Trading Journal Monthly Review: How to Turn 30 Days of Data Into Growth

2025-12-12 10:13:28

A weekly review shows you what happened.

A daily review shows you how you behaved.

But a monthly review reveals something deeper - the true direction your trading is heading.

Most traders never zoom out far enough to see the bigger picture, which is why their performance feels random. A monthly review organizes your journaled data, emotional notes, screenshots, and trade logs into a performance narrative - similar to what you build through structured backtesting and forward testing.

This is how professional traders find real edge, refine their strategy, and strengthen the psychological foundations taught in guides like Trading Psychology: Controlling Yourself and Identity-Based Trading.

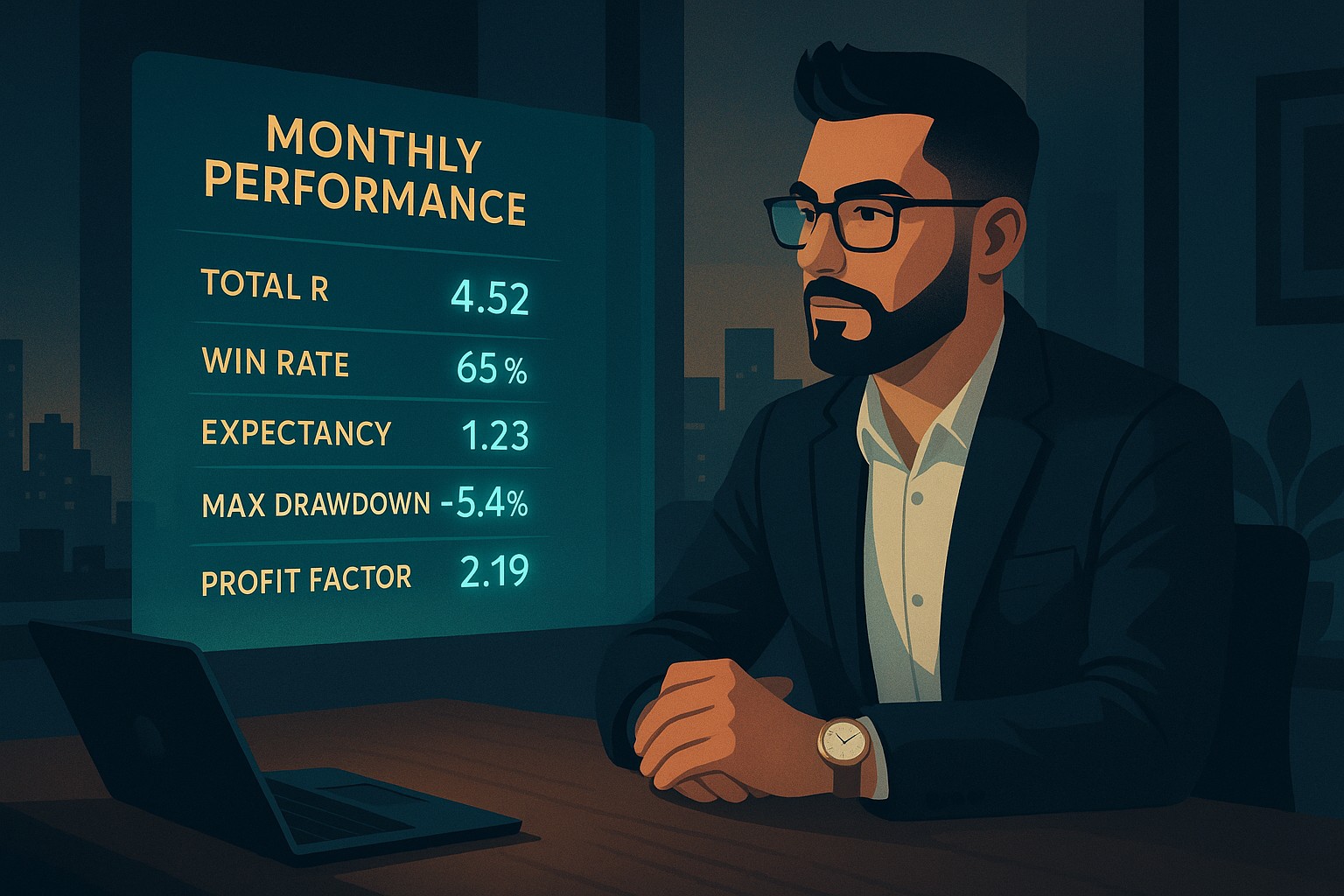

1. Monthly Data Summary - Your True Performance Snapshot

Collect your core metrics:

- Total trades

- Win rate

- Loss rate

- Average R

- Total R

- Expectancy

- Profit factor

- Maximum drawdown

- Recovery time

- System adherence

These metrics only start making sense when you compare them to last month - just like how markets only make sense when viewed through proper trend identification and macro structure rather than one candle at a time.

Your monthly summary reveals whether:

- Your strategy is improving

- Your emotional stability is increasing

- Your risk management is consistent (or needs reinforcement from guides like *Why Risk Management Is the Only Edge That Lasts)

- Your overall performance curve is trending upward

This is your trading “health report.”

2. Setup Profitability Breakdown - Your System’s Real Engine

Your strategy is not one system - it is a collection of setups, each with its own performance profile.

For each setup, measure:

- Frequency

- Win rate

- Average R

- Drawdown contribution

- Market conditions where it works best

- Times of day when it performs well

This helps you refine your system the same way you refine execution using frameworks like the Confirmation Model (OB + FVG + Liquidity Sweep).

You will often discover:

- 70–90% of your profits come from 1–2 setups

- Some setups work only in NY session or only after a liquidity sweep

- Some setups drain your account through repeated small losses

By focusing on high-expectancy setups and filtering out weak ones, you increase consistency - a principle reinforced in The Disciplined Trader Blueprint.

3. Market Condition Performance - When You Are At Your Best

Your performance changes with the environment.

Review how you traded in:

- Trends

- Choppy markets

- High-volatility conditions

- Slow sessions

- Asian vs London vs New York

- Pre-news vs post-news movement

These insights echo the importance of adapting to sentiment taught in How to Trade Risk-On and Risk-Off Sentiment and recognizing how liquidity shifts across sessions the way London Session Trading explains.

This section tells you:

- When you should trade more

- When you should trade less

- Which environments match your personality

- Where your best edge lives

It’s not about trading everywhere - it’s about trading where you are strongest.

4. Behavioral Metrics - Your Psychological Scorecard

This is where breakthroughs happen.

Your monthly behavior review should track:

Emotions

Did you improve your emotional stability, something emphasized in Managing Trading Losses and Execution Psychology?

Biases

Did recency bias spike after a losing streak?

Did overconfidence appear after a big win?

Triggers

Did certain environments, dates, or mistakes lead to rule-breaking?

Habits

- Preparation consistency

- Screenshots

- Journaling

- Adherence to trading routine (as taught in Daily Trading Routine)

Your behavior dictates your R-distribution more than your strategy does.

5. Identity Alignment - Did You Trade Like the Trader You Intend to Be?

Rate yourself monthly on:

- Discipline

- Patience

- Emotional neutrality

- Rule adherence

- Execution confidence

- Risk integrity

Identity-based improvements are the core of consistency - a principle detailed in Identity-Based Trading and The Zen of Trading.

Your system won’t change until you change.

6. System Evolution Summary - What Changed This Month?

Your system must evolve slowly, guided by data, not emotion.

Each month, document:

A. What to Keep

Rules or setups that performed well.

B. What to Fix

Weak rules that need refinements - the same refinement mindset used in Refining Your Trading Edge.

C. What to Remove

Setups, tools, or habits that repeatedly lose.

D. What to Add

Small, validated improvements - never overfitting.

E. What to Reinforce

Behaviors and habits that worked exceptionally well.

This keeps your system alive and improving, just like institutional systems evolve through iterative feedback.

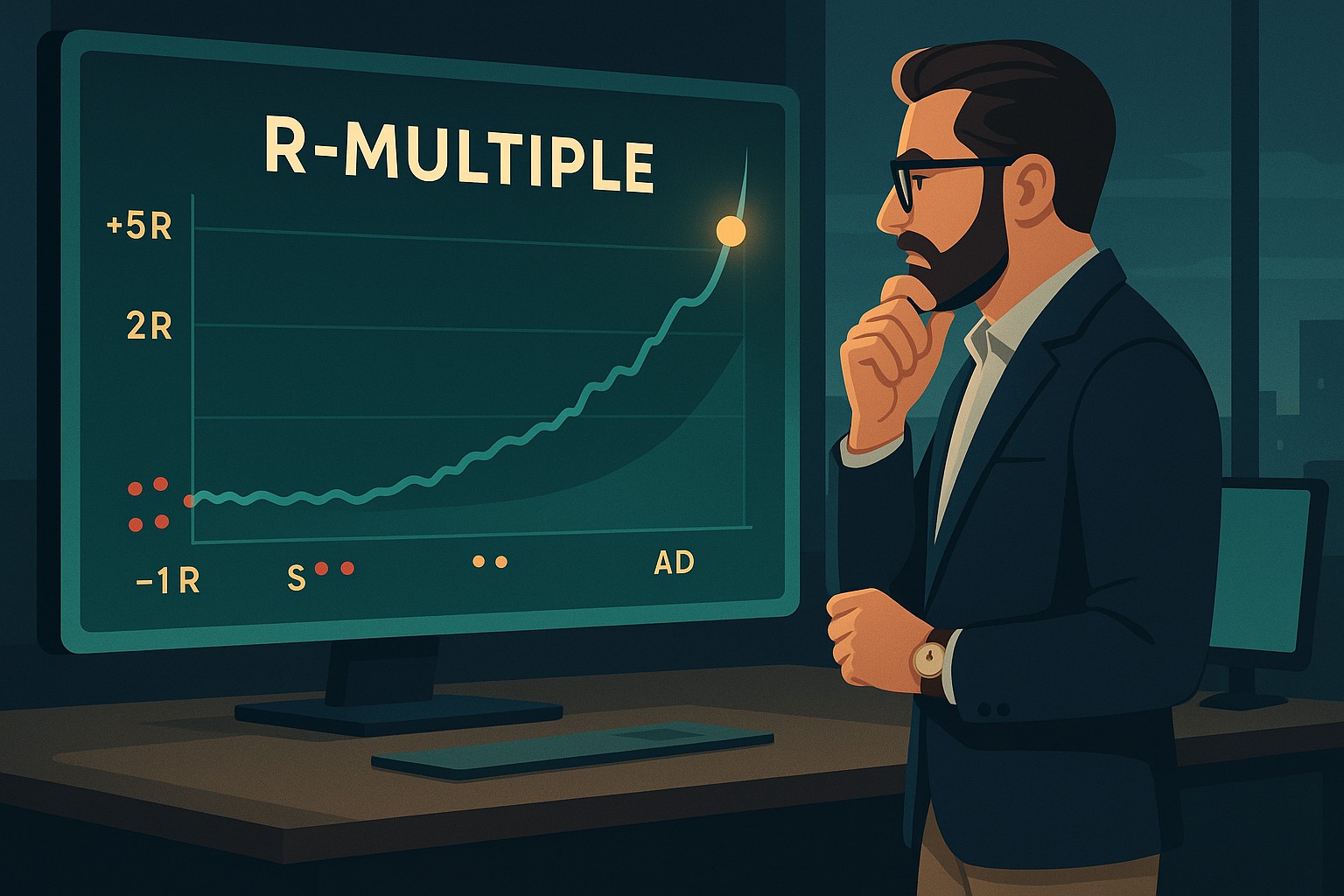

7. R-Distribution Map - The Signature of a Professional Trader

Plot your full month of trades in R-multiples:

- Losses contained to -1R or less?

- Wins reaching beyond +2R or +3R?

- Too many scratch trades?

- Cutting winners too early?

This reveals whether you’re applying the reward-to-risk principles taught in Mastering Risk Management and whether your edge is truly scalable.

If your R-distribution is healthy, your strategy is healthy.

If it is chaotic, your psychology is chaotic.

8. Equity Curve Evaluation - Your Month in One Picture

Your equity curve exposes:

- Smooth climbs → discipline

- Sudden spikes → greed

- Sharp drops → impulse

- Long flat periods → hesitation

- Chaotic swings → emotional inconsistency

This truth is similar to what traders learn in Why Most Traders Fail - they don’t lose because of strategy, but because of unmanaged internal conflict.

A monthly equity curve is the cleanest mirror of your internal state.

Real-Life Analogy - Gym Progress vs Trading Progress

Just as lifters don’t measure strength rep-by-rep but month-to-month, traders should evaluate performance across cycles:

- Strength = expectancy

- Endurance = discipline

- Recovery = drawdown management

- Technique = execution quality

- Body composition = equity curve shape

Your monthly review shows whether you’re trending toward the trader you aim to become - or drifting.

Final Thoughts

A month of data is not just information - it is a story of your evolution.

When applied consistently, this framework transforms:

- Your system

- Your execution

- Your mindset

- Your identity

- Your equity curve

This is how traders go from inconsistent to professional -

not through more trades, but through higher-quality reflection.

FAQs - Monthly Trading Review & Trading Journal

1. How often should traders perform a monthly review?

A monthly review should be done once every 30 calendar days, ideally on a weekend when markets are closed. This gives you emotional distance and enough historical data to spot patterns in setups, behavior, and performance. Weekly reviews show micro trends; monthly reviews show the real direction of your trading system.

2. What is the most important metric to focus on in a monthly trading review?

While traders obsess over win rate, the most important metric is expectancy because it reveals whether your overall system is profitable over time. A trader with a low win rate but high average R-multiple can outperform someone with 70% win rate but poor risk-to-reward. Expectancy tells the truth win rate cannot.

3. How do I know if my trading system is getting better or worse month to month?

Look at three things:

Your R-distribution (Are winners getting larger? Losers staying controlled?)

Your equity curve (Is it smoother than last month?)

Your behavior score (Are emotional mistakes decreasing?)

If these three improve, your system is strengthening - regardless of whether you had a winning or losing month.

4. Can a losing month still be considered a successful month?

Absolutely. A losing month may reveal major breakthroughs: cleaner execution, better discipline, stronger routines, fewer emotional trades, or improvements in setup selectivity. Profit isn’t the only KPI; your behavior and decision quality matter more for long-term growth. Many traders become profitable after a losing but highly educational month.

5. Should I modify my trading system every month based on the review?

Not necessarily. Monthly reviews help you observe, not overhaul. Professionals evolve their system slowly, based on recurring data - not emotional reactions to one bad week. Only change a rule if you have multiple months of evidence, similar to how you validate strategies via structured backtesting and forward testing.

Start Trading Live!

- Trade forex, indices, gold, and more

- Access ACY, MT4, MT5, & Copy Trading Platforms

It’s time to go from theory to execution!

Create an Account. Start Your Live Trading Now!

Check Out My Contents:

Beginners Path

- Learn Trading From Scratch: Clean, Simple, Zero-Noise

- Introduction to Trading: What Beginners Must Understand

- Choosing Your Trading Market: Forex, Gold, or Indices

- Beginner Trading Strategy: How to Choose One Setup and Commit

- Minimalist Trading Indicators: The Only Tools Beginners Need

- Master Candlestick Entries: Reading Price Action at Key Levels

- Backtesting for Traders: How to Build Skill Fast

- Trading Risk Management: The Real Edge Behind Consistency

- Trading Psychology: How to Control Yourself in the Markets

- Daily Trading Routine: Build Consistency and Discipline Fast

- Scenario Planning: Expect Both Sides

- Beginner Trading Master Guide 2026: The Complete Roadmap to Consistency

Strategies That You Can Use

Looking for step-by-step approaches you can plug straight into the charts? Start here:

- How To Trade & Scalp Indices at the Open Using Smart Money Concepts (SMC)

- How to Trade Breakouts Effectively in Day Trading with Smart Money Concepts

- Complete Step-by-Step Guide to Day Trading Gold (XAU/USD) with Smart Money Concepts (SMC)

- The Power of Multi-Timeframe Analysis in Smart Money Concepts (SMC)

- Forex Trading Strategy for Beginners

- Mastering Candlestick Pattern Analysis with the SMC Strategy for Day Trading

- How to Use Fibonacci to Set Targets & Stops (Complete Guide)

- RSI Divergence Trading Strategy for Gold: How to Identify and Trade Trend Reversals

- Stochastics Trading Secrets: How to Time Entries in Trending Markets using Stochastics

- Gold Trading Stochastics Strategy: How to Trade Gold with 2R - 3R Targets

- RSI Hidden Divergence Explained: How to Spot Trend Continuations Like a Pro

- Moving Averages Trading Strategy Playbook

- Mastering Fibonacci Trading Psychology - Trusting the Levels, Managing the Mind

- Mastering Price Action at Key Levels - How to Spot, Trade, and Win at the Most Crucial Zones

- Mastering Retests: How to Enter with Confirmation After a Breakout

Indicators / Tools for Trading

Sharpen your edge with proven tools and frameworks:

- The Ultimate Guide to Risk Management in Trading - A Complete Compilation for 2026

- Moving Averages Trading Strategy Playbook

- How to Think Like a Price Action Trader

- Mastering Fibonacci Trading Psychology - Trusting the Levels, Managing the Mind

How To Trade News

News moves markets fast. Learn how to keep pace with SMC-based playbooks:

- Why Smart Money Concepts Work in News-Driven Markets - CPI, NFP, and More

- How to Trade NFP Using Smart Money Concepts (SMC) - A Proven Strategy for Forex Traders

- How to Trade CPI Like Smart Money - A Step-by-Step Guide Using SMC

- Learn to Trade News by Backtesting it with Forex Tester

Learn How to Trade US Indices

From NASDAQ opens to DAX trends, here’s how to approach indices like a pro:

- How to Start Trading Indices and Get into the Stock Market with Low Capital 2026 Guide)

- Best Indices to Trade for Day Traders | NASDAQ, S&P 500, DAX + Best Times to Trade Them

- How To Trade & Scalp Indices at the Open Using Smart Money Concepts (SMC)

- NAS100 - How to Trade the Nasdaq Like a Pro (Smart Money Edition)

How to Start Trading Gold

Gold remains one of the most traded assets - here’s how to approach it with confidence:

- How to Swing Trade Gold (XAU/USD) Using Smart Money Concepts: A Simple Guide for Traders

- Complete Step-by-Step Guide to Day Trading Gold (XAU/USD) with Smart Money Concepts (SMC)

- The Ultimate Guide to Backtesting and Trading Gold (XAU/USD) Using Smart Money Concepts (SMC)

- Why Gold Remains the Ultimate Security in a Shifting World

- How to Exit & Take Profits in Trading Gold Like a Pro: Using RSI, Range Breakdowns, and MAs as Your Confluence

- Backtest Gold using Forex Tester Online

How to Trade Japanese Candlesticks

Candlesticks are the building blocks of price action. Master the most powerful ones:

- Mastering the Top Japanese Candlesticks: The Top 5 Candlesticks To Trade + Top SMC Candlestick Pattern

- How to Trade Candlestick Patterns with High Probability: A Complete Guide for Beginners

- The Top Japanese Candlestick Guide: What is an Engulfing Pattern and How to Trade It?

- Piercing Pattern Candlestick Explained: How to Trade It - Step-By-Step Guide

- Morning & Evening Star Candlestick Patterns - How to Trade Market Reversals with Confidence

How to Start Day Trading

Ready to go intraday? Here’s how to build consistency step by step:

- 5 Steps to Start Day Trading: A Strategic Guide for Beginners

- 8 Steps How to Start Forex Day Trading in 2026: A Beginner’s Step-by-Step Guide

- 3 Steps to Build a Trading Routine for Consistency and Discipline - Day Trading Edition

- The Ultimate Guide to Understanding Market Trends and Price Action

- Trading with Momentum: The Best Trading Session to Trade Forex, Gold and Indices

Swing Trading 101

- Introduction to Swing Trading

- The Market Basics for Swing Trading

- Core Principles of Swing Trading

- The Technical Foundations Every Swing Trader Must Master

- Swing Trader’s Toolkit: Multi-Timeframe & Institutional Confluence

- The Psychology of Risk Management in Swing Trading

- Swing Trading Concepts To Know In Trading with Smart Money Concepts

- Becoming a Consistent Swing Trader: Trading Structure & Scaling Strategy

Learn how to navigate yourself in times of turmoil

Markets swing between calm and chaos. Learn to read risk-on vs risk-off like a pro:

- How to Identify Risk-On and Risk-Off Market Sentiment: A Complete Trader’s Guide

- How to Trade Risk-On and Risk-Off Sentiment - With Technical Confirmation

- The Ultimate Guide to Understanding Market Trends and Price Action

- Metals in Risk-On and Risk-Off Environments: How Sentiment Moves Gold and Commodities

Want to learn how to trade like the Smart Money?

Step inside the playbook of institutional traders with SMC concepts explained:

- Why Smart Money Concepts Work: The Truth Behind Liquidity and Price Action

- Mastering the Market with Smart Money Concepts: 5 Strategic Approaches

- Understanding Liquidity Sweep: How Smart Money Trades Liquidity Zones in Forex, Gold, US Indices

- The SMC Playbook Series Part 1: What Moves the Markets? Key Drivers Behind Forex, Gold & Stock Indices

- The SMC Playbook Series Part 2: How to Spot Liquidity Pools in Trading - Internal vs External Liquidity Explained

- Fair Value Gaps Explained: How Smart Money Leaves Footprints in the Market

- Accumulation, Manipulation, Distribution: The Hidden Cycle That Runs Every Market

- Institutional Order Flow - Reading the Market Through the Eyes of the Big Players

- London Session Trading Secrets: How Smart Money Sets the High & Low of the Day

- Mastering the New York Session - Smart Money Concepts Guide

- Anatomy of a Perfect Execution: How SMC Traders Trade with Precision

- Step-by-Step Trading Confirmation Guide for Precise Execution

- Execution Psychology: Turning Hesitation into Confidence

- What Is an Order Block? The Institutional Footprint Explained

- Anatomy of a Valid Order Block in Smart Money Concepts

- How to Draw Order Blocks Accurately - Day Trading Style

- Order Blocks and AMD Market Structure (Smart Money Concepts)

- The Confirmation Model: OB + FVG + Liquidity Sweep (Smart Money Concepts)

Master the World’s Most Popular Forex Pairs

Forex pairs aren’t created equal - some are stable, some are volatile, others tied to commodities or sessions.

- The Top 5 All-Time Best Forex Pairs to Trade

- Top Forex Pairs Beyond the Big Five

- EUR/USD: The King of Forex

- USD/JPY: The Fast Mover

- GBP/USD: The Volatile Cable

- AUD/USD: The Commodity Currency

- USD/CAD: The Oil-Backed Pair

- GBP/JPY: How to Trade The Beast

- Asian & London Session Secrets

- Mastering the New York Session

Metals Trading

- Metals Trading: Why Gold and Metals Are Rising Again

- Silver Trading: The Underdog with Dual Identity

- Gold vs Silver: Institutional Demand Breakdown Explained

- How to Day Trade Silver Like a Pro: Smart Money Tactics for XAG/USD

- Platinum & Palladium: The Quiet Power Duo of Industrial Metals

- How to Trade Metals with SMC and Fundamentals - Gold Trading Strategy

- Metals in Risk-On and Risk-Off Environments: How Sentiment Moves Gold and Commodities

- Future of Metals Market: Gold Forecast 2026 & Long-Term Commodities Outlook

Stop Hunting 101

If you’ve ever been stopped out right before the market reverses - this is why:

- Stop Hunting 101: How Swing Highs and Lows Become Liquidity Traps

- Outsmarting Stop Hunts: The Psychology Behind the Trap

- How to Lessen Risk From Stop Hunts in Trading

- How Stop Hunts Trigger Revenge Trading - Breaking the Pain Cycle

- How to Accept Stop Hunts Without Losing Discipline - Shifting From Frustration to Focus

Trading Psychology

Mindset is the deciding factor between growth and blowups. Explore these essentials:

- The Mental Game of Execution - Debunking the Common Trading Psychology

- Managing Trading Losses: Why You Can Be Wrong and Still Win Big in Trading

- The Hidden Threat in Trading: How Performance Anxiety Sabotages Your Edge

- Why 90% of Retail Traders Fail Even with Profitable Trading Strategies

- Top 10 Habits Profitable Traders Follow Daily to Stay Consistent

- Top 10 Trading Rules of the Most Successful Traders

- Top 10 Ways to Prevent Emotional Trading and Stay Disciplined in the Markets

- Why Most Traders Fail - Trading Psychology & The Hidden Mental Game

- Emotional Awareness in Trading - Naming Your Triggers

- Discipline vs. Impulse in Trading - Step-by Step Guide How to Build Control

- Trading Journal & Reflection - The Trader’s Mirror

- Overcoming FOMO & Revenge Trading in Forex - Why Patience Pays

- Risk of Ruin in Trading - Respect the Math of Survival

- Identity-Based Trading: Become Your Trading System for Consistency

- Trading Psychology: Aligning Emotions with Your System

- Mastering Fear in Trading: Turn Doubt into a Protective Signal

- Mastering Greed in Trading: Turn Ambition into Controlled Growth

- Mastering Boredom in Trading: From Restless Clicking to Patient Precision

- Mastering Doubt in Trading: Building Confidence Through Backtesting and Pattern Recognition

- Mastering Impatience in Trading: Turn Patience Into Profit

- Mastering Frustration in Trading: Turning Losses Into Lessons

- Mastering Hope in Trading: Replacing Denial With Discipline

- When to Quit on Trading - Read This!

- The Math of Compounding in Trading

- Why Daily Wins Matter More Than Big Wins

- Scaling in Trading: When & How to Increase Lot Sizes

- Why Patience in Trading Fuels the Compounding Growth

- Step-by-Step Guide on How to Manage Losses for Compounding Growth

- The Daily Habits of Profitable Traders: Building Your Compounding Routine

- Trading Edge: Definition, Misconceptions & Casino Analogy

- Finding Your Edge: From Chaos to Clarity

- Proving Your Edge: Backtesting Without Bias

- Forward Testing in Trading: How to Prove Your Edge Live

- Measuring Your Edge: Metrics That Matter

- Refining Your Edge: Iteration Without Overfitting

- The EDGE Framework: Knowing When and How to Evolve as a Trader

- Scaling Your Edge: From Small Account to Consistency

- Trading in the Zone: Execution Through Habit and Structure

- Trading in the Zone: Thinking in Probabilities

- The Inner War: Fear, Greed, and the Illusion of Control

- Detachment Discipline in Trading: How to Let Go of the Need to Be Right

- Trading Hack: Why You Keep Breaking Your Own Rules (And How to Stop)

- Trading Mindset Mastery: Building Confidence Through Data

- Flow State Trading: Entering the Zone Through Structure

- Cognitive Traps in Trading: Overconfidence, Recency Bias & Revenge Trades

- The Psychology of Risk in Trading: Fear of Loss vs Fear of Missing Out

- Self-Trust in Trading – Building Confidence from Repetition, Not Just Results

- The Zen of Trading: Becoming the Observer, Not the Reactor

- The Market Is Always Right: Why You Must Adapt, Not Demand

- The Three Stages to Becoming a Consistent Trader

- The Enemy Within: Limiting Beliefs and Emotional Conflict in Trading

- Self-Discipline in Trading: A Skill, Not a Personality Trait

- Mental Energy Management in Trading: Controlling Impulse, Stress, and Overwhelm

- Creating the Disciplined Trader Identity

- The Disciplined Trader: The Complete Blueprint for Consistency

Market Drivers

- Central Banks and Interest Rates: How They Move Your Trades

- Inflation & Economic Data: CPI Trading Strategy and PPI Indicator Guide

- Geopolitical Risks & Safe Havens in Trading (Gold, USD, JPY, CHF)

- Jobs, Growth & Recession Fears: NFP, GDP & Unemployment in Trading

- Commodities & Global Trade: Oil, Gold, and Forex Explained

- Market Correlations & Intermarket Analysis for Traders

Risk Management

The real edge in trading isn’t strategy - it’s how you protect your capital:

- Mastering Risk Management: Stop Loss, Take Profit, and Position Sizing

- Why Risk Management Is the Only Edge That Lasts

- How Much Should You Risk per Trade? (1%, 2%, or Less?)

- The Ultimate Risk Management Plan for Prop Firm Traders - Updated 2026

- Mastering Position Sizing: Automate or Calculate Your Risk Like a Pro

- Martingale Strategy in Trading: Compounding Power or Double-Edged Sword?

- How to Add to Winners Using Cost Averaging and Martingale Principle with Price Confirmation

- Managing Imperfect Entries in Trading - How Professionals Stay Composed

Suggested Learning Path

If you’re not sure where to start, follow this roadmap:

- Start with Trading Psychology → Build the mindset first.

- Move into Risk Management → Learn how to protect capital.

- Explore Strategies & Tools → Candlesticks, Fibonacci, MAs, Indicators.

- Apply to Assets → Gold, Indices, Forex sessions.

- Advance to Smart Money Concepts (SMC) → Learn how institutions trade.

- Specialize → Stop Hunts, News Trading, Turmoil Navigation.

This way, you’ll grow from foundation → application → mastery, instead of jumping around randomly.

Follow me for more daily market insights!

Jasper Osita - LinkedIn - FXStreet - YouTube

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.