Understand the Stochastic Oscillator Indicator in Forex Trading

2023-07-06 12:20:47

In forex trading, there are numerous technical indicators that traders can utilise to forecast price movements. Once traders become proficient in using basic indicators, they can progress to learning more advanced ones, as incorporating additional tools can enhance the accuracy of future price predictions.

In this forex trading guide, we will delve into the Stochastic Relative Strength Index (RSI), an advanced variation of the standard RSI indicator. We will provide a comprehensive explanation of this indicator, including its calculation, its application in the forex market, the distinctions between the RSI and Stochastic Oscillator, and much more.

Join us as we explore the ins and outs of this powerful indicator!

What is a Stochastic Oscillator?

The Stochastic Oscillator is a technical indicator used in the forex market to predict trade entry and exit times based on data collected about a currency pair. It combines two indicators, Stochastic and RSI, to assess the overbought and oversold conditions of the asset.

The stochastic oscillator formula, created by Dr. George Lane in 1950, examines the relationship between the closing price of an asset and its low and high range over a specific period.

The concept of the Stochastic Oscillator was introduced by Tushar Chande and Stanley Kroll in their book "The New Technical Trader" in 1994. This sub-indicator not only helps define the prevailing market trend but also assists in identifying overbought and oversold conditions for the currency pair.

As an oscillator, its value falls within the range of 0 and 100 or moves above or below the centre line.

Stochastic Oscillator Formula

The STOCHRSI formula is used to calculate the Stochastic Oscillator indicator. It is derived by applying the Stochastic formula directly to the RSI values instead of the price levels of an asset.

The formula is as follows:

Stoch RSI = (Current RSI - Lowest RSI) / (Highest RSI - Lowest RSI)

In this formula, the Lowest RSI represents the lowest RSI reading over the last 14 periods, while the Highest RSI represents the highest RSI reading over the same 14 periods. These periods are typically based on the chosen timeframe, such as 14 days on a daily chart or 14 months on a monthly chart.

The standard settings for the Stochastic Oscillator are based on 14 periods, but traders can adjust them according to their preferences.

Using Stochastic Oscillator Charts: A Step-by-Step Guide

Here is how you can add the Stochastic Oscillator to the chart on the Finlogix.

Step 1: Select an indicator from the available choices displayed in the chart below.

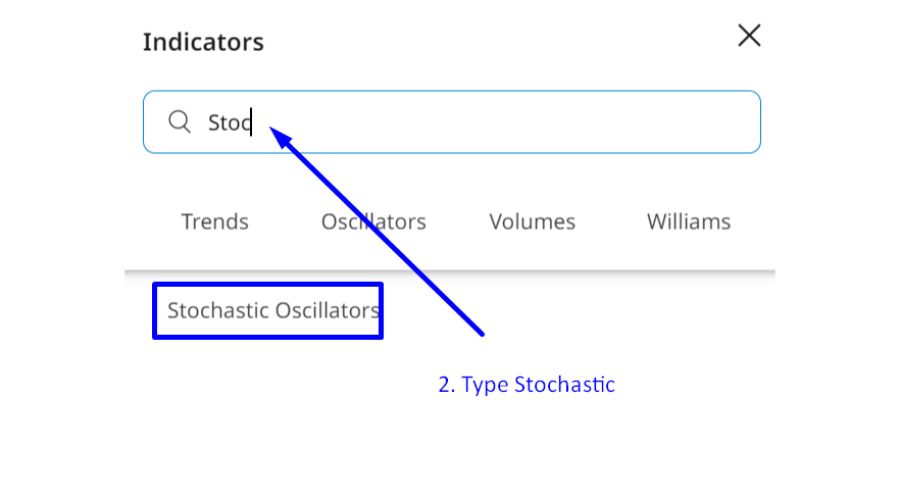

Step 2: Enter "Stochastic Oscillator" in the search bar, and the indicator will be displayed in the list of available indicators.

Step 3: Select the Stochastic Oscillator from the list of momentum indicators, and it will be applied to your chart automatically.

Understanding the Stochastic Oscillator: A Step-by-Step Guide

Interpreting the results of the Stochastic Oscillator in the forex market is straightforward and like the rules of the simple RSI. Unlike the RSI, which ranges from 0 to 100, the Stochastic indicator also uses a range of 0 to 100. The centre line is drawn at the level of 50. However, the thresholds for overbought and oversold conditions differ. When the indicator value exceeds 80, it suggests that the asset is in an overbought market, while a value below 20 indicates an oversold condition.

If the Stochastic Oscillator signals that the asset is moving towards the oversold zone, it implies a potential buying opportunity as the price is expected to increase. Conversely, if the indicator rises above the overbought zone, it suggests a potential selling opportunity, as there is a higher likelihood of a price decrease.

Divergence points can also be identified by observing the Stochastic Oscillator. Look for patterns where the Stochastic indicator line and the trend line provide conflicting signals. This is known as divergence. For example, if the Stochastic indicator line shows an upward trend while the trend line indicates a bearish trend, it indicates divergence. Such divergences can occur in both directions and are useful in predicting a potential weakening of the prevailing market trend and a potential reversal.

When the Stochastic Oscillator is applied to a price chart in the forex market, a white line called the %K line is displayed below the chart. Additionally, a red line representing the 3-period moving average of %K, known as the %D line, also appears.

Using the Stochastic Oscillator in Forex Trading

Here are some strategies employed in forex trading using the Stochastic Oscillator to anticipate the future price momentum of a currency pair.

Overbought/Oversold Strategy

To determine entry and exit levels for trades, traders use this fundamental strategy. Typically, traders observe the currency's movement crossing the overbought or oversold levels. This helps them generate trading ideas, whether to go long or short in the market.

Sell Signal: Overbought Stochastic Oscillator Indicator

When the Stochastic Oscillator indicates that the forex currency pair is overbought (Stochastic value above 80), traders may consider opening a short position.

Buy Signal: Oversold Stochastic Oscillator Indicator

Conversely, if the indicator signals that the currency is oversold (Stochastic value below 20), traders may interpret it as a buy signal.

However, it is important to note that these signals can sometimes be false. The Stochastic Oscillator's levels (80 and 20) only indicate overbought or oversold conditions within the specific periods. It is not guaranteed that a currency will automatically increase or decrease in value based solely on the Stochastic indicator.

Therefore, it is recommended to use multiple technical analysis tools and indicators rather than relying solely on one indicator when analysing a forex currency's technical aspects.

Divergence Strategy: Using Stochastic Oscillator in Forex Trading

The Stochastic Oscillator is also employed in the forex market to identify divergences in price, serving as a valuable strategy to detect potential reversals in market trends. This approach involves examining whether a currency pair is reaching new highs or lows while the Stochastic moves in the opposite direction. Divergences of this kind help traders identify signals for potential trend reversals.

Bullish and bearish divergences are the two main types. A bullish divergence occurs when the currency price is making lower lows while the Stochastic Oscillator is forming higher lows. Conversely, a bearish divergence occurs when the price is making higher highs while the Stochastic Oscillator is making lower highs.

It is important to note that a divergence on the chart does not necessarily mean an immediate reversal in price. Traders must validate the divergence using other indicators before making trading decisions. This confirmation process ensures a more reliable analysis and increases the likelihood of successful trades when employing the divergence strategy with the Stochastic Oscillator in the forex market.

Crossover Strategy: Utilising Stochastic Oscillator Crossover in Forex Trading

Forex traders also employ the Stochastic Oscillator crossover strategy to identify robust signals in the market. This strategy is highly popular as it incorporates multiple technical indicators and generates stronger signals compared to other approaches. The crossover occurs when the two lines intersect each other within the overbought or oversold zone.

Interpreting a crossover is relatively straightforward. A buy signal is generated when the rising %K line crosses above the %D line within the oversold zone. Conversely, a sell signal is triggered when the declining %K line crosses below the %D line within the overbought zone.

However, it is crucial to note that these crossover signals are most effective and reliable when the market is moving within a range. In trending markets, the signal's potency may weaken, making it riskier to execute trades solely based on these signals. Traders should exercise caution and consider additional factors in a trending market to enhance the effectiveness of the crossover strategy with the Stochastic Oscillator in forex trading.

Bull/Bear Strategy

The setups for bullish and bearish trades in the forex market can also be identified using the stochastic oscillator. This strategy is widely employed by forex traders and bears similarities to the divergence strategy.

For a bullish trade setup, traders observe the Stochastic oscillator indicating higher highs while the forex currency price exhibits lower highs. This suggests that the price may continue to rise due to the increasing momentum. Traders typically look for a short-term price pullback and enter a buy trade when the Stochastic oscillator drops below 50 but subsequently rises.

On the other hand, a bearish trade setup occurs when the Stochastic oscillator shows lower lows while the forex currency pair’s price displays higher lows. This indicates heightened selling pressure in the market and suggests that the currency price may decline. In such instances, traders open sell trades to capitalize on the downward price movement.

It is recommended for traders to utilise various technical tools to validate the trade signals generated by the Stochastic oscillator, as false signals can sometimes occur.

Bottom Line

Ultimately, the Stochastic Oscillator can prove to be a valuable technical indicator in the forex market, despite its limitations. With its higher speed and sensitivity to market movements, it offers advantages over the simple RSI, particularly for traders seeking strong signals. However, it is not advisable to rely solely on a single indicator. We recommend using a combination of multiple technical tools to generate even stronger trade signals.

As the forex market gains increasing attention, traders in this highly volatile market strive to exercise caution. They often employ numerous technical indicators to predict future prices. Including the Stochastic Oscillator in their repertoire of technical indicators can enhance their ability to generate robust signals and capitalize on the market's volatility. Divergence, crossover, and bull/bear strategies are some of the common strategies that forex traders employ with the Stochastic oscillator in the forex exchange market.

Additionally, traders can complement the Stochastic Oscillator with other technical indicators, such as trend lines and price formations like wedges and triangles. By incorporating these tools into the price chart, traders can establish valid trend lines and wait for price breakouts, confirming these moves with the Stochastic Oscillator before executing trades accordingly.

When considering forex trading, it is important to choose a reliable and reputable broker. ACY Securities is a well-known award-winning forex broker that offers a range of tradable products and platforms to cater to the needs of traders. As a regulated broker, ACY Securities provides a secure trading environment and access to various markets, enabling traders to make informed decisions based on technical indicators like the Stochastic Oscillator.