US Dollar Forecast: Bullish and Bearish Scenario Amid Fed Cut Bets and Trade War Tensions

2025-07-01 16:50:45

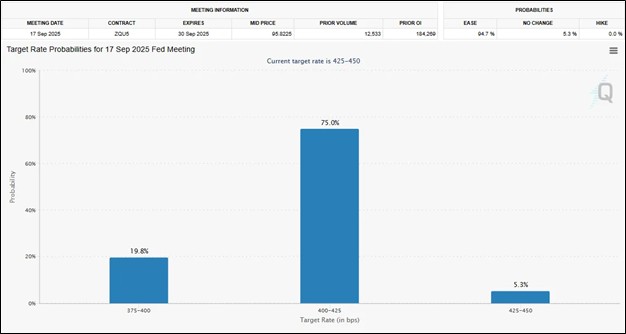

- The U.S. dollar (DXY) remains under pressure as 75% odds of a September rate cut deepen downside risk.

- Ongoing Israel-Iran tensions and trade war fears fail to lift the dollar as safe-haven flows fragment.

- Technically, bearish structure dominates with downside targets at 96.50 and 96.00 if 97.20 fails to hold.

The U.S. dollar is facing pressure from all sides—dovish Fed bets, geopolitical chaos, and growing trade war anxiety.

Market Stress Grows as the Dollar Loses Its Edge

The U.S. dollar has been struggling to find footing amid a wave of macro and political crosscurrents that have shaken risk sentiment but failed to lift the greenback. Traditionally seen as a safe haven, the dollar is now being weighed down by a rising probability of interest rate cuts, even as geopolitical instability increases.

Rate Cut Incoming

With a September rate cut now priced in at 75%, the U.S. dollar faces renewed downside risk - not just in the coming days, but potentially over the weeks ahead. As the greenback struggles to hold its ground, its grip on a meaningful recovery continues to weaken.

Fragile Ceasefire, Fragile Dollar

The recent ceasefire announcement between Israel and Iran did little to calm global markets. Violations from both sides have kept risk-on sentiment muted, and safe-haven flows - normally a benefit to the dollar - have become fragmented.

Why? Because the real driver of USD weakness isn't just geopolitical - it’s the Fed.

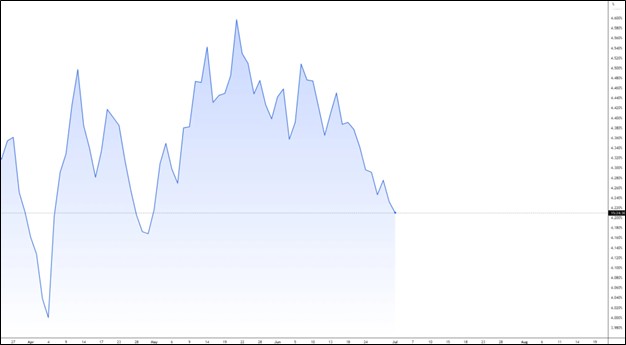

Bond Yields Drop with Fragmented USD

President Trump continues to put public pressure on the Federal Reserve to lower interest rates. Combined with fears over global trade instability - especially the looming U.S.–China tariff deadline on July 9 - ****markets are now pricing in an increased likelihood of policy easing.

What’s weighing on the dollar?

- Ceasefire violations keeping volatility high - but not enough to fuel USD demand.

- Trade tensions with China reigniting ahead of key tariff deadlines.

- Bond yields dropping on rate cut speculation, dragging USD with them.

Technical Outlook

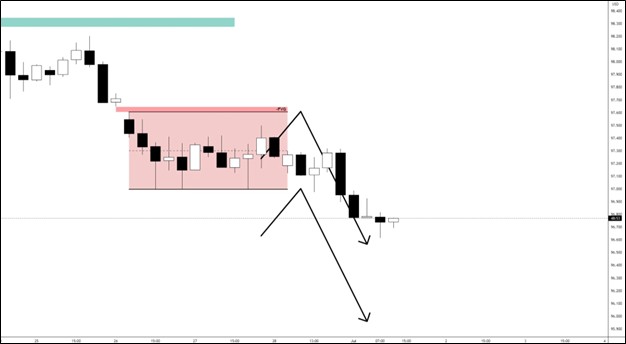

In the previous analysis - Forex, Indices, Gold Weekly Gameplan: Technical Analysis & Price Action Outlook - the bearish scenario for the dollar is beginning to play out. Ongoing geopolitical tensions between Israel and Iran continue to weigh on sentiment, while the greenback's failure to form bullish market structures signals that a sustained recovery remains unlikely for now.

Bullish Scenario

The bullish scenario has a high chance of not materializing since:

- No strong bullish structure yet (new higher highs & lows)

- NFP data is yet to be released (a positive print could lift USD)

- Breakout above: 97.00-97.20 level up-to 97.40

Targets:

- 97.40

- 97.60

Bearish Scenario

With the Fed weighing down on the greenback, downside risk is still high for the U.S. dollar. Dollar would likely proceed for further downside if:

- The 4-Hour Bearish FVG holds resting between 97.00-97.20

- NFP print is fragile regardless of result

- Tariff tension arises

Targets:

- 96.50

- 96.00

Impact on Majors

| Currency Pair | Forecast Bias | Key Drivers |

| EUR/USD | Bullish | USD weakness, ECB relatively less dovish |

| GBP/USD | Bullish (Cautious) | USD softening, but BOE uncertainty remains |

| AUD/USD | Bullish | Risk-on flows, gold strength, China stimulus optimism |

| NZD/USD | Bullish | RBNZ firm, USD weakness, risk sentiment improving |

| USD/JPY | Mixed to Bearish | USD weakness vs ultra-dovish BOJ, falling U.S. yields |

| USD/CAD | Bearish | Oil strength, CAD resilience, softer USD |

| USD/CHF | Bearish | Safe-haven CHF demand, SNB less dovish than Fed |

Is the Dollar’s Safe-Haven Status Fading?

Historically, the dollar performs well in times of global turmoil. But this time, its role is less clear.

Unless the Fed signals a hawkish pivot or data comes in stronger than expected, the dollar may remain capped, if not drift lower.

The U.S. dollar isn’t collapsing - but it’s clearly under pressure. Between Middle East volatility, U.S.–China trade friction, and growing expectations of Fed rate cuts, the greenback is no longer the easy flight-to-safety trade it once was.

Check Out My Contents:

Strategies That You Can Use:

How To Trade & Scalp Indices at the Open Using Smart Money Concepts (SMC)

How to Trade Breakouts Effectively in Day Trading with Smart Money Concepts

Complete Step-by-Step Guide to Day Trading Gold (XAU/USD) with Smart Money Concepts (SMC)

The Power of Multi-Timeframe Analysis in Smart Money Concepts (SMC)

Forex Trading Strategy for Beginners

Mastering Candlestick Pattern Analysis with the SMC Strategy for Day Trading

Mastering Risk Management: Stop Loss, Take Profit, and Position Sizing

RSI Divergence Trading Strategy for Gold: How to Identify and Trade Trend Reversals

Stochastics Trading Secrets: How to Time Entries in Trending Markets using Stochastics

Gold Trading Stochastics Strategy: How to Trade Gold with 2R–3R Targets

RSI Hidden Divergence Explained: How to Spot Trend Continuations Like a Pro

How To Trade News:

Why Smart Money Concepts Work in News-Driven Markets - CPI, NFP, and More

How to Trade NFP Using Smart Money Concepts (SMC)-A Proven Strategy for Forex Traders

How to Trade CPI Like Smart Money - A Step-by-Step Guide Using SMC

Learn How to Trade US Indices:

How to Start Trading Indices and Get into the Stock Market with Low Capital (2025 Guide)

Best Indices to Trade for Day Traders | NASDAQ, S&P 500, DAX + Best Times to Trade Them

How To Trade & Scalp Indices at the Open Using Smart Money Concepts (SMC)

NAS100 - How to Trade the Nasdaq Like a Pro (Smart Money Edition)

How to Trade CPI Like Smart Money - A Step-by-Step Guide Using SMC

Why Smart Money Concepts Work in News-Driven Markets - CPI, NFP, and More

How to Start Trading Gold:

How to Swing Trade Gold (XAU/USD) Using Smart Money Concepts: A Simple Guide for Traders

Complete Step-by-Step Guide to Day Trading Gold (XAU/USD) with Smart Money Concepts (SMC)

The Ultimate Guide to Backtesting and Trading Gold (XAU/USD) Using Smart Money Concepts (SMC)

Why Gold Remains the Ultimate Security in a Shifting World

How to Start Day Trading:

5 Steps to Start Day Trading: A Strategic Guide for Beginners

8 Steps How to Start Forex Day Trading in 2025: A Beginner’s Step-by-Step Guide

3 Steps to Build a Trading Routine for Consistency and Discipline - Day Trading Edition

The Ultimate Guide to Understanding Market Trends and Price Action

Learn how to navigate yourself in times of turmoil:

How to Identify Risk-On and Risk-Off Market Sentiment: A Complete Trader’s Guide

How to Trade Risk-On and Risk-Off Sentiment - With Technical Confirmation

The Ultimate Guide to Understanding Market Trends and Price Action

Want to learn how to trade like the Smart Money?

Why Smart Money Concepts Work: The Truth Behind Liquidity and Price Action

Mastering the Market with Smart Money Concepts: 5 Strategic Approaches

Mastering Candlestick Pattern Analysis with the SMC Strategy for Day Trading

Understanding Liquidity Sweep: How Smart Money Trades Liquidity Zones in Forex, Gold, US Indices

The SMC Playbook Series Part 4: How to Confirm Trend Reversal & Direction using SMC

The SMC Playbook Series Part 5: The Power of Multi-Timeframe Analysis in Smart Money Concepts (SMC)

Fair Value Gaps Explained: How Smart Money Leaves Footprints in the Market

The Best Time to Use Smart Money Concepts (SMC): Why Timing Is Everything in Trading SMC

How to Trade the London Session Using Smart Money Concepts (SMC)

Trading Psychology and Continuous Improvement Contents:

The Mental Game of Execution - Debunking the Common Trading Psychology

5 Steps to Backtest a Trading Strategy with AI: A Step-by-Step Guide

Managing Trading Losses: Why You Can Be Wrong and Still Win Big in Trading

The Hidden Threat in Trading: How Performance Anxiety Sabotages Your Edge

Why You Fail in Trading: You Don’t Have Enough Capital to Survive

Why 90% of Retail Traders Fail Even with Profitable Trading Strategies

The Top 10 Best Trading Books That Changed My Mindset, Strategy & Performance

Follow me for more daily market insights!

Jasper Osita - LinkedIn - FXStreet - YouTube

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.