Gold Forecast: Gold Confirms Bullish Breakout Above $3,420 as Trade Risk and Central Bank Demand Fuel Momentum

2025-07-23 14:15:32

- Gold confirms bullish breakout, reclaiming premium territory as price clears $3,400 on central bank demand and weaker USD.

- China’s hidden gold stockpiling and Fed uncertainty fuel risk-off appetite, aligning with institutional forecasts toward $3,600.

- Technical structure shows bullish FVG support, but a failure below $3,370 could trigger a return to range and deeper correction.

Market Narrative

Gold has finally confirmed the bullish breakout structure that had been building for weeks.

After holding the $3,240–$3,380 range, a key resistance zone from early July, XAU/USD surged past the $3,400 resistance, validating the institutional accumulation phase. The move comes amid rising geopolitical and economic uncertainty, central bank accumulation (especially from China), and a weaker U.S. dollar as markets anticipate a more dovish tone from the Fed in Q3.

This momentum shift has pushed gold within striking distance of the multi-year high at $3,500, which, if broken, could open the door toward $3,600 and potentially $3,700+, aligning with institutional forecasts.

Key Fundamental Drivers

1. China’s Hidden Gold Reserves Fuel Long-Term Demand

MarketWatch and Reuters reports suggest China’s official reserves (2,300t) may underrepresent its real holdings, which could exceed 5,000 tons. This aggressive accumulation underlines Beijing’s broader de-dollarization strategy, further reinforcing gold’s structural support.

2. Dollar Weakness and U.S. Yield Drop

Recent U.S. data has fallen short of expectations—particularly in housing, consumer sentiment, and business surveys—weakening the dollar and giving gold breathing room above $3,400.

3. Political Volatility Elevates Gold’s Appeal

Markets briefly spiked after reports emerged that President Trump may attempt to remove Fed Chair Powell. While speculative, it sent a shockwave through rate-sensitive markets, reinforcing gold’s safe-haven bid.

4. Institutional Forecasts Turning More Aggressive

- J.P. Morgan targets $3,800–$4,000 gold by year-end if global uncertainty persists.

- HSBC projects $3,600 as a near-term rally point under current policy outlooks.

- Morgan Stanley has issued similar calls, citing the Fed's expected pivot and Asia’s sustained demand.

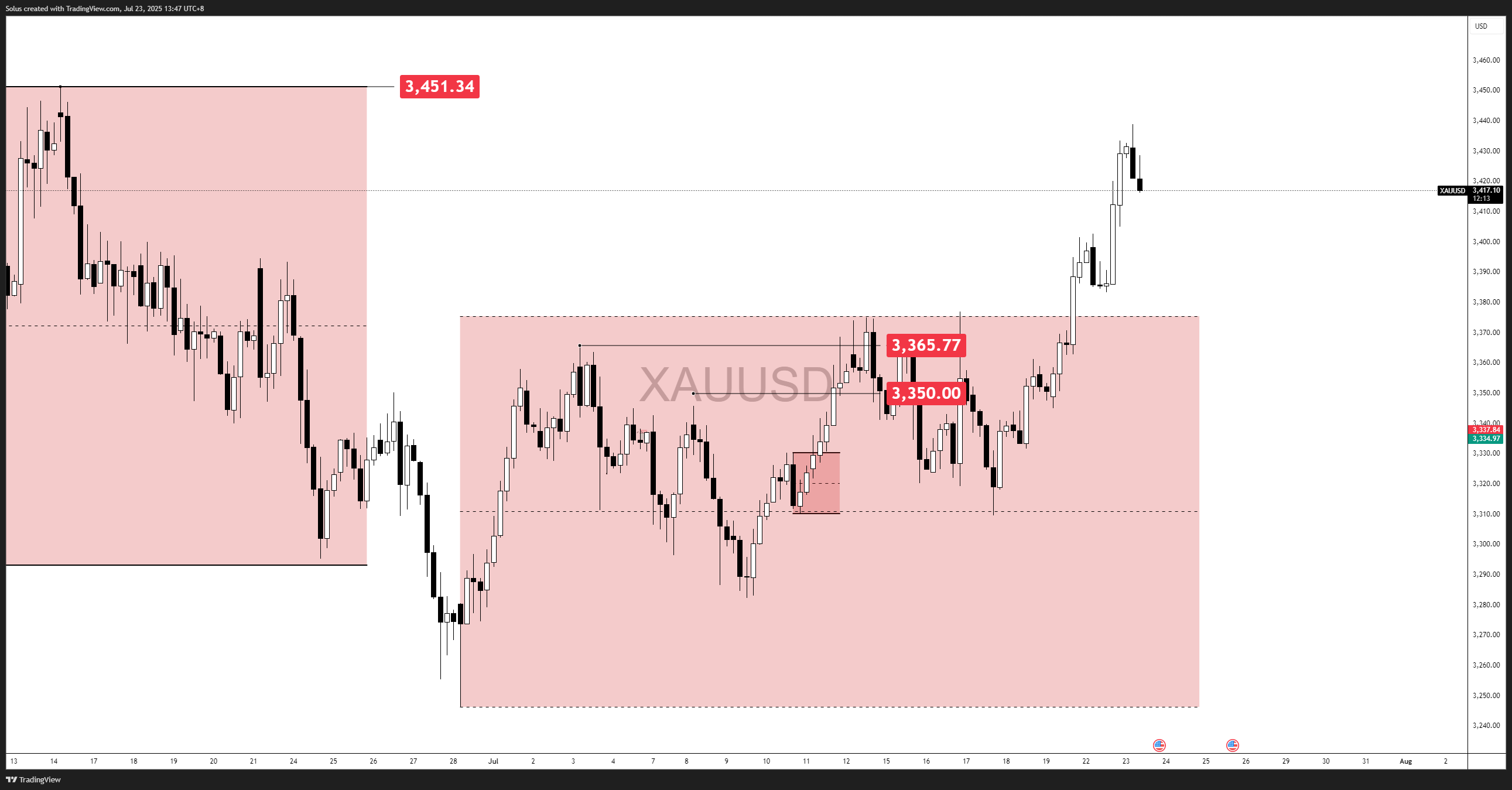

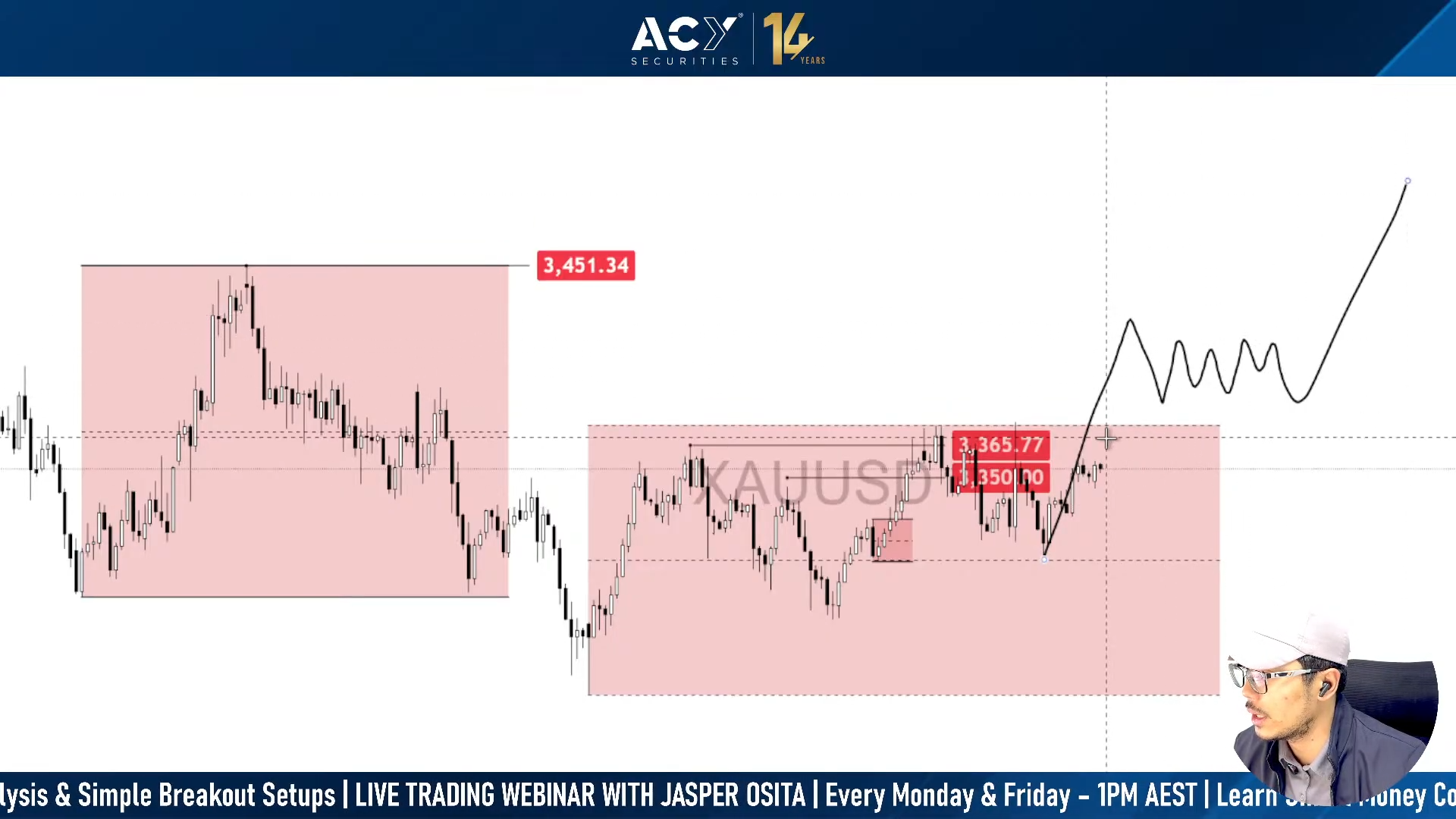

Technical Outlook

Gold has decisively broken out of its multi-week consolidation, above the $3,375 resistance level, confirming a bullish breakout structure and reclaiming key premium territory. The move validates our previously outlined breakout forecast.

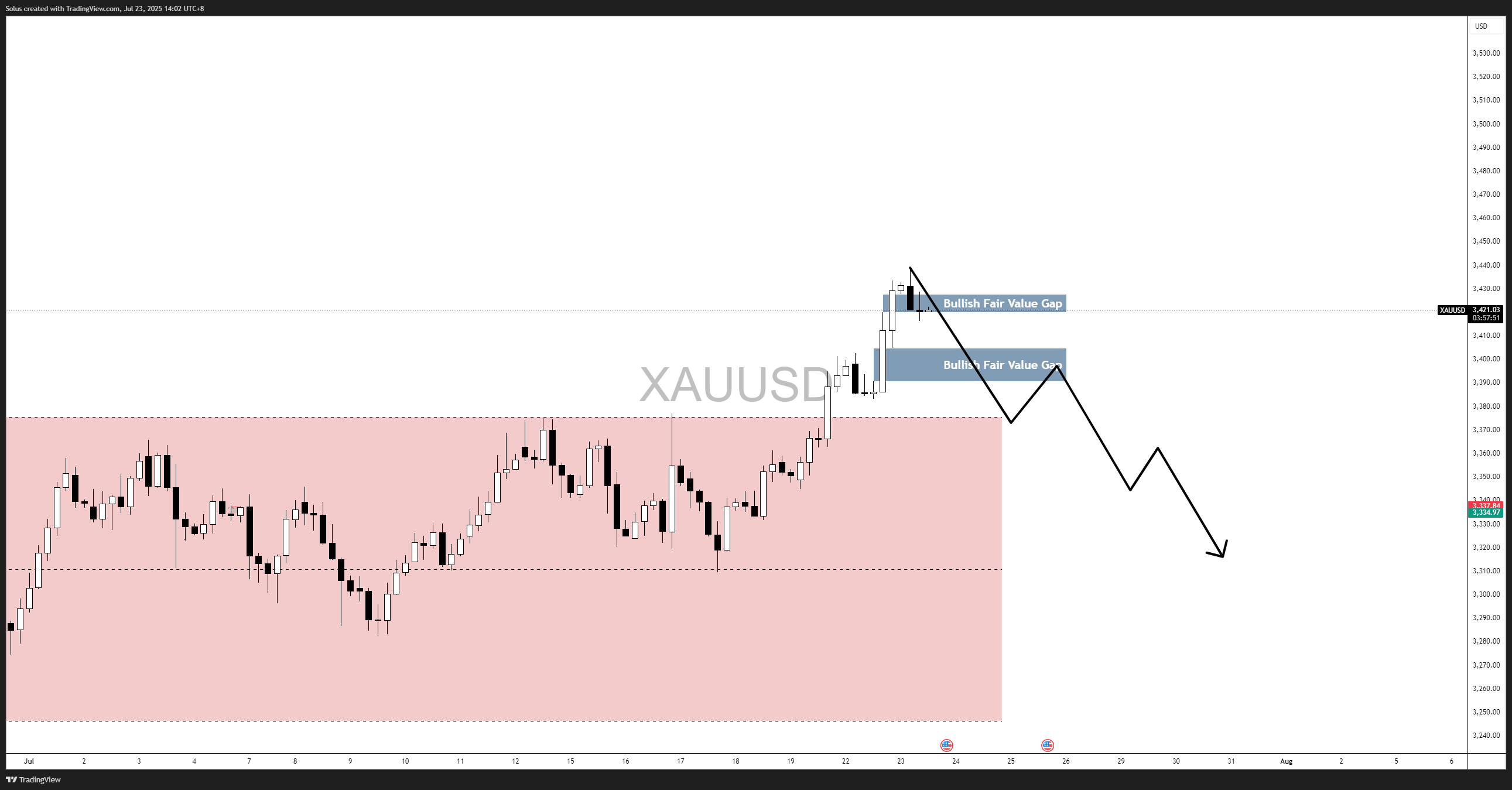

Bullish Scenario: Continuation Through FVG Support

Gold has formed two Bullish Fair Value Gaps between $3,390–$3,405 and $3,420–$3,425. If price pulls back and finds support within these gaps, it could confirm that institutions are defending discount pricing.

Note: $3,370 support is still valid for an upside continuation.

- Price must show bullish re-accumulation inside the FVGs (e.g. bullish engulfing, rejection wicks, liquidity sweep).

- A clean reclaim above $3,450 will confirm continuation.

- Retesting them at a premium confirms buyers are still in control.

- Absence of major bearish catalyst in fundamentals supports further upside.

Targets:

- First Target: $3,450 – recent swing high

- Second Target: $3,500 – psychological round number

- Third Target: $3,600 – extension target & institutional projection (as forecasted by JPMorgan & HSBC)

Bearish Scenario: Distribution Followed by Breakdown

If price fails to hold within the Bullish FVGs and begins to form lower highs beneath $3,420, it could signal distribution at premium pricing. This would align with a return-to-range scenario.

- Breakdown through $3,395 and $3,380 Fair Value Gaps

- Clean bearish close below $3,370 (prior range high)

- If the market is risk-on or if upcoming U.S. data strengthens the dollar, gold could correct.

- Strong daily rejection from the $3,451 level increases probability of reversal structure forming.

Start Practicing with Confidence - Risk-Free!

Open a free demo account today and experience institutional-grade spreads, lightning-fast execution, and all the tools you need to grow as a trader.

- Trade forex, indices, gold, and more

- Access ACY, MT4, MT5, & Copy Trading Platforms

- Practice with zero risk

It’s time to go from theory to execution - risk-free.

Create an Account. Start Your Free Demo!

Check Out My Contents:

Strategies That You Can Use

How To Trade & Scalp Indices at the Open Using Smart Money Concepts (SMC)

How to Trade Breakouts Effectively in Day Trading with Smart Money Concepts

Complete Step-by-Step Guide to Day Trading Gold (XAU/USD) with Smart Money Concepts (SMC)

The Power of Multi-Timeframe Analysis in Smart Money Concepts (SMC)

Forex Trading Strategy for Beginners

Mastering Candlestick Pattern Analysis with the SMC Strategy for Day Trading

Mastering Risk Management: Stop Loss, Take Profit, and Position Sizing

How to Use Fibonacci to Set Targets & Stops (Complete Guide)

RSI Divergence Trading Strategy for Gold: How to Identify and Trade Trend Reversals

Stochastics Trading Secrets: How to Time Entries in Trending Markets using Stochastics

Gold Trading Stochastics Strategy: How to Trade Gold with 2R–3R Targets

RSI Hidden Divergence Explained: How to Spot Trend Continuations Like a Pro

How To Trade News

Why Smart Money Concepts Work in News-Driven Markets - CPI, NFP, and More

How to Trade NFP Using Smart Money Concepts (SMC)-A Proven Strategy for Forex Traders

How to Trade CPI Like Smart Money - A Step-by-Step Guide Using SMC

Learn How to Trade US Indices

How to Start Trading Indices and Get into the Stock Market with Low Capital (2025 Guide)

Best Indices to Trade for Day Traders | NASDAQ, S&P 500, DAX + Best Times to Trade Them

How To Trade & Scalp Indices at the Open Using Smart Money Concepts (SMC)

NAS100 - How to Trade the Nasdaq Like a Pro (Smart Money Edition)

How to Trade CPI Like Smart Money - A Step-by-Step Guide Using SMC

Why Smart Money Concepts Work in News-Driven Markets - CPI, NFP, and More

How to Start Trading Gold

How to Swing Trade Gold (XAU/USD) Using Smart Money Concepts: A Simple Guide for Traders

Complete Step-by-Step Guide to Day Trading Gold (XAU/USD) with Smart Money Concepts (SMC)

The Ultimate Guide to Backtesting and Trading Gold (XAU/USD) Using Smart Money Concepts (SMC)

Why Gold Remains the Ultimate Security in a Shifting World

How to Trade Japanese Candlesticks

How to Trade Candlestick Patterns with High Probability: A Complete Guide for Beginners

The Top Japanese Candlestick Guide: What is an Engulfing Pattern and How to Trade It?

Piercing Pattern Candlestick Explained: How to Trade It - Step-By-Step Guide

Morning & Evening Star Candlestick Patterns – How to Trade Market Reversals with Confidence

How to Start Day Trading

5 Steps to Start Day Trading: A Strategic Guide for Beginners

8 Steps How to Start Forex Day Trading in 2025: A Beginner’s Step-by-Step Guide

3 Steps to Build a Trading Routine for Consistency and Discipline - Day Trading Edition

The Ultimate Guide to Understanding Market Trends and Price Action

Trading with Momentum: The Best Trading Session to Trade Forex, Gold and Indices

Learn how to navigate yourself in times of turmoil

How to Identify Risk-On and Risk-Off Market Sentiment: A Complete Trader’s Guide

How to Trade Risk-On and Risk-Off Sentiment - With Technical Confirmation

The Ultimate Guide to Understanding Market Trends and Price Action

Want to learn how to trade like the Smart Money?

Why Smart Money Concepts Work: The Truth Behind Liquidity and Price Action

Mastering the Market with Smart Money Concepts: 5 Strategic Approaches

Mastering Candlestick Pattern Analysis with the SMC Strategy for Day Trading

Understanding Liquidity Sweep: How Smart Money Trades Liquidity Zones in Forex, Gold, US Indices

The SMC Playbook Series Part 4: How to Confirm Trend Reversal & Direction using SMC

The SMC Playbook Series Part 5: The Power of Multi-Timeframe Analysis in Smart Money Concepts (SMC)

Fair Value Gaps Explained: How Smart Money Leaves Footprints in the Market

The Best Time to Use Smart Money Concepts (SMC): Why Timing Is Everything in Trading SMC

How to Trade the London Session Using Smart Money Concepts (SMC)

Trading Psychology and Continuous Improvement Contents

The Mental Game of Execution - Debunking the Common Trading Psychology

5 Steps to Backtest a Trading Strategy with AI: A Step-by-Step Guide

Managing Trading Losses: Why You Can Be Wrong and Still Win Big in Trading

The Hidden Threat in Trading: How Performance Anxiety Sabotages Your Edge

Why You Fail in Trading: You Don’t Have Enough Capital to Survive

Why 90% of Retail Traders Fail Even with Profitable Trading Strategies

The Top 10 Best Trading Books That Changed My Mindset, Strategy & Performance

Discovering Your Trader Profile: What Kind of Trader Are You?

Follow me for more daily market insights!

Jasper Osita - LinkedIn - FXStreet - YouTube

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.

Probieren Sie Diese Als Nächstes

4 Powerful Tactics to Overcome the Most Costly Forex Mistakes

How to Master MT4 & MT5 - Tips and Tricks for Traders

The Importance of Fundamental Analysis in Forex Trading

Forex Leverage Explained: Mastering Forex Leverage in Trading & Controlling Margin

The Importance of Liquidity in Forex: A Beginner's Guide

Close All Metatrader Script: Maximise Your Trading Efficiency and Reduce Stress

Best Currency Pairs To Trade in 2025

Forex Trading Hours: Finding the Best Times to Trade FX

MetaTrader Expert Advisor - The Benefits of Algorithmic Trading and Forex EAs

Top 5 Candlestick Trading Formations Every Trader Must Know