EUR/USD Market Drivers and Outlook, Will it Break 1.10 Soon?

2025-03-18 10:08:04

The week begins with major FX pairs settling into a holding pattern as markets await crucial central bank decisions. The US dollar remains in a consolidatory phase, trading just below the 104.00 mark on the dollar index. Investors are keenly focused on policy updates from the Bank of Japan (BoJ) and the Federal Reserve midweek, followed by rate decisions from the Swiss National Bank (SNB), Riksbank, and the Bank of England (BoE) on Thursday.

Federal Reserve’s Position and US Economic Signals

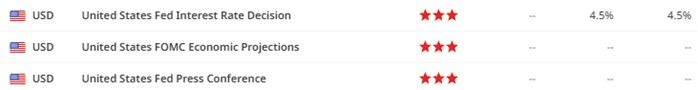

The Federal Reserve is unlikely to deviate from its recent messaging, maintaining a cautious stance on rate cuts. Market expectations have shifted towards a potential rate cut in June, with speculation mounting on whether the Fed will deliver two or three cuts this year. The latest University of Michigan consumer confidence data highlights growing concerns, with sentiment hitting its lowest level since July 2022. Inflation expectations have surged, reaching their highest mark since 1993, while fears of rising unemployment have dragged down labour market confidence. These developments suggest that while the Fed may not rush to ease policy, economic headwinds are growing, warranting a more careful approach.

FED Rates Decision

Euro’s Momentum and German Fiscal Plans

The euro has found support in expectations of increased fiscal stimulus from Germany. Chancellor-in-waiting Friedrich Merz has brokered an agreement with the Green Party to ramp up infrastructure and defence spending, setting aside EUR 100 billion from a proposed EUR 500 billion public investment fund for climate initiatives. With parliamentary approval expected this week, the move signals a shift towards looser fiscal policy. Markets initially reacted positively, pushing EUR/USD to a high of 1.09466 and German Bund yields to 2.94%, though some of those gains have since faded.

EURUSD H1 Chart

GBP: BoE’s Steady Approach Amid Rising Inflation

Sterling has benefited from improved sentiment towards European assets, with GBP/USD approaching the 1.3000 level for the first time since the last US election. However, the pound has underperformed against the euro, pushing EUR/GBP above 0.8400 again. The BoE is expected to maintain its trajectory of gradual rate cuts, with the market pricing in reductions in May and August. However, the path beyond that remains uncertain, particularly with UK inflation set to pick up towards 4% in the coming months. The BoE faces a delicate balancing act between supporting growth and managing inflation expectations.

GBPUSD H1 Chart

Trade Tensions and Market Risks

One wildcard in the broader outlook is the potential for renewed trade disputes. The EU’s swift retaliation against US tariff hikes on steel and aluminium—hitting back with EUR 26 billion in tariffs—has drawn sharp criticism from Washington. President Trump has countered with threats of 200% tariffs on select European alcohol imports, a move that could disrupt trade flows and impact sentiment. Interestingly, the UK has chosen to abstain from retaliatory measures, reinforcing expectations that its economy may avoid the worst fallout from escalating trade tensions.

The FX market remains poised for volatility as central banks shape their next moves. The dollar’s direction will hinge on the Fed’s tone and evolving US economic data, while the euro’s near-term strength rests on Germany’s fiscal pivot. Meanwhile, the pound remains supported but faces headwinds from inflation dynamics. With geopolitical risks adding another layer of uncertainty, traders will need to navigate shifting narratives carefully in the weeks ahead.

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.

Probieren Sie Diese Als Nächstes

4 Powerful Tactics to Overcome the Most Costly Forex Mistakes

How to Master MT4 & MT5 - Tips and Tricks for Traders

The Importance of Fundamental Analysis in Forex Trading

Forex Leverage Explained: Mastering Forex Leverage in Trading & Controlling Margin

The Importance of Liquidity in Forex: A Beginner's Guide

Close All Metatrader Script: Maximise Your Trading Efficiency and Reduce Stress

Best Currency Pairs To Trade in 2025

Forex Trading Hours: Finding the Best Times to Trade FX

MetaTrader Expert Advisor - The Benefits of Algorithmic Trading and Forex EAs

Top 5 Candlestick Trading Formations Every Trader Must Know