Best Moving Average Settings Based on Your Trading Style

2025-07-23 09:39:04

This is Part 2 of our Moving Averages Series

If you're just starting out and want to first understand what moving averages are, how they work, and why traders use them - read Part 1: Moving Averages for Beginners before diving in.

Goal of This Lesson

To help you choose the right moving average (MA) setup by understanding your trading style, so you can either confidently apply proven setups or personalize them into something that truly fits the way you see the market.

Real-Life Analogy: MAs Are Like Eyeglasses for Price

Imagine walking into an optician and borrowing your friend’s glasses.

They might work, but if the prescription isn’t quite right, everything feels off.

That doesn’t mean their glasses were bad - it just means you need your own lens.

Moving averages are similar.

A 9 EMA or 21 EMA might work great for someone else - and it’s totally fine to start there.

But over time, the best traders learn to tweak their tools to match how they see the market.

It's Smart to Learn From Others - Then Adapt

Take a note of this:

Many great traders learned by studying others. Copying a mentor’s setup isn’t wrong - it’s wise.

But here’s the key:

Don’t stop at copying. Evolve what you learn into something that makes sense for you.

And that starts with knowing your trader type.

Step 1: Discover Your Trader Profile

Before choosing your moving average settings, ask:

- Am I fast and reactive, or patient and selective?

- Do I like quick momentum entries or multi-day trend plays?

- Do I hold through noise, or want to be in and out?

To get clarity, read: Discovering Your Trader Profile

It’s a quick guide to identifying your strengths, preferences, and pace - so you can choose tools that work with you, not against you.

Step 2: Match Your Moving Averages to Your Trading Type

Once you understand your style, you can choose MAs that match your rhythm:

| Trader Type | MA Setup | Why It Works |

|---|---|---|

| Scalper | 9 EMA + 20 EMA | Fast reaction to momentum shifts |

| Day Trader | 20 EMA + 50 SMA | Balance between speed and confirmation |

| Swing Trader | 50 EMA + 200 SMA | Smoother trend following, filters noise |

| Momentum Trader | 21 EMA + 100 EMA | Clean impulse tracking, avoids choppy zones |

| Mean Reverter | 20 SMA + Oscillator (RSI, MACD) | Helps fade extreme moves back to equilibrium |

Pro Tip: Use one fast EMA for entries, and one slow SMA for trend bias.

Common MAs and What They Do

| MA Type | Best For | Description |

|---|---|---|

| EMA (Exponential) | Momentum setups | Weighs recent candles more heavily - faster reaction |

| SMA (Simple) | Trend structure | Averages all candles equally - smoother movement |

| 200 EMA/SMA | Institutional bias | Common long-term trend guide |

| 9 EMA | Pullback entries | Great for quick reaction in trends |

| 21 EMA | Balanced system | Widely used across trading styles |

| 20 SMA | Mean reversion | Pairs well with RSI and Bollinger Bands |

Step 3: Observe and Journal Your Findings

Open your charts and watch how price reacts around your MAs:

- Does it bounce cleanly?

- Does it chop through?

- Does structure align with your MA?

- Do you feel more confident using them?

Create a simple journal or screenshot log:

- Date

- Asset

- Timeframe

- MA reaction (rejection, breakout, fakeout)

- What you learned from that moment

Over time, you’ll spot patterns - and those patterns become confidence.

Bonus Tip:

If you're unsure which pair to start with, try the 20 EMA + 50 SMA combo on the 15-minute or 1-hour chart. It's widely used, balanced, and beginner-friendly - making it a strong default while you learn.

Why the lower timeframe? It’s faster to learn if you practicing learning while the candles are printing much faster compared to a much higher timeframe like the 4-Hour, Daily, and Weekly

The Role of Timeframe & Volatility

- A 20 EMA on a 1-minute chart behaves very differently than on an H1 chart

- Fast pairs (like NASDAQ or GBP/JPY) may need quicker MAs

- Slower markets (like EUR/CHF) can use wider settings

Always match your MA speed to the asset + timeframe combo you’re trading.

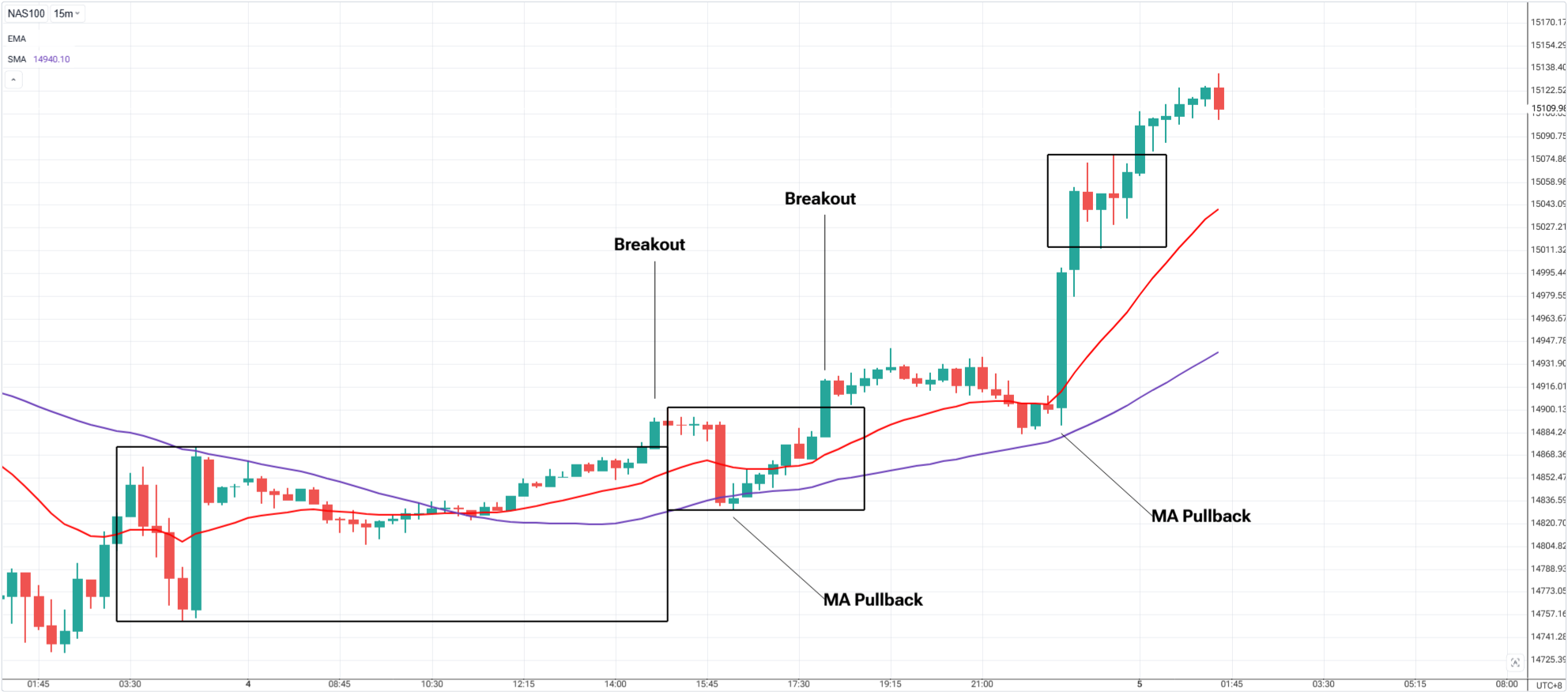

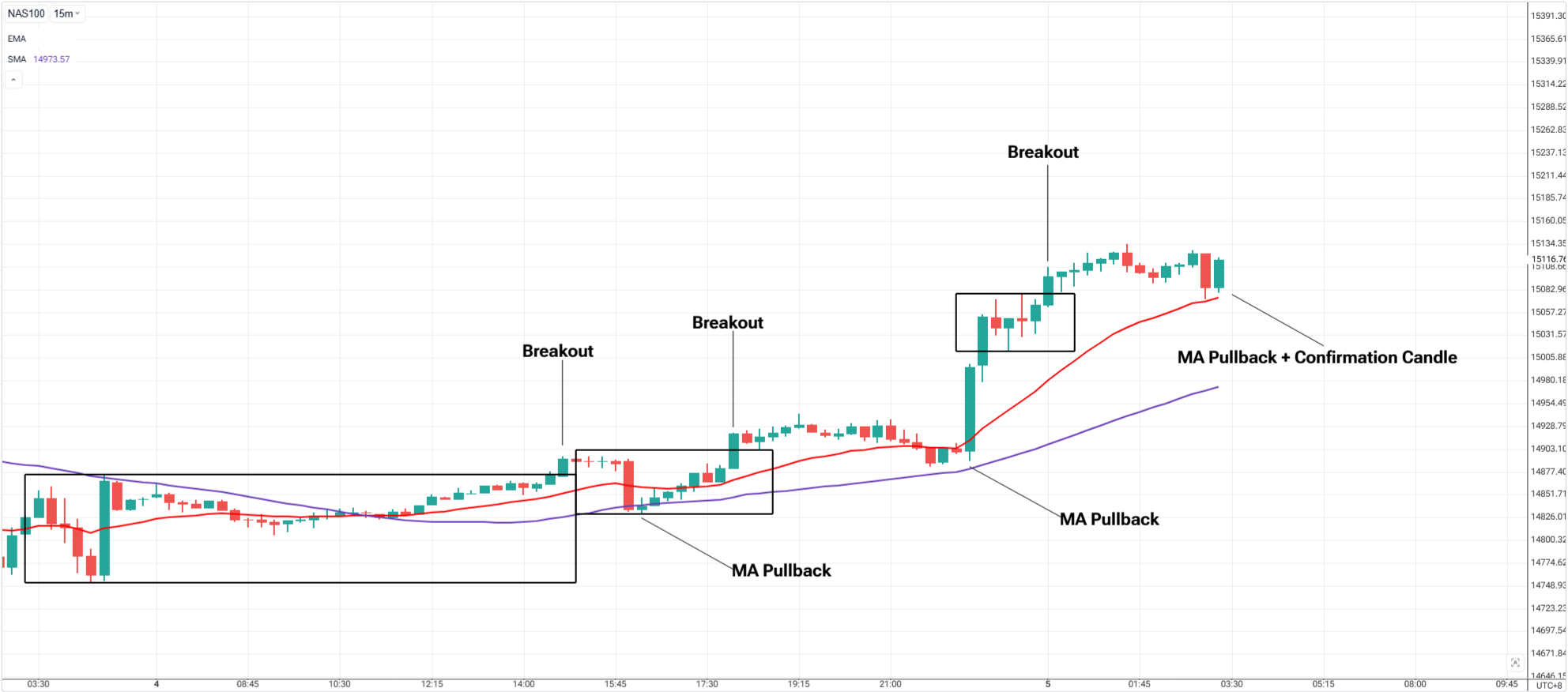

Chart Example

This is your space to bring theory to life. Consider showing:

- A breakout of price action

- A clean pullback entry using 20 EMA on NASDAQ

- A trend continuation using the 50 SMA until it flips

Pro Tip: Use Structure + MA confluence as confirmation for a higher probability setup

Strategies to Test With MA Setups

| Strategy | MA Setup | How It Helps |

|---|---|---|

| Pullback Entry | 20 EMA + 50 SMA | Buy dips, sell rallies in trend |

| Breakout Entry | 9 EMA + 21 EMA | React to explosive breakouts |

| Trend Filtering | 50 SMA + 200 SMA | Avoid counter-trend trades |

| SMC Confluence | 21 EMA Only | Aligns with BOS/CHoCH and FVG zones |

Common Mistakes to Avoid

- Using too many MAs and clouding your chart

- Entering just because price “touched the line”

- Not aligning MAs with structure or price action

- Ignoring timeframe when choosing MA settings

Final Thought

Copying someone else’s system is a great starting point - but the best traders evolve what they learn into something that reflects their mindset, lifestyle, and style.

Moving averages aren’t magic. They’re not predictors.

They’re just tools - but when they match your rhythm, they become powerful.

So whether you’re scalping, swinging, or catching trends - choose MAs that make you feel in control.

Let them simplify your chart, not complicate it.

3 Simple Steps to Build Your MA System:

- Read: Discovering Your Trader Profile - Understand how you naturally trade

- Choose: Pick a 2-MA combo that matches your pace

- Observe: Watch how price respects your MAs - and journal what you notice

Start Practicing with Confidence - Risk-Free!

Open a free demo account today and experience institutional-grade spreads, lightning-fast execution, and all the tools you need to grow as a trader.

- Trade forex, indices, gold, and more

- Access ACY, MT4, MT5, & Copy Trading Platforms

- Practice with zero risk

It’s time to go from theory to execution - risk-free.

Create an Account. Start Your Free Demo!

Check Out My Contents:

Strategies That You Can Use

How To Trade & Scalp Indices at the Open Using Smart Money Concepts (SMC)

How to Trade Breakouts Effectively in Day Trading with Smart Money Concepts

Complete Step-by-Step Guide to Day Trading Gold (XAU/USD) with Smart Money Concepts (SMC)

The Power of Multi-Timeframe Analysis in Smart Money Concepts (SMC)

Forex Trading Strategy for Beginners

Mastering Candlestick Pattern Analysis with the SMC Strategy for Day Trading

Mastering Risk Management: Stop Loss, Take Profit, and Position Sizing

How to Use Fibonacci to Set Targets & Stops (Complete Guide)

RSI Divergence Trading Strategy for Gold: How to Identify and Trade Trend Reversals

Stochastics Trading Secrets: How to Time Entries in Trending Markets using Stochastics

Gold Trading Stochastics Strategy: How to Trade Gold with 2R–3R Targets

RSI Hidden Divergence Explained: How to Spot Trend Continuations Like a Pro

How To Trade News

Why Smart Money Concepts Work in News-Driven Markets - CPI, NFP, and More

How to Trade NFP Using Smart Money Concepts (SMC)-A Proven Strategy for Forex Traders

How to Trade CPI Like Smart Money - A Step-by-Step Guide Using SMC

Learn How to Trade US Indices

How to Start Trading Indices and Get into the Stock Market with Low Capital (2026 Guide)

Best Indices to Trade for Day Traders | NASDAQ, S&P 500, DAX + Best Times to Trade Them

How To Trade & Scalp Indices at the Open Using Smart Money Concepts (SMC)

NAS100 - How to Trade the Nasdaq Like a Pro (Smart Money Edition)

How to Trade CPI Like Smart Money - A Step-by-Step Guide Using SMC

Why Smart Money Concepts Work in News-Driven Markets - CPI, NFP, and More

How to Start Trading Gold

How to Swing Trade Gold (XAU/USD) Using Smart Money Concepts: A Simple Guide for Traders

Complete Step-by-Step Guide to Day Trading Gold (XAU/USD) with Smart Money Concepts (SMC)

The Ultimate Guide to Backtesting and Trading Gold (XAU/USD) Using Smart Money Concepts (SMC)

Why Gold Remains the Ultimate Security in a Shifting World

How to Trade Japanese Candlesticks

How to Trade Candlestick Patterns with High Probability: A Complete Guide for Beginners

The Top Japanese Candlestick Guide: What is an Engulfing Pattern and How to Trade It?

Piercing Pattern Candlestick Explained: How to Trade It - Step-By-Step Guide

Morning & Evening Star Candlestick Patterns – How to Trade Market Reversals with Confidence

How to Start Day Trading

5 Steps to Start Day Trading: A Strategic Guide for Beginners

8 Steps How to Start Forex Day Trading in 2026: A Beginner’s Step-by-Step Guide

3 Steps to Build a Trading Routine for Consistency and Discipline - Day Trading Edition

The Ultimate Guide to Understanding Market Trends and Price Action

Trading with Momentum: The Best Trading Session to Trade Forex, Gold and Indices

Learn how to navigate yourself in times of turmoil

How to Identify Risk-On and Risk-Off Market Sentiment: A Complete Trader’s Guide

How to Trade Risk-On and Risk-Off Sentiment - With Technical Confirmation

The Ultimate Guide to Understanding Market Trends and Price Action

Want to learn how to trade like the Smart Money?

Why Smart Money Concepts Work: The Truth Behind Liquidity and Price Action

Mastering the Market with Smart Money Concepts: 5 Strategic Approaches

Mastering Candlestick Pattern Analysis with the SMC Strategy for Day Trading

Understanding Liquidity Sweep: How Smart Money Trades Liquidity Zones in Forex, Gold, US Indices

The SMC Playbook Series Part 4: How to Confirm Trend Reversal & Direction using SMC

The SMC Playbook Series Part 5: The Power of Multi-Timeframe Analysis in Smart Money Concepts (SMC)

Fair Value Gaps Explained: How Smart Money Leaves Footprints in the Market

The Best Time to Use Smart Money Concepts (SMC): Why Timing Is Everything in Trading SMC

How to Trade the London Session Using Smart Money Concepts (SMC)

Trading Psychology and Continuous Improvement Contents

The Mental Game of Execution - Debunking the Common Trading Psychology

5 Steps to Backtest a Trading Strategy with AI: A Step-by-Step Guide

Managing Trading Losses: Why You Can Be Wrong and Still Win Big in Trading

The Hidden Threat in Trading: How Performance Anxiety Sabotages Your Edge

Why You Fail in Trading: You Don’t Have Enough Capital to Survive

Why 90% of Retail Traders Fail Even with Profitable Trading Strategies

The Top 10 Best Trading Books That Changed My Mindset, Strategy & Performance

Discovering Your Trader Profile: What Kind of Trader Are You?

Follow me for more daily market insights!

Jasper Osita - LinkedIn - FXStreet - YouTube

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.

Try These Next