Fibonacci Trading Strategy: Combining Technicals for High-Probability Setups

2025-07-10 12:03:09

Goal of This Lesson

To teach you how to stack Fibonacci retracement levels, support/resistance zones, moving average filters, and price action signals—then exit with clean precision using Fibonacci extensions.

This creates a complete, high-probability trading strategy that works in forex, indices, crypto, and commodities.

Quick Review: Fibonacci Trading Series So Far

Before we dive into today's strategy, here’s a quick recap of what you’ve learned in previous parts of this Fibonacci Trading Series:

Beginner’s Guide to Fibonacci Trading: Introduced key ratios (0.382, 0.5, 0.618, 0.786), how to plot retracements, and when to apply Fibonacci tools for pullbacks or continuations.

Fibonacci Confluence & Confirmation Strategy: Taught how to use Fibonacci levels with a stack of trade confluences across timeframes and how confirmation (e.g., structure break) builds confidence.

Multi-Timeframe Confluence Strategy: Showed how aligning Fibonacci levels across multiple timeframes boosts entry precision and trend validation.

Trading the Golden Ratios: Explained how to identify the highest probability Fibonacci levels (0.618 retracement, 1.618 extension) and use them as reaction or continuation zones. Note: They are high probable due to confluences.

How to Use Fibonacci Extensions for Targets: Covered how to plot the Fibonacci Extension tool for projecting future price targets and placing stop losses beyond logical retracement points.

Now, in this new section, we combine all of that and add a key missing piece: price action and trend filters using support and resistance levels, along with moving averages, for maximum confluence and clarity.

Why Add Price Action & Moving Averages?

Fibonacci is not magic—but it’s powerful when combined with context.

- Fibonacci provides the structure for where price may pull back or extend

- Support and resistance give you levels where institutions may be interested

- The moving average acts as your compass and another support & resistance layer

- Price action provides the real-time trigger for when to enter the trade

When all four align, your odds of success multiply.

The Full Fibonacci Trading Strategy Breakdown

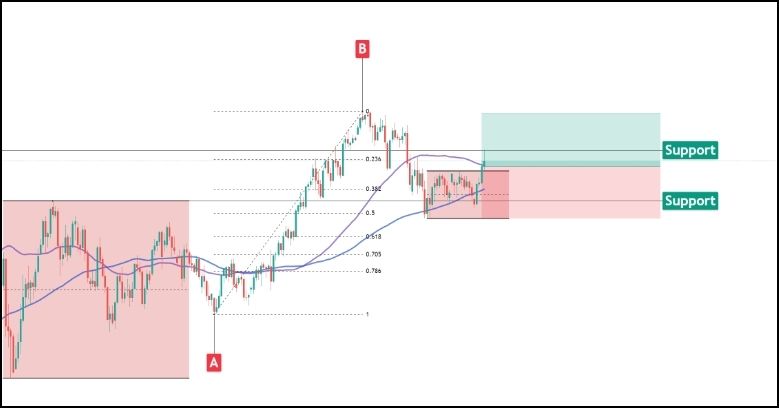

1. Trend Filter: Add a Moving Average

Use either:

- 50 EMA (faster trend)

- 100 SMA (slower trend)

Rules:

- Price above MA → look for longs

- Price below MA → look for shorts

This helps you avoid fighting momentum.

2. Plot the Fibonacci Retracement

- Identify the latest impulse leg (A to B)

- Plot the retracement from swing low to high (for longs) or high to low (for shorts)

- Key pullback zones: 0.5, 0.618, 0.786

3. Mark Support/Resistance Levels

- Check historical reaction areas on the left

- Is the Fib level overlapping a previous resistance-turned-support or liquidity sweep?

- This makes the level more meaningful

- Align the S/R levels with the Moving Average

4. Wait for Price Action Confirmation

At the confluence zone (Fib + S/R + MA):

- Look for a reversal signal on the Lower Timeframe:

- Bullish/bearish engulfing

- Pin bar

- LTF range breakout

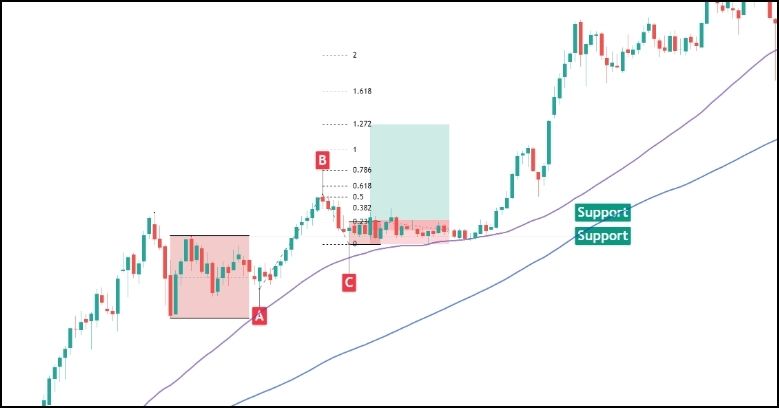

5. Use Fibonacci Extension for Take-Profit

Switch to Fibonacci Extension Tool:

- A = Start of impulse

- B = End of impulse

- C = End of retracement

Your take-profits:

- 1.272 – short-term target

- 1.618 – trend continuation target

- 2.0 – extended move or swing play

Common Mistakes to Avoid

- Blindly trading Fib levels without context

- Ignoring trend direction (never counter-trade a strong EMA trend)

- Entering too early (wait for a clean signal)

- Misplacing your Fibonacci A–B–C points

Quick Entry Checklist

- Price aligned with the MA trend?

- Fib retracement at 0.5–0.786?

- Overlap with support/resistance + moving averages?

- Clear reversal pattern or structure break on lower timeframe?

- Extension tool plotted for TP?

If all checks out → Take the trade.

Start Practicing with Confidence — Risk-Free!

Open a free demo account today and experience institutional-grade spreads, lightning-fast execution, and all the tools you need to grow as a trader.

- Trade forex, indices, gold, and more

- Access ACY, MT4, MT5, & Copy Trading Platforms

- Practice with zero risk

It’s time to go from theory to execution — risk-free.

Create an Account. Start Your Free Demo!

Check Out My Contents:

Strategies That You Can Use

How To Trade & Scalp Indices at the Open Using Smart Money Concepts (SMC)

How to Trade Breakouts Effectively in Day Trading with Smart Money Concepts

Complete Step-by-Step Guide to Day Trading Gold (XAU/USD) with Smart Money Concepts (SMC)

The Power of Multi-Timeframe Analysis in Smart Money Concepts (SMC)

Forex Trading Strategy for Beginners

Mastering Candlestick Pattern Analysis with the SMC Strategy for Day Trading

Mastering Risk Management: Stop Loss, Take Profit, and Position Sizing

RSI Divergence Trading Strategy for Gold: How to Identify and Trade Trend Reversals

Stochastics Trading Secrets: How to Time Entries in Trending Markets using Stochastics

Gold Trading Stochastics Strategy: How to Trade Gold with 2R–3R Targets

RSI Hidden Divergence Explained: How to Spot Trend Continuations Like a Pro

How To Trade News

Why Smart Money Concepts Work in News-Driven Markets - CPI, NFP, and More

How to Trade NFP Using Smart Money Concepts (SMC)-A Proven Strategy for Forex Traders

How to Trade CPI Like Smart Money - A Step-by-Step Guide Using SMC

Learn How to Trade US Indices

How to Start Trading Indices and Get into the Stock Market with Low Capital (2026 Guide)

Best Indices to Trade for Day Traders | NASDAQ, S&P 500, DAX + Best Times to Trade Them

How To Trade & Scalp Indices at the Open Using Smart Money Concepts (SMC)

NAS100 - How to Trade the Nasdaq Like a Pro (Smart Money Edition)

How to Trade CPI Like Smart Money - A Step-by-Step Guide Using SMC

Why Smart Money Concepts Work in News-Driven Markets - CPI, NFP, and More

How to Start Trading Gold

How to Swing Trade Gold (XAU/USD) Using Smart Money Concepts: A Simple Guide for Traders

Complete Step-by-Step Guide to Day Trading Gold (XAU/USD) with Smart Money Concepts (SMC)

The Ultimate Guide to Backtesting and Trading Gold (XAU/USD) Using Smart Money Concepts (SMC)

Why Gold Remains the Ultimate Security in a Shifting World

How to Trade Japanese Candlesticks

How to Trade Candlestick Patterns with High Probability: A Complete Guide for Beginners

The Top Japanese Candlestick Guide: What is an Engulfing Pattern and How to Trade It?

Piercing Pattern Candlestick Explained: How to Trade It - Step-By-Step Guide

Morning & Evening Star Candlestick Patterns – How to Trade Market Reversals with Confidence

How to Start Day Trading

5 Steps to Start Day Trading: A Strategic Guide for Beginners

8 Steps How to Start Forex Day Trading in 2026: A Beginner’s Step-by-Step Guide

3 Steps to Build a Trading Routine for Consistency and Discipline - Day Trading Edition

The Ultimate Guide to Understanding Market Trends and Price Action

Learn how to navigate yourself in times of turmoil

How to Identify Risk-On and Risk-Off Market Sentiment: A Complete Trader’s Guide

How to Trade Risk-On and Risk-Off Sentiment - With Technical Confirmation

The Ultimate Guide to Understanding Market Trends and Price Action

Want to learn how to trade like the Smart Money?

Why Smart Money Concepts Work: The Truth Behind Liquidity and Price Action

Mastering the Market with Smart Money Concepts: 5 Strategic Approaches

Mastering Candlestick Pattern Analysis with the SMC Strategy for Day Trading

Understanding Liquidity Sweep: How Smart Money Trades Liquidity Zones in Forex, Gold, US Indices

The SMC Playbook Series Part 4: How to Confirm Trend Reversal & Direction using SMC

The SMC Playbook Series Part 5: The Power of Multi-Timeframe Analysis in Smart Money Concepts (SMC)

Fair Value Gaps Explained: How Smart Money Leaves Footprints in the Market

The Best Time to Use Smart Money Concepts (SMC): Why Timing Is Everything in Trading SMC

How to Trade the London Session Using Smart Money Concepts (SMC)

Trading Psychology and Continuous Improvement Contents

The Mental Game of Execution - Debunking the Common Trading Psychology

5 Steps to Backtest a Trading Strategy with AI: A Step-by-Step Guide

Managing Trading Losses: Why You Can Be Wrong and Still Win Big in Trading

The Hidden Threat in Trading: How Performance Anxiety Sabotages Your Edge

Why You Fail in Trading: You Don’t Have Enough Capital to Survive

Why 90% of Retail Traders Fail Even with Profitable Trading Strategies

The Top 10 Best Trading Books That Changed My Mindset, Strategy & Performance

Discovering Your Trader Profile: What Kind of Trader Are You?

Follow me for more daily market insights!

Jasper Osita - LinkedIn - FXStreet - YouTube

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.

Try These Next