Dollar Outlook: Key Scenarios and Market Impacts This Week

2025-02-18 12:07:45

Overview

- Dollar Index (DXY): The Dollar remains in a vulnerable position as it faces a potential bearish follow-through or a reversal depending on upcoming economic data and Fed policy signals.

- AUDUSD: Testing critical resistance with the potential for volatility around the upcoming RBA Rate Cut decision. A breakout could confirm bullish momentum, while rejection may resume downside risks.

- NZDUSD: Maintaining a bullish outlook above the Daily Fair Value Gap. Continued strength depends on staying above the key support range.

- EURUSD: Consolidating amid low liquidity, with upcoming geopolitical events possibly influencing sentiment. A break of the current range could determine the next direction.

- UK100: Driven by defense stocks' rally, benefiting from geopolitical developments. A continuation of the bullish trend depends on sustained sector strength.

- GBPUSD: Strong bullish momentum with clear upside targets. A break above the recent high confirms continuation, while a pullback could offer buying opportunities.

- USDCAD: Retracing at an imbalance zone, with the potential for a bearish reaction. Tariff news could influence the next move.

- USDCHF: Stuck in a broad range without a decisive trend. A move towards equilibrium could offer directional clues.

- GAS: Bearish breakdown below 3.586 suggests continued weakness unless a reversal pattern emerges.

- GOLD: Regaining momentum near equilibrium, with a bullish breakout signaling further upside.

- OIL: Testing the 50% equilibrium level of its range. A confirmed breakout could initiate a bullish trend reversal.

As the U.S. Dollar continues its bearish momentum, traders are watching closely for a potential follow-through or a bullish reversal. With key economic events and global market dynamics at play, here are three possible scenarios for the Dollar's movement in the coming days.

Scenario 1: Bearish Follow-Through – Continued Weakness

The Dollar remains unattractive due to stagflation concerns and uncertainty around the Fed's next move. If the Dollar taps into the Fair Value Gaps (FVGs) without closing above them, we could see a continuation of the downside trend.

Scenario 2: Upside Reversal – Invalidation of Bearish Volume Imbalances

The recent low presents a potential liquidity pool, which institutions might exploit to trigger an upside reversal. Additionally, high CPI and PPI numbers could pressure the Fed to reconsider rate hikes, supporting a bullish move for the Dollar.

Scenario 3: Range-Bound Movement – Awaiting a Catalyst

With key data releases on the horizon, including the GDP Growth Rate on February 27, the Dollar may remain range-bound until a significant catalyst triggers a breakout or breakdown. Positive growth data could offset inflation worries and support the Dollar’s recovery.

Approach on USD Pairs

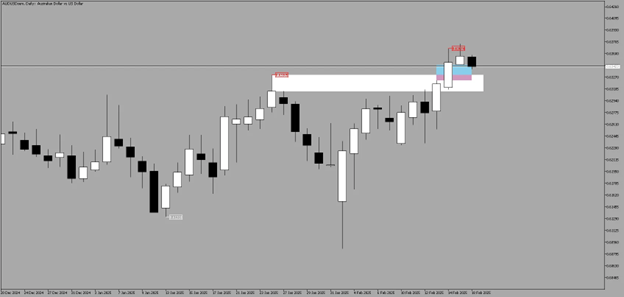

AUDUSD – Testing Key Resistance

AUD pierced through the 0.63674 level but has yet to confirm a breakout.

Expected Rate Cut is Out

We had a strong rejection as a rate cut is not good for the Aussie. But overall, AUD is still bullish technically unless proven otherwise, if the level does not hold for bullish bias.

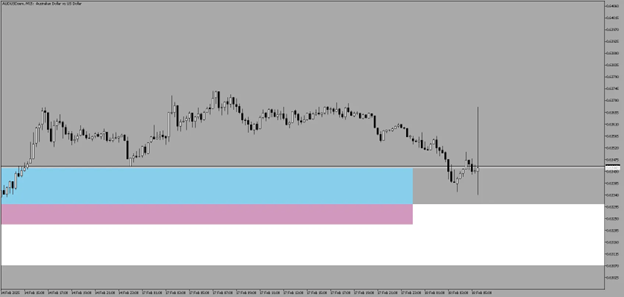

NZD – Retesting the Daily Fair Value Gap 0.56793 - 0.57155

NZD is retesting the Daily FVG (0.56793 - 0.57155) after a fresh breakout. As long as the price stays above this range, the bullish momentum is expected to continue.

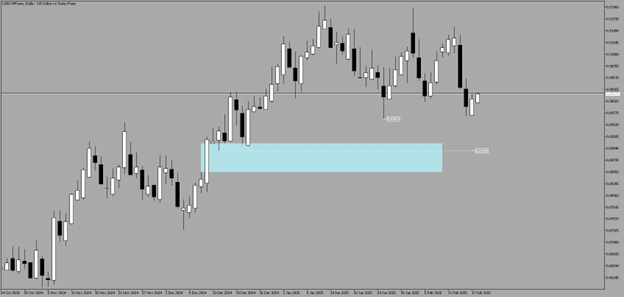

EUR Potential Retracement at the 1.04297 - 1.04463 Level

EUR remains sluggish amid low liquidity following the U.S. Bank Holiday. Attention is also on the upcoming Russia-Ukraine peace talks, which could influence market sentiment.

UK100 – Boosted by Defense Stocks

Defense stocks are driving UK100 higher as the Europe Aerospace & Defense Index gained +1.62%.

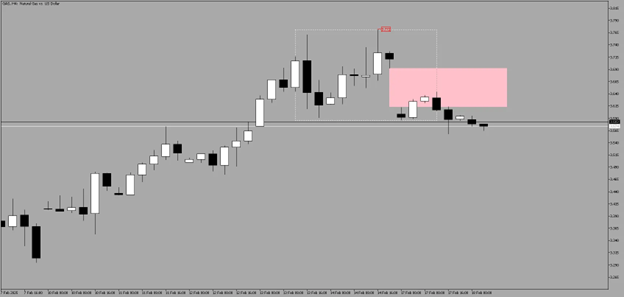

GBPUSD – Strong Bullish Momentum

GBP continues to show strength above 1.26139. A break above 1.26345 would signal continued upside, while a pullback to the 1.25683 - 1.25757 level could provide a bullish entry point.

USDCAD – Retracing at Imbalance Zone

CAD remains strong amid delayed tariffs, but a retracement at the previous imbalance could lead to a bearish reaction.

USDCHF – Range-Bound with No Clear Direction

USDCHF remains range-bound, with no clear bearish follow-through. A move towards equilibrium could present new trading opportunities.

GAS – Bearish Breakdown Below 3.586

GAS reacted at the FVG and broke below 3.586, signaling continued downside pressure.

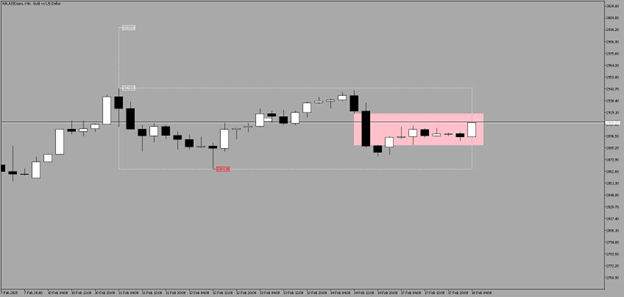

GOLD – Regaining Momentum Near Equilibrium

If Gold breaks above the 50% range, it could reach the higher end of the range, maintaining its bullish outlook.

OIL – Picking Up Steam for Upside Potential

Oil is testing the 50% equilibrium level of its range. A confirmed breakout could signal a bullish reversal.

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.

Try These Next