USD/JPY Forecast: ISM Beats Previous, Can NFP Drive Break Above 150?

2025-09-03 11:20:11

USD/JPY holds near 149 after ISM PMI improved from 48.0 to 48.7. Can NFP push the pair through 150 or trigger a pullback?

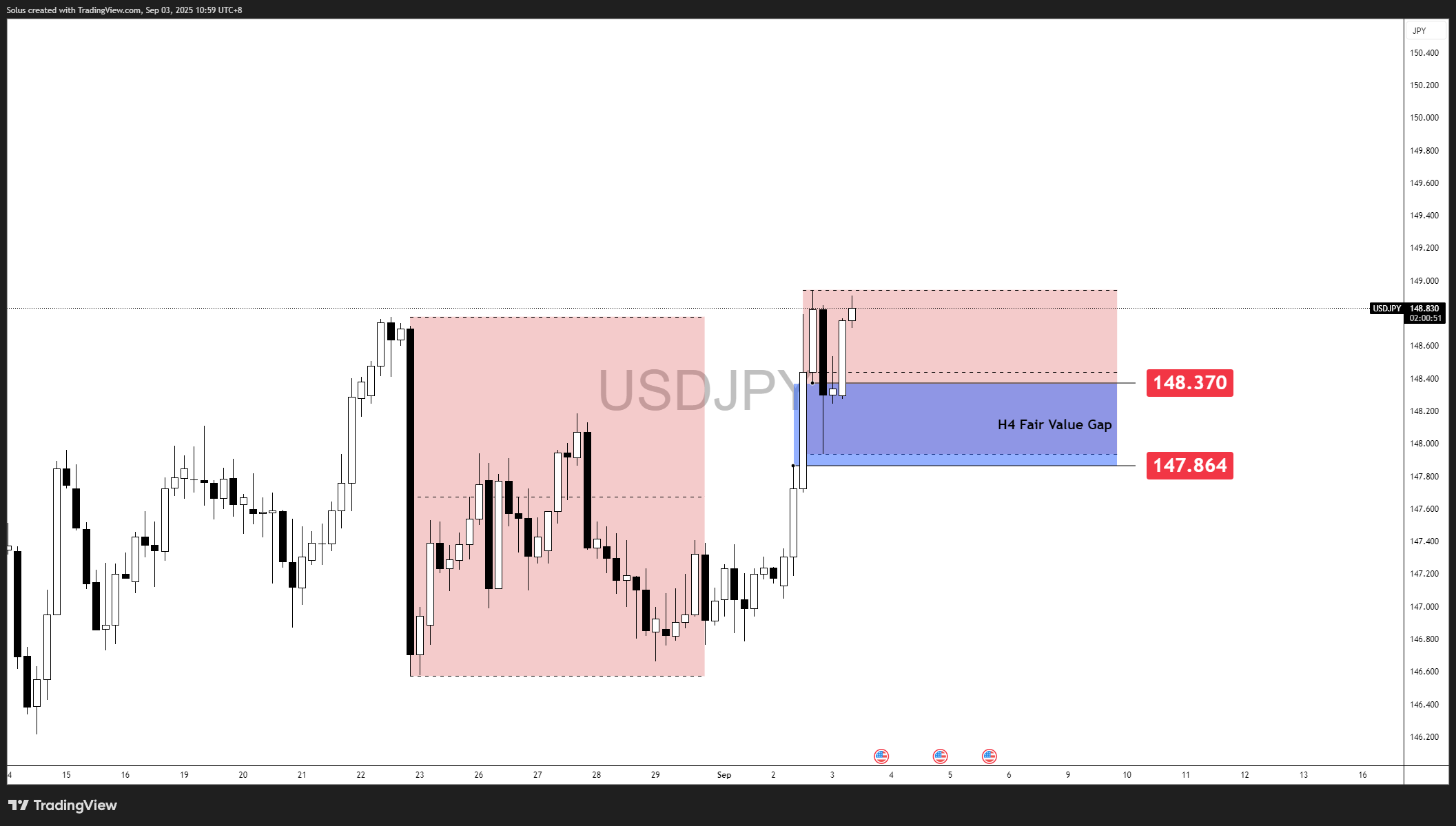

- USD/JPY extends higher after bouncing off the H4 Fair Value Gap (147.864–148.370) and is retesting the 149.00 resistance with 150.00 back in sight.

- BoJ’s cautious stance keeps the yield gap wide while U.S. data shows incremental improvement, sustaining dollar demand.

- A clean break above 149.00 unlocks a run toward 150.00–151.20; a firm rejection at 149.00 risks a dip back into 148.37–147.86 before NFP.

Why USD/JPY Stays Bid

Dollar-yen is trading heavy-on-the-upside: U.S. yields remain comparatively firm and the BoJ continues to signal patience on policy normalization, reinforcing the positive carry in favor of USD. If you’re building your plan around structure and sessions, these playbooks help: How To Trade & Scalp Indices at the Open Using SMC and The Power of Multi-Timeframe Analysis in SMC - the same multi-TF logic applies neatly to USD/JPY trend continuation and pullback entries. For a pair-specific refresher, see USD/JPY: The Fast Mover

BoJ’s Cautious Stance: Policy Divergence Widens (Concise)

The BoJ remains deliberately cautious, emphasizing the need for sustained wage-led inflation before meaningful tightening. With JGB 10-year yields near ~1% versus much higher U.S. Treasury yields, the carry incentive favors holding dollars over yen. That yield differential is a persistent structural tailwind for USD/JPY, keeping dips shallow and making pullbacks into demand zones (like your H4 FVG) buyable until the BoJ signals a firmer path to normalization. For context on how institutions exploit such edges, see Institutional Order Flow and Fair Value Gaps Explained.

ISM PMI: Missed Forecast, But Trend Improved (Why USD Popped)

ISM Manufacturing PMI (Aug) printed 48.7, a touch below 49.0 forecast - but above the previous 48.0. Markets read that as stabilization rather than deterioration, and the USD caught a bid despite the “contractionary” label. This is a good reminder that direction of change often beats the absolute level. If you trade data-driven moves, these guides are useful:

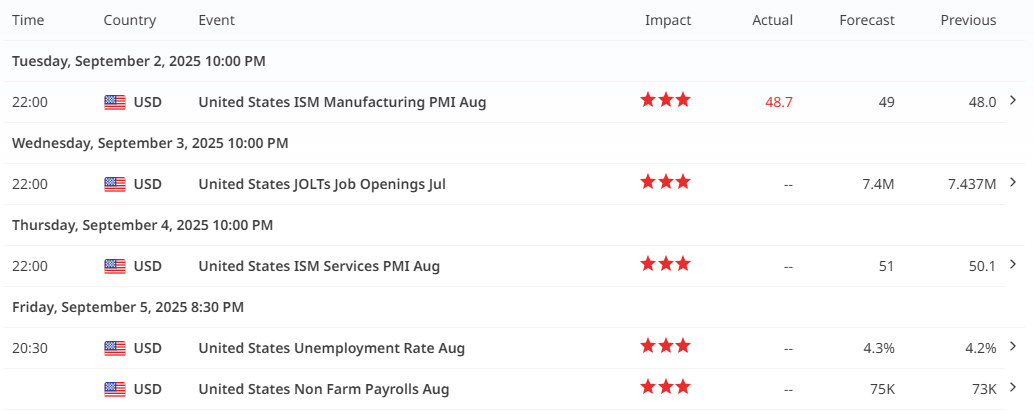

Red-Folder Watch (This Week)

- JOLTs Job Openings (Wed)

- ISM Services PMI (Thu)

- Nonfarm Payrolls + Unemployment Rate (Fri)

Prep your playbook: How to Trade CPI/NFP with SMC and Risk-On vs Risk-Off Guide.

Technical Outlook: H4 FVG Bounce → 149 Retest

USD/JPY has bounced off the H4 FVG (147.864–148.370) decisively and pressing back into 148.80–149.00, where supply capped prior attempts. That reaction confirms active demand inside the gap and keeps the bullish structure intact into Friday’s data.

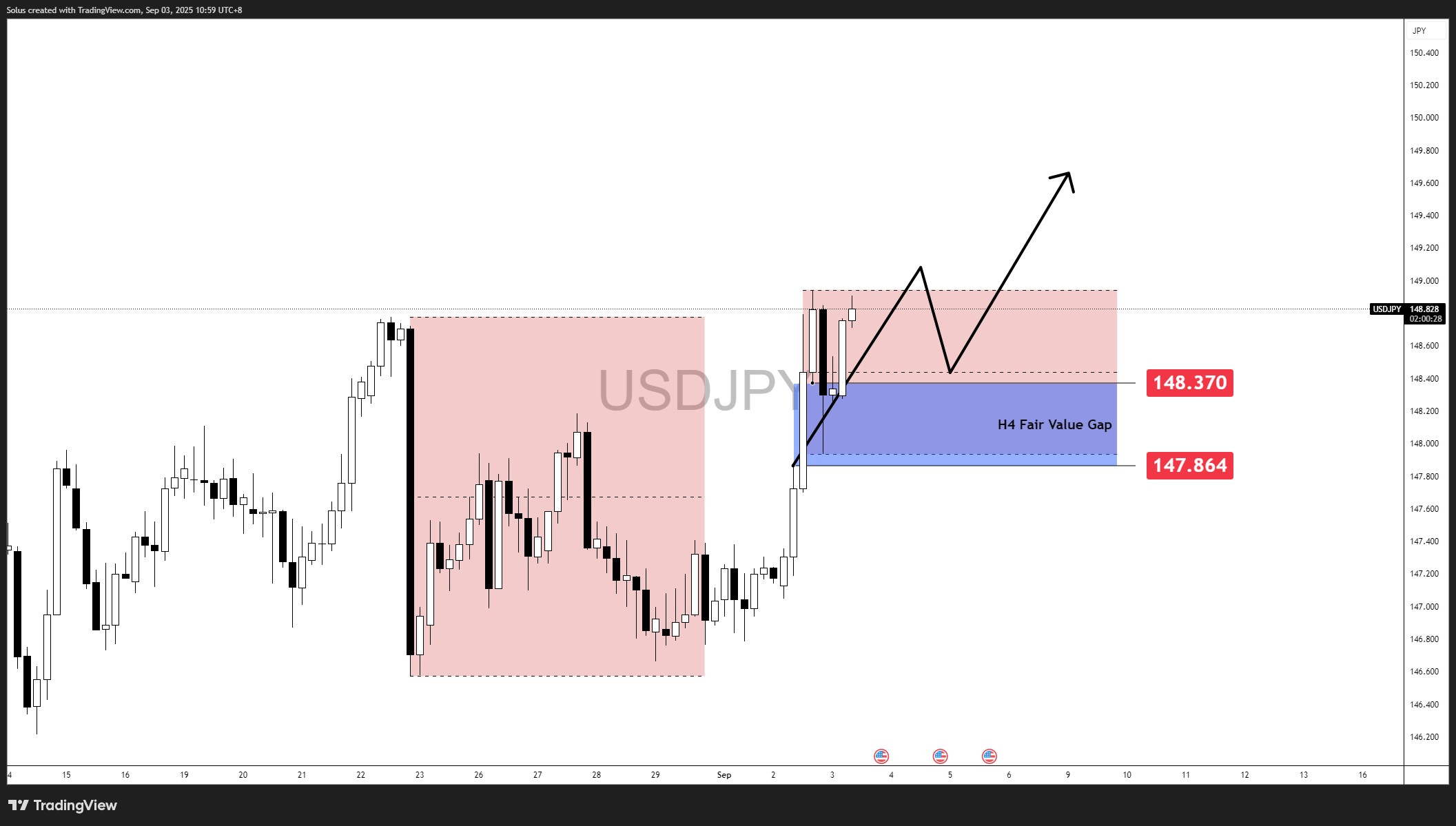

Bullish Scenario: FVG Demand Holds, Breakout Above 149 in Play

On the chart, price reacted cleanly from the H4 Fair Value Gap (147.864–148.370), confirming it as a demand zone. That bounce carried USD/JPY back into the 148.80–149.00 resistance band, where sellers capped momentum previously. If bulls can force a breakout above this zone, the path toward the psychological 150.00 handle opens up.

- A sustained close above 149.00 signals continuation.

- Next liquidity rests at 149.50 before the round 150.00.

- Break of 150 unlocks extension targets at 150.70–151.20.

- FVG remains the defense line; pullbacks into 148.37–148.20 can act as continuation setups.

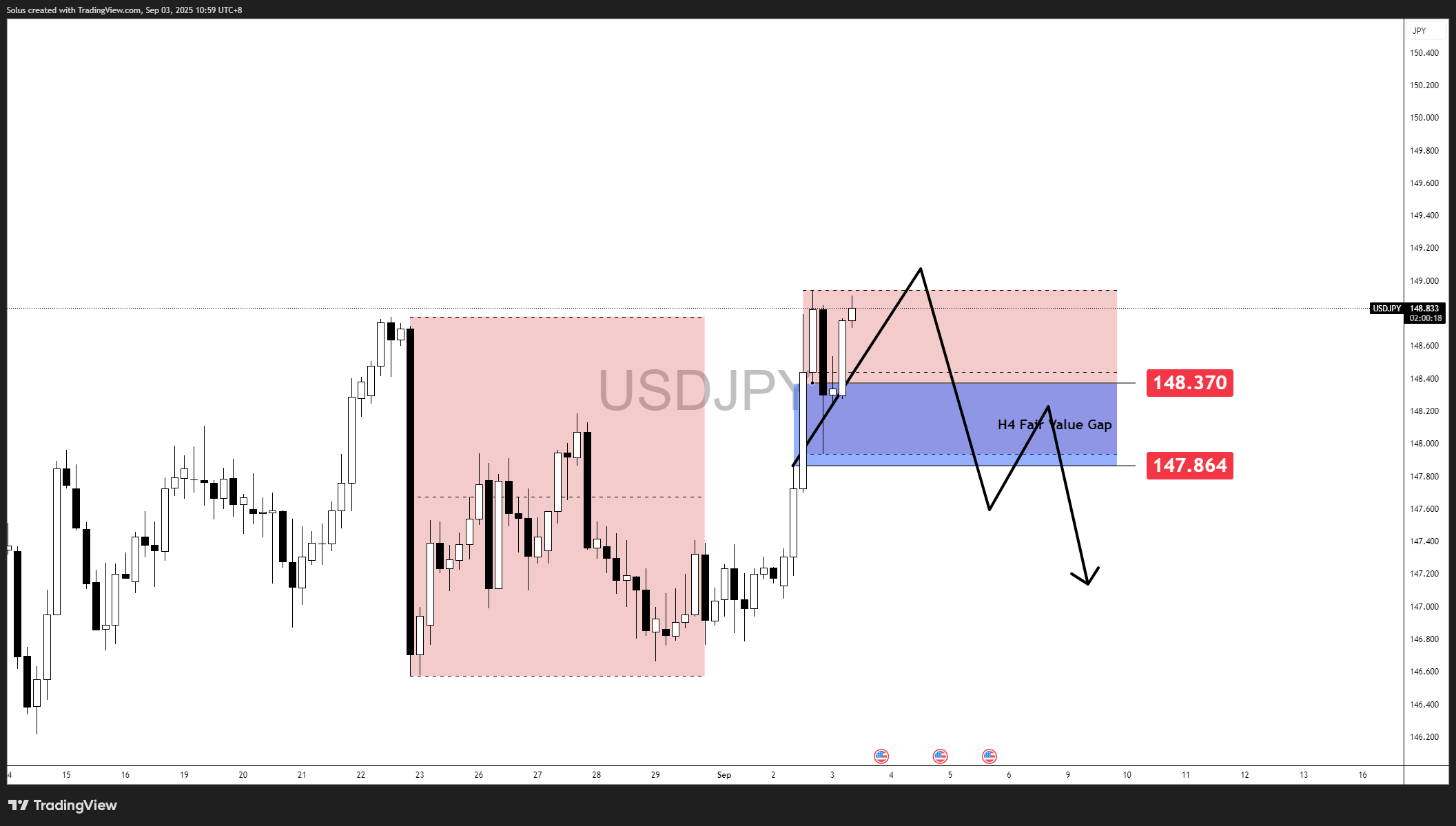

Bearish Scenario: Rejection at 149, Back Into the Gap

The same chart also highlights the risk: 149.00 is still acting as firm resistance. If price fails to clear this zone and prints rejection wicks or bearish engulfing patterns, sellers may regain control. That would likely send USD/JPY back into the H4 FVG (147.864–148.370) to test demand again.

- Failure at 149.00 brings downside back to the FVG mid-point (~148.20).

- Break below 147.864 signals demand exhaustion.

- If that occurs, price risks a deeper move to 147.20 → 146.80–146.20.

- Such a shift would frame the August rebound as distribution at premium pricing.

NFP Game Plan: Jobs Data as the Decider

Friday’s Nonfarm Payrolls (NFP) and Unemployment Rate will likely act as the catalyst that decides whether USD/JPY breaks cleanly above 149.00 or falls back into the H4 Fair Value Gap (147.864–148.370).

Bullish NFP Outcome (Supports Breakout Above 149)

If headline NFP beats expectations (>75K) and unemployment holds steady or drops:

- Markets will interpret it as labor resilience.

- Yields stay firm, reinforcing the dollar’s edge over the yen.

- USD/JPY would likely break above 149.00 quickly, targeting 149.50 → 150.00 into early next week.

- Strong upside surprise could even accelerate toward 150.70–151.20 liquidity zones.

Bearish NFP Outcome (Triggers Rejection at 149)

If NFP misses (<75K) and unemployment ticks up (>4.3%):

- Dollar sentiment weakens, and yields soften.

- USD/JPY would likely reject 149.00, slipping back into the FVG for retests.

- Break below 147.864 exposes 147.20 → 146.80–146.20 downside liquidity.

- Weak data could reframe the recent rally as distribution at premium levels.

Start Practicing with Confidence - Risk-Free!

- Trade forex, indices, gold, and more

- Access ACY, MT4, MT5, & Copy Trading Platforms

- Practice with zero risk

It’s time to go from theory to execution - risk-free.

Create an Account. Start Your Free Demo!

Check Out My Contents:

Strategies That You Can Use

Looking for step-by-step approaches you can plug straight into the charts? Start here:

- How To Trade & Scalp Indices at the Open Using Smart Money Concepts (SMC)

- How to Trade Breakouts Effectively in Day Trading with Smart Money Concepts

- Complete Step-by-Step Guide to Day Trading Gold (XAU/USD) with Smart Money Concepts (SMC)

- The Power of Multi-Timeframe Analysis in Smart Money Concepts (SMC)

- Forex Trading Strategy for Beginners

- Mastering Candlestick Pattern Analysis with the SMC Strategy for Day Trading

- How to Use Fibonacci to Set Targets & Stops (Complete Guide)

- RSI Divergence Trading Strategy for Gold: How to Identify and Trade Trend Reversals

- Stochastics Trading Secrets: How to Time Entries in Trending Markets using Stochastics

- Gold Trading Stochastics Strategy: How to Trade Gold with 2R–3R Targets

- RSI Hidden Divergence Explained: How to Spot Trend Continuations Like a Pro

- Moving Averages Trading Strategy Playbook

- Mastering Fibonacci Trading Psychology – Trusting the Levels, Managing the Mind

- Mastering Price Action at Key Levels – How to Spot, Trade, and Win at the Most Crucial Zones

- Mastering Retests: How to Enter with Confirmation After a Breakout

Indicators / Tools for Trading

Sharpen your edge with proven tools and frameworks:

- The Ultimate Guide to Risk Management in Trading - A Complete Compilation for 2025

- Moving Averages Trading Strategy Playbook

- How to Think Like a Price Action Trader

- Mastering Fibonacci Trading Psychology - Trusting the Levels, Managing the Mind

How To Trade News

News moves markets fast. Learn how to keep pace with SMC-based playbooks:

- Why Smart Money Concepts Work in News-Driven Markets - CPI, NFP, and More

- How to Trade NFP Using Smart Money Concepts (SMC)-A Proven Strategy for Forex Traders

- How to Trade CPI Like Smart Money - A Step-by-Step Guide Using SMC

Learn How to Trade US Indices

From NASDAQ opens to DAX trends, here’s how to approach indices like a pro:

- How to Start Trading Indices and Get into the Stock Market with Low Capital (2025 Guide)

- Best Indices to Trade for Day Traders | NASDAQ, S&P 500, DAX + Best Times to Trade Them

- How To Trade & Scalp Indices at the Open Using Smart Money Concepts (SMC)

- NAS100 - How to Trade the Nasdaq Like a Pro (Smart Money Edition)

How to Start Trading Gold

Gold remains one of the most traded assets — here’s how to approach it with confidence:

- How to Swing Trade Gold (XAU/USD) Using Smart Money Concepts: A Simple Guide for Traders

- Complete Step-by-Step Guide to Day Trading Gold (XAU/USD) with Smart Money Concepts (SMC)

- The Ultimate Guide to Backtesting and Trading Gold (XAU/USD) Using Smart Money Concepts (SMC)

- Why Gold Remains the Ultimate Security in a Shifting World

- How to Exit & Take Profits in Trading Gold Like a Pro: Using RSI, Range Breakdowns, and MAs as Your Confluence

How to Trade Japanese Candlesticks

Candlesticks are the building blocks of price action. Master the most powerful ones:

- Mastering the Top Japanese Candlesticks: The Top 5 Candlesticks To Trade + Top SMC Candlestick Pattern

- How to Trade Candlestick Patterns with High Probability: A Complete Guide for Beginners

- The Top Japanese Candlestick Guide: What is an Engulfing Pattern and How to Trade It?

- Piercing Pattern Candlestick Explained: How to Trade It - Step-By-Step Guide

- Morning & Evening Star Candlestick Patterns - How to Trade Market Reversals with Confidence

How to Start Day Trading

Ready to go intraday? Here’s how to build consistency step by step:

- 5 Steps to Start Day Trading: A Strategic Guide for Beginners

- 8 Steps How to Start Forex Day Trading in 2025: A Beginner’s Step-by-Step Guide

- 3 Steps to Build a Trading Routine for Consistency and Discipline - Day Trading Edition

- The Ultimate Guide to Understanding Market Trends and Price Action

- Trading with Momentum: The Best Trading Session to Trade Forex, Gold and Indices

Learn how to navigate yourself in times of turmoil

Markets swing between calm and chaos. Learn to read risk-on vs risk-off like a pro:

- How to Identify Risk-On and Risk-Off Market Sentiment: A Complete Trader’s Guide

- How to Trade Risk-On and Risk-Off Sentiment - With Technical Confirmation

- The Ultimate Guide to Understanding Market Trends and Price Action

Want to learn how to trade like the Smart Money?

Step inside the playbook of institutional traders with SMC concepts explained:

- Why Smart Money Concepts Work: The Truth Behind Liquidity and Price Action

- Mastering the Market with Smart Money Concepts: 5 Strategic Approaches

- Understanding Liquidity Sweep: How Smart Money Trades Liquidity Zones in Forex, Gold, US Indices

- The SMC Playbook Series Part 1: What Moves the Markets? Key Drivers Behind Forex, Gold & Stock Indices

- The SMC Playbook Series Part 2: How to Spot Liquidity Pools in Trading-Internal vs External Liquidity Explained

- Fair Value Gaps Explained: How Smart Money Leaves Footprints in the Market

- Accumulation, Manipulation, Distribution: The Hidden Cycle That Runs Every Market

- Institutional Order Flow – Reading the Market Through the Eyes of the Big Players

- London Session Trading Secrets: How Smart Money Sets the High & Low of the Day

- Mastering the New York Session - Smart Money Concepts Guide

Master the World’s Most Popular Forex Pairs

Forex pairs aren’t created equal — some are stable, some are volatile, others tied to commodities or sessions.

- The Top 5 All-Time Best Forex Pairs to Trade

- Top Forex Pairs Beyond the Big Five

- EUR/USD: The King of Forex

- USD/JPY: The Fast Mover

- GBP/USD: The Volatile Cable

- AUD/USD: The Commodity Currency

- USD/CAD: The Oil-Backed Pair

- GBP/JPY: How to Trade The Beast

- Asian & London Session Secrets

- Mastering the New York Session

Stop Hunting 101

If you’ve ever been stopped out right before the market reverses — this is why:

- Stop Hunting 101: How Swing Highs and Lows Become Liquidity Traps

- Outsmarting Stop Hunts: The Psychology Behind the Trap

- How to Lessen Risk From Stop Hunts in Trading

- How Stop Hunts Trigger Revenge Trading - Breaking the Pain Cycle

- How to Accept Stop Hunts Without Losing Discipline - Shifting From Frustration to Focus

Trading Psychology

Mindset is the deciding factor between growth and blowups. Explore these essentials:

- The Mental Game of Execution - Debunking the Common Trading Psychology

- Managing Trading Losses: Why You Can Be Wrong and Still Win Big in Trading

- The Hidden Threat in Trading: How Performance Anxiety Sabotages Your Edge

- Why 90% of Retail Traders Fail Even with Profitable Trading Strategies

- Top 10 Habits Profitable Traders Follow Daily to Stay Consistent

- Top 10 Trading Rules of the Most Successful Traders

- Top 10 Ways to Prevent Emotional Trading and Stay Disciplined in the Markets

- Why Most Traders Fail – Trading Psychology & The Hidden Mental Game

- Emotional Awareness in Trading – Naming Your Triggers

- Discipline vs. Impulse in Trading – Step-by Step Guide How to Build Control

- Trading Journal & Reflection – The Trader’s Mirror

- Overcoming FOMO & Revenge Trading in Forex – Why Patience Pays

- Risk of Ruin in Trading - Respect the Math of Survival

- Identity-Based Trading: Become Your Trading System for Consistency

- Trading Psychology: Aligning Emotions with Your System

- Mastering Fear in Trading: Turn Doubt into a Protective Signal

- Mastering Greed in Trading: Turn Ambition into Controlled Growth

- Mastering Boredom in Trading: From Restless Clicking to Patient Precision

Risk Management

The real edge in trading isn’t strategy — it’s how you protect your capital:

- Mastering Risk Management: Stop Loss, Take Profit, and Position Sizing

- Why Risk Management Is the Only Edge That Lasts

- How Much Should You Risk per Trade? (1%, 2%, or Less?)

- The Ultimate Risk Management Plan for Prop Firm Traders – Updated 2025

Suggested Learning Path

If you’re not sure where to start, follow this roadmap:

- Start with Trading Psychology → Build the mindset first.

- Move into Risk Management → Learn how to protect capital.

- Explore Strategies & Tools → Candlesticks, Fibonacci, MAs, Indicators.

- Apply to Assets → Gold, Indices, Forex sessions.

- Advance to Smart Money Concepts (SMC) → Learn how institutions trade.

- Specialize → Stop Hunts, News Trading, Turmoil Navigation.

This way, you’ll grow from foundation → application → mastery, instead of jumping around randomly.

Follow me for more daily market insights!

Jasper Osita - LinkedIn - FXStreet - YouTube

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.

Try These Next

4 Powerful Tactics to Overcome the Most Costly Forex Mistakes

How to Master MT4 & MT5 - Tips and Tricks for Traders

The Importance of Fundamental Analysis in Forex Trading

Forex Leverage Explained: Mastering Forex Leverage in Trading & Controlling Margin

The Importance of Liquidity in Forex: A Beginner's Guide

Close All Metatrader Script: Maximise Your Trading Efficiency and Reduce Stress

Best Currency Pairs To Trade in 2025

Forex Trading Hours: Finding the Best Times to Trade FX

MetaTrader Expert Advisor - The Benefits of Algorithmic Trading and Forex EAs

Top 5 Candlestick Trading Formations Every Trader Must Know