U.S. Dollar Struggles as Tariff Fears Stir Recession Warnings

2025-04-14 10:18:03

The U.S. dollar faced renewed headwinds at the start of the week as markets reacted to escalating concerns over President Trump’s aggressive trade policies. Economists are warning that the dollar’s recent decline may be more than just technical—it’s now tied to rising recession risks and global backlash over tariffs.

Overview

- Tariff Shock Hits Dollar – U.S. imposes 145% tariff on Chinese goods

- Markets fear inflation and recession; dollar drops sharply.

- DXY breaks below 100 as investor confidence weakens.

- China Strikes Back – 125% tariffs on U.S. goods

- Beijing retaliates, warning of long-term damage.

- Safe-haven demand shifts away from USD.

- Tech Tariff Threat Looms – Electronics next in line

- Temporary exemptions on smartphones and laptops expiring.

- Semiconductor tariffs expected in coming weeks.

- Foreign Investors Exit – U.S. assets see outflows

- Treasury bonds sold off amid policy distrust.

- USD loses safe-haven status; gold and JPY rise.

- Volatility Surges – VIX remains near highs

- Fear dominates U.S. markets; no relief in sight.

- Dollar weakness likely to persist.

Escalation of U.S. Tariffs on Chinese Imports

Following the April 2 announcement of a 10% universal tariff and a 145% tariff on Chinese imports, the dollar has struggled to maintain strength.

President Donald Trump significantly increased tariffs on Chinese imports, raising the effective rate to 145%. This escalation is part of a broader strategy to address trade imbalances and encourage domestic manufacturing. The tariff increase includes a baseline 10% universal tariff, a 125% reciprocal tariff, and an additional 10% penalty related to China's alleged role in fentanyl trafficking.

China's Retaliatory Measures

In response to the U.S. tariff increases, China raised its tariffs on U.S. goods to 125%, effective April 12, 2025. Chinese officials criticized the U.S. tariff strategy, labeling it as "a joke" and expressing that further U.S. tariff hikes would be economically nonsensical.

Temporary Exemptions and Future Tariffs on Electronics

Initially, certain consumer electronics such as smartphones, laptops, and smartwatches were exempted from the new tariffs. However, these exemptions are temporary.

Commerce Secretary Howard Lutnick announced that these products will soon be subject to separate tariffs under a national security investigation focusing on semiconductors, with new duties expected to be implemented within one to two months.

Global Confidence in U.S. Dollar Erodes Amid Trade Turmoil

The U.S. dollar has experienced a significant decline, reaching its lowest point in three years. This downturn is attributed to escalating trade tensions under President Trump's administration, particularly the imposition of sweeping tariffs.

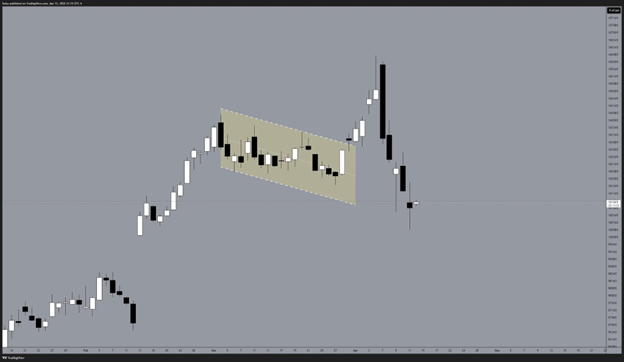

Daily

Dollar continues to decline and has already closed below a significant level at 100.157 with continued weakness still on the horizon.

The dollar's traditional role as a safe-haven asset is being questioned as investors seek alternatives amid policy unpredictability.

Weekly

Dollar is now trading below 100 level with no signs of recovery. The weekly also tells us that the move at the 107 level was not sustained and with trust going under, Dollar continued to decline ever since.

Foreign Investors Retreat from U.S. Assets

Global investors are increasingly divesting from U.S. Treasury bonds and dollar-denominated assets. This shift is driven by concerns over the U.S.'s rising fiscal deficits, volatile leadership, and deteriorating international relationships. The traditional inverse relationship between stocks and bonds has broken down, signaling deeper structural issues in investor sentiment.

VIX: US Market Fears Escalating

With confidence dying down on the US markets, VIX is still on record highs with no signs of fears in the US market going away anytime soon.

The dollar's decline isn’t just a market adjustment—it reflects growing concerns among neighboring countries that the U.S. is becoming an unreliable trade partner.

Is the U.S. Dollar Signaling a Recession Ahead?

The U.S. dollar is under pressure — and this time, it’s not just technical noise. As global markets digest the ripple effects of President Trump’s sweeping tariff hikes, investors are asking a bigger question: Is the dollar warning us that a recession is on the horizon?

As import costs climb and major trading partners like China retaliate, the pressure on U.S. businesses and consumers is building. Corporate margins are shrinking, supply chains are tightening, and the Federal Reserve may soon face the impossible task of balancing sticky inflation with slowing growth. If these dynamics continue to unfold, the dollar’s current decline may become a leading indicator of broader economic pain ahead.

What You Should Watch

Actionable Approach:

- Watch DXY closely: A sustained break below 100 could trigger broader USD outflows.

- Monitor Treasury yields (US-10 Year Bonds): If foreign buyers retreat, yields could rise — but if growth slows, they could fall even faster.

- Gold remains a key barometer: Central banks are accumulating, and prices remain supported on dips.

- Diversify beyond the dollar: Consider EUR, CHF, JPY and even CNY in longer-term macro positioning.

Check Out Our Market Education

Learn how to navigate yourself in times of turmoil. Check out my market education links:

Final Thought

The dollar isn’t disappearing — but the world is moving toward a more balanced currency landscape. Traders, investors, and policymakers can’t ignore the signals. Whether it’s through gold, regional currency deals, or new payment systems, the post-dollar era is quietly being built — and 2025 may be remembered as a turning point.

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.

Try These Next