The SMC Playbook Series - Beginners Guide to Trading SMC

2025-04-03 15:49:41

The SMC Playbook Series - Beginners Guide to Trading SMC

If you've ever asked:

- “Why does price hit my stop, then go in my direction?”

- “How do institutions really move the market?”

- “How can I stop trading like retail and start thinking like smart money?”

You're in the right place.

The SMC Playbook Series is a step-by-step framework designed to help you transform from confused or inconsistent trader into a confident, structure-driven executionist — guided by Smart Money Concepts (SMC) and liquidity-based price action.

This isn’t just theory. It’s a structured training designed to teach you how the market truly works — and how institutions use liquidity, displacement, market structure, and timing to trap retail traders and control price.

The SMC Playbook Series - Beginners Guide to Trading SMC Part 1: What Moves the Markets? Key Drivers Behind Forex, Gold & Stock Indices

Goal of This Lesson:

To shift your mindset from trading what you see (like breakouts or indicators) to understanding why price moves the way it does—by following institutional liquidity flow.

By the End of This Lesson, You Should Be Able To:

- Spot common liquidity traps (like fake breakouts)

- Understand the concept of liquidity pools

- Explain why price often reverses near obvious levels

- Begin thinking in terms of trapped traders and institutional intent, not patterns

Start Here: Why Most Traders Get Stopped Out

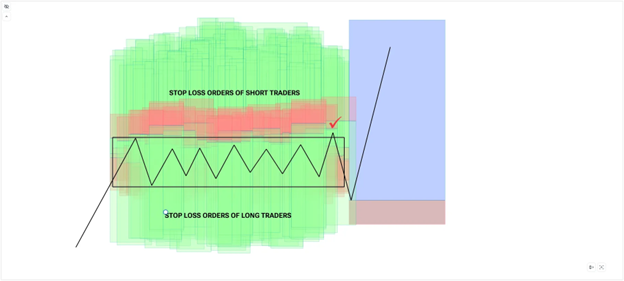

IMAGINE: You enter in a trade with a rationale that price is about to break. As a “breakout” trader, its logical to anticipate a breakout, most especially, price is now trading near the resistance level which could pave way for price to create new highs.

You set your stop-loss at a logical level, which is behind the support level, thinking that the level is a good stop loss location since its where your trade idea would obviously be invalidated.

Only to find out, you got STOPPED OUT. You were perfectly fine since you only FOLLOWED your idea but a renewed stress resurfaced after realizing, you had a SOUND TRADING IDEA but before the market went up, you were taken out of the game.

One of the struggles of a developing trader is realizing YOU “WERE” RIGHT but got taken out.

Let’s be honest. If you’ve been trading for any length of time, you’ve probably asked yourself:

“Why does price hit my stop-loss, then go in my original direction?”

That feeling of frustration isn’t just coincidence—it’s design, it’s engineered.

The market isn’t moving randomly. It’s being shaped by liquidity—and liquidity is where most traders get trapped. Other term for liquidity is Orders. The market moves primarily because of resting Orders, either Buy or Sell Orders.

Key Concept: Liquidity Is the Fuel That Moves the Market

Let’s use a simple metaphor.

Think of the market like a giant whale swimming through an ocean of tiny fish (retail traders). The whale can’t eat just one or two—it needs a school of fish in the same spot to make a move worthwhile.

In trading terms:

- The whale = institutional traders (banks, funds, smart money)

- The fish = retail traders or medium to large commercials

- The food source = clusters of stop-losses and pending orders, the school of fish

The whale won’t move unless there's a pool of liquidity. That’s why institutions target the same levels most retail traders rely on:

- Support and resistance

- Double tops and bottoms

- Breakout levels

They don’t use them to join the crowd—they use them to trap the crowd.

The market moves because of orders.

Retail vs Institutional Thinking

| Retail Mindset | Institutional Mindset |

|---|---|

| “It’s breaking out!” | “Great, now there’s more liquidity to exploit.” |

| “This support is holding.” | “Let’s run below support to fill buy orders.” |

| “I’ll buy once price moves higher.” | “Let’s sell to those breakout buyers.” |

Institutions create the illusion of opportunity (like a breakout), only to reverse once enough traders commit.

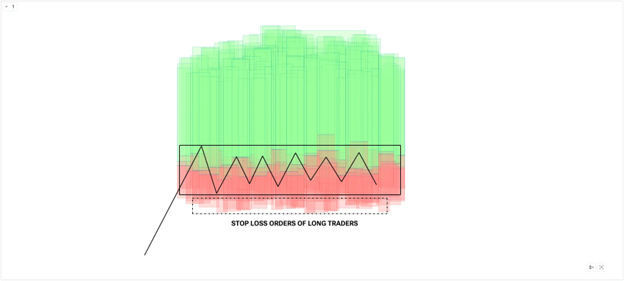

What Is a Liquidity Pool?

A liquidity pool is a zone where there’s a concentration of:

- Stop-loss orders (especially clustered below lows or above highs)

- Pending orders (like buy stops or sell stops)

These zones are like bait. Smart money knows they’re there. They drive price into these areas to trigger those orders and fill their larger positions.

They can’t enter a massive trade in thin air—they need your loss to become their entry.

So Why Does Price Reverse After You Enter?

It’s not you. It’s the structure of the market.

When you buy a breakout above a high, your stop-loss usually goes just below that level.

Now imagine thousands of traders doing the same thing.

Smart money drives price up to that high—not because they want to buy—but because they want to:

- Trigger buy orders for retail traders to large commercials to set sell orders behind structure

- Fill their sell orders by providing liquidity

- Reverse and move price the other way

That’s why most breakouts fail.

Once traders are caught up with the “wrong” direction, many reverse their biases and short orders are now set in the market. Now, stop loss orders are set at the opposite side allowing smart money to push through the “right” direction through engineered manipulation.

How This Changes Everything

Once you stop thinking about:

- “Is it going up or down?” and instead ask:

- “Who is trapped here?”

- “Where is the liquidity?”

- “Where would smart money enter?”

…you start to see the real structure behind price movement.

How Smart Money Engineers Liquidity

There’s a framework: AMD

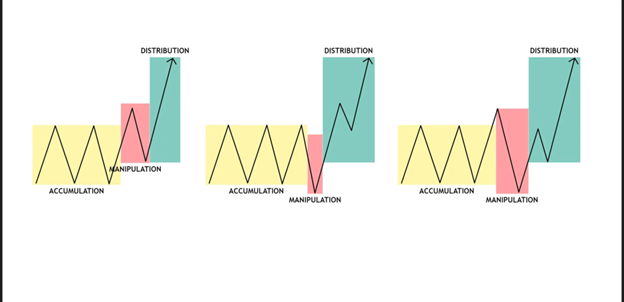

AMD Framework: Accumulation, Manipulation, Distribution

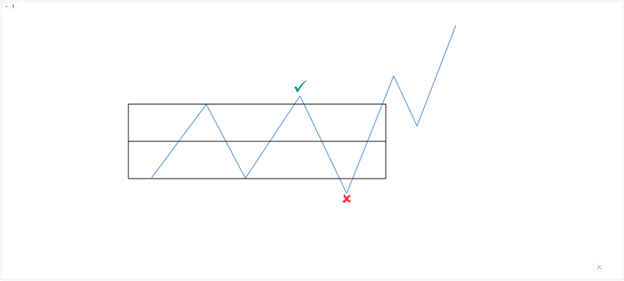

- Accumulation: Smart Money Allows Price to Range

This is the phase where liquidity is being pooled as the market is going on sideways.

During the Accumulation phase, the market trades in a narrow range as buyers quietly build positions.

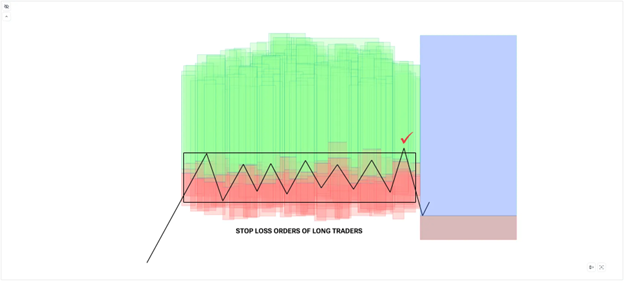

2. Manipulation: Smart Money Takes Out Orders, Stop-Losses, Buy/Sell Orders, Pending Orders

In the Manipulation phase, the market is engineered taking out either side of the market before going to the actual direction. Knowing the manipulation phase keeps you out of the market and waiting for the coast to be clear before you look for opportunities.

During the manipulation phase, price stages a breakout but pulls back inside the range, taking out the weak hands. Another scenario are price break down on the opposite side then quickly reverses to the upside, taking out stop loss orders on both sides.

3. Distribution: Smart Money Proceeds to the Right Direction

Finally, in the Distribution phase, as the manipulation is already done, and the needed liquidity has already been gathered, this is where we’d want to ride where the price is now ready to go in a certain direction.

This is the phase after the manipulation, or the liquidity has already been taken out and its ready to go to the actual direction.

The market will always move to a certain liquidity location. This is often engineered by large institutions, big banks.

For reference: https://acy.com/en/market-news/education/ultimate-guide-market-trends-price-action-j-o-03252025-141804/

Our goal is:

- Observe what price is doing.

- Allow institutions to show us signs of manipulation.

- Ride the institutions.

Step-by-Step Action Plan

1. Start Each Chart With This 3-Question Mindset

Before placing any trade, ask yourself:

- Where are traders trapped?

- Where is the liquidity?

- Where would smart money enter?

This shifts your thinking from prediction to positioning.

2. Identify Liquidity Pools on Your Chart

Mark these zones as potential traps, not trade entries:

- Above equal highs (buy-side liquidity)

- Below equal lows (sell-side liquidity)

- At obvious support and resistance levels

- Near recent breakout levels

Tip: These are not your entry points — they’re trap zones for others. Wait until liquidity is taken before you look to enter.

3. Use the AMD Framework in Real-Time

Look for these 3 phases before taking a trade:

- Accumulation – Market ranges in a tight zone. Liquidity builds.

- Manipulation – Price sweeps one side (above highs or below lows).

- Distribution – The real move begins after the trap is sprung.

Practice this by replaying past price action and labeling each phase.

4. Spot Common Fakeouts

Train your eye to catch these:

- Breakouts above resistance that fail

- Breakdowns below support that quickly reverse

- Double tops/bottoms that sweep, then reverse

Action: Mark these zones and wait for price to show displacement (strong move away) before entering in the real direction.

5. Start Mapping Liquidity Zones Every Day

On a clean chart:

- Draw horizontal lines at:

- Previous day/session highs and lows

- Major swing highs and lows

- Highlight Fair Value Gaps (FVGs) as internal liquidity zones (covered in Part 2)

6. Wait for the Trap to Be Sprung

Once price hits a liquidity pool:

- Don’t rush in

- Watch for a reaction or reversal

- Confirm with displacement and market structure shift (MSS)

This is when the real move is likely beginning.

7. Journaling Routine (Daily)

After your trading session:

- Write down:

- Where the liquidity pool was

- Whether price manipulated that area

- If you entered: Did you wait for confirmation?

- What was the outcome and lesson?

Takeaway Principle:

Price seeks liquidity before it seeks direction.

This means the market will often move into your stop-loss, grab that liquidity, and then move in the intended direction. If you understand this, you can position yourself to profit after the trap is sprung, not before.

Now that you understand why price moves — and how institutions manipulate price to trigger retail orders — it’s time to ask a more focused question:

Where exactly does that liquidity sit on your chart?

Because once you can see the zones where orders are clustered…

You can start thinking like the smart money — and stop trading where retail gets trapped.

In Part 2, we’re going to break down Internal vs External Range Liquidity (IRL vs ERL) — two simple but powerful categories that show you exactly where institutions are:

- Hunting stops, and

- Re-entering positions after they’ve sprung the trap.

You’ll learn how to mark:

- Previous highs and lows that act as external liquidity targets (ERL),

- And how Fair Value Gaps (FVGs) serve as internal liquidity zones.

This is where we shift from understanding the market’s intent

→ to tracking where price is engineered to go next.

Try These Next