Gold vs Silver: Institutional Demand Breakdown Explained

2025-10-21 09:54:16

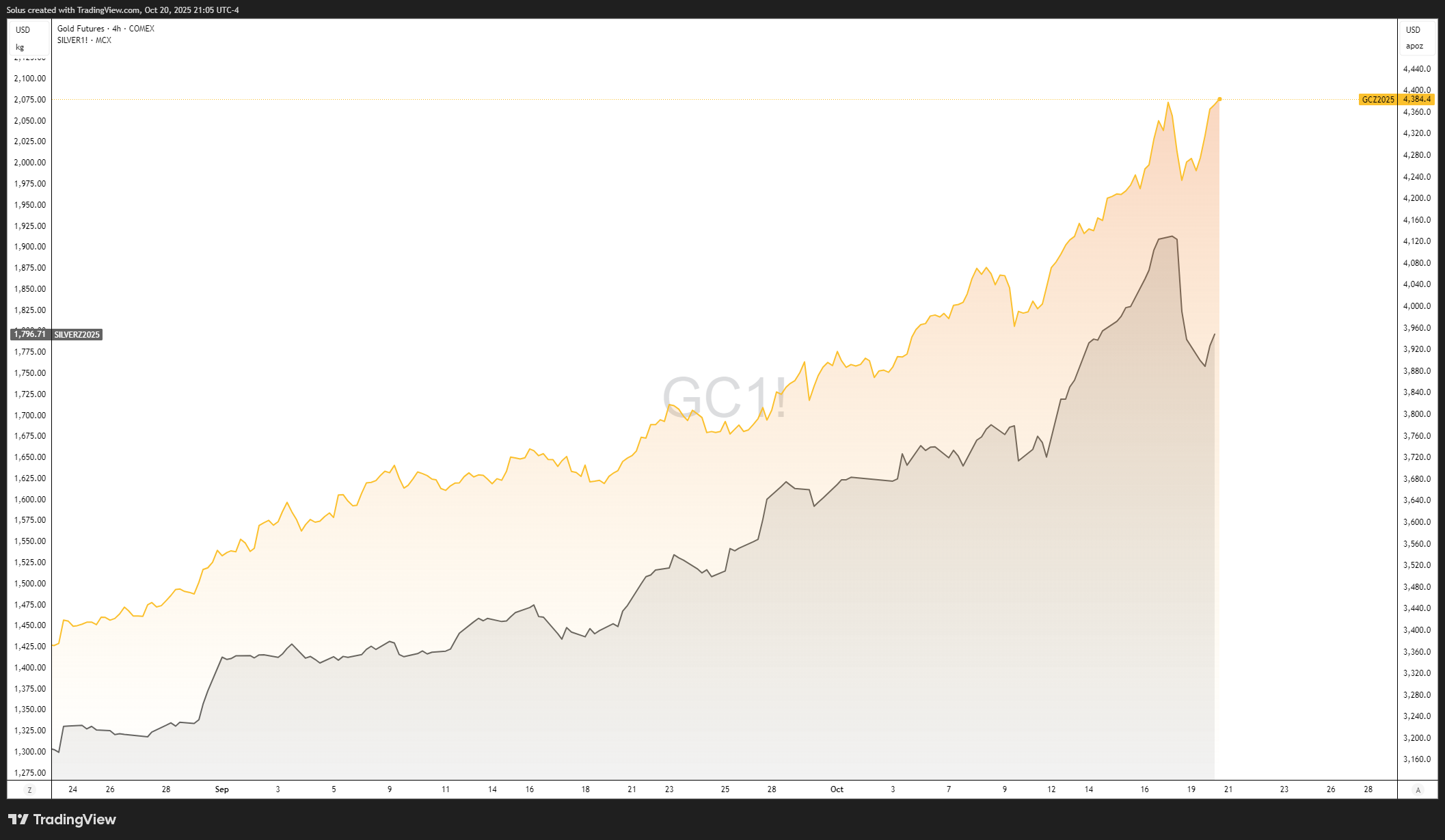

The Battle of Metals: Safe Haven vs. Industrial Momentum

Gold and silver may share the “precious metal” label, but they serve very different masters. Gold thrives in uncertainty - the classic institutional hedge when inflation bites, rate-cut odds rise, or the dollar weakens. If you’re framing those phases through market structure instead of headlines, study how Smart Money Concepts actually work in real markets to read liquidity and intent rather than chasing candles.

Silver plays a double role. It’s a safe haven and an industrial workhorse, so when manufacturing, solar build-outs, and EV demand accelerate, AI, its cyclicality kicks in and it can outrun gold. That’s why broad metals upswings often begin with a narrative turn you can recognize in context - as outlined in this perspective on why gold and the wider metals complex reignite in risk cycles.

When conditions stabilize and fiscal impulse returns, silver typically outpaces; during shock events or tightening cycles, gold reclaims leadership. The trader’s edge is spotting that regime shift early and expressing it with disciplined execution.

Institutional Positioning: Reading the Flows

Institutions treat the two metals differently:

- Gold is a monetary asset, living on central-bank balance sheets and acting as a currency hedge and store of value.

- Silver is a cyclical commodity, where funds scale exposure more speculatively during growth-sensitive phases.

CFTC positioning (COT) tends to echo this split: when large specs expand gold longs while silver stalls, the tape is leaning defensive; when silver’s net longs accelerate faster than gold’s, desks are quietly rotating toward cyclical beta. To align your analysis with that behavior, ground your chart work in Institutional Order Flow so your bias follows money, not mood.

Interpreting Divergences: The Smart Money Angle

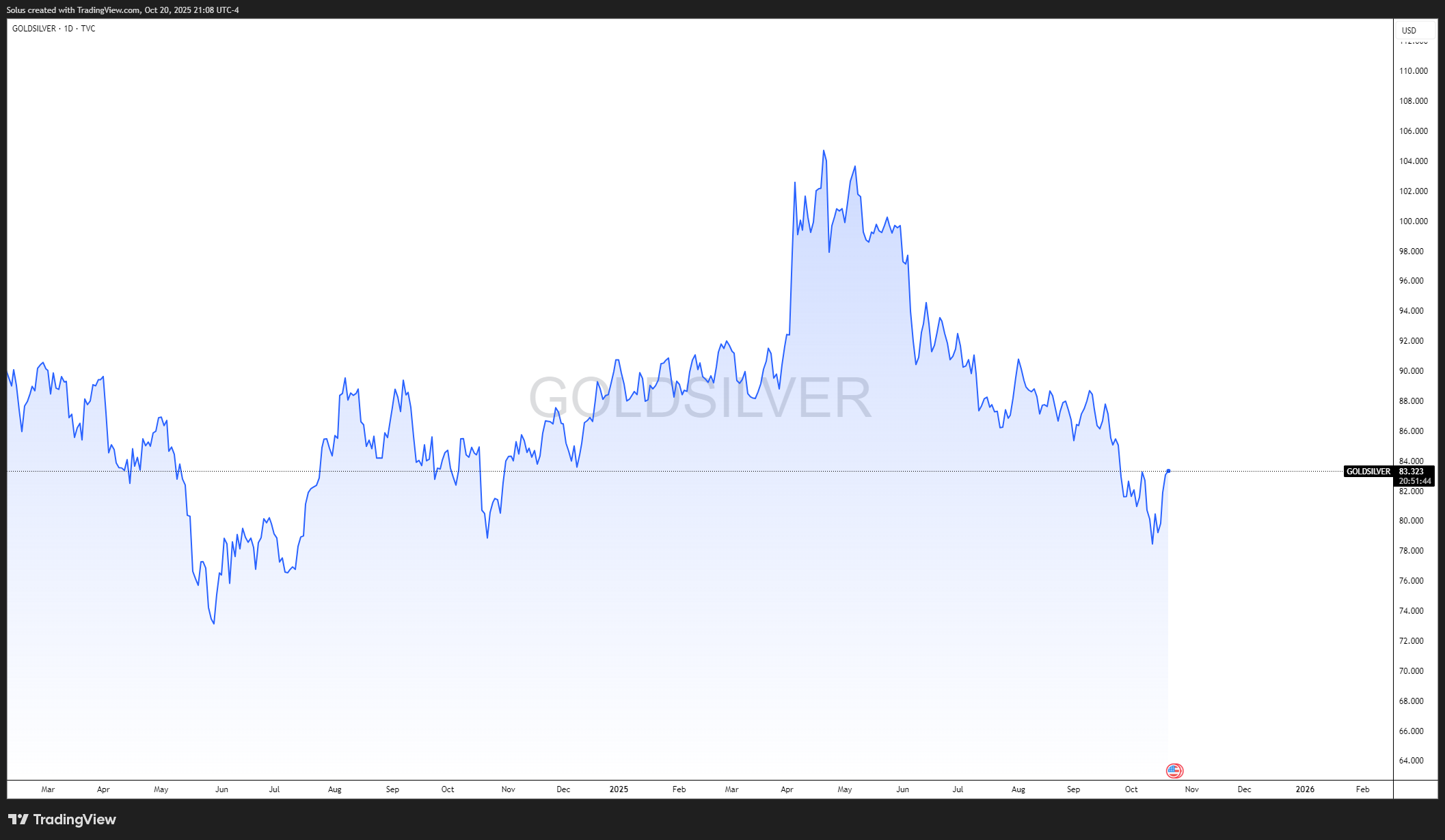

This XAU/XAG visual aligns perfectly with the “behavioral tell” concept in your narrative:

- The spike above 100 = panic phase / gold dominance / defensive hedging.

- The collapse toward 80 and below = silver leadership / cyclical recovery.

- The current rebound to 83 = potential liquidity adjustment or short-term hedging.

In Smart Money terms, this is where professional traders look for liquidity sweeps in both metals — watching if gold’s short-term strength is merely reactive before silver resumes its broader uptrend.

Peak and Decline:

You can see the GSR peaked above 105 around April–May 2025 — a period when gold clearly outperformed silver. This aligns with a “risk-off” market tone, where investors favored gold’s safety over silver’s industrial exposure.

Downtrend in GSR (May–Oct 2025):

The steady decline from ~105 to below 80 shows silver gaining relative strength. This represents a rotation from defensive hedging to reflation optimism — institutions moving from gold’s protection trade into silver’s growth-linked momentum.

Recent Bounce (October 2025):

The small uptick to ~83 signals a short-term risk-off reaction, possibly a pause or pullback after silver’s strong outperformance. Traders would interpret this as a temporary rotation back to gold, not yet a full reversal unless GSR continues to rise toward the 90+ range.

The Gold/Silver Ratio (GSR) - ounces of silver per ounce of gold - is your simplest leadership gauge:

- Rising GSR (~85 and above): gold leadership, risk aversion, defensive hedging.

- Falling GSR (~70 and below): silver leadership, reflation momentum, cyclical optimism.

The ratio isn’t trivia; it’s a behavioral tell. In panic spikes (GSR rising fast), stalk exhaustion in gold’s fear bid with liquidity sweeps and confirmation - exactly the sort of footprint discussed in how smart money trades liquidity zones. When the ratio collapses, it’s often early evidence of silver-led momentum that you can validate with structure rather than opinion.

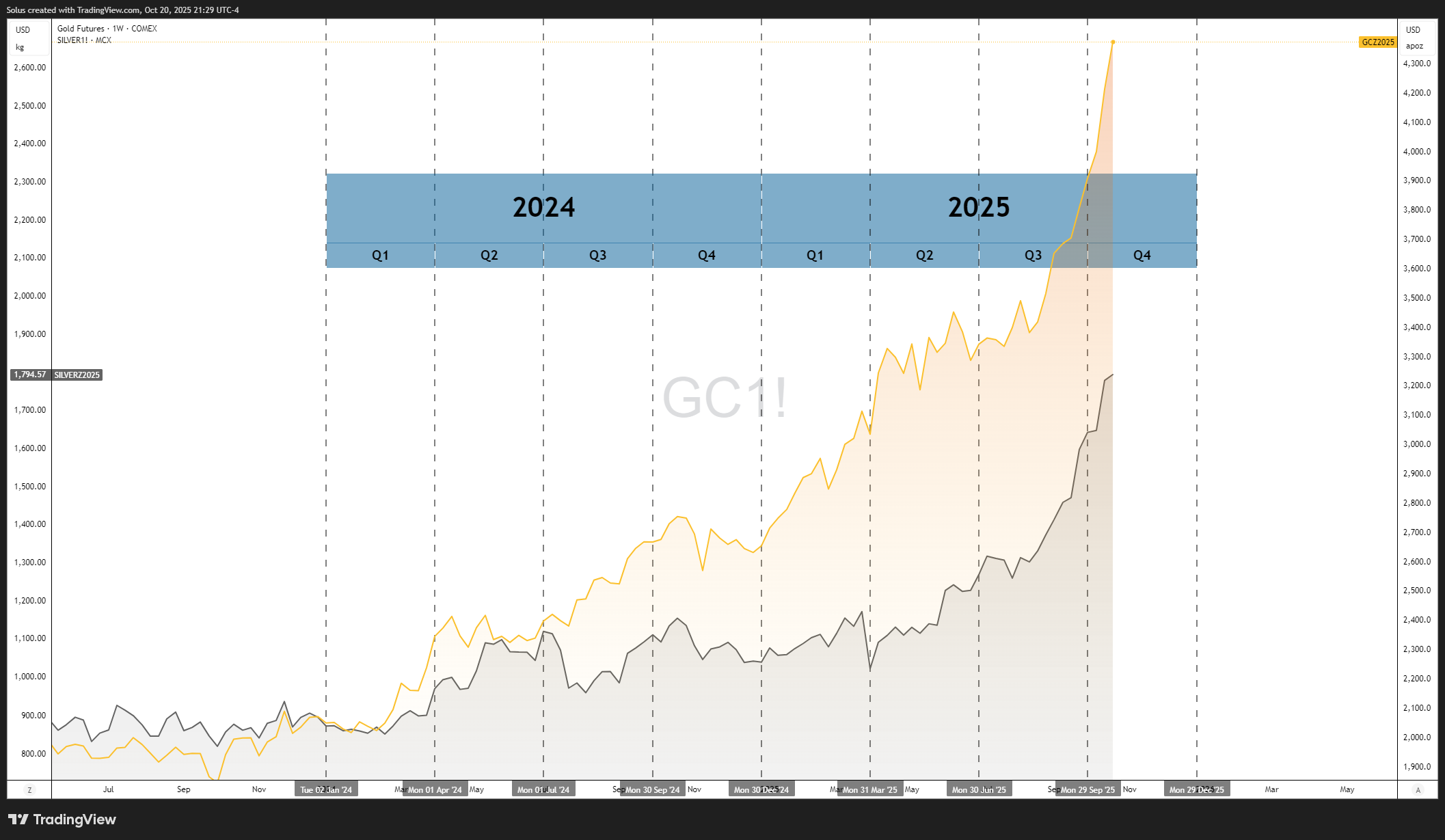

Seasonality and Volatility Cycles

Seasonality adds nuance: gold often catches tailwinds in Q1–Q2 (geopolitics, reserve accumulation, real-yield shifts), while silver tends to shine in Q3–early Q4 when industrial orders and energy demand pick up. But opportunity shows up most clearly in volatility: silver routinely moves about twice gold’s percentage swings. That’s a gift only if your process is multi-framed and rules-based; the workflow in powerful multi-timeframe analysis for SMC helps you avoid forcing trades from a single chart.

When Silver Outperforms Gold

Silver’s advantage emerges in expansionary phases - manufacturing upswings, energy transitions, fiscal stimulus. In those windows the market reprices both precious-metal safety and future use. Execution then becomes a matter of letting gold’s steadier tone confirm while harnessing silver’s higher beta. If you want a model for turning that narrative into trades, mirror the step-by-step approach from the complete XAU/USD day-trading guide with SMC and adapt it to silver’s speed.

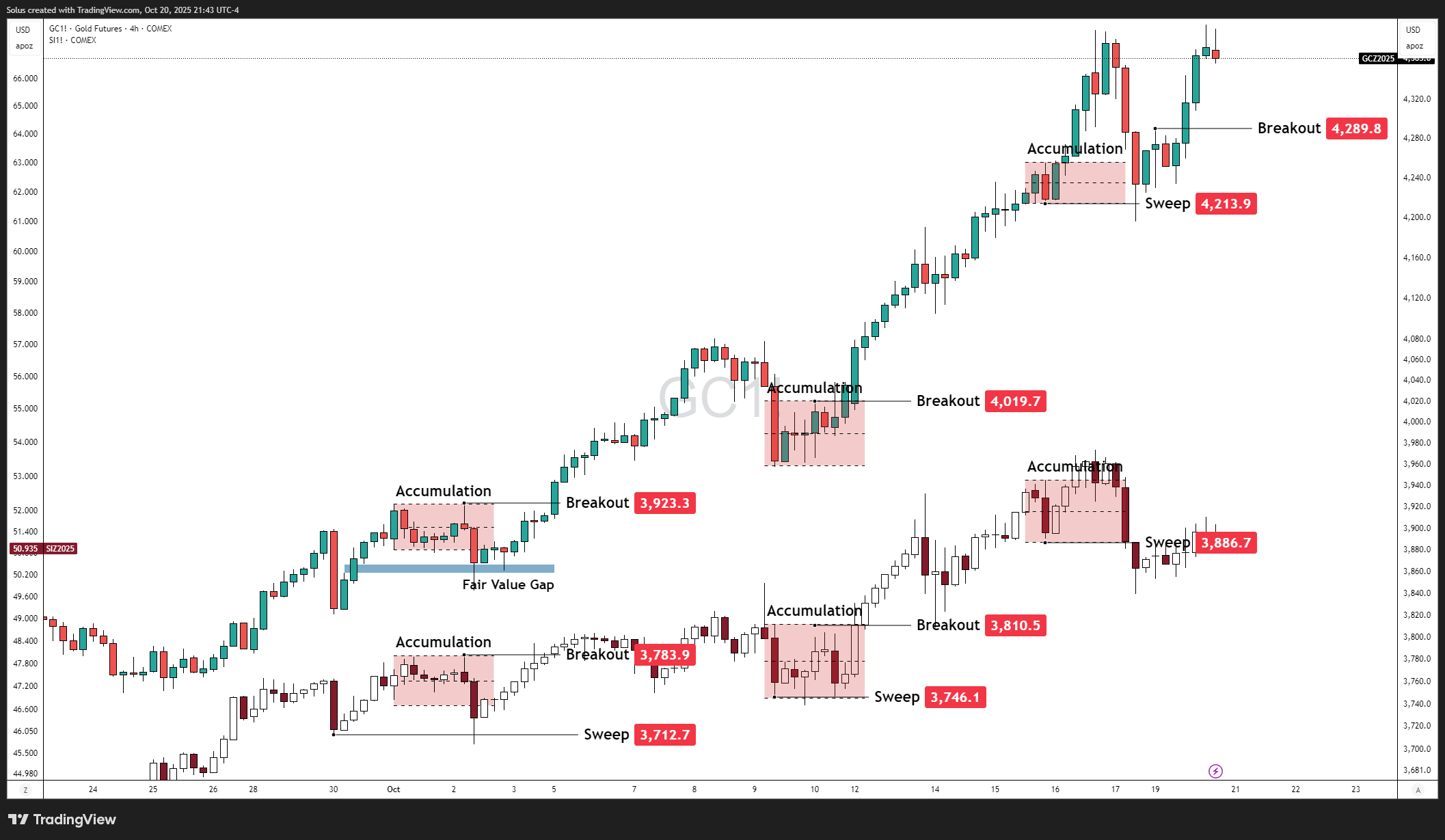

Case Study: Trading Gold vs. Silver Divergence

Scenario: Gold consolidates near highs after an inflation-driven push; silver breaks structure with a strong displacement. COT shows speculative longs building in silver while gold’s positioning stalls.

Plan (top-down):

- Bias: On D1/H4, confirm gold’s range and silver’s impulsive break, then cascade to H1/M15 for execution windows.

- Flow Check: Validate with positioning shifts (silver > gold).

- Trigger: Wait for a liquidity sweep into an iFVG/FVG within the bullish leg; the entry logic from Fair Value Gaps explained as institutional footprints keeps confirmation > prediction.

- Execution: Take the silver continuation; watch gold for lagging alignment and potential catch-up.

- Management: Targets set at prior swing highs/session ranges; risk sized from the start. Your durability comes from the playbook in stop loss, take profit, and position sizing mastery - not from hope.

Most traders call the divergence right and the timing wrong; structure, liquidity, and risk convert “right idea” into “right trade.”

For smart money traders:

- Prioritize the metal that has tapped a previous swing for a sweep. This confirms that smart money is now in play after taking out a previous swing high or low, lessening risk of getting stopped out.

The Bigger Picture: Institutional Psychology

Treat gold and silver as opposite ends of the institutional mood spectrum:

- Gold = Fear hedge, the quiet absorber of flight-to-quality flows.

- Silver = Growth proxy, the loud beneficiary when production ramps.

When both rise, liquidity is abundant across regimes. When they diverge, the ratio shows where capital hides and where it ventures. Trade with that rotation and you’ll feel less like you’re guessing and more like you’re following footprints.

Real-Life Analogy: The Marathon vs. the Sprint

Gold is the marathoner - steady cadence, built for distance, relentlessly consistent when resilience is demanded.

Silver is the sprinter - explosive, emotional, breathtaking when it hits stride. You don’t train or time them the same; you shouldn’t trade them the same either. The job is to know which race the market is running today.

Final Thoughts

Gold and silver aren’t tickers; they’re macro storyboards. Gold narrates currency hedging and caution; silver narrates industrial optimism and cyclicality. The market flips between chapters faster than headlines admit. Your edge is not predicting the next page - it’s reading the current chapter cleanly and expressing it with a repeatable, risk-first process. Use the ratio to detect tone shifts, positioning to confirm rotation, and SMC footprints to time participation. Keep sizing honest and confirmation tight; the divergence turns from noise into roadmap. When momentum really turns, the sprinter tells you - loudly - and the marathoner keeps the direction credible.

FAQs: Gold vs. Silver Institutional Dynamics

1. Why do institutions favor gold over silver in volatile markets?

Institutions lean toward gold because it acts as a monetary hedge-a store of value during inflation, geopolitical tension, or rate uncertainty. Silver, while also a precious metal, has a heavy industrial demand component that ties it to global manufacturing and growth. When fear dominates, funds seek stability in gold; when optimism returns, silver tends to catch up. You can see this shift reflected in the Institutional Order Flow between safe-haven and cyclical assets.

2. What does the Gold/Silver Ratio (GSR) tell traders?

The GSR measures how many ounces of silver equal one ounce of gold, acting as a sentiment barometer for the metals market. A rising ratio signals risk aversion and institutional preference for gold, while a falling ratio indicates reflation and silver-led optimism. Combining GSR insights with multi-timeframe confluence helps traders align with the right market environment before entering any trade.

3. Why is silver more volatile than gold?

Silver moves faster because it’s thinner in liquidity and carries both investment and industrial exposure. This dual demand amplifies swings-especially during macro shifts or policy changes. While gold might grind slowly, silver often surges or collapses in larger percentages. This volatility makes timing crucial, which is why traders often use Fair Value Gaps and Liquidity Sweeps to confirm entries rather than guess direction.

4. How can traders use gold-silver divergence for swing setups?

When gold consolidates but silver breaks structure-or vice versa-it signals institutional rotation. Traders can track this through COT positioning, GSR changes, and displacement candles. The key is to wait for confirmation: a liquidity sweep followed by a clear iFVG/FVG entry in the leading metal’s direction. Understanding this alignment, as detailed in Liquidity Sweep: How Smart Money Trades Liquidity Zones, allows swing traders to follow institutional footprints instead of chasing volatility.

Start Practicing with Confidence - Risk-Free!

- Trade forex, indices, gold, and more

- Access ACY, MT4, MT5, & Copy Trading Platforms

- Practice with zero risk

It’s time to go from theory to execution - risk-free.

Create an Account. Start Your Free Demo!

Check Out My Contents:

Strategies That You Can Use

Looking for step-by-step approaches you can plug straight into the charts? Start here:

- How To Trade & Scalp Indices at the Open Using Smart Money Concepts (SMC)

- How to Trade Breakouts Effectively in Day Trading with Smart Money Concepts

- Complete Step-by-Step Guide to Day Trading Gold (XAU/USD) with Smart Money Concepts (SMC)

- The Power of Multi-Timeframe Analysis in Smart Money Concepts (SMC)

- Forex Trading Strategy for Beginners

- Mastering Candlestick Pattern Analysis with the SMC Strategy for Day Trading

- How to Use Fibonacci to Set Targets & Stops (Complete Guide)

- RSI Divergence Trading Strategy for Gold: How to Identify and Trade Trend Reversals

- Stochastics Trading Secrets: How to Time Entries in Trending Markets using Stochastics

- Gold Trading Stochastics Strategy: How to Trade Gold with 2R - 3R Targets

- RSI Hidden Divergence Explained: How to Spot Trend Continuations Like a Pro

- Moving Averages Trading Strategy Playbook

- Mastering Fibonacci Trading Psychology - Trusting the Levels, Managing the Mind

- Mastering Price Action at Key Levels - How to Spot, Trade, and Win at the Most Crucial Zones

- Mastering Retests: How to Enter with Confirmation After a Breakout

Indicators / Tools for Trading

Sharpen your edge with proven tools and frameworks:

- The Ultimate Guide to Risk Management in Trading - A Complete Compilation for 2026

- Moving Averages Trading Strategy Playbook

- How to Think Like a Price Action Trader

- Mastering Fibonacci Trading Psychology - Trusting the Levels, Managing the Mind

How To Trade News

News moves markets fast. Learn how to keep pace with SMC-based playbooks:

- Why Smart Money Concepts Work in News-Driven Markets - CPI, NFP, and More

- How to Trade NFP Using Smart Money Concepts (SMC) - A Proven Strategy for Forex Traders

- How to Trade CPI Like Smart Money - A Step-by-Step Guide Using SMC

Learn How to Trade US Indices

From NASDAQ opens to DAX trends, here’s how to approach indices like a pro:

- How to Start Trading Indices and Get into the Stock Market with Low Capital (2026 Guide)

- Best Indices to Trade for Day Traders | NASDAQ, S&P 500, DAX + Best Times to Trade Them

- How To Trade & Scalp Indices at the Open Using Smart Money Concepts (SMC)

- NAS100 - How to Trade the Nasdaq Like a Pro (Smart Money Edition)

How to Start Trading Gold

Gold remains one of the most traded assets - here’s how to approach it with confidence:

- How to Swing Trade Gold (XAU/USD) Using Smart Money Concepts: A Simple Guide for Traders

- Complete Step-by-Step Guide to Day Trading Gold (XAU/USD) with Smart Money Concepts (SMC)

- The Ultimate Guide to Backtesting and Trading Gold (XAU/USD) Using Smart Money Concepts (SMC)

- Why Gold Remains the Ultimate Security in a Shifting World

- How to Exit & Take Profits in Trading Gold Like a Pro: Using RSI, Range Breakdowns, and MAs as Your Confluence

How to Trade Japanese Candlesticks

Candlesticks are the building blocks of price action. Master the most powerful ones:

- Mastering the Top Japanese Candlesticks: The Top 5 Candlesticks To Trade + Top SMC Candlestick Pattern

- How to Trade Candlestick Patterns with High Probability: A Complete Guide for Beginners

- The Top Japanese Candlestick Guide: What is an Engulfing Pattern and How to Trade It?

- Piercing Pattern Candlestick Explained: How to Trade It - Step-By-Step Guide

- Morning & Evening Star Candlestick Patterns - How to Trade Market Reversals with Confidence

How to Start Day Trading

Ready to go intraday? Here’s how to build consistency step by step:

- 5 Steps to Start Day Trading: A Strategic Guide for Beginners

- 8 Steps How to Start Forex Day Trading in 2026: A Beginner’s Step-by-Step Guide

- 3 Steps to Build a Trading Routine for Consistency and Discipline - Day Trading Edition

- The Ultimate Guide to Understanding Market Trends and Price Action

- Trading with Momentum: The Best Trading Session to Trade Forex, Gold and Indices

Swing Trading 101

- Introduction to Swing Trading

- The Market Basics for Swing Trading

- Core Principles of Swing Trading

- The Technical Foundations Every Swing Trader Must Master

- Swing Trader’s Toolkit: Multi-Timeframe & Institutional Confluence

- The Psychology of Risk Management in Swing Trading

- Swing Trading Concepts To Know In Trading with Smart Money Concepts

- Becoming a Consistent Swing Trader: Trading Structure & Scaling Strategy

Learn how to navigate yourself in times of turmoil

Markets swing between calm and chaos. Learn to read risk-on vs risk-off like a pro:

- How to Identify Risk-On and Risk-Off Market Sentiment: A Complete Trader’s Guide

- How to Trade Risk-On and Risk-Off Sentiment - With Technical Confirmation

- The Ultimate Guide to Understanding Market Trends and Price Action

Want to learn how to trade like the Smart Money?

Step inside the playbook of institutional traders with SMC concepts explained:

- Why Smart Money Concepts Work: The Truth Behind Liquidity and Price Action

- Mastering the Market with Smart Money Concepts: 5 Strategic Approaches

- Understanding Liquidity Sweep: How Smart Money Trades Liquidity Zones in Forex, Gold, US Indices

- The SMC Playbook Series Part 1: What Moves the Markets? Key Drivers Behind Forex, Gold & Stock Indices

- The SMC Playbook Series Part 2: How to Spot Liquidity Pools in Trading - Internal vs External Liquidity Explained

- Fair Value Gaps Explained: How Smart Money Leaves Footprints in the Market

- Accumulation, Manipulation, Distribution: The Hidden Cycle That Runs Every Market

- Institutional Order Flow - Reading the Market Through the Eyes of the Big Players

- London Session Trading Secrets: How Smart Money Sets the High & Low of the Day

- Mastering the New York Session - Smart Money Concepts Guide

Master the World’s Most Popular Forex Pairs

Forex pairs aren’t created equal - some are stable, some are volatile, others tied to commodities or sessions.

- The Top 5 All-Time Best Forex Pairs to Trade

- Top Forex Pairs Beyond the Big Five

- EUR/USD: The King of Forex

- USD/JPY: The Fast Mover

- GBP/USD: The Volatile Cable

- AUD/USD: The Commodity Currency

- USD/CAD: The Oil-Backed Pair

- GBP/JPY: How to Trade The Beast

- Asian & London Session Secrets

- Mastering the New York Session

Metals Trading

Stop Hunting 101

If you’ve ever been stopped out right before the market reverses - this is why:

- Stop Hunting 101: How Swing Highs and Lows Become Liquidity Traps

- Outsmarting Stop Hunts: The Psychology Behind the Trap

- How to Lessen Risk From Stop Hunts in Trading

- How Stop Hunts Trigger Revenge Trading - Breaking the Pain Cycle

- How to Accept Stop Hunts Without Losing Discipline - Shifting From Frustration to Focus

Trading Psychology

Mindset is the deciding factor between growth and blowups. Explore these essentials:

- The Mental Game of Execution - Debunking the Common Trading Psychology

- Managing Trading Losses: Why You Can Be Wrong and Still Win Big in Trading

- The Hidden Threat in Trading: How Performance Anxiety Sabotages Your Edge

- Why 90% of Retail Traders Fail Even with Profitable Trading Strategies

- Top 10 Habits Profitable Traders Follow Daily to Stay Consistent

- Top 10 Trading Rules of the Most Successful Traders

- Top 10 Ways to Prevent Emotional Trading and Stay Disciplined in the Markets

- Why Most Traders Fail - Trading Psychology & The Hidden Mental Game

- Emotional Awareness in Trading - Naming Your Triggers

- Discipline vs. Impulse in Trading - Step-by Step Guide How to Build Control

- Trading Journal & Reflection - The Trader’s Mirror

- Overcoming FOMO & Revenge Trading in Forex - Why Patience Pays

- Risk of Ruin in Trading - Respect the Math of Survival

- Identity-Based Trading: Become Your Trading System for Consistency

- Trading Psychology: Aligning Emotions with Your System

- Mastering Fear in Trading: Turn Doubt into a Protective Signal

- Mastering Greed in Trading: Turn Ambition into Controlled Growth

- Mastering Boredom in Trading: From Restless Clicking to Patient Precision

- Mastering Doubt in Trading: Building Confidence Through Backtesting and Pattern Recognition

- Mastering Impatience in Trading: Turn Patience Into Profit

- Mastering Frustration in Trading: Turning Losses Into Lessons

- Mastering Hope in Trading: Replacing Denial With Discipline

- When to Quit on Trading - Read This!

- The Math of Compounding in Trading

- Why Daily Wins Matter More Than Big Wins

- Scaling in Trading: When & How to Increase Lot Sizes

- Why Patience in Trading Fuels the Compounding Growth

- Step-by-Step Guide on How to Manage Losses for Compounding Growth

- The Daily Habits of Profitable Traders: Building Your Compounding Routine

- Trading Edge: Definition, Misconceptions & Casino Analogy

- Finding Your Edge: From Chaos to Clarity

- Proving Your Edge: Backtesting Without Bias

- Forward Testing in Trading: How to Prove Your Edge Live

- Measuring Your Edge: Metrics That Matter

- Refining Your Edge: Iteration Without Overfitting

- The EDGE Framework: Knowing When and How to Evolve as a Trader

- Scaling Your Edge: From Small Account to Consistency

Market Drivers

- Central Banks and Interest Rates: How They Move Your Trades

- Inflation & Economic Data: CPI Trading Strategy and PPI Indicator Guide

- Geopolitical Risks & Safe Havens in Trading (Gold, USD, JPY, CHF)

- Jobs, Growth & Recession Fears: NFP, GDP & Unemployment in Trading

- Commodities & Global Trade: Oil, Gold, and Forex Explained

- Market Correlations & Intermarket Analysis for Traders

Risk Management

The real edge in trading isn’t strategy - it’s how you protect your capital:

- Mastering Risk Management: Stop Loss, Take Profit, and Position Sizing

- Why Risk Management Is the Only Edge That Lasts

- How Much Should You Risk per Trade? (1%, 2%, or Less?)

- The Ultimate Risk Management Plan for Prop Firm Traders - Updated 2026

- Mastering Position Sizing: Automate or Calculate Your Risk Like a Pro

- Martingale Strategy in Trading: Compounding Power or Double-Edged Sword?

- How to Add to Winners Using Cost Averaging and Martingale Principle with Price Confirmation

Suggested Learning Path

If you’re not sure where to start, follow this roadmap:

- Start with Trading Psychology → Build the mindset first.

- Move into Risk Management → Learn how to protect capital.

- Explore Strategies & Tools → Candlesticks, Fibonacci, MAs, Indicators.

- Apply to Assets → Gold, Indices, Forex sessions.

- Advance to Smart Money Concepts (SMC) → Learn how institutions trade.

- Specialize → Stop Hunts, News Trading, Turmoil Navigation.

This way, you’ll grow from foundation → application → mastery, instead of jumping around randomly.

Follow me for more daily market insights!

Jasper Osita - LinkedIn - FXStreet - YouTube

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.

Try These Next