All Eyes on the Fed: EUR/USD Technical Setup Before the Break

2025-06-17 18:10:50

- EUR/USD is range-bound between 1.1630–1.1490, awaiting direction from tomorrow’s FOMC rate decision.

- Bullish case: A dovish Fed or soft tone from Powell could trigger a breakout above 1.1585 toward 1.1600–1.1630.

- Bearish case: A hawkish stance or reaffirmed “higher for longer” narrative may drive price back to 1.1500 and below.

All Eyes on the Fed

EUR/USD is currently trading within a range between 1.163 - 1.149 level. showing signs of indecision as traders await the FOMC rate decision.

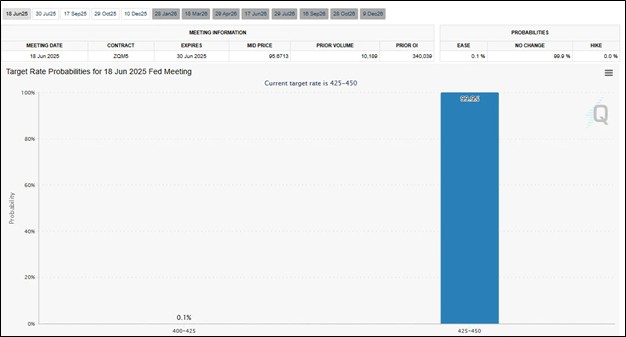

The Federal Reserve’s interest rate decision will be a critical event for EUR/USD. While markets broadly expect the Fed to hold rates steady, the focus will be on:

- The tone of the policy statement

- Any shift in the dot plot

- Powell’s press conference language

Last week’s soft U.S. CPI report renewed market speculation of rate cuts later this year. However, during the June 13 FOMC update, the Fed surprised traders by projecting only one cut in 2025 instead of the previously expected two. This hawkish stance caused short-term dollar (DXY) strength, but traders remain skeptical.

Bullish Scenario: Sweep + Reclaim = Expansion

If the Fed’s tone tomorrow is more dovish than expected, or if Powell leaves room for a cut in September, the dollar could weaken, pushing EUR/USD higher.

- 4-Hour FVG Holds 1.15443 - 1.15697

- Break of Bearish 4-Hour FVG 1.15638 - 1.15783

- EUR/USD trades above equilibrium of the range

- Dovish Fed

Targets:

- 1.1631 → breakout level

- 1.1600 → psychological level

Bearish Scenario: FVG Rejection + Breakdown

If Powell doubles down on the “higher for longer” narrative or pushes back against market expectations for cuts, the dollar could gain, sending EUR/USD lower.

- Bearish 4-Hour FVG 1.15638 - 1.15783 Holds

- Bullish 4-Hour FVG 1.15443 - 1.15697 Breaks

- Equilibrium or 50% of the range holds and acts as a resistance

- Hawkish Fed

Targets:

- 1.1500 → psychological level

Neutral Bias Until FOMC Clarity

Price is currently sandwiched between 1.163 - 1.149, a known liquidity trap. Institutions often let price hover in these zones until the catalyst hits. This range is engineered to trap early buyers and sellers. Do not chase either side until the market shows intent after the FOMC.

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.