategies.

How to Apply Bollinger Bands Indicator

Here is how you can add the Bollinger Bands to the chart.

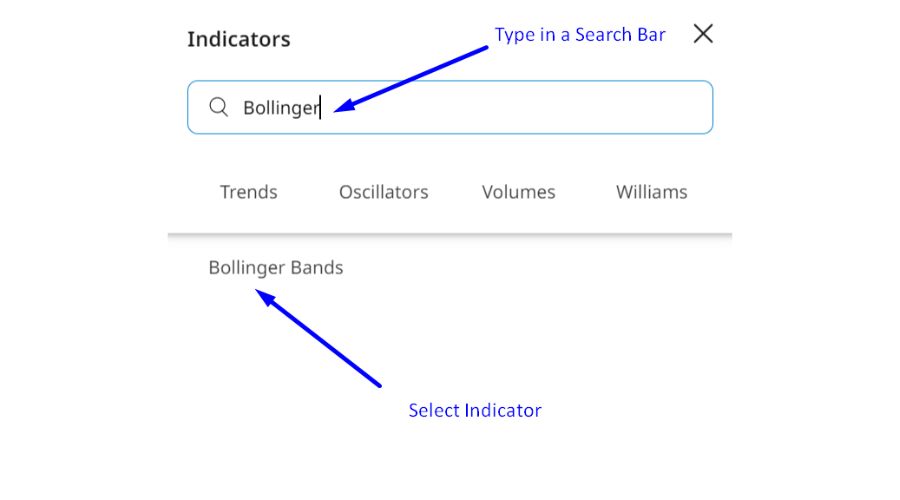

Step 1: Select the desired indicator from the available choices displayed in the Finlogix chart shown above.

Step 2: Enter "Bollinger Bands" in the search bar, and you will find the Bollinger Bands indicator listed among the search results.

Step 3: Select "Bollinger Bands" from the list of technical indicators, and the Bollinger Bands will be automatically applied to your Finlogix chart.

Structure of Bollinger Bands

- The middle band of Bollinger Bands is calculated using a simple moving average of N periods.

- By multiplying the value of the middle line by K times the standard deviation of the currency's price, one can obtain the upper band.

- By subtracting K times the price standard deviation of the forex pair from the middle line, one can determine the lower band.

- Mathematically, the upper and lower bands can be represented as SMA ± k x SD.

The default parameters for Bollinger Bands are often set as N = 20 and k = 2, but traders can customize these values according to their preferences. Bollinger Bands also offer the flexibility to adjust the value of "k" and replace the SMA with the EMA if desired.

When applied to a price chart, Bollinger Bands create a pattern resembling an envelope or channel.

Understanding the Upper, Lower, and Middle Bands of Bollinger Bands

The upper line in Bollinger Bands represents the positive standard deviation from the SMA, while the lower line represents the negative SMA. These lines are depicted in blue and referred to as the upper and lower bands.

- The middle line, shown in red, represents the SMA calculated based on the last 20 periods. It is obtained by adding the closing prices of the previous 20 periods and dividing the sum by 20.

- The width of the bands expands when there is higher volatility around the SMA and contracts when volatility decreases.

- Bollinger Bands can provide insights into overbought and oversold areas. If a price reaches new highs or lows within the bands and then extends beyond the band on the next high or low, it indicates a potential trend reversal.

- It is important to note that when a currency pair’s prices surge above the upper band or decline below the lower band, it does not necessarily imply a trend reversal. In some cases, it may indicate a continuation of the current trend.

- When the price of a currency pair fluctuates between the upper and lower bands, it indicates a range-bound market, which can be used to identify price support and resistance levels.

- A currency is in a trend if its price consistently stays above the middle line of the Bollinger Bands and reaches the upper band for an extended period.

When both the upper and lower bands narrow and come close to each other for an extended duration, it suggests an upcoming breakout. Differentiating between continuation and reversal signals using Bollinger Bands requires experience and practice in interpreting the indicators.

Fine-tuning Bollinger Band Parameters

The configurations of Bollinger Bands are primarily based on the trading style of individual traders. The suggested settings for several types of traders are as follows:

Day Traders: Traders who operate in the short-term are advised to set their SMA (Simple Moving Average) in Bollinger Bands to 10 periods and the bands at 1.5 standard deviations (SD).

Swing Traders: Traders with a medium-term approach should set the SMA to 20 periods and the SD to 2. These are the default parameters for Bollinger Bands on most trading platforms.

Position Traders: Traders who take long-term positions are recommended to use a 50-period SMA as the middle band and set the standard deviation for the upper and lower bands at 2.5.

Using Bollinger Bands in Forex Trading

As mentioned earlier, Bollinger Bands can be applied to identify various trading signals. Now, let us explore how these indicators can be effectively utilised in forex trading to uncover profitable trading opportunities.

Here are some techniques that individual traders can adopt to leverage Bollinger Bands:

Bollinger Bounce Strategy in Forex Trading

The Bollinger Bounce strategy is a simple and straightforward approach that involves using the Bollinger Bands. The key rules to follow when implementing this strategy are as follows:

- Execute a buy trade when the price touches the lower band and execute a sell trade when the price touches the upper band.

- Set a trailing stop at the 20-period moving average (MA) and adjust it whenever the moving average changes.

- Exit the market and close the trade immediately when the price returns to the 20-MA.

For example, consider the EUR/USD trading chart on ACY Securities. When EUR/USD crosses the upper Bollinger Band, forex traders often initiate short positions. Conversely, when the price breaks through the lower Bollinger Band, bullish traders enter the market.

While these rules provide a basic framework for executing profitable trades using the Bollinger Bounce strategy, it is important to note that this approach is most effective in range-bound or sideways markets, where the bands remain relatively flat over an extended period.

Conversely, in trending markets where the bands are expanding or contracting significantly, employing the Bollinger Bounce strategy may result in unfavourable outcomes.

Hence, it is advisable to avoid using this strategy in trending markets and restrict its application to range-bound conditions.

Identifying New Trends with the Bollinger Band Squeeze

As mentioned before, the Bollinger Bands can also be utilised in the forex market to identify the initiation of a new trend. This strategy focuses on identifying new trend levels by following simple rules.

The rules for implementing this strategy are as follows:

1. Look for a prolonged period of low volatility in the market. This can be determined by observing the narrowing of the Bollinger Bands.

2. Once a period or candle closes outside the bands, wait for the breakout to occur. The breakout can happen either above or below the bands.

3. The breakout is confirmed when the bands start to expand, indicating the beginning of a new trend.

4. After identifying the new trend, open a trade in the direction of the breakout. If the price breaks above the upper band, consider opening a buy trade. Conversely, if the price breaks below the lower band, consider opening a sell trade.

By following these rules, traders can utilise the Bollinger Band Squeeze strategy to identify latest trends in the forex market and potentially capitalize on profitable trading opportunities.

Identifying W-Bottoms & M-Tops with Bollinger Bands

In addition to using Bollinger Bands for squeeze and bounce trades, forex traders can also employ this tool to identify trading opportunities based on W-bottoms and M-tops patterns in price charts. These patterns are relatively easy to identify and trade.

W-Bottoms

To identify a W-bottom pattern, traders should look for double bottoms in the price chart. The first low point should occur outside the Bollinger Bands, while the second low point should happen within the Bollinger Bands.

For example, on the daily EUR/USD chart, a W-bottom or double-bottom pattern can be observed. When the price bounces back from the second low, it indicates a potential reversal. Traders can take advantage of this by opening a long or buy position in the market.

M-Tops

When the price of a currency pair reaches higher levels, the M-top pattern serves as a signal for traders. To identify this pattern, traders should observe whether the first high is outside the Bollinger Bands and the second high is inside the Bollinger Bands.

For instance, on the daily EUR/USD chart, an M-top or double-top pattern can be observed. Once traders identify this pattern, they can consider opening a short position or sell trade. This is because a potential trend reversal is expected following the pattern, as depicted in the chart below.

By utilizing Bollinger Bands to identify W-bottoms and M-tops patterns, forex traders can potentially identify trend reversals and make informed trading decisions in the dynamic forex market.

Bottom Line

Bollinger Bands are valuable technical indicators that provide traders with excellent trading opportunities. It is crucial to understand how to interpret the bands, as their interpretation can differ depending on the market trend, whether it is a trending market or a range-bound market. It is important to note that Bollinger Bands should not be solely relied upon to identify overbought or oversold zones.

To confirm the signals generated by Bollinger Bands, it is recommended to combine their readings with those of other indicators. They work particularly well with indicators like the Relative Strength Index (RSI) and Average Directional Index (ADX), which help determine entry and exit points. Experienced traders understand the importance of not relying solely on a single indicator and making trading decisions only after receiving confirmation from multiple indicators.

ACY Securities offers a wide range of forex trading opportunities. To access more educational content, expand your knowledge and enhance your trading skills, visit the education section of ACY.com.

Try These Next