Soft CPI, Hawkish Rivals: Why the Dollar Slid Against EUR, GBP, CAD, and CHF

2025-04-15 10:57:36

Overview

The U.S. dollar softened noticeably this week as fresh data and central bank signals pointed to a less aggressive Federal Reserve stance ahead. A cooler-than-expected U.S. CPI report for March underscored easing inflation pressures, reinforcing bets that the Fed may hold off on further rate hikes – or even consider cuts later in the year.

EURUSD – Euro Surges as U.S. Inflation Cools

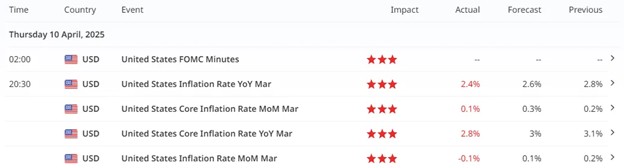

- March U.S. CPI slowed to 2.4% y/y, sparking speculation of a Fed pause or rate cuts.

- A 90-day tariff delay improved risk sentiment, allowing EUR/USD to push to multi-month highs.

GBPUSD – Pound Gains Despite Tariff Exposure

- Strong UK GDP (+0.5% in Feb) reduced near-term BoE rate cut expectations.

- Ongoing 10% U.S. tariff threat on UK goods limits GBP upside despite dollar weakness.

USDCAD – Loonie Strengthens on Trade Exemption

- Canada avoided new U.S. tariffs, preserving export outlook under USMCA.

- Fed’s dovish tilt and strong CAD flows pushed USD/CAD to five-month lows.

USDCHF – Swiss Franc Soars on Safe-Haven Demand

- Risk aversion from tariff headlines drove flows into CHF as a safe haven.

- Fed’s softer tone and falling yields fueled a steep USD/CHF drop to decade lows.

Meanwhile, global markets whipsawed on shifting trade war headlines and central bank commentary. The net result was broad USD weakness, with the dollar index plumbing multi-month lows as currencies like the euro, pound, Canadian dollar, and Swiss franc gained ground.

EUR & GBP Tanking vs USD

For more analysis on the Dollar, check out my previous contents:

Dollar Weakness on Major Pairs

EURUSD – Euro Climbs as Soft U.S. Inflation Stokes Fed Pause Speculation

EURUSD continued to surge, rallying to its highest levels in nearly two years after U.S. inflation came in cooler than anticipated. The March U.S. Consumer Price Index fell to 2.4% year-over-year, down from 2.8% in February

This softer CPI reading – alongside a mere +0.1% core inflation print (2.8% y/y) – bolstered the case that the Federal Reserve’s rate hikes are taming price pressures.

Eurozone Easing Inflation - Rate Cut Ahead?

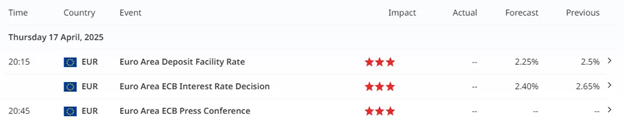

Euro area inflation has also been easing and growth remains fragile, leading the European Central Bank into an easing cycle. The ECB has cut rates six times over the past year, bringing the deposit rate down to 2.50%, and officials have signaled another possible 0.25% cut at the April 17 meeting.

- Euro gets a boost despite ECB easing bias: ECB policymakers signaled the case for another rate cut at next week’s meeting has “clearly strengthened” amid growth risks

- Trade war reprieve aids sentiment: A 90-day pause on new U.S. tariffs announced mid-week improved global risk mood and sparked a broad dollar sell-off

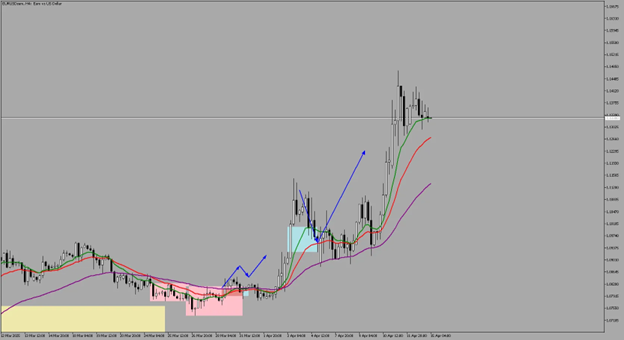

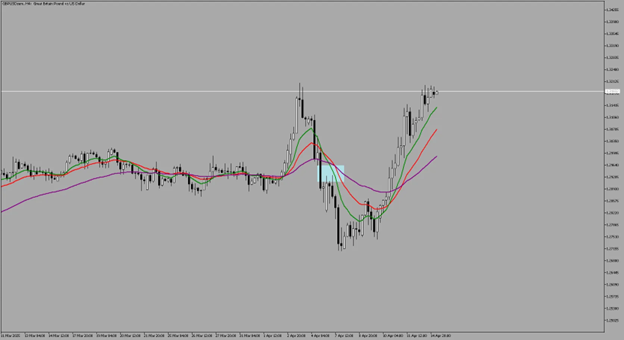

4-Hour

Potential Scenario

- 1.12416 - 1.12924 Bounce opportunity for long bias.

- If level fails, we might see deeper pullback with EUR.

GBPUSD – Sterling Rises on Strong UK Growth Data and Weaker Dollar, Despite Tariff Jitters

The British pound rallied against the U.S. dollar last week with Pound still holding ground at the new week open, riding on both encouraging domestic data and the broader USD downturn.

At the end of last week, UK GDP on a MoM basis released a positive print with UK GDP grew 0.5% in February, the fastest monthly expansion in 11 months. This much-stronger-than-expected growth print placed the UK economy on a firmer footing heading into spring. It also led investors to trim expectations for Bank of England rate cuts later this year – if the economy is proving resilient, the BoE can afford to keep its policy rate at 4.50% for longer.

Tariff Threats still an On-Going Issue Despite GDP Growth

BoE officials, including Deputy Governor Sarah Breeden, warned that Trump’s new tariffs could have a “chilling effect” on UK output if they persist With the UK directly facing a 10% blanket U.S. import tariff (unlike the EU which got a temporary reprieve), the pound’s upside was tempered by fears of trade fallout.

As the week progressed, USD weakness became the dominant theme, allowing GBPUSD to push higher. The soft U.S. CPI print and ensuing speculation of a Fed pause drove the dollar lower across the board – and sterling was no exception. By Thursday, the pound was up roughly 1% on the day, nearing $1.30 in its biggest one-day jump in over a month.

BoE is likely to stay on hold in the coming meetings, and the pound’s fate near-term will hinge on how U.S. dollar trends evolve and whether risk appetite can be sustained.

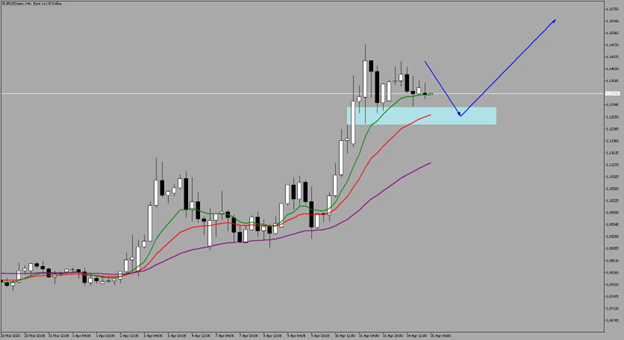

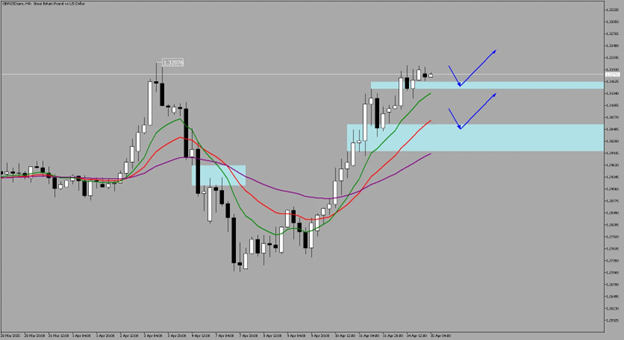

1.32076 Target Ahead

1.32076 - Previous Key High - is still our target.

Potential Scenario

- 1.31451 - 1.31619

- 1.29960 - 1.30603

Levels outline can be potential bounce levels for upside move on Pound.

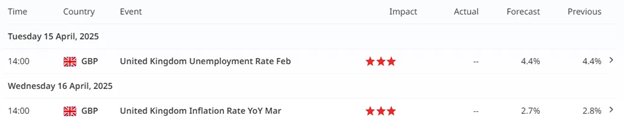

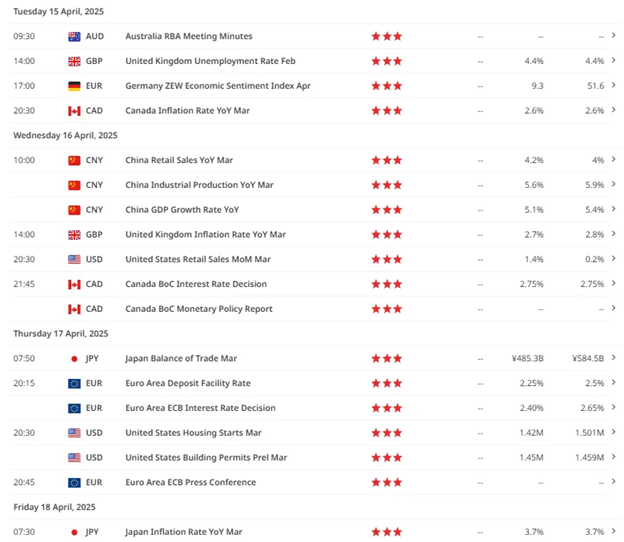

Key Market Driver This Week

We are looking at a stable number with Unemployment rate and Inflation. A number deviating lower than the forecast and previous could be a negative impact on the British pound.

USDCAD – Loonie Edges to Fresh Lows as Trade Relief and Fed Doves Sink USD

The Canadian dollar was a standout performer this week, surging against its U.S. counterpart and sending USDCAD to five-month lows.

Several forces aligned in Canada’s favor:

- U.S. administration’s tariff U-turn largely spared Canada from new trade penalties: President Trump imposed a blanket 10% tariff on most countries, but Canada (and Mexico) won exemptions for goods covered under USMCA – meaning most Canadian exports avoid the new tariffs.

- Cooling U.S. inflation and a potentially pausing Fed: With the dollar in retreat after the soft CPI, commodity-linked currencies like the Loonie found additional support.

- The anticipation of a BoC pause: The Bank of Canada, which cut rates in March, may hold fire at its April meeting. Markets see about a 60% chance the BoC pauses its easing campaign on April 15.

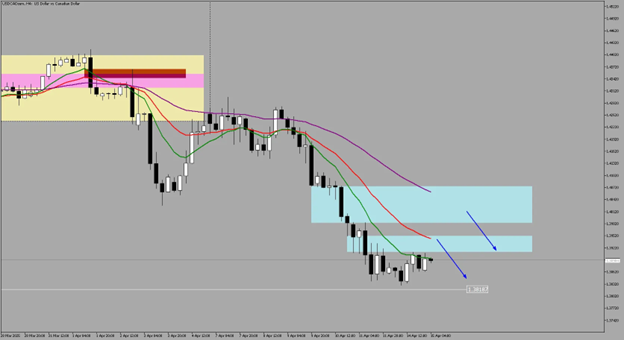

Daily

With CAD gaining traction over the Dollar, and we’ve been calling this out for weeks already, we might see further downside for the USDCAD and may potentially reach the 1.38187 level.

4-Hour

Potential Rebound Levels for Downside Continuation

- 1.39114 - 1.39515

- 1.39838 - 1.40749

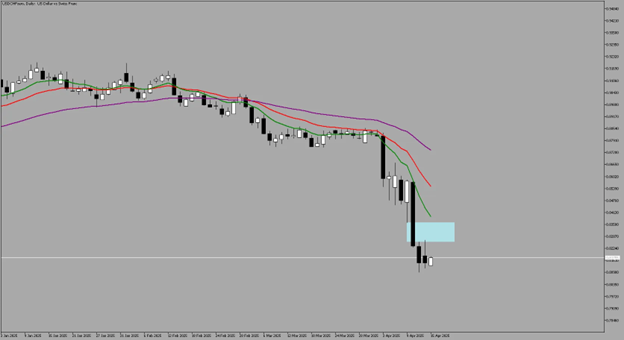

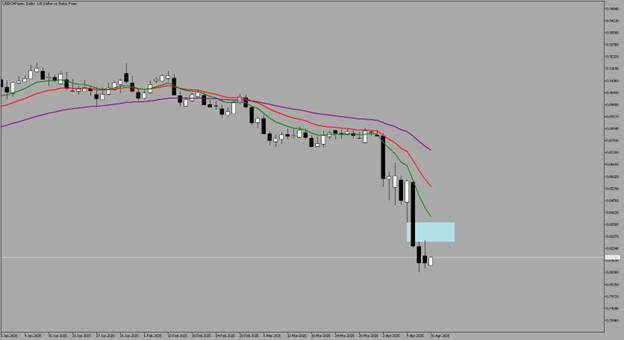

USDCHF – Dollar Plunges to Historic Lows vs Swiss Franc as Safe-Haven Demand Surges

The traditionally safe-haven Swiss franc lived up to its reputation the previous week, strengthening dramatically as global uncertainty sent investors flocking to safety.

USDCHF collapsed to levels not seen in a decade – briefly trading around 0.8250 CHF per USD reaching new lows at 0.80993– as a confluence of factors pressured the Dollar.

President Trump announced hefty tariffs on dozens of countries (and China hit with even steeper duties), market turmoil ensued: stocks sold off and the Swiss franc soared to its highest level of 2025 against the dollar, euro, and pound.

With Switzerland seen as a safe harbor in times of global stress, capital flowed into the CHF. Mid-week, Trump’s partial tariff reversal (a 90-day pause for most nations) caused a brief dip in the franc as risk sentiment improved.

Swiss Remains at a Bullish Momentum

The SNB is under pressure as the stronger franc tightens financial conditions. While Swiss inflation is barely above zero, the central bank has signaled it’s ready to act if needed, including the return of negative rates. For now, USDCHF remains in a freefall, with risk sentiment and Fed expectations the main drivers.

Potential Scenario

- Bearish Reaction at: 0.82577 - 0.83594 Level

What to Watch This Week – April 15–22

Check out my previous contents as forecasts are now materializing:

https://acy.com/en/market-news/market-analysis/major-forex-pairs-analysis-j-o-03312025-165328/https://acy.com/en/market-news/market-analysis/global-sell-off-forex-majors-turmoil-trade-tensions-j-o-04072025-145734/

Check Out Our Market Education

Learn how to navigate yourself in times of turmoil. Check out my market education links:

Want to learn how to trade like the Smart Money? Check out my new contents:

https://acy.com/en/market-news/education/smc-playbook-series-beginners-guide-j-o-04032025-155530/

Follow me on LinkedIn: https://www.linkedin.com/in/jasperosita/

Join me in Discord: https://discord.gg/G8f7a5RnaF

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.