Struggling Consumer Confidence and Rising Tariffs: What’s Next for the U.S. Dollar?

2025-03-17 14:22:50

Overview

- USD – Weakened, Cautious, Volatile - Remains under pressure amid declining consumer confidence, trade tensions, and a Fed holding rates amid economic uncertainty.

- JPY – Safe, Undervalued, Divergent - Continues to serve as a safe-haven asset, though its momentum is limited by the BoJ's ultra-loose monetary policy and global yield differentials.

- AUD – Commodity-Linked, Volatile, Reactive - Closely tied to China’s economic recovery and commodity prices, reacting sharply to global trade disruptions and market sentiment.

- NZD – Resilient, Attractive, Steady - Strengthened by robust domestic growth and a more hawkish central bank stance, making it attractive despite global uncertainties.

- EUR – Resilient, Supported, Optimistic - Buoyed by strong fiscal reforms in Germany and improving sentiment in the Eurozone, despite ongoing inflation risks.

- GBP – Fragile, Uncertain, Under Pressure - Struggling with economic contraction and fiscal deficits, with policy uncertainty and slow growth dampening its momentum.

- CAD – Sensitive, Rangebound, Reactive - Fluctuating amid trade uncertainties, tariff escalations, and moderate domestic policy adjustments, keeping it rangebound.

- CHF – Stable, Safe, Watchful - Remains a bastion of stability and safe-haven demand, supported by a resilient economy and low inflation, even amid global market risks.

Consumer confidence in the U.S. just took a major hit, reaching its lowest level in over two years. According to the University of Michigan's Consumer Sentiment Index, March’s reading fell to 57.9, down sharply from 64.7 in February. This drop was much worse than economists expected, signaling growing concerns about the economy.

Why Is Consumer Sentiment Falling?

- Policy Uncertainty – Consumers and businesses remain cautious about Trump’s economic policies, slowing spending and investment.

- Rising Inflation – Expected inflation surged to 4.9% for next year and 3.9% for the next 5-10 years, pressuring the Federal Reserve.

- Trade War & Tariffs – Trump’s 200% tariff on EU spirits and the EU’s 50% tariff on U.S. whiskey threaten higher consumer prices.

- Stock Market Volatility & Layoffs – A market correction and rising layoff concerns weaken confidence and spending.

Fed Holds Steady, Investors Seek Reassurance Amid Market Volatility

Federal Reserve Chair Jerome Powell faces the challenge of balancing investor concerns while maintaining confidence in the U.S. economy. As markets react to trade tensions and policy uncertainty, the Fed remains in "wait-and-see" mode, signaling readiness to act if necessary.

- Interest Rates: The Fed is expected to hold rates steady, but markets anticipate up to three cuts this year.

- Economic Uncertainty: Investors worry about the impact of tariffs, inflation, and a slowing labor market.

- Powell’s Stance: The Fed seeks more clarity on economic trends before adjusting policy.

- Market Impact: Bond yields have fallen, and the S&P 500 has entered correction territory.

Despite inflation cooling, the Fed remains cautious, emphasizing the need for sustained data before making policy shifts. Powell is set to clarify the Fed’s stance in upcoming projections.

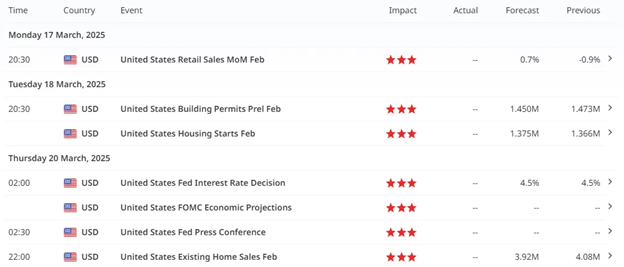

Incoming Red Folders for the US Dollar this Week

Main event for this week is the Fed Interest Rate Decision, anticipating a rate pause as the Fed still assesses economic data whether a cut is still on schedule.

A 4.50% rate pause is already priced in this week.

Market Sentiment Shifts: Volatility & Bonds Signal Risk-On Environment

Volatility Index Easing

The VIX is declining, indicating that market fear is subsiding despite ongoing economic uncertainties, including tariffs and policy risks. This suggests that investors are becoming more comfortable with risk, even as U.S. markets face turbulence.

U.S. Government Bonds Losing Appeal

Treasury yields are stalling, indicating reduced demand for safe-haven assets as investors shift toward a risk-on market environment. The expectation of a Fed rate pause is also contributing to the easing bond market, reinforcing investor confidence in riskier assets.

Risk-On vs. Risk-Off Sentiment

- Risk-On Indicators:

- Lower VIX suggests reduced market fear.

- Bond yields pausing indicates a move toward equities and riskier assets.

- Fed’s expected rate pause reduces pressure on financial markets.

- Risk-Off Triggers to Watch:

- If economic data worsens or inflation surprises to the upside, uncertainty could return.

- Trade war escalations could reignite market volatility.

- A stronger dollar could pressure global liquidity, reversing risk appetite.

Bottom Line

Markets are currently leaning toward risk-on sentiment, but lingering economic uncertainties could shift the balance. Watch for key economic data and trade developments that could tilt sentiment back to risk-off.

How This Impacts the U.S. Dollar

The stalling of Treasury yields and the shift toward a risk-on sentiment could impact the U.S. dollar in several ways:

- Short-Term Weakness

- As investors move away from safe-haven assets like bonds and the dollar, demand for the USD may decline.

- A risk-on environment typically favors higher-yielding assets like equities and emerging market currencies, reducing the dollar’s appeal.

- Fed Rate Pause Impact

- With the market pricing in a Federal Reserve rate pause, expectations of lower yields could weaken the dollar’s carry advantage over other currencies.

- If the Fed signals a dovish stance, the dollar could see further downside pressure.

- Global Trade and Tariff Uncertainty

- While trade tensions can sometimes boost the dollar due to safe-haven flows, a prolonged trade war with Europe could disrupt global demand for U.S. goods, potentially softening the dollar.

- If foreign retaliation leads to reduced investment in U.S. markets, it could further weigh on the currency.

A Crossroads for the U.S. Economy and Dollar

The sharp drop in consumer sentiment is a warning sign for the economy. If confidence continues to fall, it could lead to lower spending, slower growth, and increased recession risks.

For now, the U.S. dollar could see short-term strength due to investor uncertainty. But over the longer term, if inflation stays high and growth slows, the dollar may weaken as rate cut expectations rise.

The Federal Reserve’s next moves will be critical. If inflation expectations keep climbing, the Fed may have no choice but to keep interest rates elevated longer than expected—which could either support the dollar or trigger market turmoil.

Dollar Struggles to Regain Strength

Daily

Dollar is still on weak side as it hovers below the 50% of the range where it broke down.

4-Hour

A breakdown of the 4-hour range could spark a continued downside for the Dollar with targets at 103.20 - 103.00.

JPY: 3-Week Losing Streak

In recent developments, the Bank of Japan (BOJ) has signaled a potential rate cut but ultimately decided to maintain its current policy rate at 0.5%. This decision reflects the BOJ's cautious approach amid global economic uncertainties, particularly those arising from U.S. trade policies under President Donald Trump.

Impact on Risk-On/Risk-Off Sentiment

The BOJ's decision to maintain rates, despite earlier hints at a cut, has several implications for market sentiment:

- Risk-On Sentiment: The decision to hold rates steady may boost investor confidence in Japan's economic stability, encouraging investment in riskier assets such as equities.

- Risk-Off Sentiment: Conversely, the persistence of global trade tensions and the BOJ's cautious stance could lead some investors to seek safe-haven assets, reflecting a more risk-averse attitude.

Weekly

With rate pause already priced in, Yen is also on a “pause” in 3 consecutive weeks as it fails to have a bullish follow-through.

Daily

Yen failed to break through at 773 and currently testing the 755 level which is currently on a bearish territory that could spark a downside move for the Japanese Yen.

USDJPY: USD Gaining Traction over JPY

4-Hour

With Dollar experiencing short-term gains, USDJPY is gaining strength to the upside with price hovering above the 50% of the range and currently testing the resistance level for an upside potential.

A break of 149.20 could trigger USDJPY for a further upside potential.

AUDUSD: Chinese ‘Xi Put’ Boosts Aussie Dollar

China’s Stock Market Surge: How the ‘Xi Put’ is Shaping Global Markets and Boosting AUD & NZD

China’s stock market is experiencing a powerful resurgence in 2025, driven by government stimulus, economic expansion, and rising investor confidence. As Beijing rolls out market-friendly policies and aims for a 5% GDP growth target, foreign capital is flowing back into Chinese equities. This shift is strengthening commodity-linked currencies like the Australian and New Zealand dollars, which rely heavily on China’s demand.

At the same time, economic uncertainty in the US—sparked by protectionist trade policies and recession fears—has further fueled the appeal of China-linked assets, including AUD and NZD.

Commodity Demand Surging: Boost for AUD & NZD

China’s economic recovery has direct implications for commodity-driven currencies like the Australian dollar (AUD) and New Zealand dollar (NZD):

- China's Economic Stimulus: China has launched special initiatives aimed at boosting consumption and raising incomes. These measures are designed to stimulate domestic demand, which can lead to increased imports from trading partners like Australia. Such policies have contributed to the AUD edging higher to around 0.6325 during the early Asian session on March 17, 2025.

- Iron ore prices, Australia’s largest export to China, are rising as infrastructure projects ramp up.

- China’s construction rebound is increasing demand for raw materials, lifting Australia’s mining sector and driving AUD higher.

- Agricultural exports to China, particularly from New Zealand, are seeing renewed strength as China expands food security policies.

- Both AUD and NZD are benefitting from the risk-on sentiment, as China’s recovery eases global recession fears.

Foreign Investment Returning to China

- Global investors have reversed their outflows, with institutional funds pouring back into Chinese equities.

- JP Morgan reported record capital conversions into the Hong Kong dollar and Chinese yuan, signaling strong interest in Chinese markets.

- The valuation gap between Chinese and US stocks remains wide, attracting long-term investors looking for undervalued opportunities.

The Weakening ‘Trump Put’ & US Recession Risks

- US recession fears, heightened by Donald Trump’s tariff policies, have made investors look toward China’s more structured economic approach.

- This has led to a shift in capital flows away from USD and toward AUD, NZD, and other pro-growth assets.

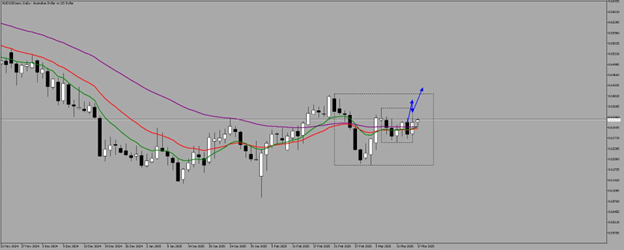

Daily

Aussie continues to go steady as it is still on a positive territory inside the macro and micro range.

4-Hour

A break of 0.63639 is still in play for a potential upside move that could trigger a test of the 0.64083 macro resistance level.

NZDUSD: Imminent Breakout, Outpacing Aussie’s Strength

As of March 2025, New Zealand's economic landscape is showing signs of recovery following a period of contraction. The Reserve Bank of New Zealand (RBNZ) recently lowered the Official Cash Rate (OCR) by 50 basis points to 3.75%, aiming to stimulate economic activity while maintaining inflation within the target range.

New Zealand’s Stronger Economic Data

- NZ GDP growth has been more resilient than expected, reducing recession fears and supporting the currency.

- Business confidence in New Zealand has been improving faster than in Australia, reflecting stronger domestic economic momentum.

- Australian retail sales and labor market figures, while still solid, have shown some signs of slowing, putting slight pressure on AUD.

While recent data indicates past economic challenges, forward-looking projections suggest a gradual recovery supported by accommodative monetary policy and stable inflation. The RBNZ's proactive stance in adjusting the OCR reflects its commitment to fostering economic growth while maintaining price stability.

Diverging Central Bank Outlooks

- The Reserve Bank of New Zealand (RBNZ) has maintained a more hawkish stance, signaling that interest rates may stay higher for longer due to persistent inflation risks.

- The Reserve Bank of Australia (RBA), on the other hand, has turned more neutral, with markets anticipating potential rate cuts sooner than in New Zealand.

- This policy gap makes NZD more attractive to investors seeking yield differentials.

Daily

As New Zealand’s economy remains strong, further upside potential for the Kiwi dollar is likely. Despite global trade disruptions and tariffs, it continues to demonstrate resilience against external shocks.

Kiwi is trading near the macro resistance level which could be tested in the coming days.

4-Hour

A break of 0.57597 could trigger price to trade to and through 0.57722 level.

EURUSD: Gaining Traction After Germany’s “Done-Deal” with the Greens

As of March 17, 2025, the Eurozone shows signs of economic recovery, while the British pound navigates a complex landscape shaped by inflation trends and political stability.

Germany's Historic Debt Deal: A Paradigm Shift in Fiscal Policy

On March 14, 2025, Germany's leading political parties reached a landmark agreement to overhaul the nation's fiscal framework, signaling a significant shift from its traditional fiscal conservatism. This consensus aims to bolster defense capabilities and stimulate economic growth through substantial investments in infrastructure.

Key Components of the Agreement:

- Relaxation of the Debt Brake: The agreement proposes exempting defense and security expenditures exceeding 1% of Germany's Gross Domestic Product (GDP) from the constitutionally mandated debt brake. This exemption allows for increased borrowing to enhance military readiness and address emerging security challenges.

- €500 Billion Infrastructure Fund: A special fund amounting to €500 billion has been established to finance infrastructure projects over the next decade. This initiative aims to modernize Germany's infrastructure, thereby stimulating economic growth and job creation.

- Allocation for Climate Initiatives: To secure the support of the Green Party, €100 billion from the infrastructure fund has been earmarked for the Climate Transformation Fund. This allocation underscores Germany's commitment to addressing climate change and facilitating the transition to sustainable energy sources.

Implications for Germany and Europe

This fiscal policy shift represents a departure from Germany's longstanding adherence to strict budgetary discipline. By permitting increased borrowing for defense and infrastructure, Germany aims to enhance its military capabilities and stimulate economic growth.

Immediate Euro Appreciation

- The euro strengthened against major currencies, particularly the U.S. dollar (EUR/USD) and British pound (EUR/GBP), as investors viewed Germany’s increased spending as a pro-growth policy shift.

- The market perceived the relaxation of Germany’s strict fiscal rules as a signal of higher government investment, which could boost economic growth in the Eurozone.

- EUR/USD surged above 1.10, reflecting renewed confidence in European financial stability.

GBPUSD: Faces Uncertainty Amid Economic Slowdown and Fiscal Challenges

GDP Contraction

In January 2025, the UK's Gross Domestic Product (GDP) contracted by 0.1%, missing market expectations of modest growth. This decline was primarily driven by a 0.9% fall in production output, with the manufacturing sector, especially basic metals and metal products, being significant contributors to this downturn.

Rachel Reeves' Budget Deficit and Its Impact on the British Pound (GBP)

Chancellor Rachel Reeves is currently grappling with a budget deficit that has significant implications for the British Pound (GBP). The interplay between fiscal challenges and currency valuation is complex, influenced by economic performance, fiscal policy, and market perceptions.

Current Fiscal Situation

- Budget Deficit: Recent analyses indicate that Reeves' fiscal headroom has transformed into a £4.4 billion deficit, necessitating potential tax increases or spending cuts to adhere to fiscal rules.

Impact on the British Pound

- Currency Depreciation: The fiscal deficit and economic contraction have contributed to a depreciation of the GBP, reflecting diminished investor confidence in the UK's fiscal health.

Rachel Reeves' budget deficit poses significant challenges for the British Pound. The government's response, balancing fiscal consolidation with growth stimulation, will be pivotal in determining the pound's trajectory.

Bank of England (BoE) Interest Rate Decision

Source: BoE

The BoE's Monetary Policy Committee is scheduled to announce its interest rate decision on March 20, 2025. Current market expectations suggest that the BoE will maintain the base rate at 4.5%, with a 95% probability of no change. However, projections indicate a 77% chance of a rate cut in May and a 55.6% chance in August, reflecting growing concerns about economic growth and inflation dynamics.

Daily

The British Pound's upward momentum stalled for three consecutive days as the Euro gained traction, driven by economic developments, particularly increased German defense spending.

4-Hour

On the 4-hour chart, the Pound lacks significant upside momentum, pressured by the Euro's stronger pace.

We are still looking for price to trade through the 1.2950 level to gain traction for upside potential. Target is still at 1.30478.

Red Folders for Pound this Week

The rate pause is already factored in, while the unemployment rate is expected to increase by 0.1%.

USDCAD: Loonie Steady as Markets Factor in Rate Pause and Labor Market Shift

The Canadian economy faces challenges from trade uncertainties and domestic policy shifts. The Bank of Canada's monetary easing aims to alleviate financial pressures, but concerns about inflation and economic growth persist.

Double Levy Threats “Threatens” Loonie’s Upside Potential

President Donald Trump announced plans to double tariffs on Canadian steel and aluminum imports to 50% in response to Ontario's electricity surcharge on U.S. states. This escalation has heightened fears of a potential "Trumpcession," leading to significant declines in global stock markets.

Bank of Canada's Interest Rate Cut

On March 13, 2025, the Bank of Canada reduced its main interest rate by 25 basis points to 2.75%. This decision aims to mitigate the economic impacts of escalating trade tensions between the U.S. and Canada. The central bank faces the challenge of balancing economic support with the risk of tariff-induced inflation.

Daily

USDCAD remains in a volatile zone, with uncertainty prevailing. Without a decisive break in either direction, positioning too early could carry higher risks.

Canadian dollar's recent movements are closely tied to domestic monetary policies and external trade relations, particularly with the United States. Ongoing developments in these areas will likely continue to influence the CAD's trajectory.

USDCHF: Stability Amid Global Uncertainty

Daily

4-Hour

The Swiss Franc (CHF) continues to exhibit resilience as investors seek safe-haven assets amid economic uncertainties.

Swiss Economy & Inflation Trends

- Switzerland’s economy remains relatively stable, supported by a robust financial sector and strong external trade balances.

- Inflation levels are modest, giving the SNB room to maneuver its monetary policy without aggressive interventions.

Technical Outlook

- A break of Friday’s high could trigger a downside pause for USDCHF, benefitting the Dollar for upside strength.

- A break of Friday’s low with Dollar index continued weakness could send the USDCHF for new lows.

Weekly Trading Quote

"Markets can remain irrational longer than you can remain solvent." — John Maynard Keynes

The market isn’t always logical, and expecting it to behave rationally can be a dangerous assumption. Economic data may suggest one outcome, but price action often tells a different story. Traders who stubbornly stick to their biases—whether it’s expecting the Fed to cut rates or assuming a correction must happen—often find themselves caught on the wrong side of a trade.

Take recent market conditions as an example: despite weakening consumer confidence and inflationary pressures, equities may still rally, or the U.S. dollar may defy expectations. Why? Because market sentiment, liquidity flows, and institutional positioning can override fundamental logic.

Actionable Approach:

Since markets can remain irrational longer than traders expect, the key is to trade based on confirmation, not expectation:

- Wait for technical validation—instead of predicting reversals, let price action confirm a shift with clear breakouts, retests, or momentum signals.

- Use stop-loss levels wisely—avoid emotional bias by setting risk parameters based on structure, not assumptions about what "should" happen.

- Adapt to market conditions—if a fundamental outlook isn’t aligning with price movement, reassess and adjust rather than holding onto losing trades.

Rather than fighting the market, traders must learn to adapt, trade what they see, and respect price action.

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.