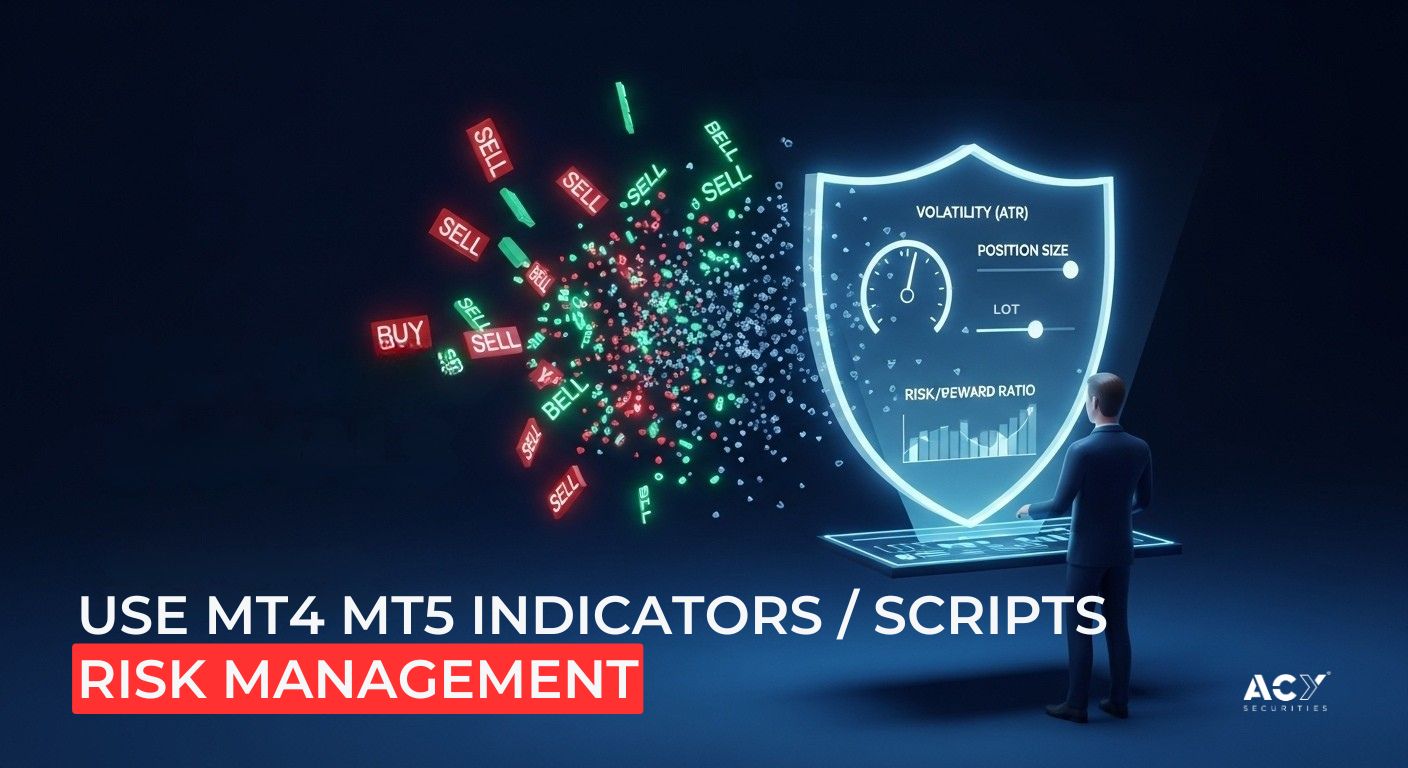

How to Use MT4 MT5 Indicators and Scripts for Risk Management, Not Just Signals?

2025-09-08 16:58:07

This article is reviewed annually to reflect the latest market regulations and trends

TL;DR (Too Long; Didn’t Read)

- Shift from Signals to Risk: Professional Forex trading prioritizes capital preservation through systematic risk management, moving beyond the flawed pursuit of perfect entry signals.

- Automate Discipline with MT4/MT5 Tools: Utilize scripts (Position Sizing, Order Management) and Expert Advisors (EAs) for emotion-free, consistent execution of risk rules like stop-losses and drawdown limits.

- Measure Volatility, Don't Guess: Employ indicators like ATR and Bollinger Bands to quantify market volatility, enabling smarter, data-driven stop-loss placements and adaptive risk per trade.

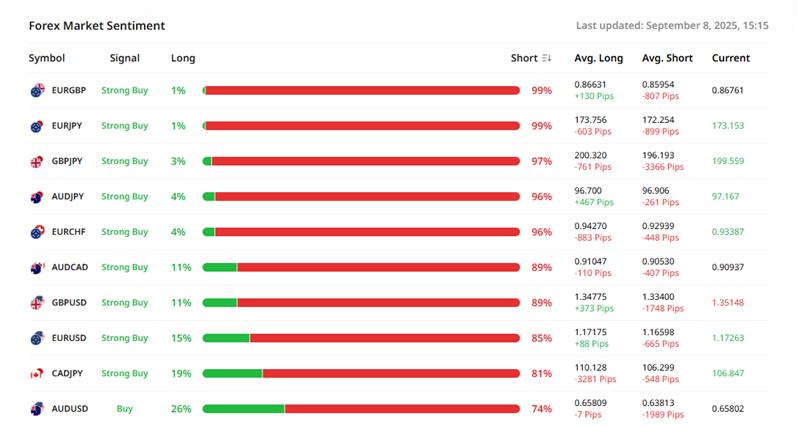

- Leverage Social Sentiment as a Risk Filter: Use sentiment analysis as a contrarian tool to identify crowded trades and potential reversals, adding a non-correlated layer to your risk assessment.

- Build a Sustainable Affiliate Business: Approach forex affiliate marketing as a long-term media business, emphasizing consistent content creation, strategic automation, and outsourcing to achieve scalable, passive income.

"Risk comes from not knowing what you're doing." – Warren Buffett

This timeless wisdom, often applied to traditional investing, holds even greater weight in the dynamic world of Forex trading. The pursuit of quick riches often leads aspiring traders down a perilous path, fixated on predicting market movements with illusory "holy grail" signals. Yet, the true masters of the market understand that sustainable profitability isn't about clairvoyance; it's about the unwavering discipline of risk management.

This comprehensive guide unveils a paradigm shift: from the impulsive chase for entry signals to a systematic, risk-centric methodology. We’ll deconstruct how MetaTrader 4 (MT4) and MetaTrader 5 (MT5) tools,from foundational scripts to advanced Expert Advisors (EAs),can transform your trading from a gamble into a controlled, professional endeavor. Furthermore, we’ll outline a blueprint for building a thriving Forex affiliate business, leveraging these very principles of systematic operation and long-term value creation.

How Does Blindly Following an Indicator's Arrows Lead to Big Losses? The Peril of False Signals and Lagging Information

Imagine a traffic light system for trading: green for buy, red for sell. Many novice traders approach indicators with this simplistic mindset, believing that a moving average crossover or an RSI divergence is a definitive "signal" to enter or exit. This blind reliance is a fast track to financial ruin, primarily due to two fundamental flaws: false signals and lagging information.

False Signals: The Market's Deceptive Whispers

Indicators are, by their nature, derived from past price data. They are mathematical interpretations, not predictive crystal balls. A "false signal" occurs when an indicator suggests a strong directional move that either doesn't materialize or quickly reverses.

For instance:

- Whipsaws: A common moving average crossover strategy might generate a buy signal, only for the price to immediately reverse, triggering a stop-loss, and then generate a sell signal, only for that to reverse too. These rapid, unprofitable reversals are known as whipsaws, draining accounts quickly.

- Overbought/Oversold Traps: Oscillators like the Relative Strength Index (RSI) or Stochastic Oscillator are designed to identify overbought or oversold conditions. A common misconception is that "overbought" automatically means "sell," and "oversold" means "buy." In strong trends, however, an asset can remain overbought for extended periods, continuing to climb significantly before any meaningful pullback. Selling prematurely based on an overbought signal in a strong uptrend is a classic mistake.

- Divergence Deceptions: While divergence (where price makes a new high/low but the indicator doesn't) can be a powerful reversal signal, it's not foolproof. Divergences can persist, fail to lead to a reversal, or only lead to minor corrections before the trend resumes. Acting solely on a divergence without other confirmations is a gamble.

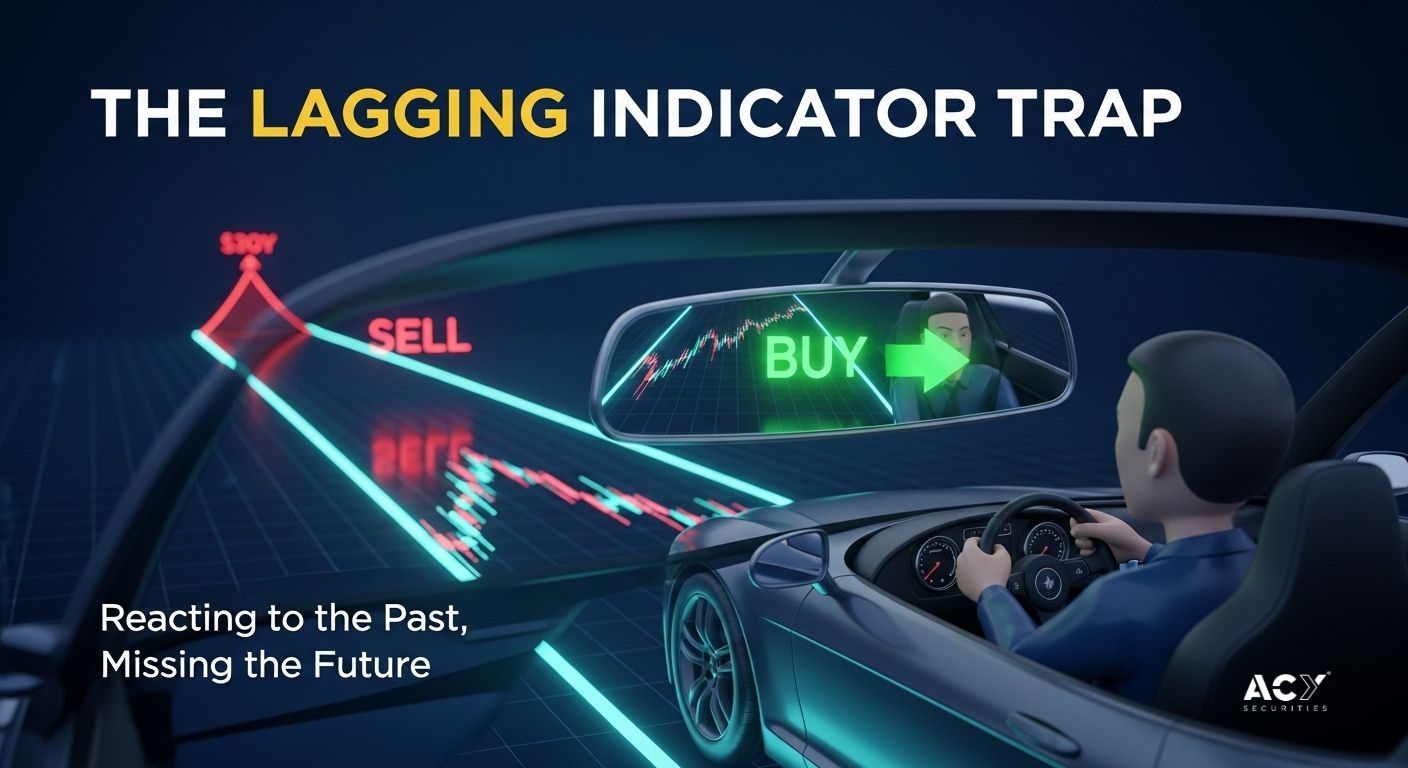

Lagging Information: Always a Step Behind

Another critical limitation is that most indicators are lagging indicators. This means they reflect what has already happened in the market, not what is currently happening or what will happen next.

- Moving Averages: These smooth out price action over a period, by definition, lagging the current price. A 50-period moving average will only reflect the average price of the last 50 periods, not the immediate price action. By the time a moving average crossover signal appears, a significant portion of the move might already be over, leaving little profit potential for a late entry.

- Oscillators: Even seemingly "faster" oscillators like RSI or MACD still use historical data in their calculations. While they can provide insights into momentum, their signals often appear after a price move has initiated, making them better for confirmation than for pinpointing exact entry points.

Blindly following these arrows is akin to driving by looking only in the rearview mirror. You're reacting to past events, not anticipating the road ahead. This reactive approach leads to missed opportunities, late entries, and most importantly, an inability to manage risk effectively because you're always playing catch-up.

Professional traders understand that indicators are tools to provide context and confirmation within a broader, risk-managed strategy, not standalone buy/sell signals. They are pieces of a puzzle, not the entire picture. The critical shift is to use them for understanding market structure, momentum, and risk assessment, rather than as a simplistic trigger for speculation.

Beyond Signals to Systematic Risk Management

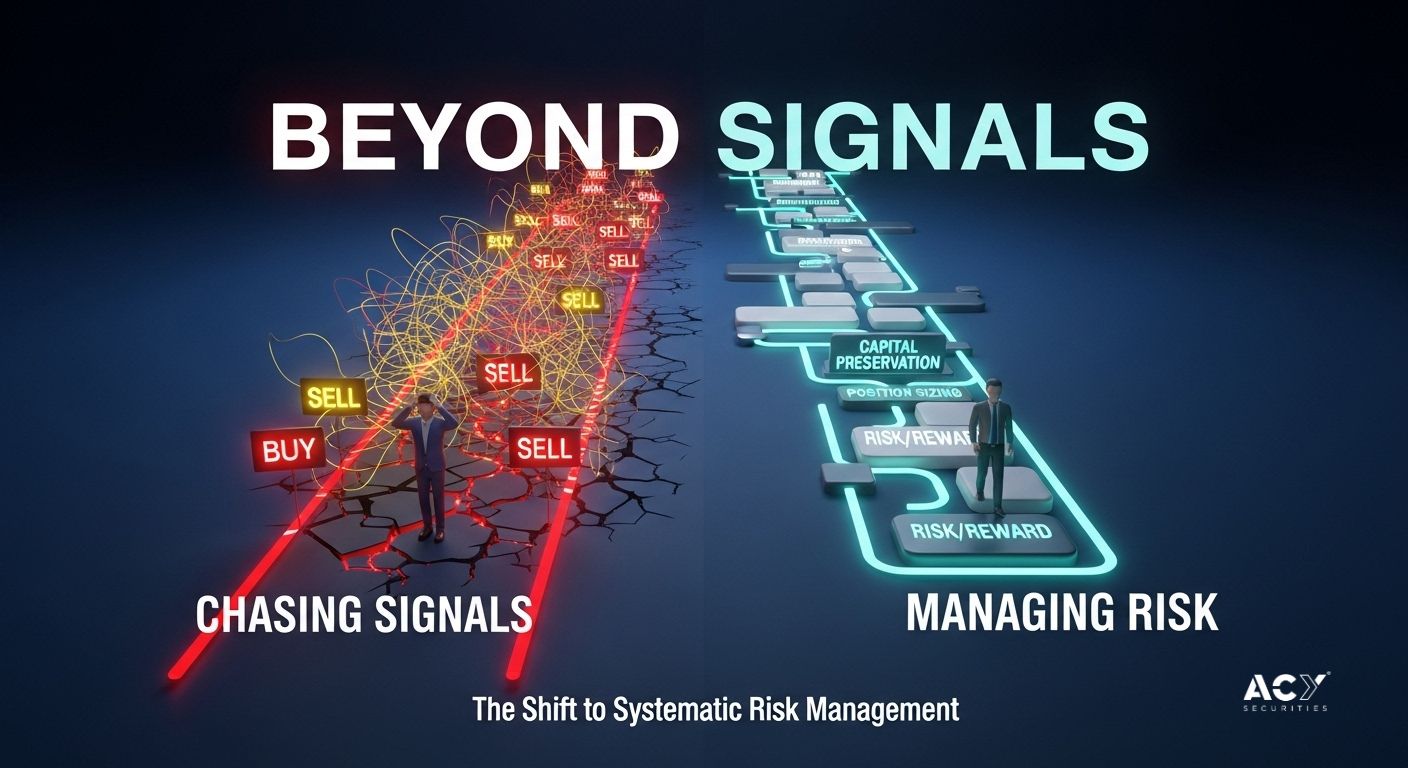

The landscape of retail forex trading is littered with the abandoned accounts of aspiring traders who pursued the wrong objective. The common fallacy is the search for a perfect signal,a "holy grail" indicator or strategy that predicts market movements with unerring accuracy. This approach is fundamentally flawed. Professional, sustainable trading is not a function of predicting the future but of managing uncertainty and preserving capital in the present.

The paradigm shift from signal-chasing to a risk-centric methodology is the single most important transition a trader can make. It redefines the goal from "being right" on any single trade to ensuring long-term survival and profitability over a large series of trades. This section deconstructs the tools available on the MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms that facilitate this crucial shift, moving from foundational scripts that enforce discipline to advanced Expert Advisors (EAs) that act as automated risk managers.

From Signal-Chasing to Risk-Centric Trading

The core vulnerability of the novice trader lies in their emotional and psychological response to market fluctuations. The desire for quick profits leads to an overemphasis on entry signals, while the fear of loss leads to poor, undisciplined exit decisions. This emotional interference is the primary cause of account failure. A risk-centric approach systematically dismantles this vulnerability by replacing subjective decision-making with a rules-based framework where capital preservation is the highest priority.

The efficacy of this approach is not theoretical; it is validated by performance data from proprietary trading firms. An analysis of over 1,500 funded trader accounts reveals that traders who employ dedicated risk management indicators and EAs exhibit markedly superior performance and longevity. Specifically, these accounts demonstrate a 52% longer average lifespan and suffer 37% fewer rule violations (such as exceeding daily drawdown limits) compared to traders who rely solely on manual discipline. This data provides a clear, quantitative verdict: automated risk controls are a powerful determinant of success.

The foundational principles of this methodology are straightforward but require unwavering consistency. The first principle is defined risk per trade, where a trader commits to risking only a small, predetermined percentage of their total account equity on any single position, typically between 1% and 2%. For a $10,000 account, this translates to a maximum acceptable loss of $100 to $200 per trade. The second principle is the consistent application of stop-loss orders, which act as a non-negotiable exit point for a losing trade, preventing small losses from escalating into catastrophic ones.

The third, and perhaps most crucial, principle is correct position sizing. This involves calculating the appropriate trade volume (lot size) so that the distance from the entry price to the stop-loss price equates exactly to the predetermined risk percentage. It is in the precise and unemotional execution of these principles that MT4 and MT5 tools provide their greatest value.

Foundational Risk Management: The Role of MT4/MT5 Scripts

Scripts are simple, single-task programs for MT4/MT5 that execute a specific function upon activation. Unlike EAs, they do not run continuously. Their power lies in their ability to automate critical, often high-pressure, moments in the trade lifecycle, thereby enforcing discipline when a trader is most susceptible to emotional error. These tools are the essential building blocks of a systematic trading approach.

The cornerstone of all professional risk management is correct position sizing, yet it is a step that many beginners neglect due to its perceived complexity. The manual calculation involves determining the maximum risk in currency terms (e.g., 1% of a $10,000 account is 100),defining the stop - loss in pips(e.g.,20pips), calculating the risk per pip(100), 100 / 20 pips = $5 per pip), and then dividing this by the specific currency pair's pip value to arrive at the correct lot size. This multi-step process is prone to error, especially in fast-moving markets.

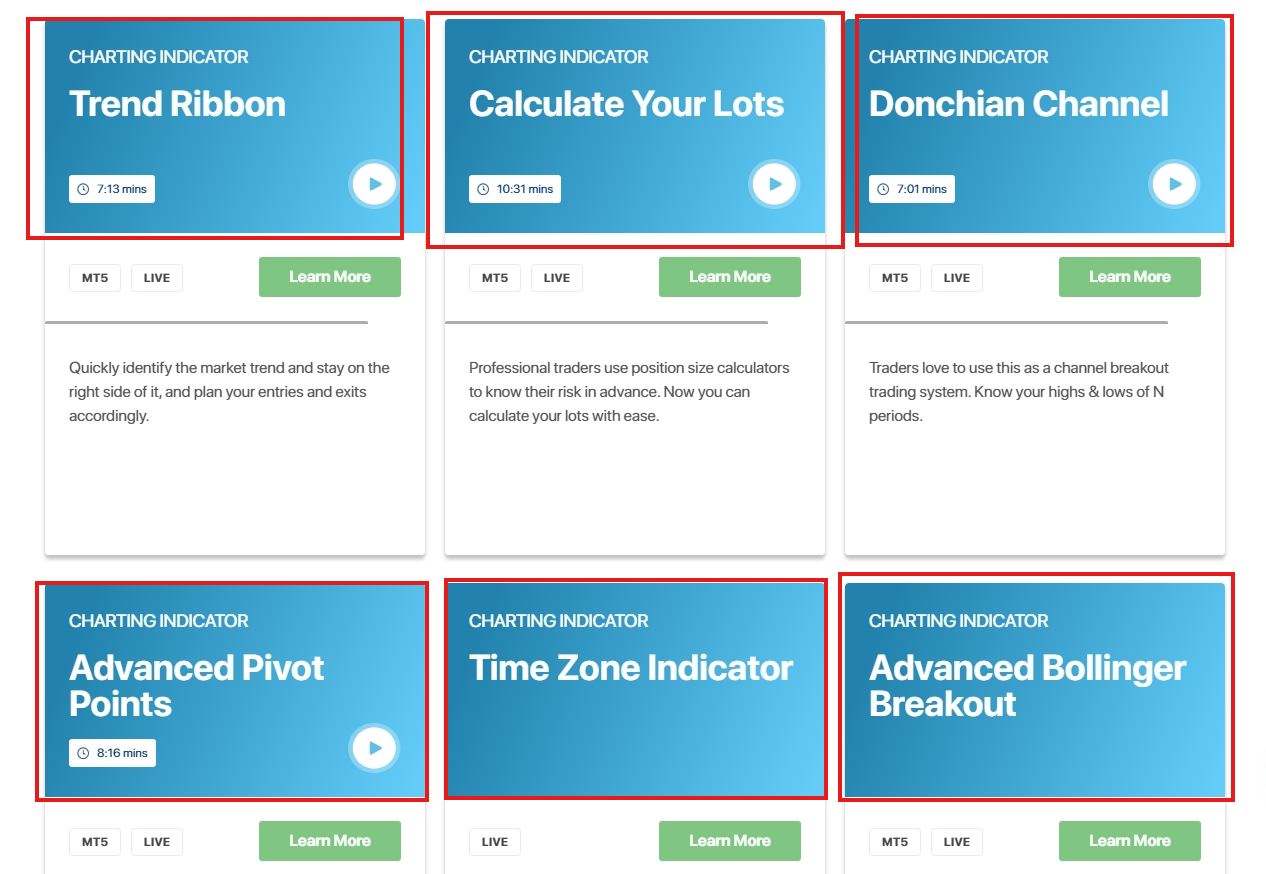

Position sizing scripts and indicators automate this entire sequence instantly and flawlessly. By inputting the desired risk percentage and dragging the stop-loss level on the chart, the tool calculates and displays the precise lot size required for the trade. This transforms risk management from a manual chore into an immutable law of execution.

The "Calculate Your Lots" indicator provided by ACY.com is a prime example of such a tool, offering professional-grade functionality that allows beginners to adopt expert habits from their very first trade. This single tool, when used consistently, can be the difference between a long trading career and a blown account. For a step-by-step guide on how Expert Advisors can help beginners conquer fear and greed, see this ACY.com article: How Beginner Traders Use Expert Advisor to Conquer Fear and Greed.

A profitable trading strategy requires not only that wins are more frequent than losses, but also that the average size of a winning trade is significantly larger than the average size of a losing trade. This is quantified by the risk-to-reward ratio. A common minimum standard for professional traders is a 1:2 ratio, meaning the potential profit on a trade is at least twice the potential loss.

Risk-reward indicators for MT4/MT5 provide a clear visual representation of this ratio directly on the chart before a trade is executed. By placing entry, stop-loss, and take-profit levels, the tool displays the corresponding ratio, allowing a trader to instantly assess whether a setup meets their trading plan's criteria. This visual aid encourages disciplined trade selection, preventing traders from entering low-probability, poor-value setups out of impatience or fear of missing out (FOMO). While MT4 does not have a native tool for this, custom indicators are widely available, and some traders even adapt the Fibonacci tool for this purpose by customizing its levels to represent risk-reward multiples.

Beyond entry, scripts are invaluable for systematic trade management and exit. In moments of high market volatility or at predetermined times (such as the end of the trading day or before a major news release), traders need to execute actions across multiple positions quickly and without hesitation.

- "Close All Positions" Script: This is one of the most useful utility scripts. With a single click, it can close all open market orders and delete all pending orders. This is essential for traders who need to flatten their portfolio instantly to mitigate risk from an unexpected event or as part of a disciplined end-of-day routine. ACY.com offers a range of MetaTrader scripts to help optimize your forex trading, including such utility tools: MetaTrader Scripts to Help Optimise Your Forex Trading.

- "Partial Close" Script: Professional trade management often involves scaling out of a winning position. A partial close allows a trader to lock in a portion of their profits while leaving the remainder of the position open to capture further gains. For example, a trader might close 50% of their position when it reaches a 1:1 risk-reward target and move their stop-loss to the breakeven point on the remaining portion, creating a "risk-free" trade. Scripts that automate this process ensure it is done precisely and according to plan. Learn how to execute partial profits in MT4 and MT5 here: How to Execute a Partial Profit in MT4 and MT5.

- "Delete All Pending Orders" Script: This is a simple housekeeping tool that allows a trader to quickly clear their charts of pending orders that are no longer valid due to changed market conditions, preventing unintended entries.

Advanced Risk Control: Graduating to Expert Advisors (EAs)

While scripts are executed on-demand, Expert Advisors (EAs) are programs that run continuously on a chart, constantly monitoring market conditions and managing trades. This persistence allows for a more sophisticated and dynamic layer of automated risk control, effectively creating a "risk manager" that operates 24/7 alongside the trader.

Trade Manager EAs consolidate numerous risk and trade management functions into a single, comprehensive dashboard or panel on the trading chart. Instead of using multiple individual scripts, a trader can manage every aspect of their trade from one interface.

Key features often include:

- One-Click Order Execution: With pre-set risk parameters.

- Automated Breakeven: Automatically moves the stop-loss to the entry price once a trade reaches a specified profit target.

- Multi-Level Profit Taking: Allows for pre-programmed partial closes at multiple profit targets.

- Advanced Trailing Stops: Offers more sophisticated trailing stop logic than the platform's default options.

- On-Chart Visuals: Displays trade information, potential profit/loss, and risk-reward ratios directly on the chart.

These tools dramatically improve efficiency and reduce the chance of manual error, particularly for active day traders and scalpers who manage multiple positions simultaneously. To learn how to trade like an expert using MetaTrader scripts for systematic trading, read this ACY.com article: Trade Like an Expert: Using MetaTrader Scripts for Systematic Trading.

One of the most powerful applications of EAs is in enforcing behavioral discipline. This is especially critical for traders participating in proprietary firm challenges, where strict rules on daily and total drawdown are non-negotiable. These EAs act as an automated supervisor, preventing the kind of emotional decisions that lead to account violations.

Their functions include:

- Drawdown Limiter: This feature automatically closes all positions and can even lock the trading terminal for the rest of the day if the account's equity drawdown reaches a predefined threshold (e.g., 5% of the starting balance). This is a hard-coded circuit breaker against "revenge trading" after a series of losses.

- Trade Frequency Control: The EA can be configured to block trade execution after a certain number of trades have been placed within a day or week, combating the problem of overtrading.

- Lot Size Enforcement: Sets a maximum allowable lot size per trade, preventing a trader from taking on excessive risk in a moment of greed or overconfidence.

- News Filter: A highly valuable feature that can automatically disable trading for a set number of minutes before and after high-impact economic news releases, protecting the account from extreme volatility.

Recent data shows that EAs with this built-in risk logic can reduce equity drawdown by up to 43% in funded trader accounts, highlighting their immense value in capital preservation. To understand how a Forex EA can reduce your trading stress and help you escape the 24/7 market grind, check out this ACY.com article: Escape the 24/7 Market Grind: Can a Forex EA Finally Reduce Your Trading Stress?.

A static stop-loss protects against downside risk, but a dynamic or "trailing" stop-loss also serves to lock in unrealized profits as a trade moves in the trader's favor. While MT4/MT5 have a basic trailing stop function, dedicated EAs offer far more advanced and customizable logic.

Common types include:

- Point-Based Trailing Stop: The stop-loss trails the current price by a fixed number of pips.

- Moving Average (MA) Trailing Stop: The stop-loss is placed at the level of a specific moving average (e.g., the 21-period EMA), allowing the trade room to breathe within a trend but closing it if the trend's momentum wanes.

- Parabolic SAR Trailing Stop: Uses the Parabolic Stop and Reverse (SAR) indicator to set the stop-loss level, which is a popular method for trend-following strategies.

- Profit-Activated Trailing Stop: A particularly useful logic where the trailing stop only activates after the trade has reached a certain minimum profit level, ensuring that the trade doesn't get stopped out prematurely on minor pullbacks.

The decision to incorporate EAs into a trading workflow requires a balanced understanding of their strengths and weaknesses, a topic frequently debated in trading forums.

Pros:

- Emotion-Free Execution: EAs operate on pure logic, eliminating the destructive impact of fear, greed, and hesitation.

- 24/7 Operation: An EA can monitor markets and manage trades around the clock, capturing opportunities during sessions the trader would otherwise miss.

- Execution Speed: EAs can react to market changes and execute orders far faster than a human, which is critical in volatile conditions.

- Multitasking and Diversification: A single EA can simultaneously manage different strategies across multiple currency pairs, something impossible for a manual trader to do effectively.

Cons:

- Over-Reliance and Complacency: Traders may become too dependent on the automation, neglecting to monitor market conditions and their system's performance.

- Technical Failures: EAs are software and can be subject to bugs, coding errors, or connectivity issues with the broker's server. Using a Virtual Private Server (VPS) is often necessary to ensure reliability.

- Lack of Adaptability: Most EAs are designed for specific market conditions (e.g., trending or ranging). A skilled manual trader can often adapt to a sudden shift in market structure more quickly than a rigid, pre-programmed algorithm.

- Steep Learning Curve: Developing or even properly configuring a complex EA can require significant time, testing, and technical understanding.

The most effective approach for many is a hybrid model, where an EA handles the mechanical, rule-based aspects of risk and trade management, while the trader retains control over high-level strategic decisions. To see how MT5 alerts and scripts can automate your trading day for less screen time and more freedom, explore this ACY.com article: Less Screen Time, More Freedom: How MT5 Alerts & Scripts Automate Your Trading Day.

Which MT5 Indicators Can Help You Measure Market Volatility?

Understanding and measuring market volatility is paramount for effective risk management. Volatility is the degree of variation of a trading price series over time. High volatility means prices are changing rapidly and unpredictably, while low volatility suggests stable, predictable price movements.

MT5 offers several powerful indicators to help traders quantify this crucial market characteristic:

The Average True Range (ATR) is a classic and highly effective volatility indicator. Developed by J. Welles Wilder Jr., ATR measures market volatility by calculating the average of true ranges over a specified period (e.g., 14 periods).

The "true range" is the greatest of the following:

- The current high minus the current low.

- The absolute value of the current high minus the previous close.

- The absolute value of the current low minus the previous close.

How to Use ATR for Risk Management:

- Dynamic Stop-Loss Placement: ATR is ideal for setting dynamic stop-loss levels. Instead of a fixed pip amount, you can set your stop-loss at a multiple of the current ATR (e.g., 1.5x ATR or 2x ATR) away from your entry price. This means your stop-loss automatically adapts to current market conditions: wider in volatile markets, tighter in calmer ones. This ensures your trades have enough "breathing room" without exposing you to excessive risk.

- Position Sizing Adjustment: In highly volatile conditions (high ATR), you might reduce your position size to maintain your defined risk per trade, as each pip movement carries more weight. Conversely, in low volatility (low ATR), you might be able to take a larger position while still adhering to your risk limits.

- Identifying Breakouts: A sudden spike in ATR can signal increasing momentum and potential breakouts from consolidation patterns. While not a direct signal, it alerts you to conditions where prices might move quickly.

Bollinger Bands (BB) are another widely used indicator that visually represents volatility and potential price extremes. They consist of a simple moving average (typically 20-period) as the middle band, with an upper and lower band placed a standard deviation (typically 2 standard deviations) away from the middle band.

How to Use Bollinger Bands for Risk Management:

- Volatility Squeeze and Expansion: The width of the Bollinger Bands directly reflects market volatility.

- Squeeze: When the bands contract and move closer together, it indicates low volatility, often preceding a significant price move or "breakout." This can be a warning to prepare for increased risk or opportunity.

- Expansion: When the bands widen significantly, it signals high volatility. This means prices are moving rapidly, increasing the potential for both large profits and large losses.

- Dynamic Support and Resistance: The upper and lower bands can act as dynamic support and resistance levels. When price touches or breaches a band, it can indicate an overextended move and a potential reversal or a continuation of a strong trend.

- Stop-Loss and Take-Profit Placement: Traders might use the bands to place stop-losses beyond an opposing band or take-profit targets at the opposite band, especially in ranging markets. For instance, in a range, if you buy near the lower band, you might set your take-profit near the upper band and your stop-loss just below the lower band.

By integrating ATR and Bollinger Bands into your analysis, you move beyond simply reacting to price action. You gain a deeper understanding of the market's underlying energy, allowing you to make more informed decisions about position sizing, stop-loss placement, and overall risk exposure. These indicators empower you to adapt your strategy to the prevailing market environment, rather than imposing a rigid approach on dynamic conditions.

Can You Use Indicators to Set Smarter, Data-Driven Stop-Loss Levels?

Absolutely. Moving beyond fixed-pip stop-losses, which often get prematurely hit in volatile markets or are too wide in calm conditions, is a hallmark of professional trading. Indicators provide the objective data needed to set smarter, data-driven stop-loss levels that adapt to current market conditions.

Here are actionable techniques:

As discussed, ATR is an excellent tool for dynamic stop-loss placement.

- ATR Multiples: A common strategy is to place your stop-loss at a multiple of the current ATR away from your entry price or a key market structure.

- Calculation: Multiply the current ATR value by a factor (e.g., 1.5, 2, or 3, depending on your risk tolerance and strategy). For example, if ATR is 20 pips and you use a 2x multiple, your stop-loss would be 40 pips away from your entry (for a long trade, 40 pips below entry; for a short trade, 40 pips above entry).

- Adaptability: This method automatically adjusts to volatility. In a calm market, your stop-loss will be tighter, reducing potential loss. In a volatile market, it will be wider, giving your trade room to breathe without being stopped out by normal market noise.

- Example: If you enter a long trade, identify a recent low or support level, and then place your stop-loss 1.5 or 2 times the current ATR value below that support level. This combines market structure with volatility.

While not "indicators" in the traditional sense, identified support and resistance levels, as well as swing highs and lows, are crucial data points that can be enhanced by indicator analysis.

- Beyond the Level: Instead of placing a stop-loss exactly at a support or resistance level (which is often where market makers "hunt" for liquidity), place it a certain distance beyond that level.

- Using ATR for Buffer: You can combine this with ATR. If your support level is at 1.1000, and the current ATR is 10 pips, you might place your stop-loss 0.5x ATR (5 pips) below that support, at 1.0995. This provides a small buffer against false breakouts.

- Swing High/Low: For a long trade, place your stop-loss below the most recent significant swing low. For a short trade, place it above the most recent significant swing high. These are logical points where the market structure would be invalidated if broken.

- Bollinger Bands: In a ranging market, if you are buying at the lower Bollinger Band, a logical stop-loss might be placed just outside the lower band. If the price breaks significantly below the lower band, the ranging market assumption is invalidated.

- Keltner Channels: Similar to Bollinger Bands but using ATR for their width, Keltner Channels are excellent for trend-following strategies. A stop-loss can be placed outside the opposite channel band. If price closes outside the channel in the "wrong" direction, it signals a potential trend reversal or exhaustion.

By integrating these data-driven techniques, your stop-losses become intelligent protectors, not arbitrary lines on a chart. They are dynamic, adapting to market behavior, and strategically placed to protect your capital while giving your trades a fair chance to succeed. This systematic approach is a cornerstone of professional risk management.

What is the Difference Between Using an Indicator for Confirmation vs. a Gamble?

The distinction between using an indicator for confirmation versus a gamble is fundamental to professional trading. It separates informed decision-making from speculative impulsivity. Here’s a clear checklist to help a trader define their process:

Using an Indicator for Confirmation (Professional Approach):

- Start with Price Action/Market Structure: Your primary analysis begins with understanding the raw price chart. Are you in an uptrend, downtrend, or range? Where are key support and resistance levels? What are the recent swing highs and lows?

- Formulate a Hypothesis: Based on your price action analysis, you develop a trade idea. "I believe EUR/USD is likely to continue its uptrend from this support level."

- Use Indicators to Validate/Filter: Then you turn to indicators to see if they support or contradict your hypothesis.

a. Example (Long Trade):

Price Action: EUR/USD is pulling back to a strong demand zone/support level in an overall uptrend.

ii. Indicator Confirmation:

- RSI: Is the RSI bouncing off an oversold level (e.g., 30) at this support, indicating a potential return of bullish momentum?

- Moving Average: Is the price bouncing off a key moving average (e.g., 50 EMA) that has previously acted as dynamic support?

- Volume (if available): Is there increased buying volume as the price hits support?

- Bollinger Bands: Is the price touching the lower band at support, suggesting a temporary exhaustion of selling pressure?

4. Risk Management Precedes Entry: Before even considering entry, you've already determined your maximum risk per trade, your stop-loss placement (using volatility/structure), and your target profit, ensuring a favorable risk-to-reward ratio.

5. Look for Confluence: Multiple factors aligning (price action + 2-3 indicators + risk-reward) provide confluence, significantly increasing the probability of your trade idea.

6. Patience and Discipline: If the indicators don't confirm your hypothesis, or if the risk-reward isn't favorable, you don't take the trade. You wait for a better setup.

Using an Indicator as a Gamble (Novice Approach):

- Indicator Signal is the Sole Trigger: The trader sees a single indicator "signal" and immediately acts on it. "RSI just crossed 70, I'm selling!" or "MACD just crossed up, I'm buying!"

- Ignores Market Context: No consideration of the broader trend, key support/resistance, or the current market phase (trending vs. ranging).

- No Pre-defined Risk Management: Stop-loss and take-profit levels are often arbitrary, placed after the entry, or worse, not used at all. Position sizing is often based on emotion (e.g., "feeling confident," "revenge trading") rather than calculated risk.

- Chasing Price: Often enters late because the indicator is lagging, then gets caught in a reversal.

- Over-Reliance on One Tool: Believes one indicator holds the "holy grail" and ignores other conflicting information or the need for multiple confirmations.

- Emotional Decisions: Impatience, fear of missing out (FOMO), or the desire to "get back" losses drive trading decisions, not a systematic plan.

The Checklist for Confirmation, Not Gamble:

- Indicator Signal is the Sole Trigger: The trader sees a single indicator "signal" and immediately acts on it. "RSI just crossed 70, I'm selling!" or "MACD just crossed up, I'm buying!"

- Ignores Market Context: No consideration of the broader trend, key support/resistance, or the current market phase (trending vs. ranging).

- No Pre-defined Risk Management: Stop-loss and take-profit levels are often arbitrary, placed after the entry, or worse, not used at all. Position sizing is often based on emotion (e.g., "feeling confident," "revenge trading") rather than calculated risk.

- Chasing Price: Often enters late because the indicator is lagging, then gets caught in a reversal.

- Over-Reliance on One Tool: Believes one indicator holds the "holy grail" and ignores other conflicting information or the need for multiple confirmations.

- Emotional Decisions: Impatience, fear of missing out (FOMO), or the desire to "get back" losses drive trading decisions, not a systematic plan.

The Checklist for Confirmation, Not Gamble:

- Do I have a clear understanding of the price action and market structure before looking at indicators? (Yes/No)

- Am I using indicators to support or filter a trade idea derived from price, rather than generating the idea itself? (Yes/No)

- Do at least two non-correlated indicators (e.g., one momentum, one volatility) confirm my trade idea? (Yes/No)

- Have I calculated my position size, stop-loss, and take-profit before entering the trade, ensuring a favorable risk-to-reward? (Yes/No)

- Am I willing to not take the trade if the confluence isn't strong or the risk-reward is poor? (Yes/No)

If you can answer "Yes" to these questions consistently, you are using indicators for confirmation. If you find yourself frequently answering "No," you are likely gambling, and it's time to re-evaluate your approach and embrace a risk-centric methodology.

The Unconventional Edge: Integrating Social Sentiment for Risk Analysis

While technical indicators and price action provide a wealth of information derived from market data, a truly comprehensive risk analysis incorporates external, non-correlated data streams. One of the most potent and modern of these is social sentiment analysis.

This involves algorithmically scanning and interpreting the collective mood and opinions expressed on social media platforms, forums, and news outlets. For the sophisticated trader, this data is not used as a simplistic signal for direction but as an advanced filter for risk, providing a powerful, often contrarian, layer of insight into market psychology.

Understanding Social Sentiment as a Market Force

At its core, sentiment analysis uses natural language processing (NLP) to classify unstructured text data. Algorithms such as VADER (Valence Aware Dictionary for Sentiment Reasoning) analyze text by mapping words and phrases to sentiment scores, accounting for both polarity (positive/negative) and intensity (strength of emotion). More advanced machine learning models can be trained on vast datasets of labeled financial text to recognize nuance, sarcasm, and domain-specific language, providing a more accurate classification of sentiment as bullish, bearish, or neutral.

The application of this technology to financial markets is a serious endeavor undertaken by quantitative traders and algorithmic developers. Discussions within communities like r/algotrading and r/quant frequently revolve around the development and use of APIs to pull real-time sentiment data from sources like Reddit, X (formerly Twitter), and financial news headlines. These developers are not building simple bots that buy when Twitter is bullish; they are integrating sentiment scores as a variable within complex risk models, seeking to quantify the often-irrational behavior of the retail crowd.

Practical Application: Using Sentiment as a Risk Filter, Not a Signal

The novice mistake is to treat high social sentiment as a confirmation signal, if everyone on social media is bullish on EUR/USD, it must be a good time to buy. The professional application is almost always the exact opposite. Extreme levels of one-sided sentiment are often a hallmark of market tops and bottoms, making sentiment a powerful contrarian tool for risk management.

When a particular trade or currency pair becomes overwhelmingly popular among retail traders and is heavily discussed on forums like r/Forex or financial Twitter, it often signals a "crowded trade." This means that a large number of speculative positions are aligned in one direction, leaving fewer new buyers (in an uptrend) or sellers (in a downtrend) to push the price further. Such a market is highly vulnerable to a reversal, as even a small move against the prevailing direction can trigger a cascade of stop-loss orders, fueling a sharp correction.

An expert trader uses this information not to predict the exact turning point, but to manage their risk proactively.

For example:

- If a trader is in a long position on a currency pair and observes that retail sentiment has reached a euphoric, overwhelmingly bullish level, they might interpret this as a signal that the trend is mature and at high risk of a reversal. In response, they could tighten their trailing stop-loss, take partial profits to reduce their exposure, or decide against adding to their position.

- Conversely, if a trader is considering a new long position based on their technical analysis, but sees that social sentiment is already at an extreme bullish level, they may delay or forgo the trade entirely, judging the risk-reward to be unfavorable due to the high probability of a pullback.

Beyond direction, the volume of social media chatter can be a leading indicator of impending volatility. A sudden spike in the number of mentions or "buzz" around a currency pair, which can be tracked via APIs like the /buzz/twitter example mentioned in developer forums, often precedes a major price move. This spike in attention can be driven by a breaking news story, a significant political event, or the emergence of a strong market narrative.

A trader can use this as an early warning system, complementing traditional economic calendars. An alert triggered by a sudden surge in social media activity can prompt a trader to:

- Reduce their position size on any new trades to account for potentially wider price swings.

- Widen their take-profit targets to capitalize on a potential increase in volatility.

- Avoid the market entirely if their strategy is not suited for high-volatility environments.

In essence, social sentiment analysis provides a real-time gauge of crowd psychology. By understanding that markets are driven by human emotions of fear and greed, a trader can use this gauge to identify when those emotions are reaching unsustainable extremes.

This adds a non-correlated, behavioral layer to their risk assessment matrix, allowing them to spot potential dangers that are not yet apparent in the price chart alone. It is a sophisticated technique that moves a trader from simply analyzing price to analyzing the behavior of the market participants who are moving the price.

The Forex Affiliate as a Business: A Blueprint for Sustainable Growth

Affiliate marketing is often tied to the concept of "passive income," but this is a dangerous misnomer that sets many aspiring affiliates up for failure. The reality is that affiliate marketing income is front-loaded, requiring a significant and sustained investment of time and effort before any meaningful, consistent returns are realized.

The income only becomes "passive" after the digital assets,the website, the SEO authority, the email list,have been actively built. A realistic timeline is essential for managing expectations and maintaining motivation through the initial, uncompensated phase.

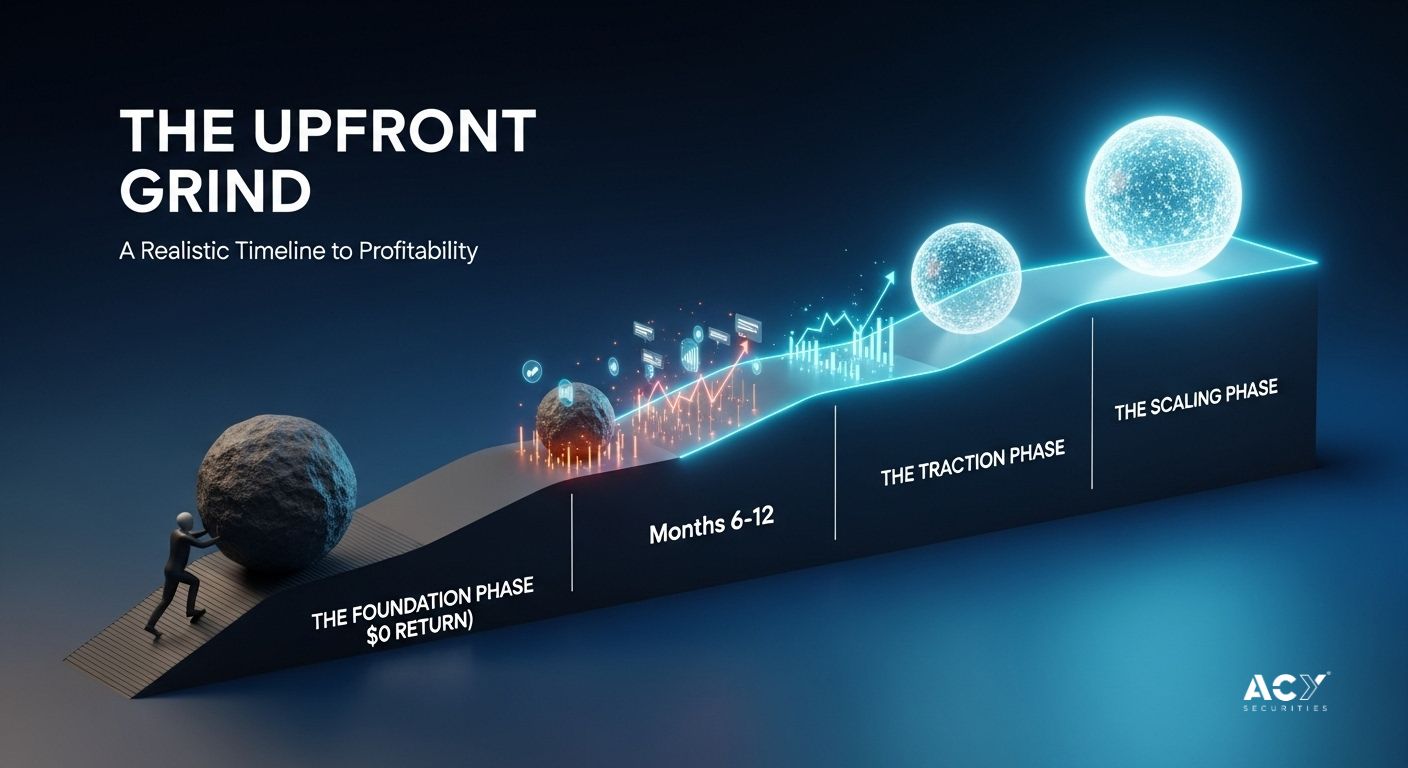

- Months 1-6 (The Foundation Phase): This initial period is characterized by intense work with little to no financial reward. The primary focus is on building the core platform (a website/blog or YouTube channel) and establishing a consistent content creation workflow. The goal is to produce an initial library of 15-20 high-value, SEO-optimized "pillar" content pieces (e.g., "The Ultimate Guide to Choosing a Forex Broker," "A Beginner's Guide to Risk Management"). During this phase, search engines are just beginning to index the site, and audience trust is non-existent. Any earnings will be sporadic and minimal, likely in the range of $0 to $500 per month. The key performance indicator (KPI) here is not revenue, but content output and consistency.

- Months 6-12 (The Traction Phase): If a consistent publishing schedule has been maintained, this is the period where the first signs of traction appear. Content begins to rank for long-tail keywords, leading to a steady increase in organic search traffic. The first consistent affiliate commissions start to roll in as visitors begin to trust the recommendations. The email list starts to grow, providing a direct channel for communication and promotion. With dedicated, full-time effort, a realistic monthly income target by the end of this phase is $500 to $2,000.

- Years 1-2 (The Authority and Scaling Phase): After a year of consistent, high-quality content production, the website begins to build domain authority. This leads to higher rankings for more competitive keywords, exponentially increasing organic traffic. The email list becomes a significant business asset, capable of generating revenue on demand. At this stage, the affiliate can begin to scale their efforts, diversifying content formats and optimizing conversion funnels. An established affiliate running their operation as a systematic business can see their income scale to $2,000 to $15,000 per month, with top-tier professionals earning significantly more.

This timeline underscores a critical point: forex affiliate marketing is not a get-rich-quick scheme. It is a business that requires the patience and discipline to build a valuable asset over a one- to two-year horizon. For more on forex affiliate marketing expectations vs. reality, visit ACY Partners: Forex Affiliate Marketing Expectations vs Reality.

What Is the Daily "Hustle" of a Full-Time Forex Affiliate? (A Day in the Life)

The daily routine of a successful forex affiliate marketer looks very different from that of a full-time day trader. While a trader's day is dictated by market sessions and chart analysis, an affiliate's day is structured around the core tasks of a digital media publisher: content creation, marketing, and business development. Their primary focus is on building and nurturing their audience, not on watching price charts. A disciplined, structured day is essential for maintaining the consistency required for long-term growth.

| Time Block | Task | Description / Goal |

| 7:00 AM - 8:00 AM | Market & Industry Review | Review overnight market movements, major economic news, and industry blogs/forums. The goal is not to find trades, but to identify content ideas, trending topics, and relevant news to share with the audience. |

| 8:00 AM - 11:00 AM | Deep Work: Content Creation | This is the most critical block of the day, dedicated to focused, uninterrupted work on a major piece of content (e.g., writing a blog post, scripting/recording a YouTube video, creating a lead magnet). |

| 11:00 AM - 12:00 PM | Performance Analytics Review | Analyze key business metrics: website traffic (Google Analytics), affiliate link clicks and conversions (partner dashboard), email list growth and engagement. Identify top-performing content and campaigns to double down on. |

| 12:00 PM - 1:00 PM | Lunch & Mental Break | Step away from the screen to recharge. Similar to a professional trader, avoiding burnout is critical for long-term performance. |

| 1:00 PM - 3:00 PM | SEO & Outreach | Focus on off-page SEO tasks. This includes promoting new content on social media, participating in relevant online communities (without spamming), and conducting outreach for guest posting or link-building opportunities. |

| 3:00 PM - 4:00 PM | Email & Community Management | Write and schedule the next email newsletter. Respond to comments on the blog, YouTube channel, and social media. Engage with the audience to build relationships and trust. |

| 4:00 PM - 5:00 PM | Strategy & Planning | Plan the content calendar for the upcoming week. Conduct keyword research for future articles/videos. Review long-term business goals and adjust the weekly plan accordingly. |

This schedule demonstrates that a successful affiliate operates as a media company, not a trader who occasionally posts online. The core activities are content production and audience building, which are the drivers of long-term, sustainable revenue.

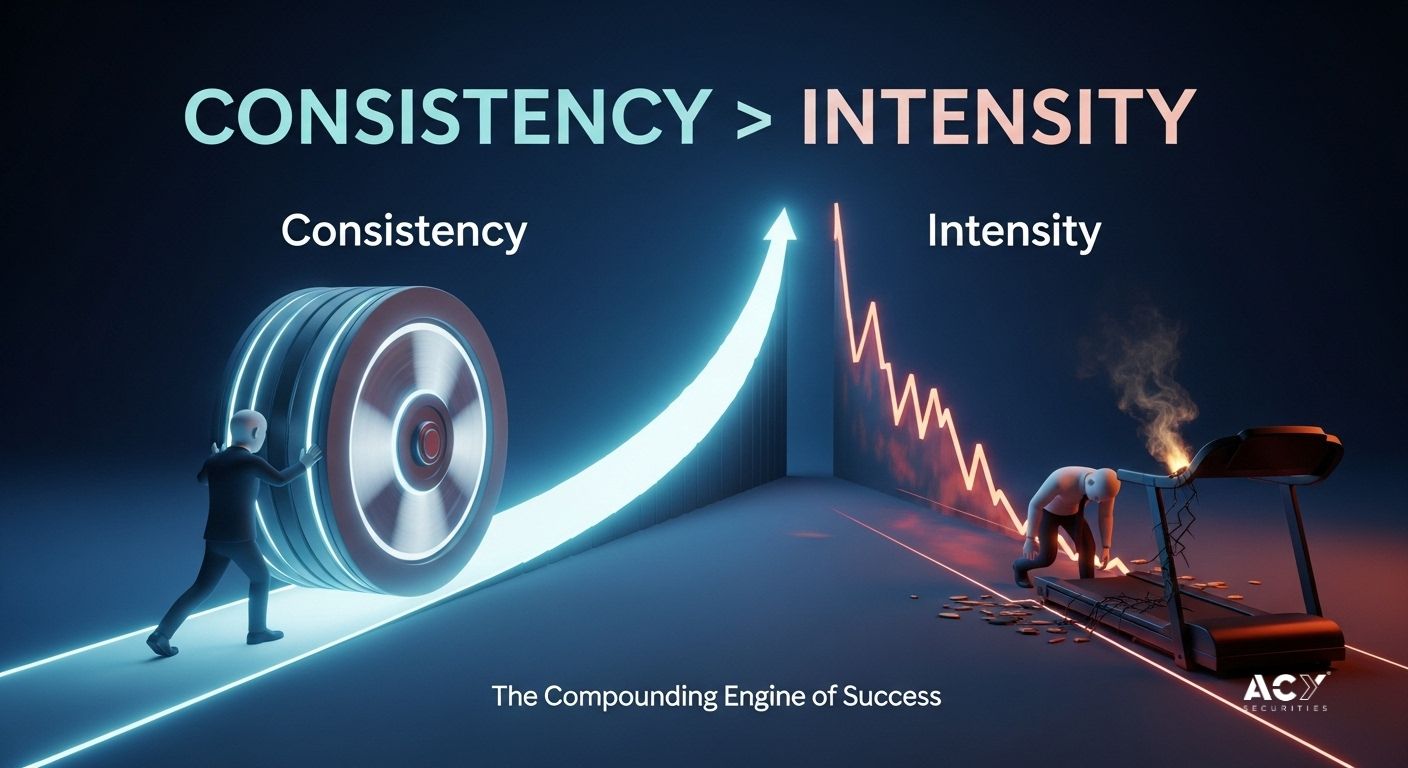

Why is Consistency in Content Creation More Important Than Intensity?

In the context of building a content-based affiliate business, the strategic choice between consistency and intensity is not a choice at all. While intense bursts of activity might feel productive, consistency is the engine of compounding growth and is unequivocally more important for long-term success.

Search engine algorithms, particularly Google's, are designed to reward reliability and authority. A website that publishes one high-quality, relevant article every week, without fail, sends a powerful signal to the algorithm that it is an active, authoritative source of information on its topic. This regular "crawl budget" allocation helps the site get indexed faster and builds topical authority over time.

This process has a compounding effect. As author James Clear notes in Atomic Habits, a tiny improvement of 1% each day results in a 37-fold improvement over a year. Similarly, each consistent piece of content builds upon the last, slowly but surely strengthening the website's overall authority and ranking potential.

In contrast, an intense burst of activity, such as publishing 15 articles in one week followed by two months of silence, is detrimental. It creates an inconsistent signal for search engines and fails to build the momentum necessary for sustained ranking growth. The initial sprint leads to burnout, and the subsequent inaction allows competitors who maintained a steady pace to overtake them.

Beyond algorithms, consistency is fundamental to building a human audience. A reader or viewer who knows to expect a new piece of content every Tuesday morning is far more likely to become a regular, loyal follower. This predictability builds a relationship and establishes a habit in the audience's consumption patterns. Over time, this consistent delivery of value fosters trust, which is the absolute prerequisite for an affiliate recommendation to be effective. When a trusted source recommends a product or service (like a forex broker), the audience is far more likely to act on that recommendation.

Intensity shatters this trust. An audience that is flooded with content and then abandoned will quickly disengage and forget about the brand. The up-and-down cycle of intense work followed by inactivity leads to inconsistent results and prevents the formation of a loyal community.

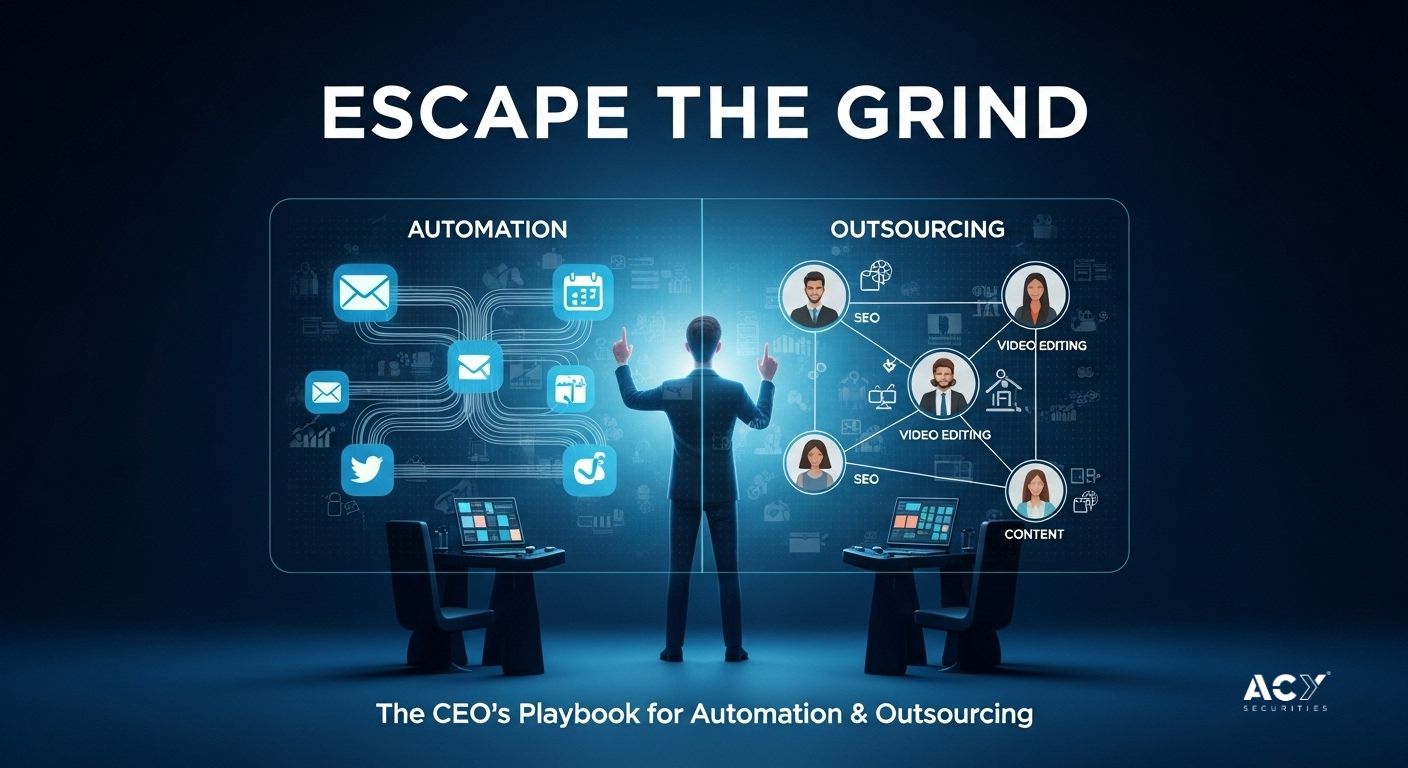

How Can You Automate and Outsource Tasks to Eventually Escape the Grind?

The ultimate goal for many business owners, including affiliate marketers, is to build a system that can operate and generate revenue without their constant, direct involvement. This is achieved not through a "set it and forget it" mentality, but through a deliberate, phased strategy of automation and outsourcing. The objective is to delegate all tasks that are not within the founder's core genius, freeing them to focus on high-level strategy, partnerships, and business growth.

Before hiring people, the first step is to automate processes with software. Modern marketing automation tools can handle many of the repetitive tasks involved in nurturing leads and managing affiliates:

- Email Marketing Automation: Tools like ConvertKit or Mailchimp can automate email welcome sequences, nurture campaigns, and promotional broadcasts. A well-designed email funnel can automatically guide a new subscriber from initial awareness to a conversion (clicking an affiliate link) over a series of days or weeks.

- Affiliate Program Management: As the business grows, managing affiliate links, tracking conversions, and processing payments can become a significant administrative burden. Platforms like Upfluence or Rewardful can automate this entire process, from affiliate onboarding and link generation to performance tracking and automated commission payouts.

- Social Media Scheduling: Tools like Buffer or Hootsuite allow an affiliate to batch-create social media content and schedule it to be published automatically throughout the week, ensuring a consistent presence without daily manual effort.

Outsourcing should be approached as a strategic investment, with tasks being delegated in phases as revenue grows to support the cost.

- Phase 1 (Revenue: ~$1,000/month): Outsource Low-Value, Time-Consuming Tasks. The first tasks to delegate are those that are necessary but do not require deep strategic input. This frees up the founder's time for the most important activity: content creation.

- Tasks: Keyword research, data entry, generating performance reports, basic graphic design (e.g., blog post headers, social media images).

- Platforms: Freelance marketplaces like Upwork or Legiit are ideal for finding specialists for these one-off or recurring tasks.

- Phase 2 (Revenue: ~$3,000/month): Outsource Specialized Skills. The next phase involves hiring experts for tasks that require a higher skill level than the founder possesses. This elevates the quality of the brand and accelerates growth.

- Tasks: Professional web design, advanced SEO (technical audits and link building), video editing, and content writing by subject matter experts.

- Platforms: This may involve hiring more experienced freelancers on Upwork or engaging specialized agencies for services like SEO or content marketing.

- Phase 3 (Revenue: ~$5,000+/month): Delegate Entire Functions. At this stage, the business is generating enough revenue to hire a virtual assistant (VA) or a small team to manage entire operational functions. This allows the founder to transition fully into the role of CEO, focusing only on vision and strategy.

- Tasks: A VA can manage the entire content calendar, from commissioning articles from freelance writers to editing, publishing, and promoting them. They can also manage the email newsletter, all social media channels, and basic customer/community support.

- Platforms: Platforms like Wishup specialize in providing trained virtual assistants, while Upwork offers access to a global talent pool for building a remote team.

| Task to Outsource | Skill Level Required | Recommended Platform / Method | When to Outsource (Approx. Monthly Revenue) |

| Keyword Research | Beginner / Intermediate | Upwork, Legiit | > $500 |

| Content Writing (Drafts) | Intermediate | Upwork, WriterAccess | > $1,000 |

| Graphic Design | Beginner / Intermediate | Fiverr, Canva Pro (VA) | > $500 |

| Video Editing | Intermediate / Advanced | Upwork, Specialized Freelancers | > $1,500 |

| SEO Link Building | Advanced | Legiit, Specialized SEO Agencies | > $2,500 |

| Web Design & Maintenance | Intermediate / Advanced | Upwork, Local Web Design Agency | > $2,000 |

| Social Media Management | Intermediate | Virtual Assistant (Upwork, Wishup) | > $3,000 |

| Email Newsletter Management | Intermediate | Virtual Assistant (Upwork, Wishup) | > $3,000 |

| Full Content Management | Advanced (VA) | Hire a dedicated Virtual Assistant | > $5,000 |

By following this phased approach, an affiliate marketer can systematically build a business that not only generates significant income but also provides them with the freedom and time that drew them to entrepreneurship in the first place.

The ACY.com Advantage: The Premier Platform for the Aspiring Expert

The journey from a novice trader chasing signals to a professional affiliate building a systematic business requires a partner that provides not just a trading platform, but a complete ecosystem for growth.

The analysis of risk management tools, content strategy, and business scaling culminates in a clear conclusion: for the aspiring expert following this blueprint, ACY.com emerges as the premier choice. Their offerings are uniquely aligned with the needs of a serious beginner who aims to trade and operate with the discipline and tools of a professional from day one.

A Curated Toolkit That Bridges the Beginner-to-Expert Gap

The single greatest technical challenge for a new trader is implementing a disciplined risk management framework. As established, this relies on the consistent use of tools like position size calculators, advanced indicators, and order management scripts. The internet is flooded with such tools, but they are of varying quality, and many from untrusted sources pose security risks.

ACY.com directly solves this critical problem by providing a library of free, pre-vetted scripts and indicators for both MT4 and MT5. This is a powerful differentiator that lowers the barrier to entry for systematic trading. A beginner can immediately access and implement the very tools discussed in Part I of this report without technical hurdles or security concerns.

- Their "Calculate Your Lots" script provides the perfect starting point for mastering the cornerstone of risk management: correct position sizing.

- Their "Advanced Pivot Points" and "Multi-Timeframe RSI/MA" indicators facilitate a more robust, rules-based technical analysis, encouraging traders to think systematically about market structure and trend alignment.

- Utility scripts like "Close All" and "Delete all Objects" streamline the trading workflow, helping to build habits of efficiency and disciplined risk mitigation.

By curating this toolkit, ACY.com does more than provide software; they provide a structured learning path. They give beginners the exact instruments needed to start building the habits of an expert trader immediately. For a visual guide on how to install and use these powerful tools, watch this tutorial: How to Install Custom Indicators and EAs on MT4/MT5.

An Ecosystem Built for Systematic, Stress-Free Trading

A broker's underlying philosophy is revealed in its educational content. ACY.com's articles consistently champion a "work smarter, not harder" approach that is deeply rooted in the principles of automation and psychological discipline. Their content actively promotes the use of scripts and EAs as tools to reduce trading stress, combat decision fatigue, and eliminate the emotional errors that plague manual traders.

This is not a broker that simply promotes active, high-frequency trading. Instead, they provide a sophisticated intellectual framework that encourages traders to build a robust, semi-automated system. They advocate for a "set it and forget it" philosophy, where high-quality analysis is front-loaded, and execution is outsourced to emotionless algorithms.

This holistic approach,providing both the practical tools and the strategic mindset to use them effectively,creates a complete ecosystem for developing a professional trading methodology. For an affiliate marketer whose entire business is built on educating their audience about best practices, partnering with a broker that embodies and teaches these same principles creates powerful brand alignment.

A Partner for Growth: The Recommended Choice for Serious Beginners

For the user profile this report is designed for,an ambitious individual seeking to build a professional trading foundation and a scalable affiliate business,ACY.com's specific features make it the logical and superior choice.

- Accessible Starting Point: With a minimum deposit of just $50 for a Basic account, ACY.com makes it possible for anyone to start with real money without taking on significant financial risk. This low barrier to entry is crucial for beginners.

- Industry-Standard Platforms: ACY.com offers full support for both MetaTrader 4 and MetaTrader 5, the platforms that form the backbone of the retail trading industry and are the focus of this report's technical analysis. This ensures that all the scripts, EAs, and strategies discussed are directly applicable.

- A Clear Path for Growth: The account structure is designed to scale with a trader's success. A trader can begin with a commission-free Standard account and, as their skills and capital grow, graduate to a professional-grade ProZero account, which offers institutional-level raw spreads from 0.0 pips with a competitive commission. This provides a clear, long-term growth path within a single brokerage.

- Unwavering Commitment to Education: The most compelling reason is their demonstrated commitment to trader success beyond simple execution. The extensive library of free, high-quality tools and the sophisticated educational articles on systematic trading and risk management prove that ACY.com is invested in building knowledgeable, sustainable traders.

In conclusion, while many brokers can provide a platform to place a trade, few provide a comprehensive roadmap and toolkit to become a better trader. For the beginner who aspires to trade like an expert and build an authoritative business educating others to do the same, ACY.com does not just offer an account; it offers an entire ecosystem for success. Learn more about ACY Securities and their offerings here: Trade Forex & CFDs with a Regulated Online Broker | ACY Securities.

How Mark Zuckerberg Thinks About Risk Management in Forex Trading

Mark Zuckerberg, the co-founder of Meta Platforms, is known for his long-term vision, systematic approach to problem-solving, and focus on building robust infrastructure rather than reacting to every short-term trend. While he's not a Forex trader, his operational philosophy offers profound parallels:

- Build Systems, Not Just Products: Zuckerberg's approach to Meta (Facebook) was always about building a platform and an ecosystem, not just a single feature. Similarly, in Forex, the goal isn't just to find the next winning trade (a "signal"), but to build a robust system of risk management, trade execution, and psychological discipline. MT4/MT5 scripts and EAs are the "infrastructure" for this system, automating repetitive tasks and enforcing rules, much like Meta's algorithms manage content delivery and user experience.

- Focus on the Long-Term Horizon: Zuckerberg famously prioritized long-term growth and vision (e.g., the metaverse) even when facing short-term controversies or financial pressures. This mirrors the risk-centric trader's mindset: surviving long-term and achieving consistent profitability over a large series of trades, rather than chasing immediate, high-risk gains. A systematic approach with defined risk per trade ensures you're still in the game years down the line.

- Delegate and Automate Repetitive Tasks: Zuckerberg built an organization designed to scale, which necessitates delegating and automating anything that doesn't require unique human insight. In Forex, this translates directly to using EAs for position sizing, stop-loss management, and drawdown control. This frees the trader from the "grind" of manual execution, allowing them to focus on high-level strategy and analysis, much like a CEO focuses on vision.

- Data-Driven Decisions: Meta's entire operation is built on data. Every change, every feature, is tested and analyzed. Similarly, a systematic Forex trader relies on performance data, backtesting, and objective metrics (like ATR, risk-reward ratios) to inform their decisions, moving away from subjective "gut feelings."

- Risk Mitigation as a Core Principle: While Meta takes calculated risks for innovation, they also invest heavily in security, privacy, and infrastructure stability to mitigate systemic risks. In trading, this translates to the non-negotiable principles of stop-losses, position sizing, and drawdown limiters. These are the "circuit breakers" that protect the core asset (your trading capital) from catastrophic failure.

In essence, Zuckerberg's philosophy champions building scalable, resilient systems that operate with logical precision and a long-term outlook. This is precisely what a modern Forex trader achieves by embracing MT4/MT5 indicators and scripts for risk management, transforming themselves from a reactive gambler into a systematic architect of their trading success.

10 Lessons from Benjamin Graham's "The Intelligent Investor" Applied to Forex Risk Management

Benjamin Graham's "The Intelligent Investor" is a foundational text for value investing, emphasizing fundamental analysis and a long-term, disciplined approach. While Forex is often seen as short-term speculation, Graham's wisdom is remarkably relevant to risk management:

- The Concept of "Margin of Safety": Graham's most famous concept. In Forex, this means never risking so much on a single trade that a small adverse move can wipe you out. Your "margin of safety" is your strict risk-per-trade percentage (e.g., 1-2%) and your carefully placed stop-loss, ensuring you can withstand multiple losing trades without significant capital impairment.

- Distinguishing Investment from Speculation: Graham vehemently separated the two. Speculation involves short-term predictions of market movements. Investment involves thorough analysis and a focus on intrinsic value. In Forex, a risk-centric approach moves you closer to "investment" by focusing on systematic rules and capital preservation, rather than pure speculative gambling on signals.

- The Investor's Chief Problem – and Even His Worst Enemy – Is Likely to Be Himself: Graham highlighted emotional pitfalls. Fear and greed are the primary drivers of poor trading decisions. Automated MT4/MT5 scripts and EAs are direct antidotes, removing human emotion from critical execution moments.

- Focus on Value, Not Price Fluctuations: While Forex doesn't have "intrinsic value" in the equity sense, the "value" for a systematic trader is the statistical edge of their strategy. Don't get distracted by every price tick; focus on executing your high-probability, risk-managed setups consistently.

- "Mr. Market" as a Manic-Depressive Partner: Graham famously personified the market as a moody partner offering prices daily. Don't let Mr. Market's mood swings dictate your actions. Your systematic risk management plan should be your anchor, not the market's irrational exuberance or despair.

- Diversification is Key: Don't put all your eggs in one basket. While not always applicable to single Forex trades, the principle extends to your overall trading portfolio and even your affiliate business. Don't rely on a single currency pair or a single income stream.

- Know What You Own (and Why): Understand your trading strategy inside and out. Know its edge, its drawdown potential, and its optimal market conditions. This detailed understanding allows for informed risk management.

- Resist the Urge to Follow the Crowd: Graham warned against popular fads. In Forex, this translates to using social sentiment as a contrarian indicator, recognizing that extreme bullishness or bearishness often signals a crowded trade ripe for reversal.

- The Importance of Patience: Building wealth takes time. This applies equally to building a profitable trading career and a successful affiliate business. Consistency over intensity, as discussed in Part III, is a direct echo of Graham's long-term perspective.

- Continuous Learning and Adaptation: While Graham emphasized timeless principles, he also valued intellectual honesty and adaptation. Your trading system should be robust but also subject to continuous review and improvement, ensuring it remains effective in evolving market conditions.

By integrating these profound lessons, Forex traders can elevate their approach from mere speculation to a disciplined, intelligent form of capital management, significantly enhancing their chances of long-term success.

Frequently Asked Questions (FAQ) about MT4/MT5 Risk Management & Trading

Q1: What is the most important MT4/MT5 script for a beginner trader?

A1: For beginners, the Position Sizing Calculator script is arguably the most crucial. It automates the complex calculation of lot size based on your defined risk per trade and stop-loss distance, ensuring you never over-leverage and always adhere to your risk limits. ACY.com offers a highly effective "Calculate Your Lots" script.

Q2: How do Expert Advisors (EAs) help reduce trading stress?

A2: EAs reduce stress by automating repetitive, high-pressure tasks. Features like Automated Breakeven, Trailing Stops, and Drawdown Limiters execute your predefined rules without emotional interference. This frees up your mental energy to focus on strategy and analysis, turning you into a "system manager" rather than a reactive "technician." Read more about this on ACY.com: Escape the 24/7 Market Grind: Can a Forex EA Finally Reduce Your Trading Stress?.

Q3: Can I use social sentiment to predict market direction?

A3: It's best to use social sentiment as a risk filter and a contrarian indicator, not a direct signal for market direction. Extreme one-sided sentiment often signals "crowded trades" that are vulnerable to reversals. It helps you assess the psychological risk of a trade, rather than predict its exact path.

Q4: What's the difference between a script and an Expert Advisor (EA) in MT4/MT5?

A4: Scripts are single-task programs that execute a specific function once when activated (e.g., "Close All Positions"). Expert Advisors (EAs) run continuously on a chart, constantly monitoring conditions and managing trades dynamically (e.g., a trailing stop-loss that adjusts automatically). EAs provide a more sophisticated, persistent layer of automation.

Q5: How can I set smarter stop-loss levels using indicators?

A5: You can use Average True Range (ATR) to set dynamic stop-losses at a multiple of the current ATR (e.g., 1.5x or 2x ATR) away from your entry or a key support/resistance level. This adapts your stop-loss to current market volatility, providing adequate breathing room without excessive risk.

Q6: Why is ACY.com recommended for systematic traders and affiliates?

A6: ACY.com is recommended because it provides a curated library of free, pre-vetted MT4/MT5 scripts and indicators (like the "Calculate Your Lots" tool), supports industry-standard platforms, offers an accessible entry point with low minimum deposits, and provides extensive educational content on systematic, stress-free trading and affiliate business building.

Q7: How long does it typically take to see consistent income from Forex affiliate marketing?

A7: Forex affiliate marketing is a front-loaded business requiring significant upfront effort. You can expect minimal earnings (0 - 500/month) in the first 6 months (foundation phase), growing to 500 - 2,000/month in months 6-12 (traction phase), and potentially scaling to 2,000 - 15,000+/month in years 1-2 (authority and scaling phase) with consistent, high-quality content production.

Q8: How do I install custom indicators or EAs on my MT4/MT5 platform?

A8: The general process involves downloading the .ex4 (for MT4) or .ex5 (for MT5) file, opening your MT4/MT5 platform, navigating to File -> Open Data Folder, then placing the file in the MQL4/MQL5 -> Indicators or Experts folder. After restarting your platform, the tool will appear in your Navigator window. For a detailed visual guide, watch this tutorial: How to Install Custom Indicators and EAs on MT4/MT5.

This content may have been written by a third party. ACY makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplies by any third-party. This content is information only, and does not constitute financial, investment or other advice on which you can rely.