Why Interest Rates Move the Markets and What That Means for Traders

2025-07-25 14:50:48

What Are Interest Rates, Really?

At its core, an interest rate is just the cost of borrowing money.

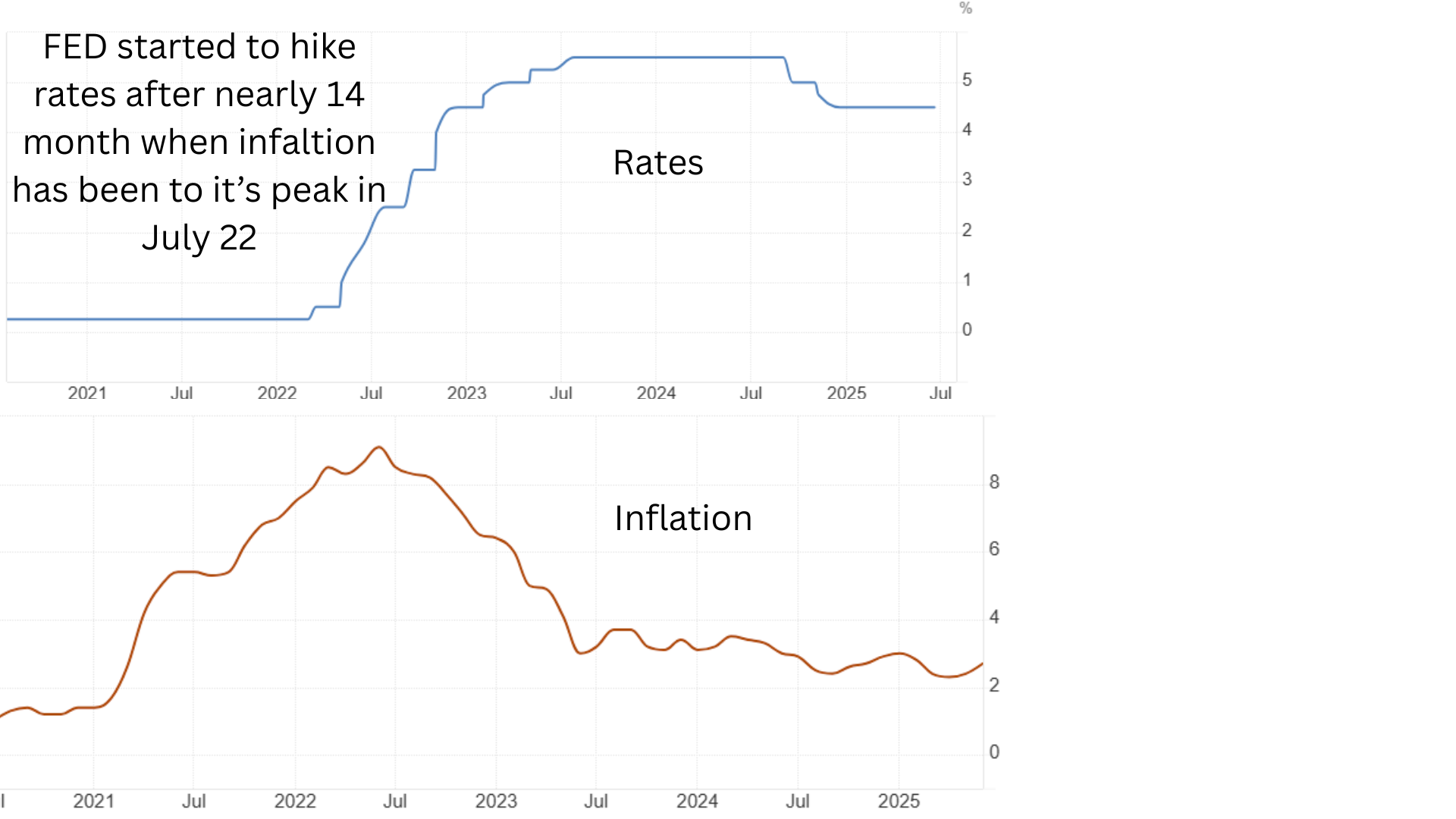

When a central bank like the U.S. Federal Reserve changes interest rates, it’s trying to guide the economy in a certain direction. If inflation is too high, they raise rates to slow things down.

If the economy is weak, they cut rates to give it a boost.

But for us as traders, interest rates are more than just a policy tool they’re a signal. They help us understand how “tight” or “loose” money is in the economy, and that’s what moves the market.

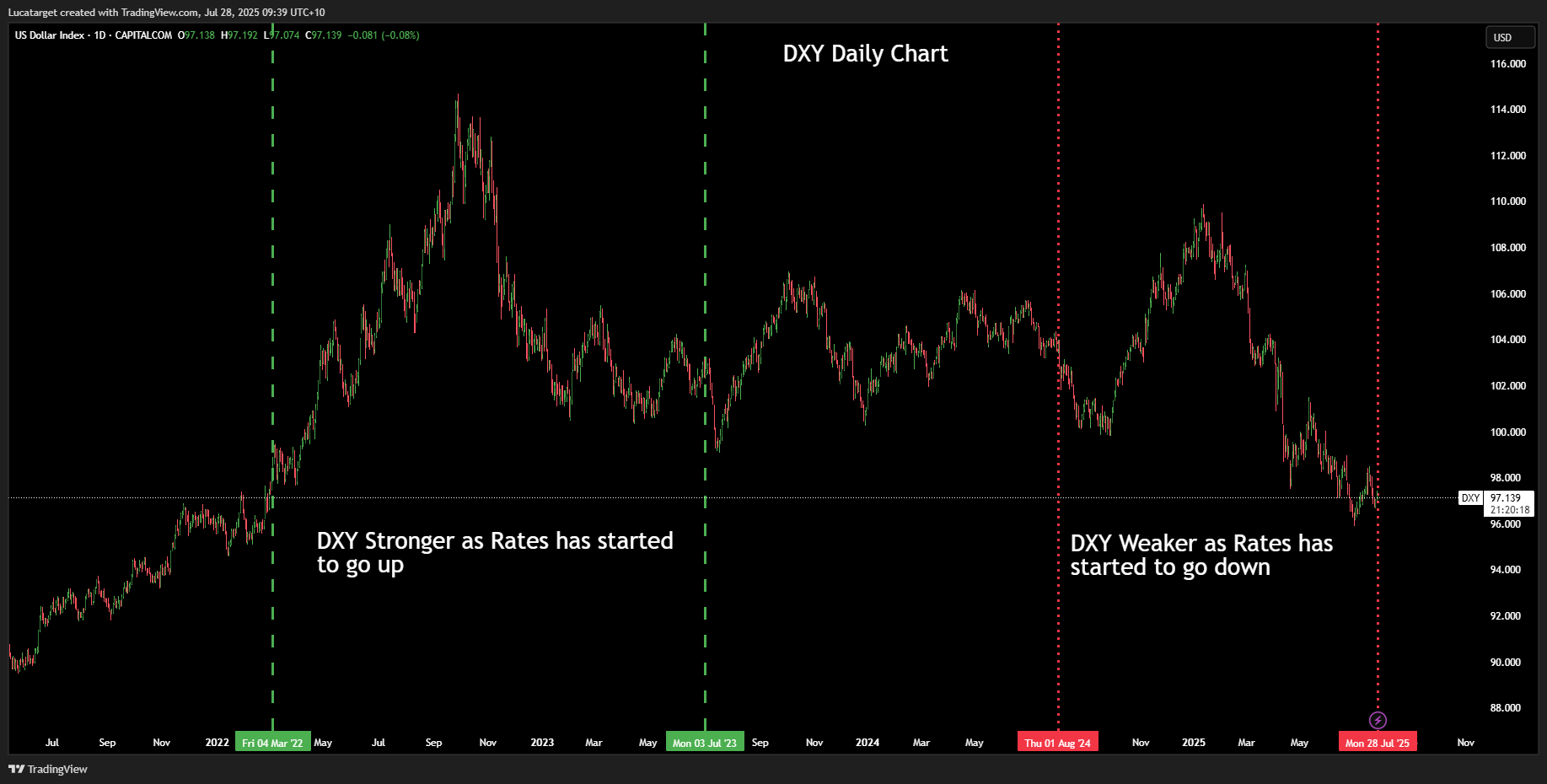

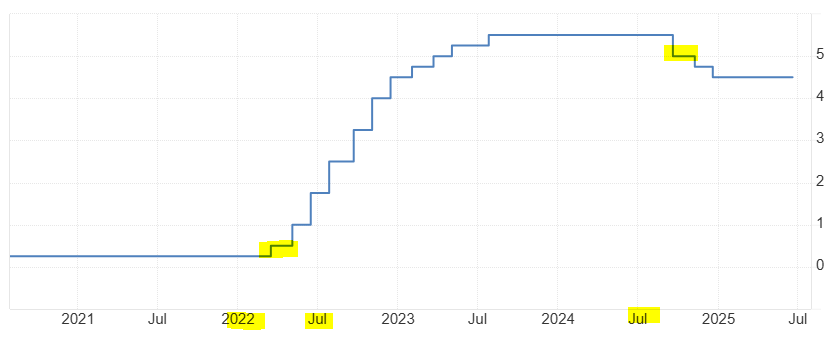

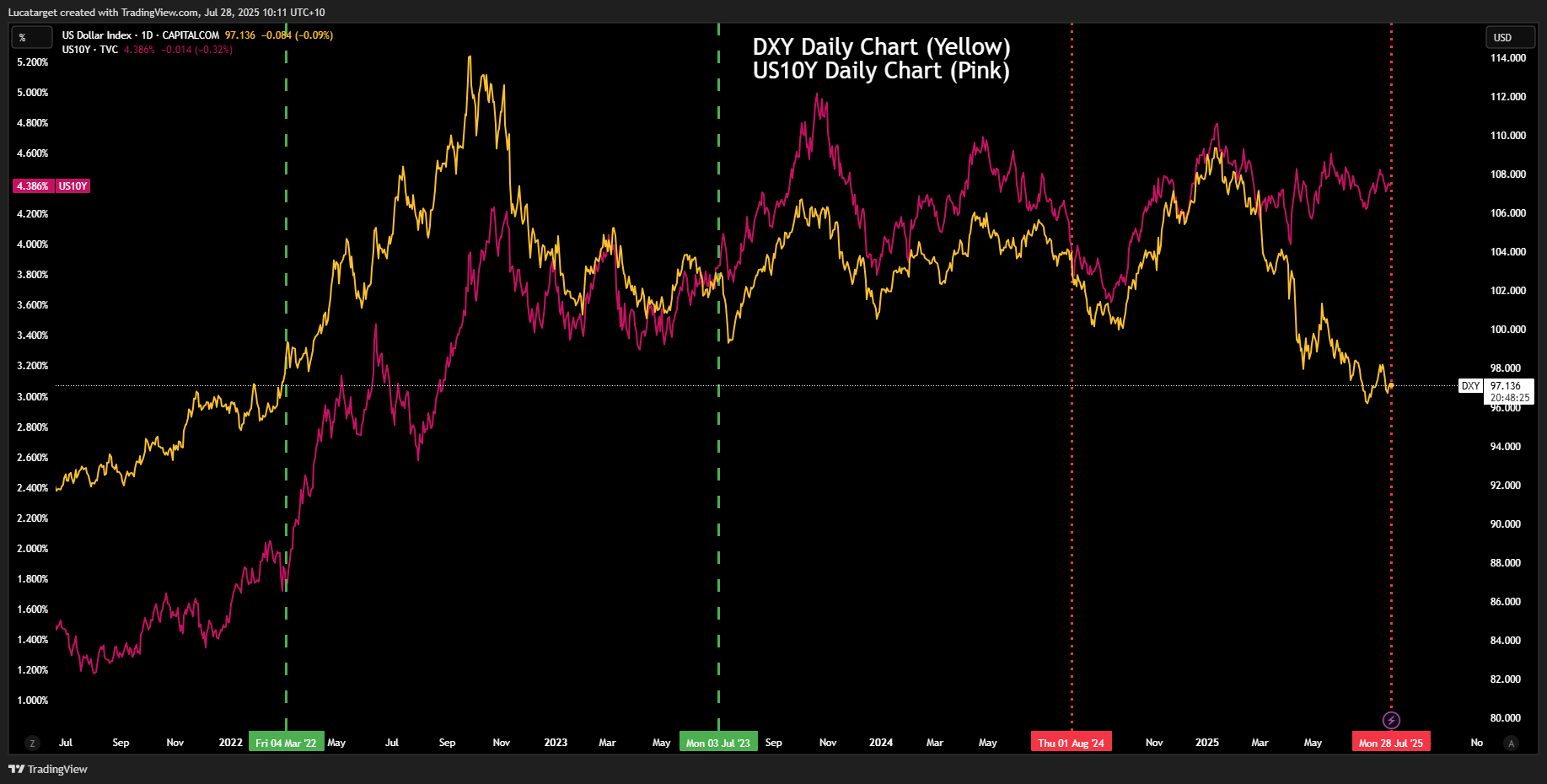

A higher rate will make a currency stronger (Bullish) a lower rate will make a currency weak (Bearish). We can clearly see that on the DXY since the FED raise rates for the first time after COVID on March 16 2022 and started to cut rates on Sep 18 2024.

Also you can check this rate chart and you will see the similiarity.

Why Central Banks Raise or Cut Rates

Central banks raise rates when they want to cool off an overheated economy or fight inflation.

This makes borrowing more expensive, slows down spending, and often leads to a stronger currency.

On the flip side, when growth is weak or there’s a risk of recession, central banks lower rates to make borrowing easier, encouraging people and businesses to spend.

Here’s how I think about it: rate hikes are like tapping the brakes, and rate cuts are like pressing the gas.

The market responds not just to what the central bank does, but to what it might do next and that’s where expectations come into play.

How Interest Rates Impact the Forex Market

Now this part is huge, especially if you trade currencies.

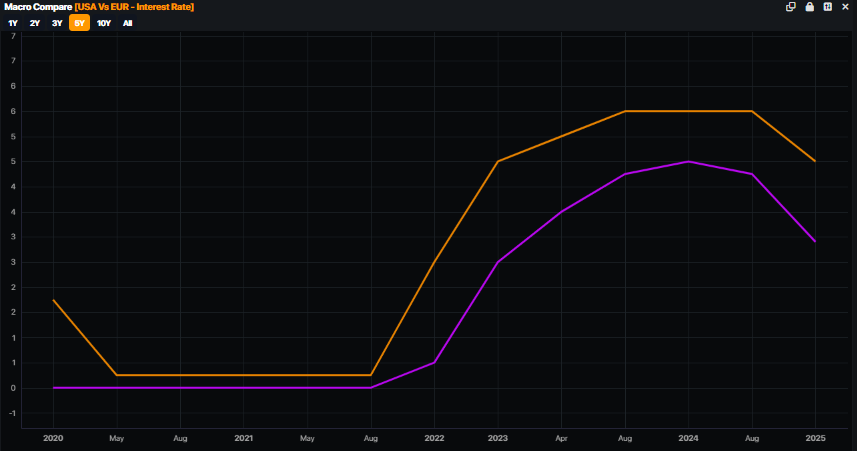

In the forex world, interest rate differentials are everything. If one country has higher interest rates than another, its currency tends to be stronger because investors want to park their money where they’ll get the best return.

So if the U.S. raises rates while Europe holds steady, the dollar usually strengthens against the euro. Have a look at thsi image USa on purple and Europe on yellow.

If you had $100 Million dollars, where would you park your money for the next 3 years? Europe having 6% or USA having 5%?

But again, it’s not just about the current rate. It’s about where the rate is headed. Traders are constantly adjusting their positions based on what they think the central bank will do next becasue context is everything on market.

So if the Fed hints at more hikes to come, the dollar may rally even if no rate change actually happens that day.

I’ve learned to always pay attention to the tone of central bank statements and speeches, not just the decision itself.

That tone tells you whether they’re leaning hawkish (focused on inflation) or dovish (focused on growth).

What About Gold?

Gold reacts a bit differently. It doesn’t pay any interest, so when rates go up especially real interest rates after inflation it becomes less attractive compared to bonds or savings accounts.

But when rates are low or inflation is high, gold tends to shine. It becomes a sort of safe haven when people worry about the value of cash being eroded. That’s why gold often does well when real interest rates are falling or even negative.

If I see inflation climbing while the Fed stays cautious or dovish, that’s typically a bullish setup for gold. On the other hand, if the Fed turns hawkish and real yields start rising, gold usually faces pressure.

The Fed: Why Everyone’s Watching

The U.S. Federal Reserve is the most influential central bank in the world.

When the Fed makes a move or even hints at a move global markets react.

Whether you’re trading forex, gold, or even tech stocks, you need to keep an eye on what the Fed is saying.

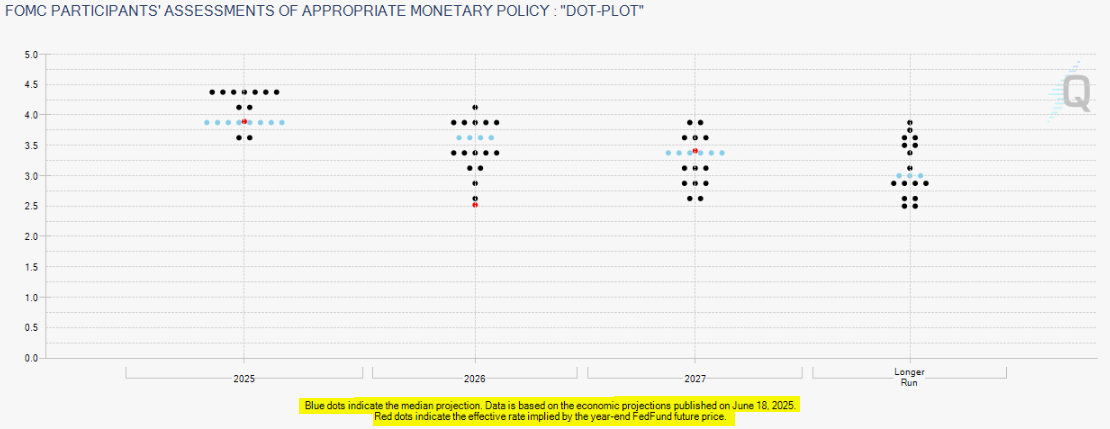

They don’t just release the rate decision. They also publish a written statement, a press conference, and sometimes a “dot plot” that shows each member’s outlook for future rates.

Markets read every line of these releases for clues.

In fact, some of the biggest market moves I’ve ever seen didn’t happen because of the rate itself but because of one comment made by Jerome Powell during a Q&A.

That’s why I always listen to the press conference, or at least read a summary.

How to Trade Interest Rate Expectations

Here’s the tricky part: markets often move before a rate decision, based on what traders expect will happen.

We call this “pricing in” a move. For example, if everyone expects the Fed to raise rates by 0.25%, and they do, the market may not move at all. But if they hike by 0.50% instead, or suggest more hikes are coming, then things can shift fast.

Some tools I use to track expectations:

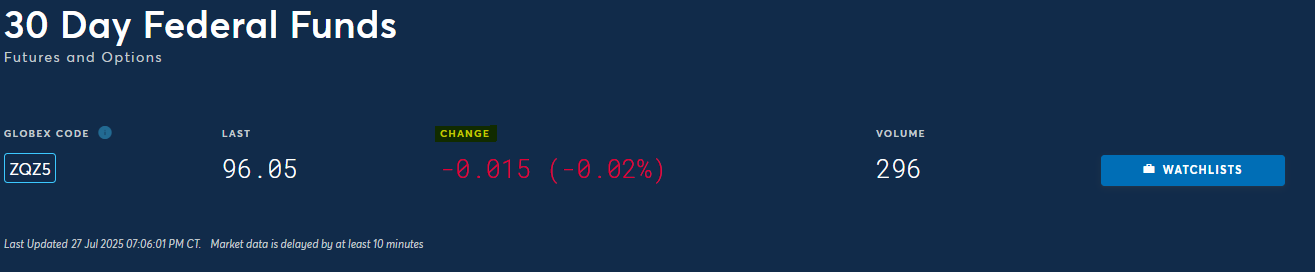

Fed Funds Futures – These show what the market expects the Fed to do.

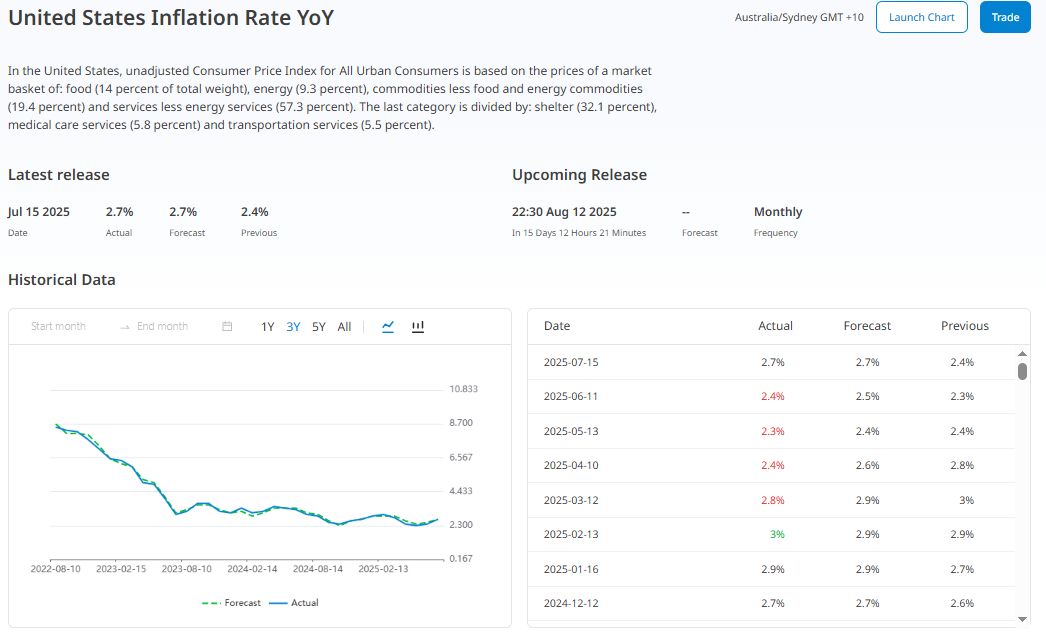

Economic data – Especially inflation (CPI), jobs (NFP), and GDP numbers, you can find all of this data into the Finlogix Economic Calander! For Free! And also look at historical data!

Click on the flag to select the desired country. From there, all available data will be displayed. Once you click on one of the data points, you'll see something like this! Easy!

Central bank speeches – Any change in language can set off market re-pricing.

Trading interest rate expectations is about staying ahead of the curve, and being ready to adapt quickly when the narrative changes.

What to Watch When Rates Are on the Move

Depending on what you trade, here’s what I suggest keeping an eye on:

Forex: Track rate differentials between countries. Higher expected rates usually support a stronger currency.

Gold: Watch real interest rates (nominal rate minus inflation). Lower real rates tend to support gold.

Equities: Rising rates can hurt high-growth stocks but help financials or value sectors.

Bonds: Rates up = prices down. Bond yields rise as prices fall.

Even if you don’t trade all these markets, they’re connected so understanding the big picture helps you stay on the right side of momentum.

Common Mistakes I’ve Made (So You Don’t Have To)

I’ll be honest, I’ve made all the classic mistakes:

Trading the headline rate without reading the statement

Ignoring the tone of the press conference

Underestimating how much is already “priced in”

Reacting too slowly when the Fed signals a shift

Eventually, I learned that markets don’t wait for clarity they move on hints. If you wait until everything is confirmed, you’re often too late.

But if you learn to read the signs early, you can start to position ahead of the crowd.

Whether you’re new to trading or just want to level up, understanding interest rates is one of the most important things you can do. Rates affect almost everything: currencies, commodities, stocks, sentiment you name it.

But you don’t need a PhD in economics. You just need to pay attention to:

What central banks are doing

What they’re saying

And how the market is reacting

It’s not about being right all the time. It’s about being aware of what drives the market’s heartbeat—and rates are a big part of that pulse.

1. Why do interest rates affect currency values?

Interest rates influence how attractive a currency is to investors. When a country raises rates, it typically attracts more foreign capital because investors want a better return on their money. This demand strengthens the currency. On the flip side, lower rates tend to weaken a currency over time.

2. How do rising interest rates affect gold prices?

Gold doesn’t pay interest, so when interest rates rise especially real interest rates (after inflation) gold becomes less attractive compared to interest-bearing assets like bonds. As a result, gold prices often fall when rates go up, and rise when rates are low or falling.

3. What’s more important for traders: the rate decision or the central bank’s comments?

Both matter, but the comments and tone often move the market more than the rate itself. That’s because markets tend to “price in” expected rate changes. It’s the unexpected language or shift in guidance that catches traders off guard and triggers reactions.

4. How can I tell if the market expected a rate hike or cut?

Watch tools like Fed Funds Futures, economic forecasts, and market sentiment leading up to the decision. If the market already expects a hike, and the central bank follows through, the reaction may be muted. But if the move is a surprise, the market will react strongly.

5. What is the best way to trade interest rate decisions as a beginner?

Start by watching the overall trend in economic data (like inflation and jobs), read central bank statements side by side from month to month, and observe how markets react. Avoid trading the actual news release until you have more experience focus instead on the narrative around the decision.

Further Reading: Deepen Your Trading Knowledge

Continue sharpening your market analysis and trading strategies with these hand-picked guides across gold, macroeconomics, risk sentiment, and trading psychology that I’ve wrote!

Gold Trading & Strategy

- Gold in War Times – XAUUSD Historical Guide

- Gold & CPI/NFP – Sentiment and Trader Insights

- XAUUSD Forecast: CPI, NFP and Outlook

- When to Trade XAU/USD – Time Zones & Sessions

- Why Fundamentals Matter in Gold Trading

- XAUUSD vs Cryptocurrency – Safe Haven Comparison

- China Reserves, Basel III and the XAUUSD Structure

- Geopolitical Conflicts and Gold in 2025

- XAUUSD in Market Crashes and Surge Conditions

Risk Sentiment & Global Events

- How to Trade Risk-On and Risk-Off Markets

- Global Events Impacting Financial Markets

- Israel-Iran Conflict and Oil Price Impact

- Understanding Market Context – Why It Matters

- Trading News Events – How the Market Reacts

- Sentiment Analysis – A Trader’s Strategy Guide

Economic Data & Macro Strategy

- Commitment of Traders (COT) Report – Full Guide

- Leading vs Lagging Economic Indicators

- Soft Data vs Hard Data – Trader’s Guide

- How Inflation Data Impacts Markets

- Mastering CPI Inflation – Key to Forex Success

- Fundamental Analysis for Forex Trading

- Understanding Inflation and Forex Impact

- GDP Reports and Their Impact on FX Markets

- PMI Data and the US Dollar Reaction

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.

Try These Next

4 Powerful Tactics to Overcome the Most Costly Forex Mistakes

How to Master MT4 & MT5 - Tips and Tricks for Traders

The Importance of Fundamental Analysis in Forex Trading

Forex Leverage Explained: Mastering Forex Leverage in Trading & Controlling Margin

The Importance of Liquidity in Forex: A Beginner's Guide

Close All Metatrader Script: Maximise Your Trading Efficiency and Reduce Stress

Best Currency Pairs To Trade in 2025

Forex Trading Hours: Finding the Best Times to Trade FX

MetaTrader Expert Advisor - The Benefits of Algorithmic Trading and Forex EAs

Top 5 Candlestick Trading Formations Every Trader Must Know