Geopolitical Turbulence - Understanding Its Impact on Gold, Oil, and Currency Markets

2025-06-20 14:26:19

Every trader eventually learns that markets don’t move on numbers alone. Behind every spike in gold, drop in the euro, or surge in oil , there’s often a deeper story one that isn’t found on a candlestick or trendline. It’s driven by global politics, diplomatic tensions, military conflicts, and the uncertainty that follows when the world becomes less predictable, everything is about the context. In 2025, this reality has never been clearer. Since the start of the year, we've seen gold surge to new highs, oil markets swing violently, and currencies react to political manoeuvres rather than economic data. The link between geopolitics and market movement isn’t theoretical anymore it’s happening in real-time, and if you’re a trader, understanding that link is no longer optional. It’s essential.

Whether you’re trading XAU/USD, EUR/USD, USD/JPY, or commodities like crude oil, geopolitical developments should be part of your decision-making process. They affect risk sentiment, capital flows, and monetary policy expectations. And because they’re often unexpected or misunderstood they create the kind of volatility that can either trap you or launch your trade into profit. This guide is here to walk you through how geopolitical events impact the markets, what you need to watch for, and how to adjust your strategy to stay one step ahead.

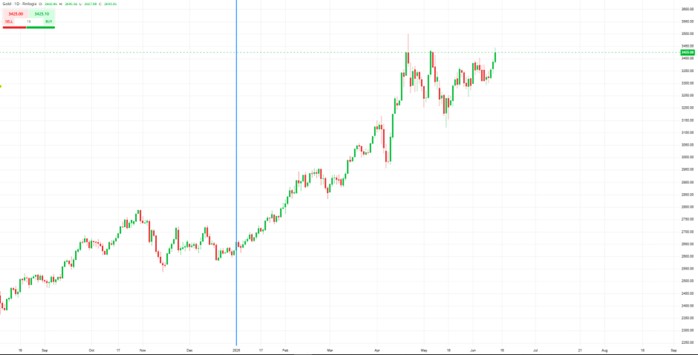

XAUUSD Daily Chart Since 2025 (Blue Line)

The Interplay Between Geopolitics and Financial Markets

At its core, geopolitics is about power: who holds it, who wants it, and how the struggle between the two affects global stability. When that power balance shifts through war, sanctions, elections, or diplomacy it impacts trade routes, energy supply, inflation expectations, and investor confidence. All this ripples into the financial markets.

In 2025, we’ve seen a perfect example of this. Rising tensions in Eastern Europe, conflict in the Middle East, and changing dynamics in U.S.-China relations have all pushed market participants into a constant state of reassessment. Even routine economic data is now viewed through a geopolitical lens. A U.S. CPI release no longer means the same thing if there’s a brewing conflict that could affect oil prices or cause safe-haven flows. This year, markets are moving not just on numbers, but on narratives and geopolitics often writes the first draft.

For traders, this means technical analysis alone isn’t enough. A perfectly drawn chart pattern can fail the moment a war breaks out, a peace treaty is signed, or sanctions are announced. You need to be aware of what’s happening beyond your platform because that’s where the next big move often begins.

Gold (XAUUSD): When Uncertainty Rises, So Does the Metal

Gold is the market’s emotional compass. When traders fear instability whether political, economic, or military they move money into gold. It doesn’t matter if inflation is falling or rising, or if the Fed is hawkish or dovish. When headlines are flashing with uncertainty, gold usually catches a bid.

In 2025, XAU/USD has proven once again that it’s the asset of last resort. When Israeli airstrikes escalated tensions with Iran earlier this year, gold prices didn’t wait for confirmation. They spiked. Not because inflation had changed or central banks had shifted but because investors were nervous. The prospect of oil supply disruption, the risk of wider conflict, and the sudden drop in market confidence all triggered a rapid move into safety. That’s gold’s job to absorb panic when everything else feels unpredictable.

This doesn’t mean gold always goes up during crises. Sometimes, if the dollar (DXY) strengthens aggressively as it often does when U.S. assets are seen as a safe haven gold can pause or even drop. But over time, the pattern holds: when geopolitical uncertainty increases, so does demand for gold. Smart traders don’t just look at CPI or rate decisions. They read the headlines, assess the risk tone, and adjust accordingly.

Oil: A Battlefield for Supply and Sentiment

Few assets are more geopolitically sensitive than oil. Because so much of the world’s supply comes from politically volatile regions the Middle East, Russia, North Africa any threat to that supply sends prices higher. That’s not just a market reflex; it’s an economic survival instinct. Oil powers everything, from logistics to manufacturing to agriculture. When supply gets tight or uncertain, economies feel the pain, and markets react fast.

This year, oil has shown exactly how geopolitics drives price. Following attacks on energy infrastructure and increased tension around shipping routes like the Strait of Hormuz, crude surged by nearly 10% in a matter of days. This wasn’t about production numbers. It was about fear that supply would be disrupted, fear that escalation would continue, fear that diplomatic efforts would fail. When fear drives price, it happens fast and often without warning.

As a trader, the key is to anticipate these scenarios not by trying to guess headlines, but by understanding which regions influence oil, how supply chains are structured, and what kind of political events could trigger disruption. If you're trading oil, you're not just trading barrels you're trading geopolitical risk premium.

Oil Chart Daily Since 2025 (Blue Line)

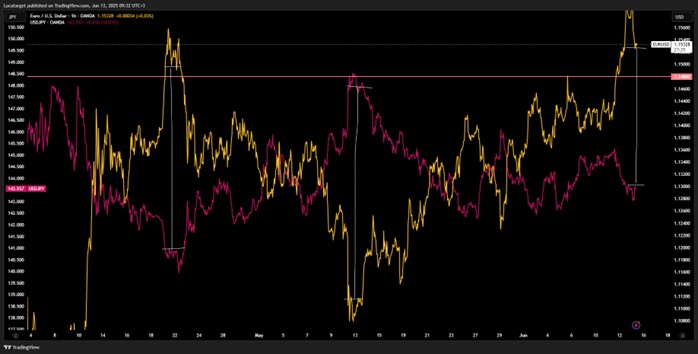

Currencies: Geopolitics and the Safe-Haven Shuffle

Currency markets react quickly and sharply to geopolitical events, often even before commodities or equities. That’s because currencies reflect confidence. When investors feel safe, they move toward higher-yielding currencies or those tied to strong growth. When fear enters the picture, they move toward safe-haven currencies traditionally the U.S. dollar (USD), Swiss franc (CHF), and Japanese yen (JPY).

In 2025, this behaviour has played out time and time again. Every time geopolitical risk increased, EUR/USD dropped, USD/JPY reversed, and emerging market currencies sold off. But here's the nuance: not all geopolitical risk is equal. A regional conflict in Europe might strengthen the dollar and hurt the euro. But a trade conflict involving the U.S. might weaken the dollar and push traders into gold or the yen. The context matters.

USDJPY (Pink) EURUSD (Yellow)

One of the biggest mistakes traders make is assuming a one-size-fits-all response to geopolitical events. They think “conflict = dollar up,” or “oil spike = CAD up.” But the market isn’t a machine it’s a living, breathing interpretation of fear, opportunity, and expectation. That’s why understanding how investors are reacting to a geopolitical event is often more important than the event itself.

How to Trade Geopolitical Events — Without Guessing Headlines

You can’t predict every political surprise. No one can. But you can prepare for how the market might react when those surprises happen. That starts by building a habit of watching key regions, understanding which instruments are sensitive to which events, and always keeping one eye on the broader narrative.

For example, if tensions rise in Eastern Europe, ask yourself: how might that impact the euro? What would it mean for gas supply and inflation expectations in the EU? If Middle Eastern conflict escalates, what happens to crude? How would a spike in oil affect inflation and central bank decisions in energy-importing economies?

These are the questions that institutional traders ask every day, and you can ask them too. You don’t need to be a geopolitical analyst to stay informed. But you do need to connect the dots between political developments and market instruments. That’s where your edge as a trader is built not in being faster, but in being more prepared.

In 2025, more than ever, geopolitical forces are shaping the market. From currency moves to commodity spikes, from rate expectations to safe-haven flows the political map is leaving its fingerprints on every chart. If you’re only trading technical, you’re missing half the story. And if you’re reacting to headlines without context, you’re trading noise instead of narrative.

This is your opportunity to level up. By understanding how geopolitics affects gold, oil, and currency markets, you’re not just trading smarter you’re trading with awareness. You’re thinking like the big players. You’re seeing the landscape, not just the candles.

And in a world this unpredictable, that kind of vision makes all the difference.

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.

Try These Next