ACY Securities Forex Spreads for EURUSD, GBPUSD and AUDUSD – 5th May to 9th May 2025

2025-05-15 14:37:22

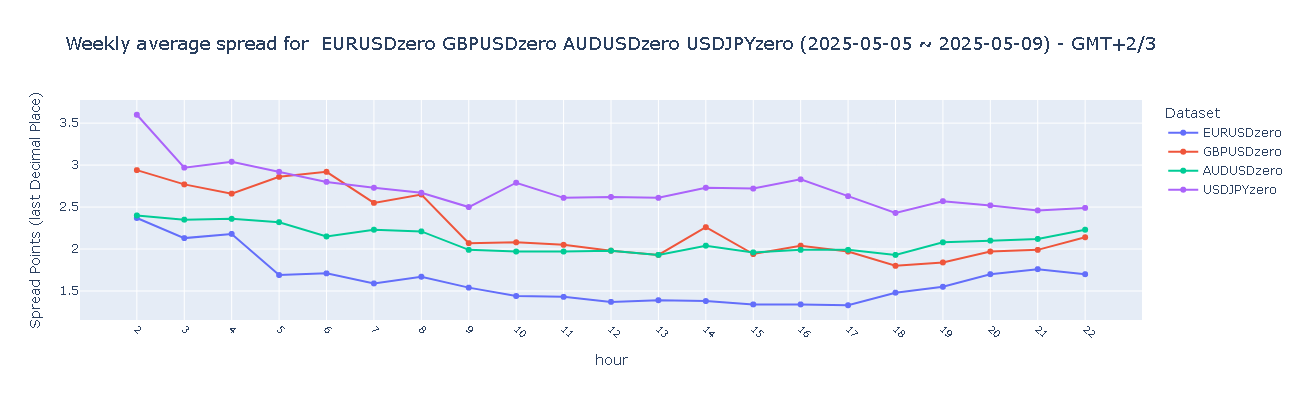

Chart I. Weekly Average Spread for Major Currency Pairs (EURUSDzero, GBPUSDzero, AUDUSDzero, USDJPYzero)

(Note: The below chart excludes the spread data of the first two hour after market open and the last one hour before market close to minimise the impact of outliers during illiquid market sessions)

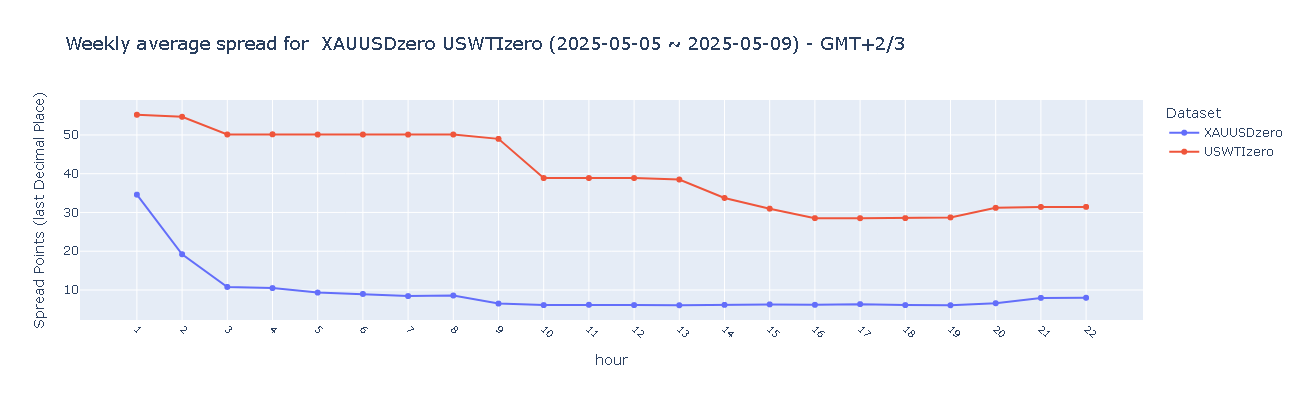

Chart II. Weekly Average Spread for Gold and US Crude Oil (XAUUSDzero, USWTIzero)

(Note: The below chart excludes the spread data of the first one hour after market open and the last one hour before market close to minimise the impact of outliers during illiquid market sessions)

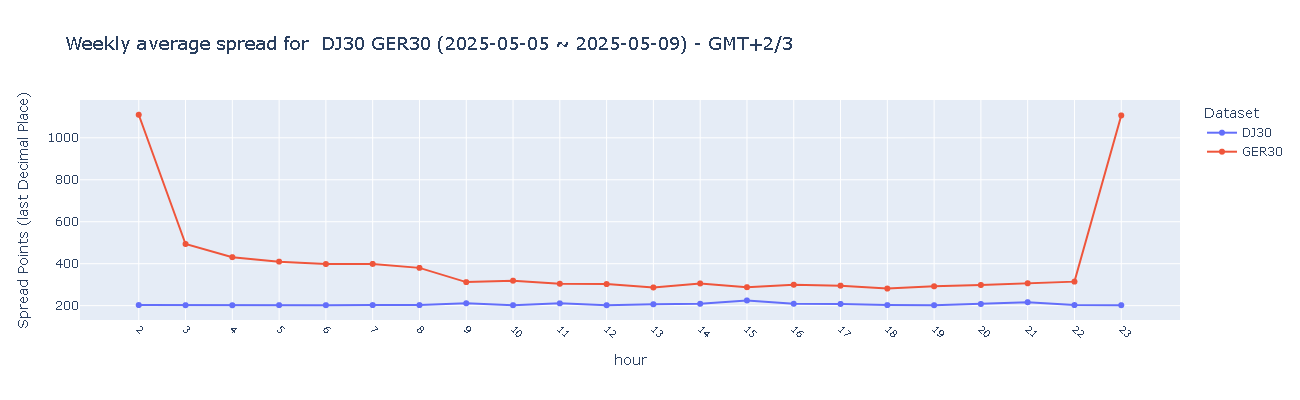

Chart III. Weekly Average Spread for German 30 Index and Dow Jones 30 Index (GER30, DJ30)

(Note: The below chart excludes the spread data of the first one hour after market open and the last one hour before market close to minimise the impact of outliers during illiquid market sessions)

Weekly Average Spread Review Results:

Majors Currency Pairs:

Among major FX pairs, EURUSD demonstrated consistent performance with Good spreads (1–2 points) across all major trading sessions — Asian, European, and US. While it did not reach “Excellent” levels during any specific session, its reliability and low spreads suggest stable liquidity throughout.

GBPUSD achieved Excellent spreads (0–2 points) only during the US session, while maintaining Good spreads (2–3 points) during Asian and European sessions. This suggests optimal trading conditions primarily in the US market, with moderately higher costs outside of it.

AUDUSD showed its best performance in the European session with Excellent spreads (0–2 points), while sustaining Good spreads (2–3 points) during both the Asian and US sessions, reflecting solid and relatively stable liquidity across time zones.

USDJPY stood out as the most consistent performer, maintaining Excellent spreads (0–3 points) across all three sessions — Asian, European, and US. This consistency points to deep liquidity and minimal cost volatility across global trading hours.

Gold and US WTI Oil:

Gold (XAUUSD) exhibited Excellent spreads (0–10 points) during European and US sessions, while spreads increased to Good levels (10–15 points) during the Asian session. This shows that gold remains highly tradable throughout the day, although trading costs are slightly higher during off-peak hours.

USWTI Oil reached Excellent spreads (20–30 points) during the US session and Good spreads (30–40 points) in the European session. However, in the Asian session, it deteriorated to Improvement Required (>45 points), reflecting significantly higher trading costs during periods of lower market activity.

Dow Jones 30 and German 30 Indices:

DJ30 (Dow Jones 30) maintained Good spread levels (200–250 points) consistently across Asian, European, and US sessions, with no indication of reaching “Excellent” levels. This suggests steady and accessible trading conditions across all markets, though not at optimal cost efficiency.

GER30 (German 30 Index) performed less favorably. All trading activity remained in the Average (300–500) range across all sessions. This indicates higher trading costs and more volatile liquidity compared to DJ30, especially during non-European hours.

Try These Next

4 Powerful Tactics to Overcome the Most Costly Forex Mistakes

How to Master MT4 & MT5 - Tips and Tricks for Traders

The Importance of Fundamental Analysis in Forex Trading

Forex Leverage Explained: Mastering Forex Leverage in Trading & Controlling Margin

The Importance of Liquidity in Forex: A Beginner's Guide

Close All Metatrader Script: Maximise Your Trading Efficiency and Reduce Stress

Best Currency Pairs To Trade in 2025

Forex Trading Hours: Finding the Best Times to Trade FX

MetaTrader Expert Advisor - The Benefits of Algorithmic Trading and Forex EAs

Top 5 Candlestick Trading Formations Every Trader Must Know